Massachusetts Power of Attorney by Trustee of Trust

Description

Form popularity

FAQ

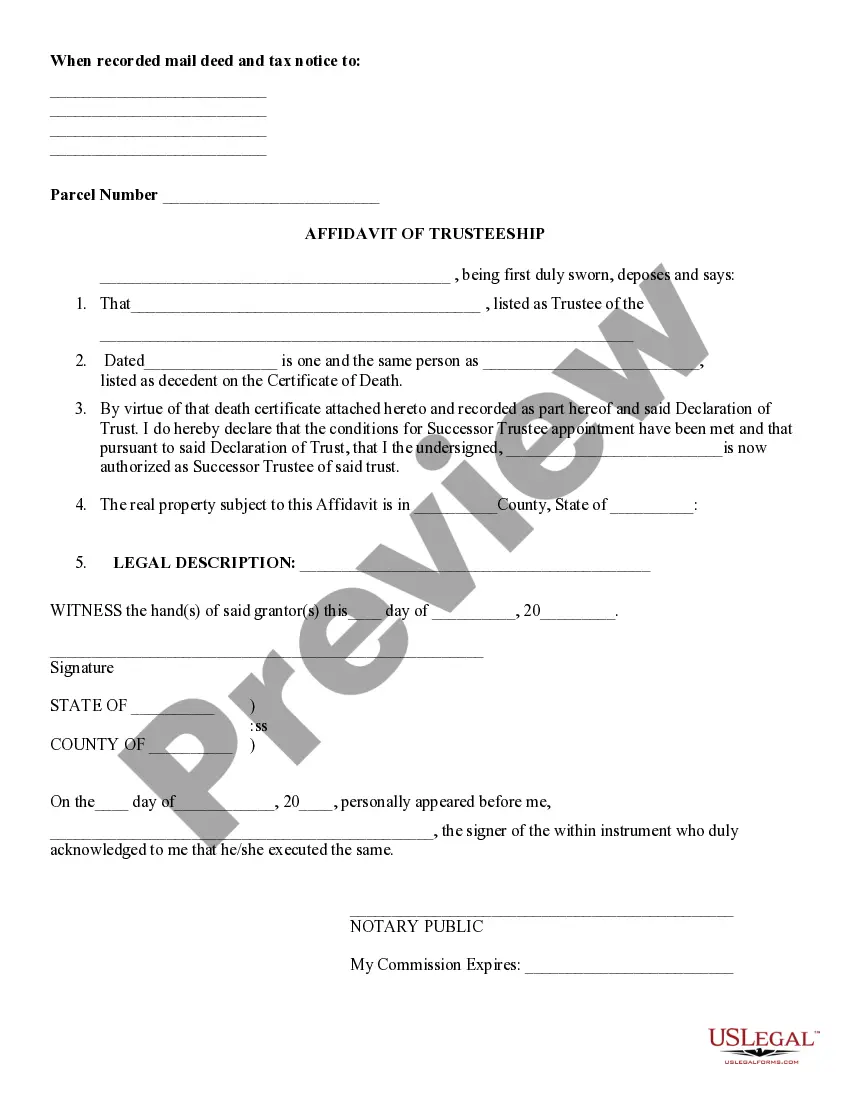

Generally speaking, a Trustee (who is not also the Grantor) cannot appoint a Power of Attorney to take over the Trustee's duties or responsibilities, unless this is something that is directly permitted by the Trust Deed or a court order.

1) Duty to Inform Beneficiaries (Section 16060). 2) Duty to Provide Terms of Trust at Beneficiary's Request (Section 16060.7). 3) Duty to Report at Beneficiary's Request (Section 16061).

The trustee cannot do whatever they want. They must follow the trust document, and follow the California Probate Code. More than that, Trustees don't get the benefits of the Trust. The Trust assets will pass to the Trust beneficiaries eventually.

A trustee cannot delegate his office or any of his duties either to a co-trustee or to a stranger, unless (a) the instrument of trust so provides, or (b) the delegation is in the regular course of business, or (c) the delegation is necessary, or (d) the beneficiary, being competent to contract, consents to the

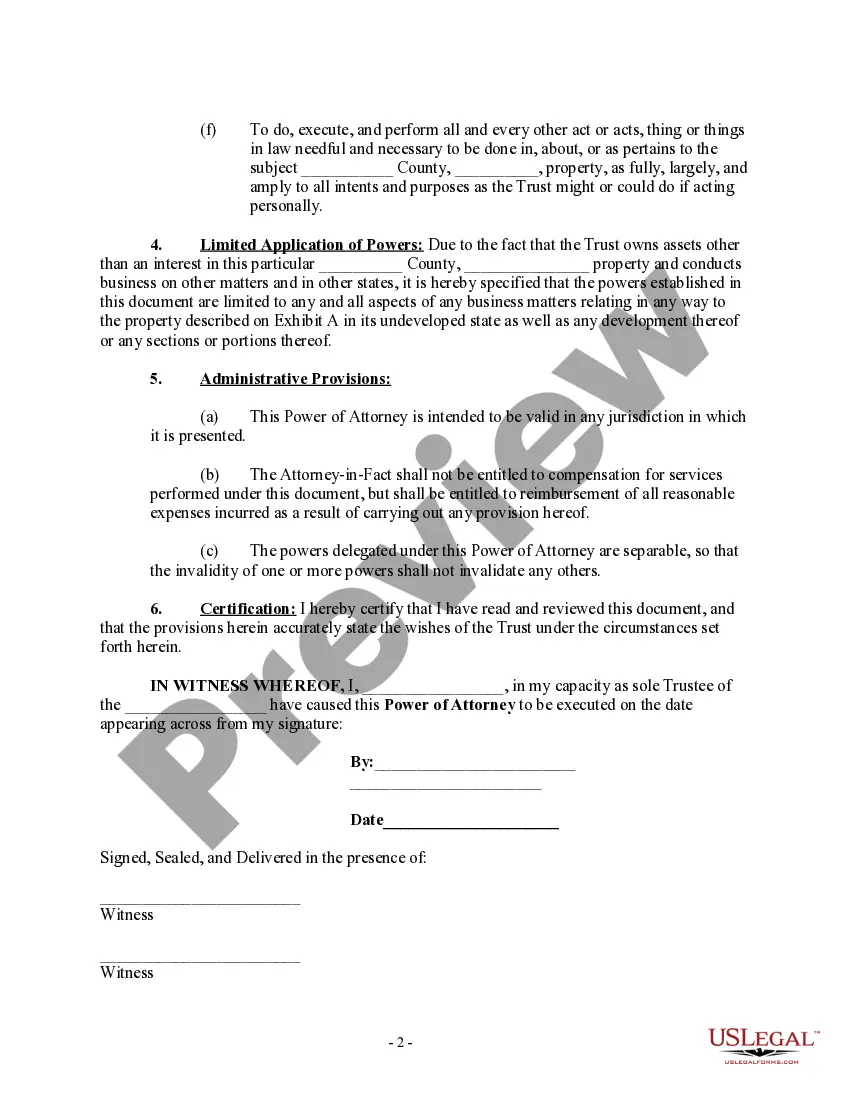

Section 25 of the Trustee Act 1925 allows a trustee to grant a power of attorney delegating their functions as a trustee to the attorney. Section 25 provides a short form of power by which a single donor can delegate trustee functions under a single trust to a single donee. Trustees can use other forms.

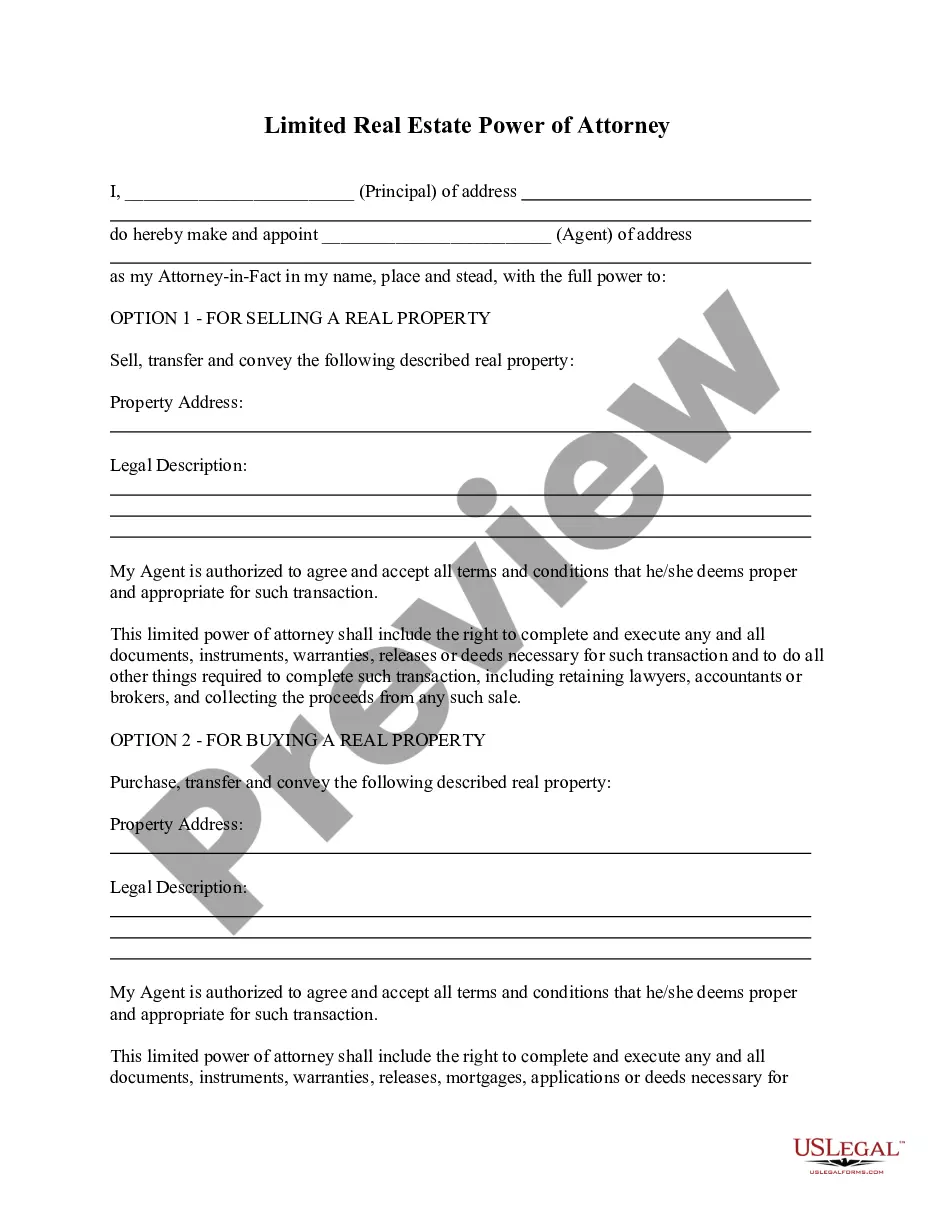

All trustees have the power to manage trust assets. This may include the sale and purchase of trust property and making investments. The trustee must decide whether to use its power to manage assets on a case-by-case basis and must only consider relevant factors when deciding to exercise any power.

A fiduciary cannot delegate his authority to someone else. He cannot give a Power of Attorney to anyone to perform the jobs that he is required to do. Thus, if a closing for the sale of real estate is to occur, the fiduciary is the only person with the authority to sign the deed and other transfer papers.

The trustee cannot fail to carry out the wishes and intent of the settlor and cannot act in bad faith, fail to represent the best interests of the beneficiaries at all times during the existence of the trust and fail to follow the terms of the trust. A trustee cannot fail to carry out their duties.

A trust is a legal arrangement through which one person, called a "settlor" or "grantor," gives assets to another person (or an institution, such as a bank or law firm), called a "trustee." The trustee holds legal title to the assets for another person, called a "beneficiary." The rights of a trust beneficiary depend

A trustee may delegate duties and powers, according to the Uniform Trust Code §807, and investment and management functions, according to Section 9 of the Uniform Prudent Investor Act, to an agent while exercising reasonable care, skill and caution in selecting said agent; establishing the scope and terms of the