Full text of legislative history behind the Post Assessment Property and Liability Insurance Guaranty Association Model Act.

Massachusetts Post Assessment Property and Liability Insurance Guaranty Association Model Act Legislative History

Description

How to fill out Post Assessment Property And Liability Insurance Guaranty Association Model Act Legislative History?

Choosing the best legitimate record template can be quite a struggle. Obviously, there are tons of themes accessible on the Internet, but how will you find the legitimate develop you need? Take advantage of the US Legal Forms web site. The services provides 1000s of themes, for example the Massachusetts Post Assessment Property and Liability Insurance Guaranty Association Model Act Legislative History, that you can use for company and personal needs. All of the types are examined by experts and satisfy federal and state specifications.

When you are presently signed up, log in to the accounts and click on the Obtain switch to obtain the Massachusetts Post Assessment Property and Liability Insurance Guaranty Association Model Act Legislative History. Utilize your accounts to appear throughout the legitimate types you may have bought earlier. Proceed to the My Forms tab of your accounts and acquire an additional backup of your record you need.

When you are a brand new customer of US Legal Forms, allow me to share simple instructions for you to follow:

- Very first, be sure you have selected the correct develop for the area/region. It is possible to check out the form making use of the Preview switch and read the form information to make certain this is basically the right one for you.

- In case the develop will not satisfy your expectations, make use of the Seach area to discover the proper develop.

- When you are certain that the form would work, click on the Purchase now switch to obtain the develop.

- Select the pricing strategy you would like and enter in the needed info. Make your accounts and pay money for the transaction using your PayPal accounts or bank card.

- Select the file format and obtain the legitimate record template to the device.

- Complete, change and printing and indicator the received Massachusetts Post Assessment Property and Liability Insurance Guaranty Association Model Act Legislative History.

US Legal Forms is definitely the greatest collection of legitimate types that you can see different record themes. Take advantage of the company to obtain expertly-created paperwork that follow status specifications.

Form popularity

FAQ

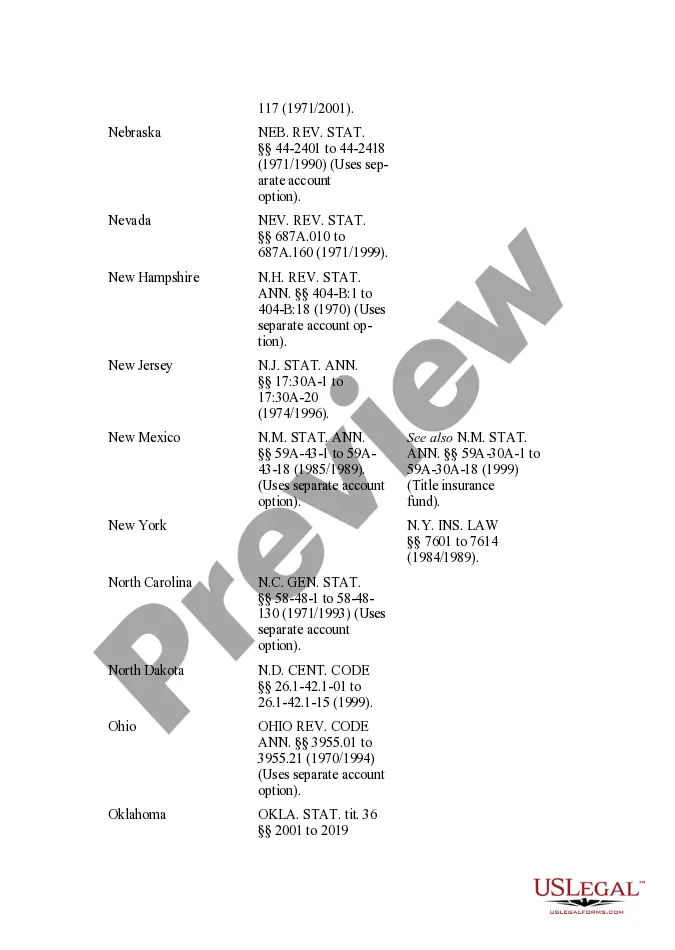

MPCGA WAS CREATED BY AN ACT OF THE MICHIGAN LEGISLATURE, MCL 500.7901 ET SEQ., IN ORDER TO PROTECT THE PUBLIC AGAINST FINANCIAL LOSSES TO POLICYHOLDERS AND CLAIMANTS AS A RESULT OF PROPERTY AND CASUALTY INSURANCE COMPANY INSOLVENCIES.

$100,000 in net cash surrender or withdrawal values for life insurance. $300,000 in disability income (DI) insurance benefits. $300,000 in long-term care (LTC) insurance benefits.

The guaranty association's coverage of insurance company insolvencies is funded by post-insolvency assessments of the other guaranty association member companies. These assessments are based on each member's share of premium during the prior three years.

The maximum total amount the Guarantee Association will provide for any one individual for life insurance and annuity coverage is $300,000, even if that individual is covered by multiple life insurance policies and annuities. Is my claim against the insolvent insurer affected by the Guarantee Association? Yes. Frequently ... - California Life & Health Insurance Guarantee Association califega.org ? FAQ ? Print califega.org ? FAQ ? Print

$500,000 Protections and Limits on Protection The Guaranty Fund provides up to $500,000 of coverage to a life insurance policy owner, individual annuity (such as a single premium deferred annuity) contract holder or individual accident and health insurance policyholder, or any beneficiary, assignee, or payee of the foregoing. Guaranty Fund Protection in New York State - DFS.NY.gov ny.gov ? consumers ? life_insurance ? p... ny.gov ? consumers ? life_insurance ? p...

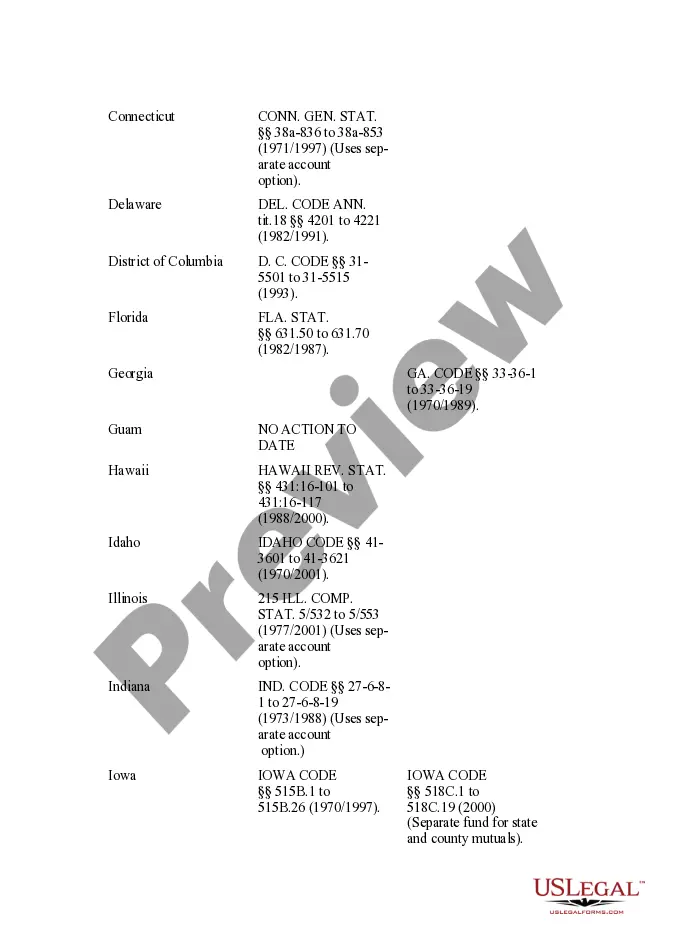

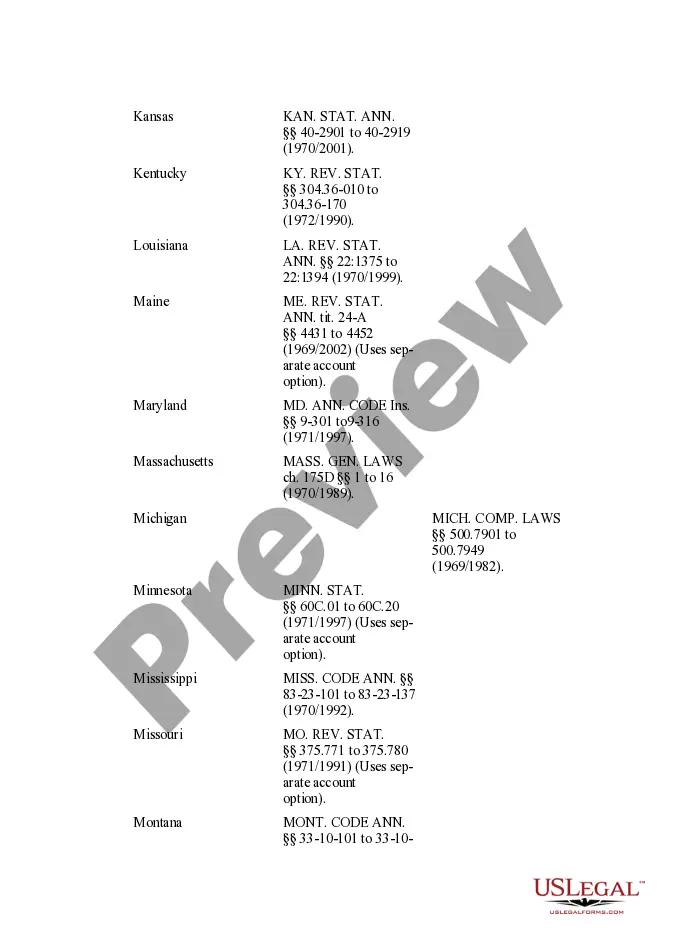

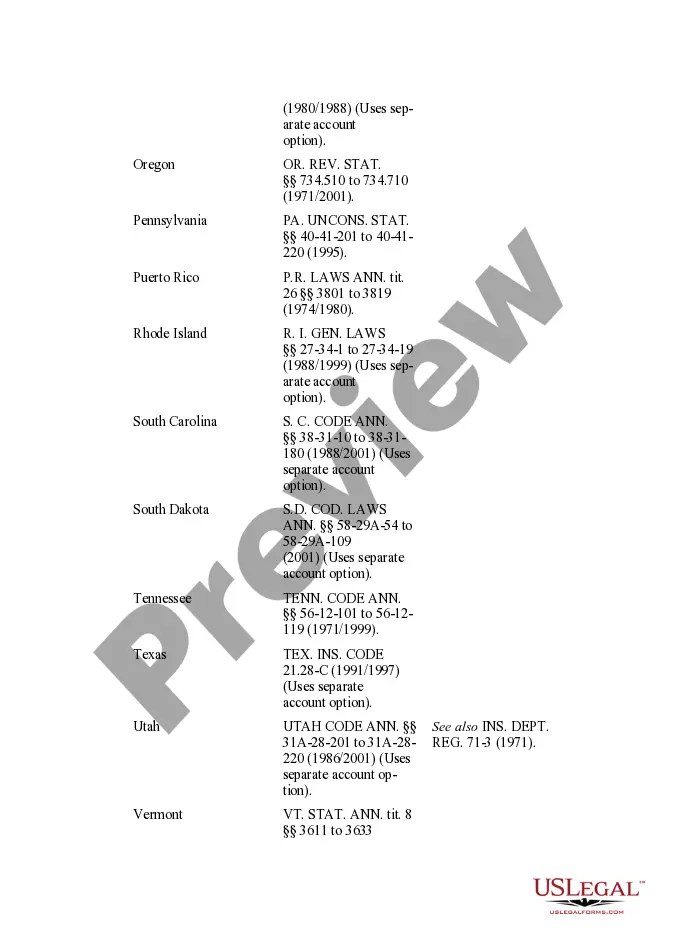

Insurance guaranty associations provide protection to insurance policyholders and beneficiaries of policies issued by an insurance company that has become insolvent and is no longer able to meet its obligations. All states, the District of Columbia, and Puerto Rico have insurance guaranty associations.

A guaranty association is a privately funded organization in each state that ultimately serves as a backup in case an insurer fails completely and is unable to pay its claims.

The health insurance protection for which the Guarantee Association may become liable shall be the contractual obligations for which the insurer is liable or would have been liable if it were not an insolvent insurer, up to a maximum benefit of $200,000. FAQs - California Life & Health Insurance Guarantee Association California Life & Health Insurance Guarantee Association ? FAQ California Life & Health Insurance Guarantee Association ? FAQ

The maximum amount of protection for each individual, regardless of the number of policies or contracts, is $300,000. Special rules may apply with regard to hospital, medical, and surgical insurance benefits.

The purpose of the Insurance Guaranty Association is to protect policyholders when an insurance company becomes insolvent. Benefits paid to claimants and policyholders are subject to limits.