Massachusetts Wage Withholding Authorization

Description

How to fill out Wage Withholding Authorization?

Should you require to complete, obtain, or print legal document templates, utilize US Legal Forms, the largest selection of legal forms accessible online.

Employ the site's user-friendly and effective search to find the files you need.

A range of templates for business and personal applications are categorized by types and states, or keywords.

Step 5. Complete the payment. You can use your credit card or PayPal account to finalize the transaction.

Step 6. Choose the format of the legal form and download it to your device. Step 7. Fill out, modify, and print or sign the Massachusetts Wage Withholding Authorization. Each legal document template you download is yours permanently. You will have access to every form you saved in your account. Click on the My documents section and select a form to print or download again. Stay competitive and obtain, and print the Massachusetts Wage Withholding Authorization with US Legal Forms. There are countless professional and state-specific forms available for your business or personal needs.

- Use US Legal Forms to locate the Massachusetts Wage Withholding Authorization in just a few clicks.

- If you are already a US Legal Forms member, sign in to your account and click the Download button to access the Massachusetts Wage Withholding Authorization.

- You can also view forms you previously saved in the My documents section of your account.

- If this is your first time using US Legal Forms, follow these steps.

- Step 1. Ensure you have selected the form for the correct area/region.

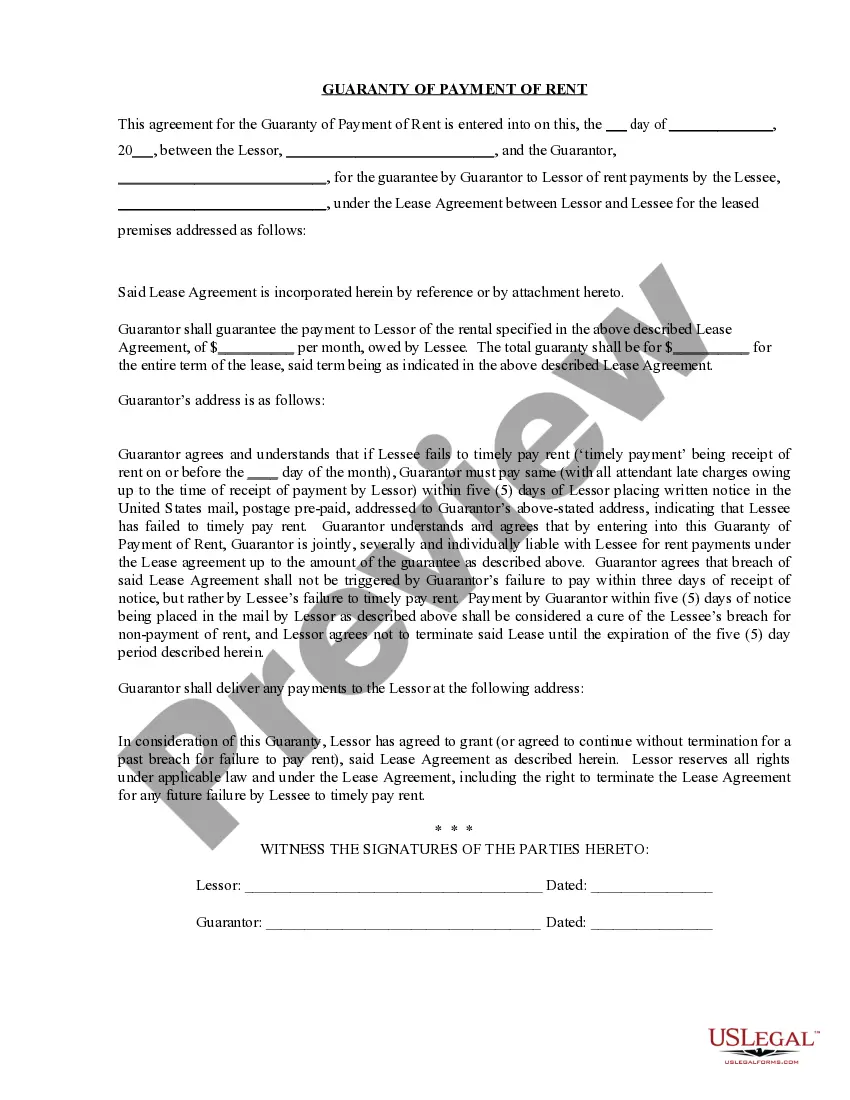

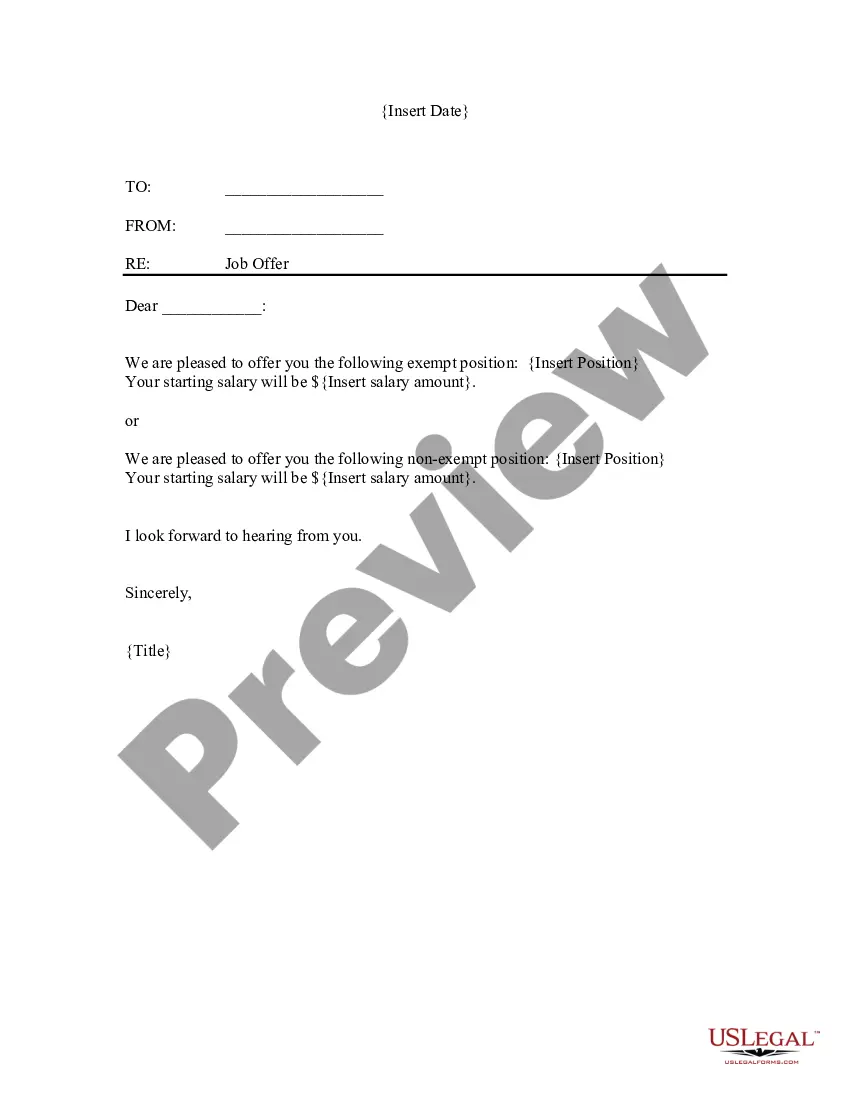

- Step 2. Use the Preview option to check the form's details. Be sure to read the summary.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have found the form you prefer, click the Get now button. Choose the payment plan you prefer and enter your information to sign up for an account.

Form popularity

FAQ

Information for Massachusetts M-4 Form can be found at the Commonwealth of Massachusetts website. If the allowable Massachusetts withholding exemptions are the same as being claimed for federal income tax purposes, the employee should complete Form W-4 only.

The W-4 is a form that you complete and give to your employer (not the IRS) for federal tax and the equivalent form for state tax withholding. The W-4 communicates to your employer(s) how much federal and/or state tax you - and your spouse if s/he works - wish to have withheld from each paycheck in a pay period.

As an employer, you must withhold Massachusetts personal income taxes from all Massachusetts residents' wages for services performed either in or outside Massachusetts and from nonresidents' wages for services performed in Massachusetts.

The following states require state tax withholding whenever federal taxes are withheld. We will apply the state's default with- holding rate to the taxable portion of your distribution if you reside in: Iowa, Kansas, Maine, Massachusetts, Nebraska, Oklahoma, or Virginia. You may not elect out of state withholding.

Massachusetts Employee's Withholding Allowance Certificate. The M-4 form tells Harvard how much to withhold for state income taxes.

The following states opted to create their own state W-4 forms: Delaware, Idaho, Nebraska, Oregon, South Carolina, and Wisconsin whereas Colorado, New Mexico, North Dakota, and Utah will adopt the new inputs that the 2020 Federal W-4 put forth.

State law generally requires employers to withhold state income tax based primarily on where an employee performs services, and secondarily where the employee resides.

The income tax withholding formula for the State of Massachusetts includes the following changes: The tax rate has decreased from 5.05 percent to 5.00 percent. The tax credit for Head of Household has decreased from $121.20 to $120.00. The Blindness tax credit has decreased from $111.10 to $110.00.

Here you will find an alphabetical listing of withholding tax forms administered by the Massachusetts Department of Revenue (DOR).