Massachusetts Consulting Contract Questionnaire - Self-Employed

Description

How to fill out Consulting Contract Questionnaire - Self-Employed?

If you want to finish, download, or print authentic document templates, utilize US Legal Forms, the largest assortment of official forms that are accessible online.

Take advantage of the site's straightforward and user-friendly search feature to locate the documents you need.

Various templates for business and personal purposes are categorized by types and titles, or keywords.

Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find alternative versions of the official form template.

Step 4. Once you have located the form you need, click the Purchase now button. Select the pricing plan you prefer and enter your details to create an account.

- Use US Legal Forms to locate the Massachusetts Consulting Contract Questionnaire - Self-Employed with just a few clicks.

- If you are already a US Legal Forms user, sign in to your account and click the Download button to access the Massachusetts Consulting Contract Questionnaire - Self-Employed.

- You can also find forms you previously downloaded under the My documents tab in your account.

- If this is your first time using US Legal Forms, refer to the instructions below.

- Step 1. Ensure you have chosen the form for the correct state/region.

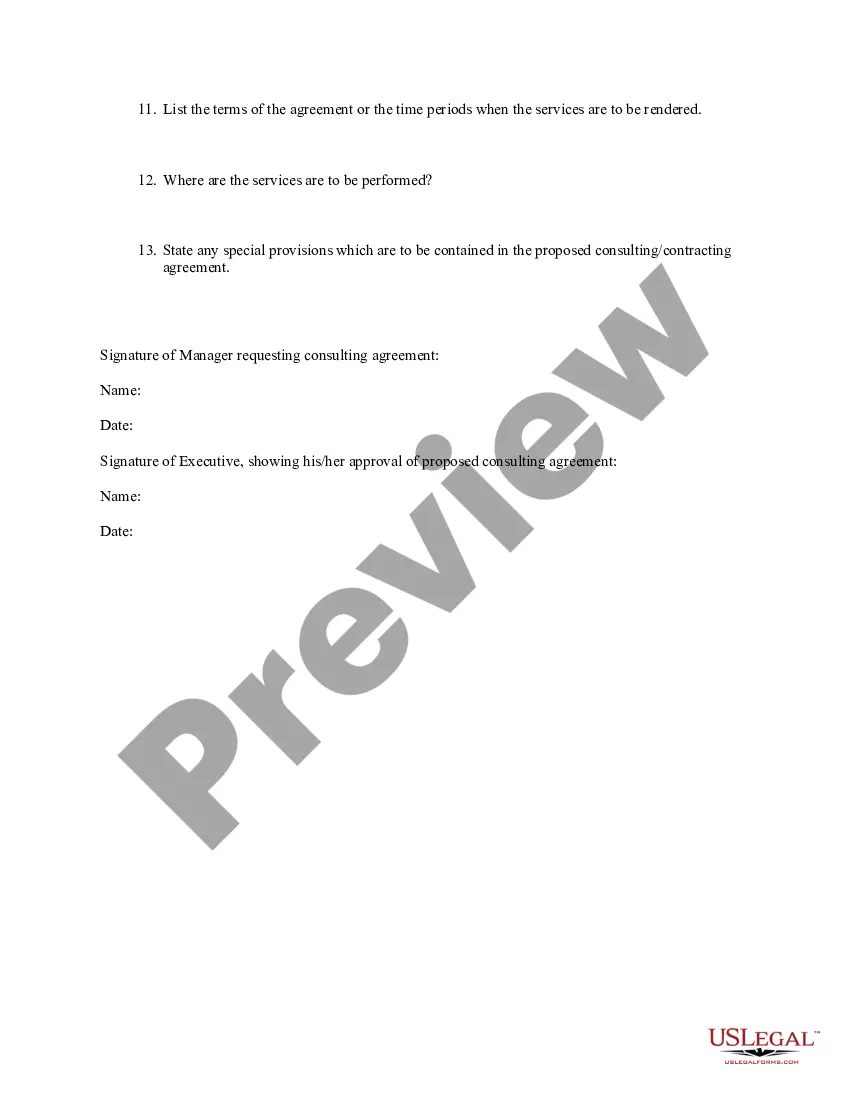

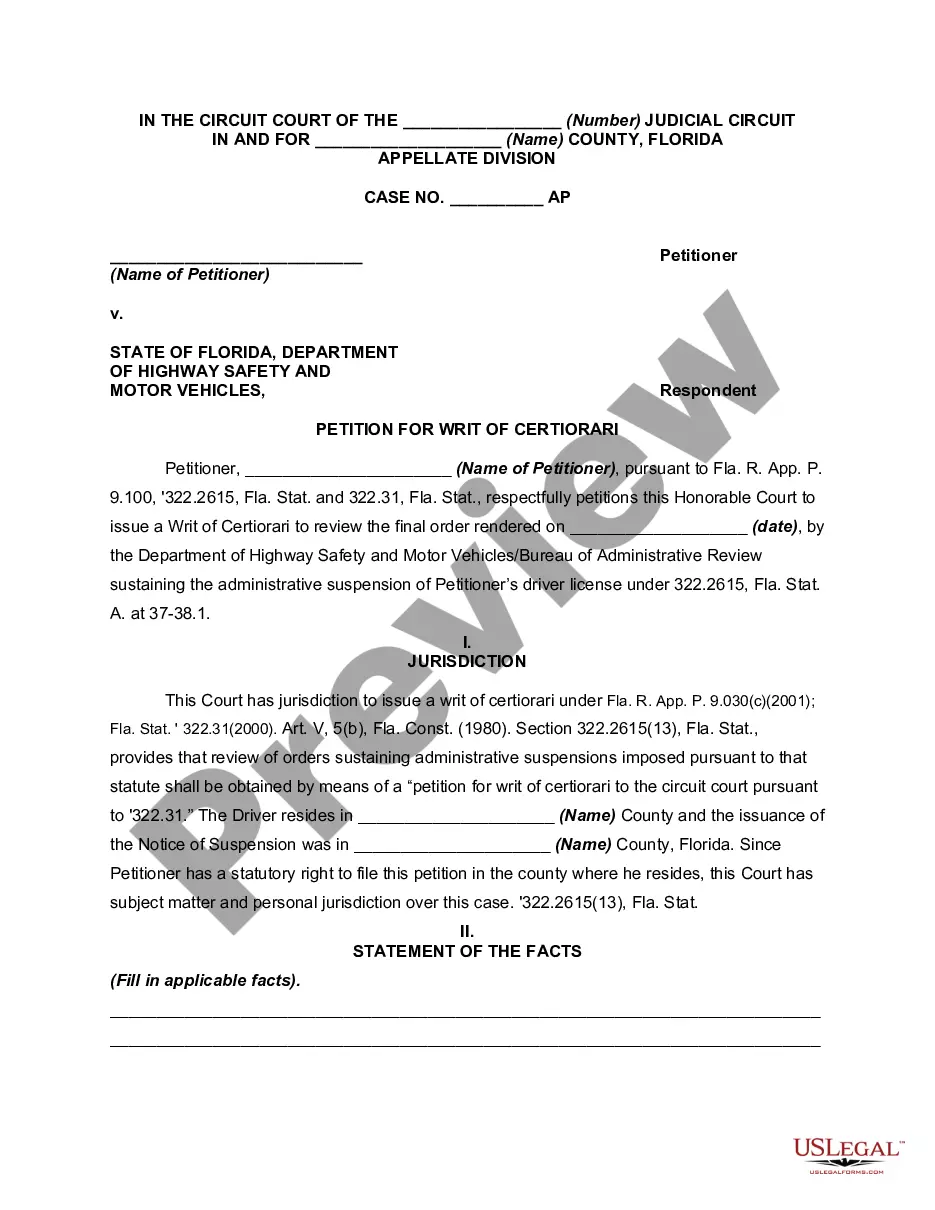

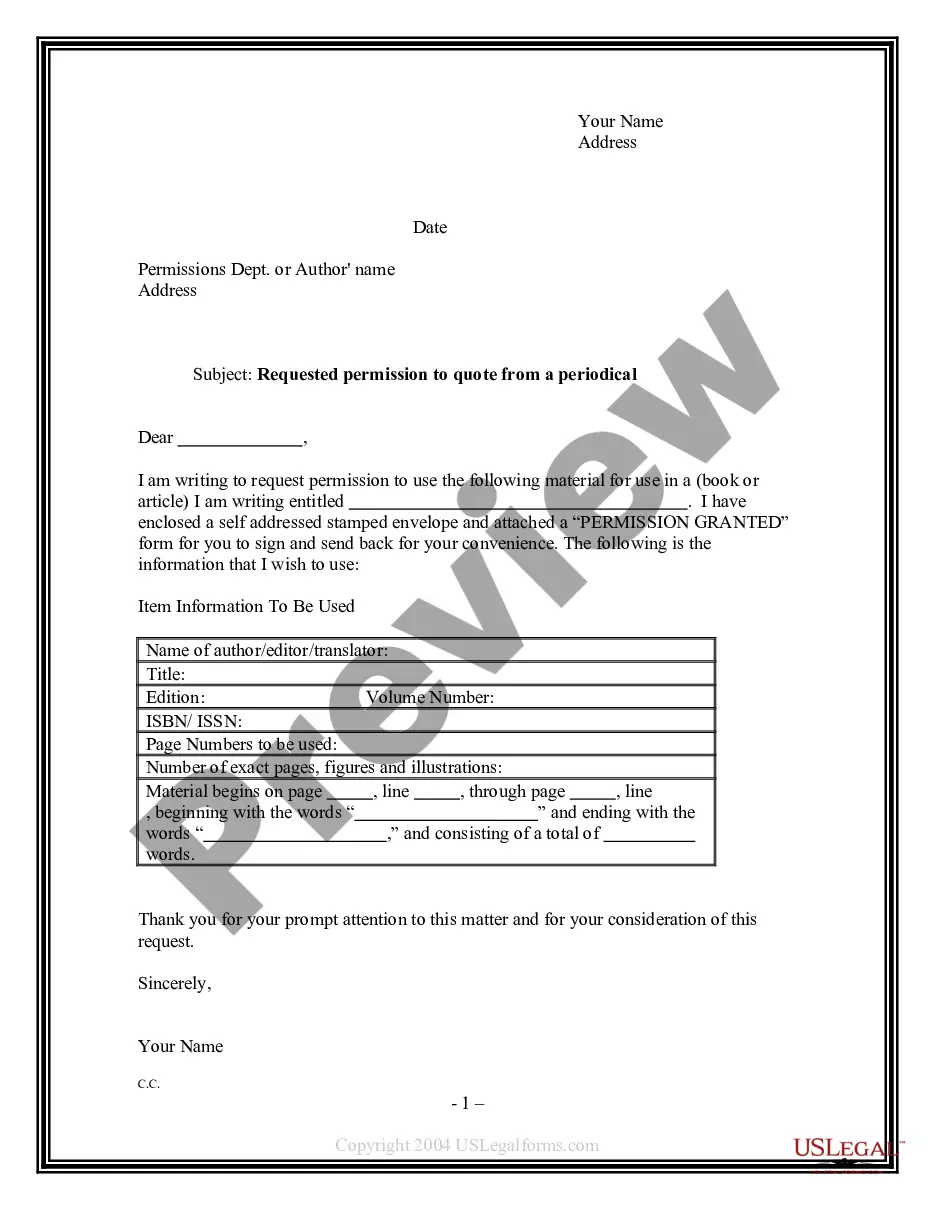

- Step 2. Use the Preview option to review the form’s content. Be sure to read the description.

Form popularity

FAQ

Consultants Are Usually Self-Employed According to the IRS, you're self-employed if you're a business owner or contractor who provides services to other businesses. To remain a contractor rather than an employee, you must: Have the right to direct or control the work you perform.

The IRS says that someone is self-employed if they meet one of these conditions:Someone who carries on a trade or business as a sole proprietor or independent contractor,A member of a partnership that carries on a trade or business, or.Someone who is otherwise in business for themselves, including part-time business.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

Simply put, being an independent contractor is a way of being self-employed. Is an independent contractor self-employed? Yes. Independent contractors are self-employed who earn an income but do not work as employees.

The law does not require you to complete a contract with your self-employed or freelance workers - a verbal contract can exist even when there is nothing in writing.

What is the difference between a Consultant and a Contractor? The short answer is that the Consultants role is evaluate a client's needs and provide expert advice and opinion on what needs to be done while the Contractors role is generally to evaluate the client's needs and actually perform the work.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

If a person is truly an independent contractor (meaning they meet all three elements of the three part test), then the wage and hour laws are not applicable. This includes minimum wage, overtime, and rules for the timely payment of wages under the Massachusetts Wage Act.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.