Massachusetts Ratification and approval of directors and officers insurance indemnity fund with copy of agreement

Description

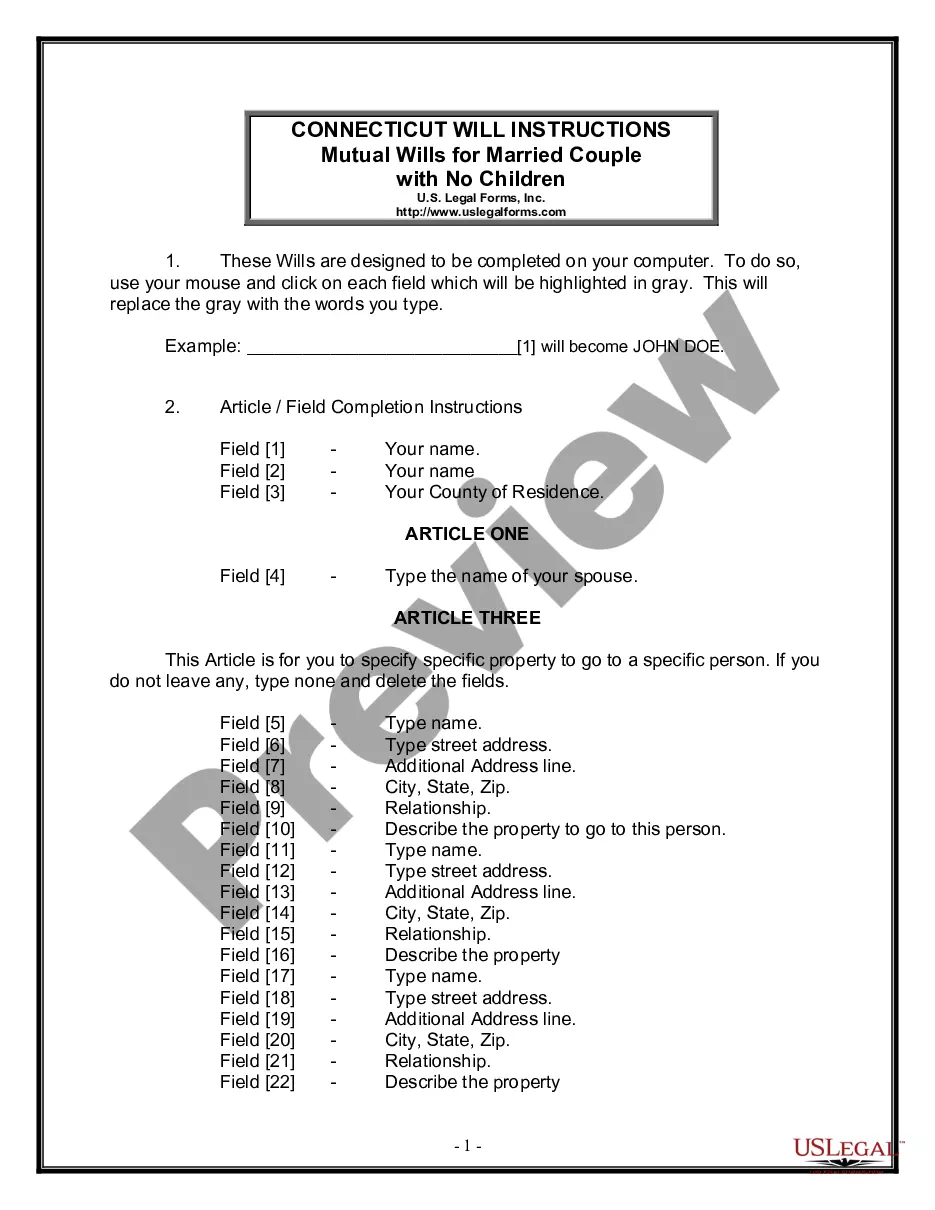

How to fill out Ratification And Approval Of Directors And Officers Insurance Indemnity Fund With Copy Of Agreement?

Have you been inside a situation the place you will need documents for both company or personal uses almost every working day? There are a lot of legitimate file layouts accessible on the Internet, but finding versions you can depend on is not easy. US Legal Forms gives 1000s of develop layouts, much like the Massachusetts Ratification and approval of directors and officers insurance indemnity fund with copy of agreement, which are written in order to meet state and federal requirements.

In case you are presently acquainted with US Legal Forms site and also have an account, merely log in. Next, you can acquire the Massachusetts Ratification and approval of directors and officers insurance indemnity fund with copy of agreement design.

If you do not have an account and need to start using US Legal Forms, adopt these measures:

- Find the develop you want and make sure it is for the correct area/region.

- Utilize the Review switch to check the form.

- See the description to actually have selected the proper develop.

- In the event the develop is not what you are searching for, take advantage of the Lookup industry to find the develop that meets your needs and requirements.

- If you obtain the correct develop, click on Get now.

- Pick the prices prepare you desire, fill in the necessary information to create your money, and buy the order using your PayPal or credit card.

- Select a hassle-free file structure and acquire your backup.

Locate all of the file layouts you possess purchased in the My Forms menus. You can get a further backup of Massachusetts Ratification and approval of directors and officers insurance indemnity fund with copy of agreement any time, if possible. Just click the necessary develop to acquire or printing the file design.

Use US Legal Forms, probably the most substantial selection of legitimate kinds, to conserve time and steer clear of faults. The support gives skillfully created legitimate file layouts that can be used for an array of uses. Produce an account on US Legal Forms and initiate generating your life a little easier.

Form popularity

FAQ

An indemnity agreement is a contract that protects one party of a transaction from the risks or liabilities created by the other party of the transaction. Hold harmless agreement, no-fault agreement, release of liability, or waiver of liability are other terms for an indemnity agreement.?

Key Takeaways. A letter of indemnity (LOI) is a legal agreement that renders one or both parties to a contract harmless by some third party in the event of a delinquency or breach by the contracted parties.

A release and indemnity agreement, also called an indemnity agreement or a hold harmless agreement, is a legal contract that releases a party from specific liabilities. Essentially, one party in the contract agrees to pay for all potential losses or damages caused by the other party.

How to Write an Indemnity Agreement Consider the Indemnity Laws in Your Area. ... Draft the Indemnification Clause. ... Outline the Indemnification Period and Scope of Coverage. ... State the Indemnification Exceptions. ... Specify How the Indemnitee Notifies the Indemnitor About Claims. ... Write the Settlement and Consent Clause.

This form of a Release Agreement, Indemnity Agreement and Hold Harmless Agreement releases a party from certain specified liabilities. Releases are used to transfer risk from one party to another and protect against the released party or reimburse the released party for damage, injury, or loss.

A Receipt, Release, Refunding and Indemnification Agreement is a probate tool that allows the executor to distribute estate funds to a beneficiary with the promise from the beneficiary to return the funds if it later turns out they were distributed in error.

Indemnity Agreement: Although similar to a hold harmless agreement, an indemnity agreement is an arrangement whereby one party agrees to pay the other party for any damages regardless of who is at fault.

Insurance ? The indemnification agreement typically will require that the company provide D&O liability insurance that protects the indemnitee to the same extent as the most favorably insured of the company's and its affiliates' current directors and officers.