Massachusetts New Company Benefit Notice

Description

How to fill out New Company Benefit Notice?

You might invest numerous hours online searching for the legal document template that meets the federal and state requirements you will require.

US Legal Forms offers a vast array of legal forms that can be assessed by experts.

You can easily download or print the Massachusetts New Company Benefit Notice from the service.

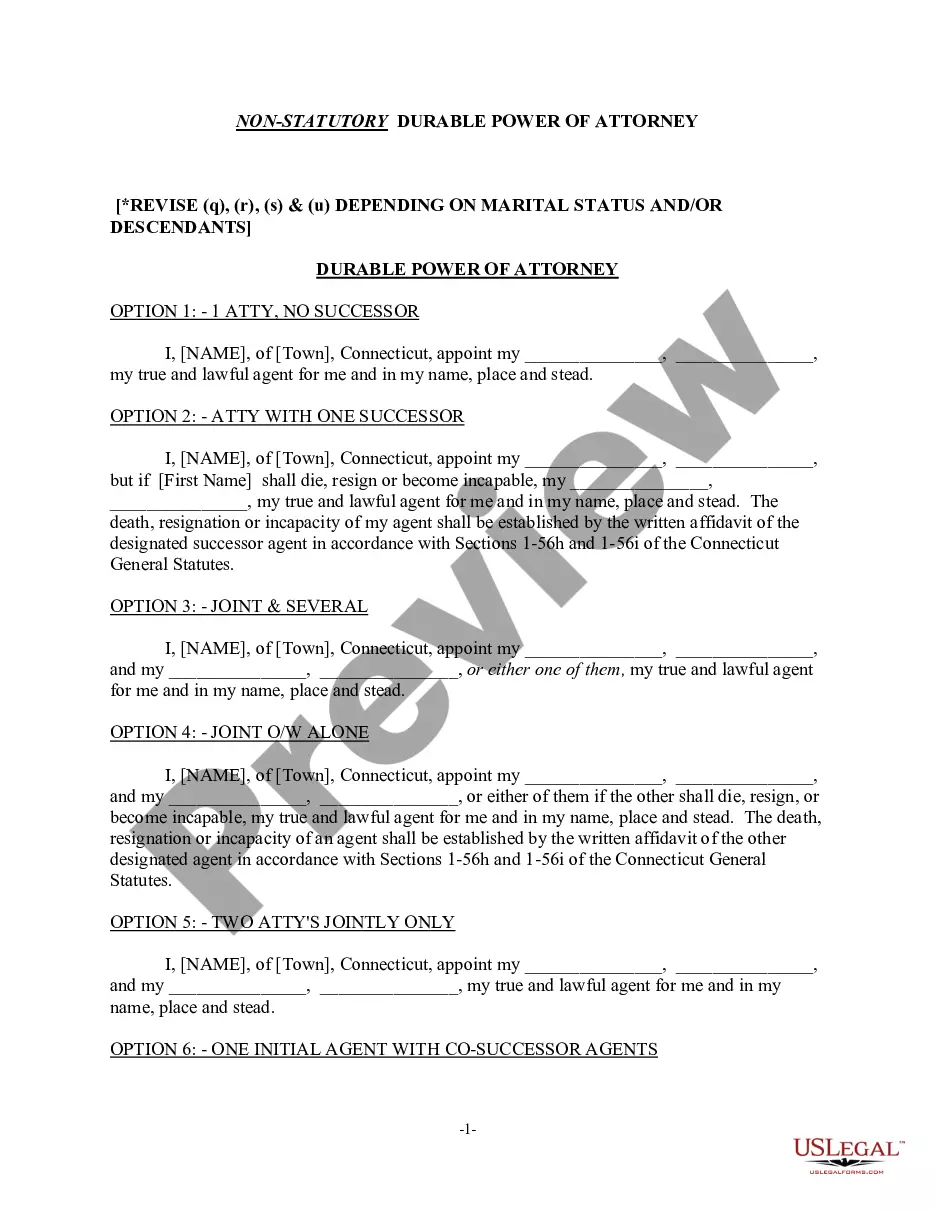

If available, use the Review option to view the document template as well. If you wish to find another version of the form, use the Search field to locate the template that fulfills your needs and requirements.

- If you already possess a US Legal Forms account, you can Log In and select the Download option.

- Following this, you can complete, modify, print, or sign the Massachusetts New Company Benefit Notice.

- Every legal document template you purchase is yours permanently.

- To receive an additional copy of a purchased form, go to the My documents tab and click on the relevant option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- Firstly, ensure that you have chosen the correct document template for your preferred county/city.

- Check the form description to confirm you have selected the appropriate form.

Form popularity

FAQ

To register as an employer in Massachusetts, visit the Massachusetts Department of Revenue website. You will need to complete Form TA-1 to obtain an Employer Identification Number (EIN). Once registered, make sure to review the Massachusetts New Company Benefit Notice to understand your responsibilities concerning employee benefits. Additionally, consider using the uslegalforms platform to streamline your registration process and access necessary forms.

Through PFML, if you work in Massachusetts you're likely eligible to take up to 26 weeks per year of paid, job-protected time off from work when you need it most, so that you can focus on your health and the health of your family.

Anyone who has an ownership stake in the business and is paid through form W-2 is subject to PFML law and considered part of the covered workforce, unless the business is co-owned by family members. DFML follows the Massachusetts unemployment statute about the employment of family members.

Businesses and organizations with one or more employees are subject to the MA PFML law. Exceptions include: Self-employed individuals (may opt in to the state plan). Municipal employers (may opt in if city or town decides to take part in program).

If you employ Massachusetts employees, you're required to comply with the PFML law. Learn more about the law, your obligations, how to make contributions, and other employer responsibilities.

Weekly Benefit Calculation:80% of the portion of the employee's average weekly wage that is equal to or less than 50% of the State average weekly wage (SAWW);Plus 50% of the portion of the employee's average weekly wage that is more than 50% of the SAWW;Capped at the Maximum Weekly Benefit.

The Massachusetts Paid Family and Medical Leave (MA PFML) law allows workers to take paid time off for a serious health condition or to care for family members and provides job protection during approved leaves. This law went into effect for most employees working in Massachusetts on January 1, 2021.

You're eligible for PFML coverage if you are:A full-time, part-time, or seasonal employee in Massachusetts. A 1099-MISC contractor who works for a business that issues 1099-MISC tax forms to more than 50% of its employees. Unemployed for 26 weeks or fewer.

Paid family and medical leave (PFML) is a program designed to help people in Massachusetts take paid time off of work for family or medical reasons. If you are looking to apply for paid time off, you can learn how to begin an application online.

Your benefits payment is based on your individual average weekly wage, the state average weekly wage for Massachusetts workers, and the type of leave you are taking. The maximum weekly benefit is $1,084.31.