Full text and statutory guidelines for the Insurers Rehabilitation and Liquidation Model Act.

Massachusetts Insurers Rehabilitation and Liquidation Model Act

Description

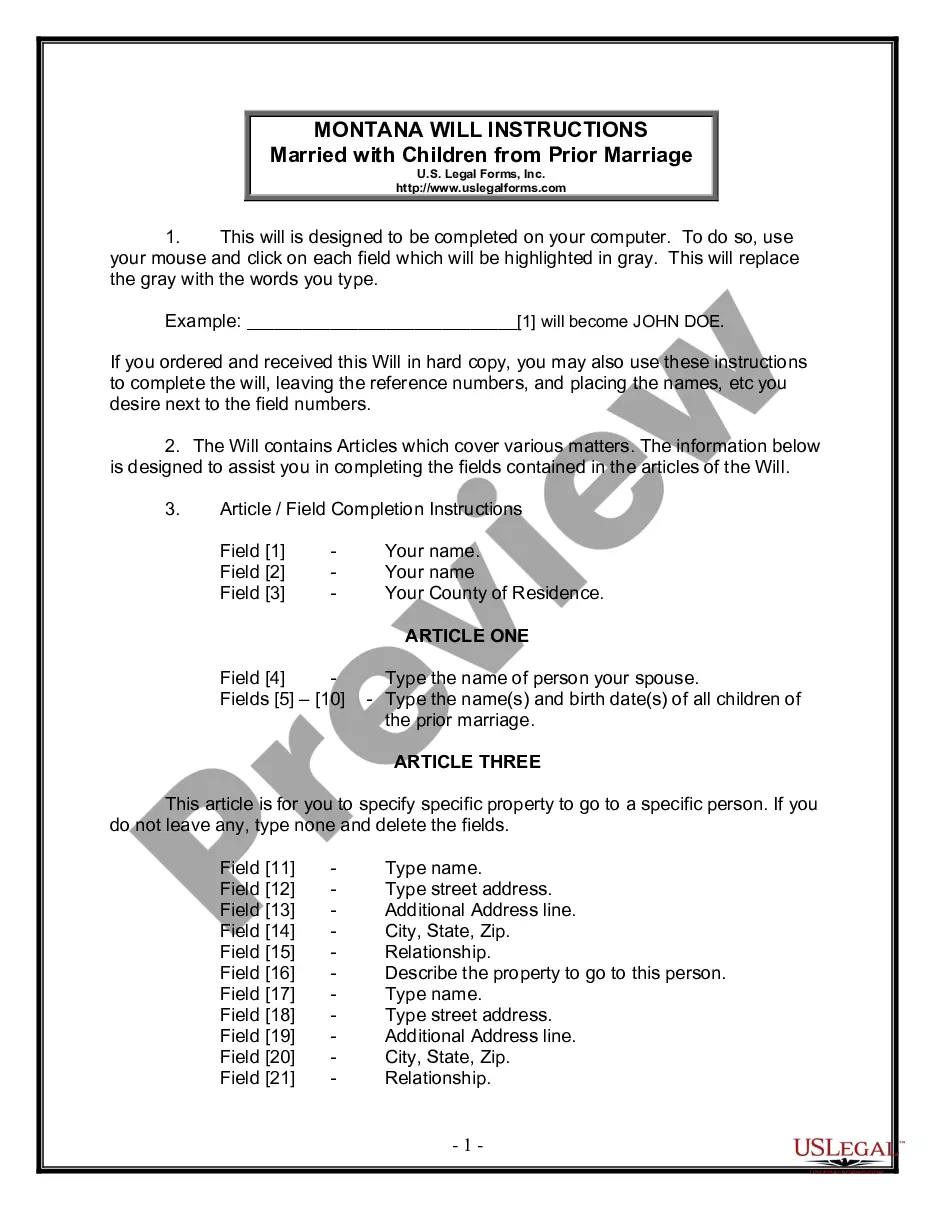

How to fill out Insurers Rehabilitation And Liquidation Model Act?

US Legal Forms - among the biggest libraries of legitimate kinds in America - offers a variety of legitimate record layouts you may download or print out. While using web site, you may get thousands of kinds for enterprise and person reasons, sorted by categories, says, or search phrases.You can get the latest models of kinds just like the Massachusetts Insurers Rehabilitation and Liquidation Model Act within minutes.

If you already have a subscription, log in and download Massachusetts Insurers Rehabilitation and Liquidation Model Act from your US Legal Forms catalogue. The Obtain button will show up on every develop you look at. You get access to all formerly delivered electronically kinds within the My Forms tab of your account.

If you wish to use US Legal Forms the very first time, listed below are simple recommendations to get you started:

- Be sure you have chosen the correct develop to your area/county. Select the Preview button to examine the form`s articles. See the develop description to ensure that you have selected the right develop.

- When the develop doesn`t match your requirements, make use of the Lookup discipline towards the top of the screen to find the one who does.

- In case you are content with the form, confirm your option by clicking on the Get now button. Then, select the prices plan you favor and offer your qualifications to register for an account.

- Procedure the deal. Utilize your credit card or PayPal account to complete the deal.

- Find the structure and download the form on your own system.

- Make adjustments. Fill up, revise and print out and signal the delivered electronically Massachusetts Insurers Rehabilitation and Liquidation Model Act.

Each design you included with your money lacks an expiry time which is yours forever. So, in order to download or print out another copy, just go to the My Forms area and click on about the develop you need.

Get access to the Massachusetts Insurers Rehabilitation and Liquidation Model Act with US Legal Forms, by far the most considerable catalogue of legitimate record layouts. Use thousands of skilled and express-distinct layouts that meet up with your organization or person requirements and requirements.

Form popularity

FAQ

"Liquidation" is the process whereby the Commissioner, upon a Superior Court's order, terminates an insurance company's insurance business by canceling all insurance policies and by not issuing any new or renewal policies.

Once the liquidation is ordered, the guaranty association provides coverage to the company's policyholders who are state residents (up to the levels specified by state laws?see below; any benefit amounts above the guaranty asociation benefit levels become claims against the company's remaining assets).

(2) ?Regulatory Action Level RBC? means the product of 1.5 and its Authorized Control Level RBC; (3) ?Authorized Control Level RBC? means the number determined under the risk-based capital formula in ance with the RBC Instructions; (4) ?Mandatory Control Level RBC? means the product of .

(3) ?Authorized Control Level RBC? means the number determined under the risk-based capital formula in ance with the RBC Instructions; (4) ?Mandatory Control Level RBC? means the product of . 70 and the Authorized Control Level RBC.

The model laws are proposed insurance laws drafted by the NAIC to promote uniformity among the states. Upon NAIC adoption of a model law, it is a priority of the NAIC to uniformly adopt the model law in a majority of the states.

Company Action Level means the designation given by either the National Association of Insurance Commissioners or the state department of insurance of the state of domicile of the insurance company in question of a level or range of levels of Risk-Based Capital Ratios as the Risk-Based Capital Ratio or Ratios, as ...

The regulatory action level occurs if surplus falls below 150 percent of the RBC amount. The authorized control level occurs if surplus falls below 100 percent of the RBC amount.

One way they do this is by imposing a risk-based capital (RBC) requirement. The RBC requirement is a statutory minimum level of capital that is based on two factors: 1) an insurance company's size; and 2) the inherent riskiness of its financial assets and operations.