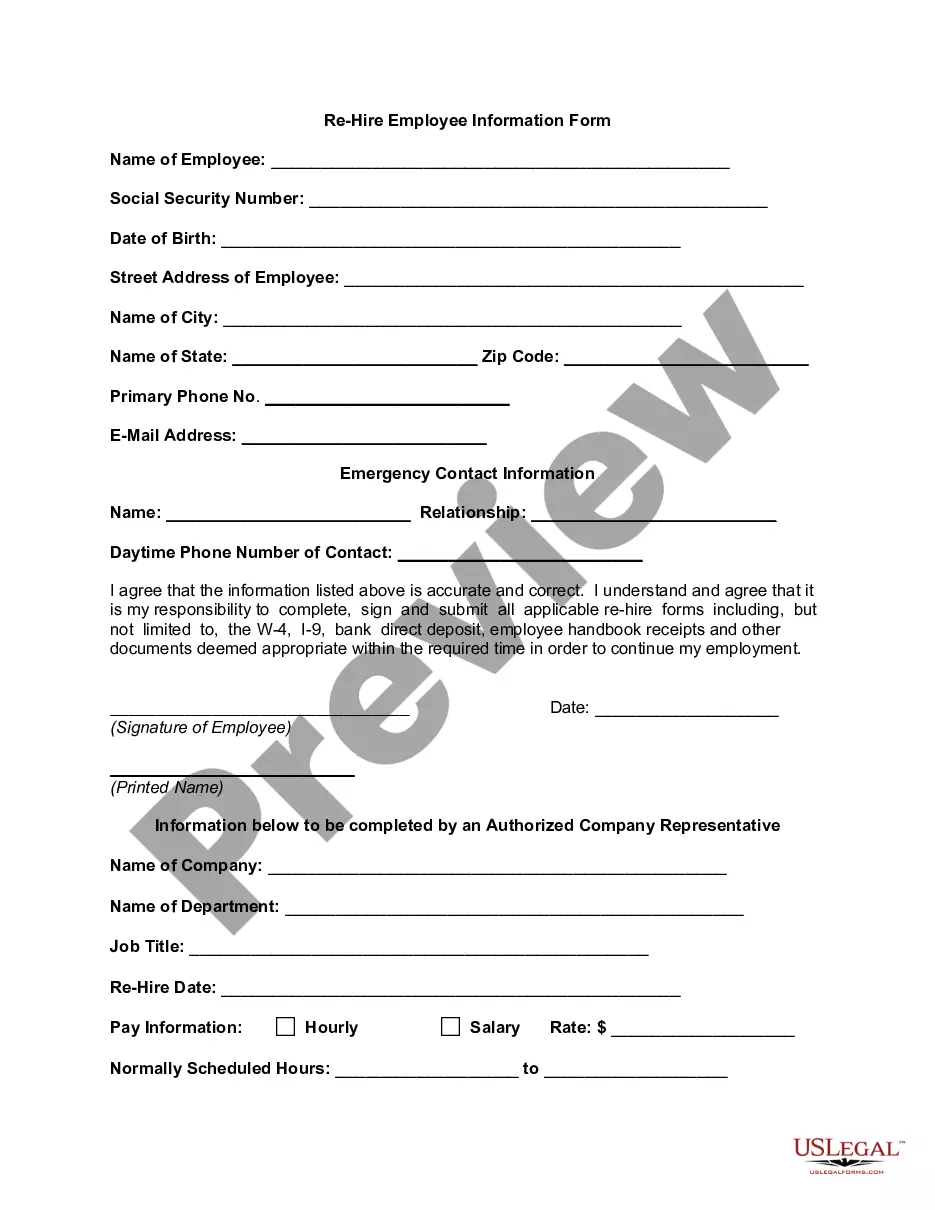

Massachusetts Re-Hire Employee Information Form

Description

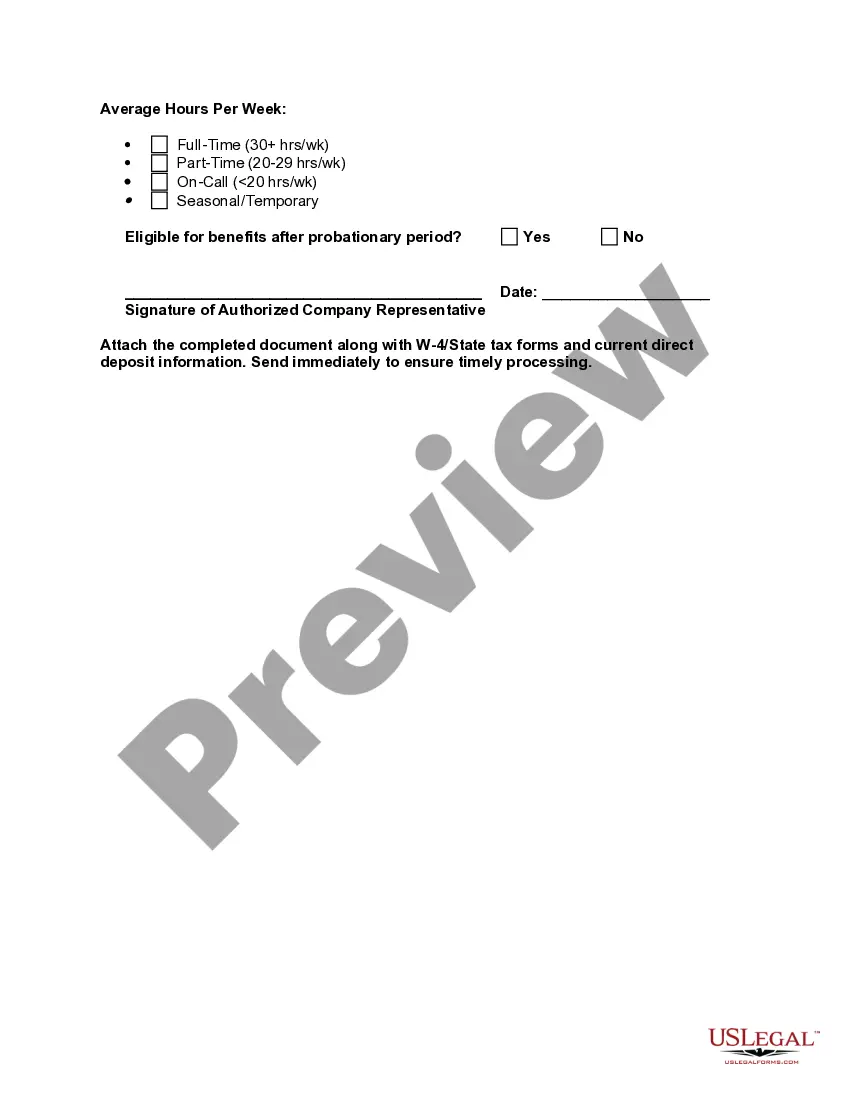

How to fill out Re-Hire Employee Information Form?

Are you within a location where you require documentation for both business or individual activities almost every single day.

There are many legal document templates available online, but finding versions that you can trust is not simple.

US Legal Forms offers thousands of form templates, including the Massachusetts Re-Hire Employee Information Form, which can be tailored to meet federal and state requirements.

Once you acquire the correct form, click on Get now.

Choose the pricing plan you prefer, fill out the necessary information to create your account, and pay for your order using PayPal or a credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Massachusetts Re-Hire Employee Information Form template.

- If you don't have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct area/region.

- Use the Preview button to view the form.

- Check the description to ensure you have selected the right form.

- If the form isn't what you’re looking for, use the Search bar to locate the form that suits your needs and requirements.

Form popularity

FAQ

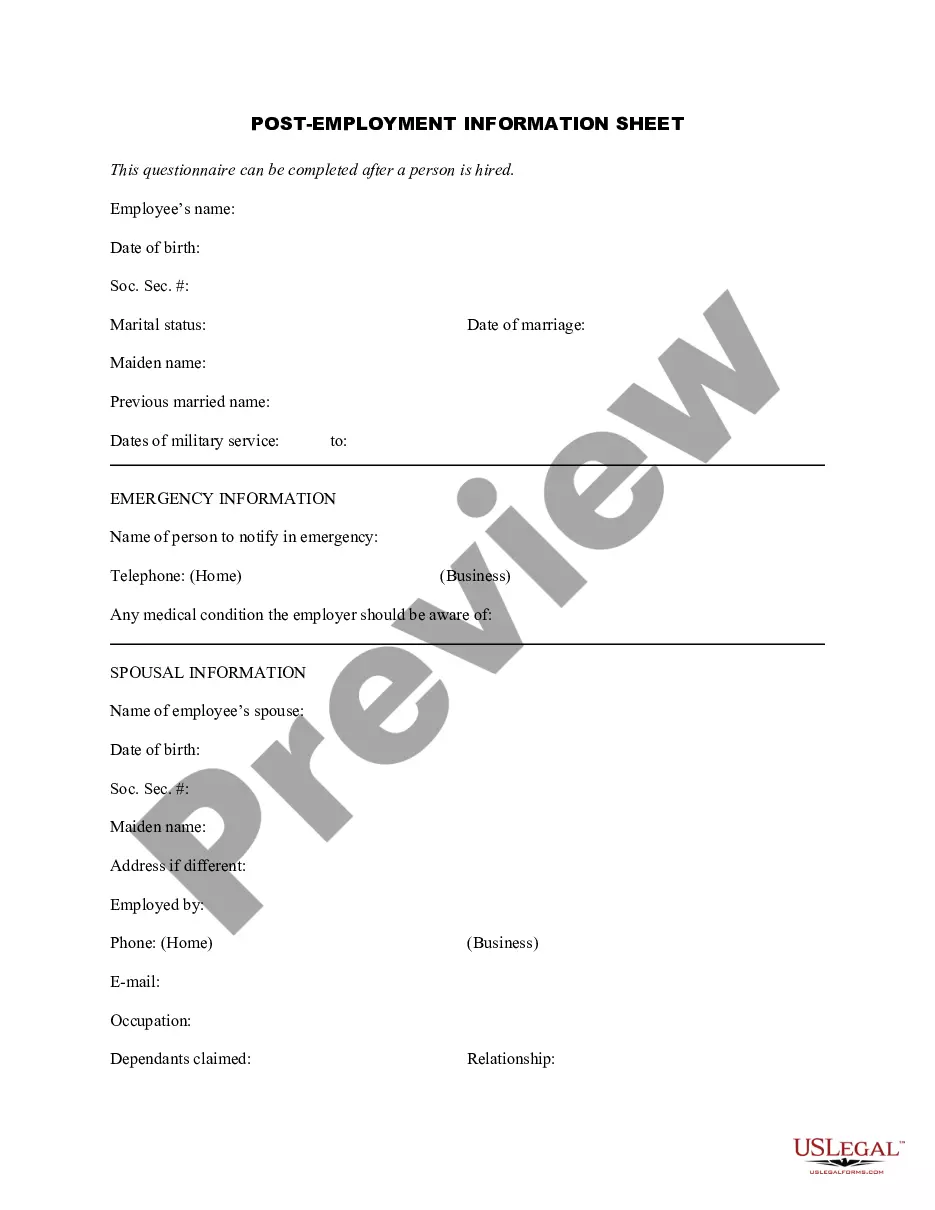

Forms and notices for newly-hired employeesForm I-9 Employment eligibility verification form, US Dept.Form M-4: Massachusetts employee's withholding exemption certificate, Mass.Form NHR: New hire and independent contractor reporting form, Mass.Form W2 Federal tax withholding, IRS.More items...?

Required Employment Forms and Paperwork in MassachusettsSigned Job Offer Letter. W2 Tax Form. I-9 Form and Supporting Documents. Direct Deposit Authorization Form (Template)

How to reportOnline. If you have 25 or more employees, you must file your new hire reports online through MassTaxConnect.By mail. If you have fewer than 25 employees, you can use the New Hire Reporting Form (Form NHR) to submit your new hire reports by mail.By fax.

Before you can add a new hire to your payroll, you need to know how much money to withhold from their wages for federal and, if applicable, state income taxes. To find out, you need to collect two new hire tax forms: federal and state W-4 forms.

How to reportOnline. If you have 25 or more employees, you must file your new hire reports online through MassTaxConnect.By mail. If you have fewer than 25 employees, you can use the New Hire Reporting Form (Form NHR) to submit your new hire reports by mail.By fax.

Here are some forms you can expect to fill out when you begin a new job:Job-specific forms. Employers usually create forms unique to specific positions in a company.Employee information.CRA and tax forms.Compensation forms.Benefits forms.Company policy forms.Job application form.Signed offer letter.More items...?

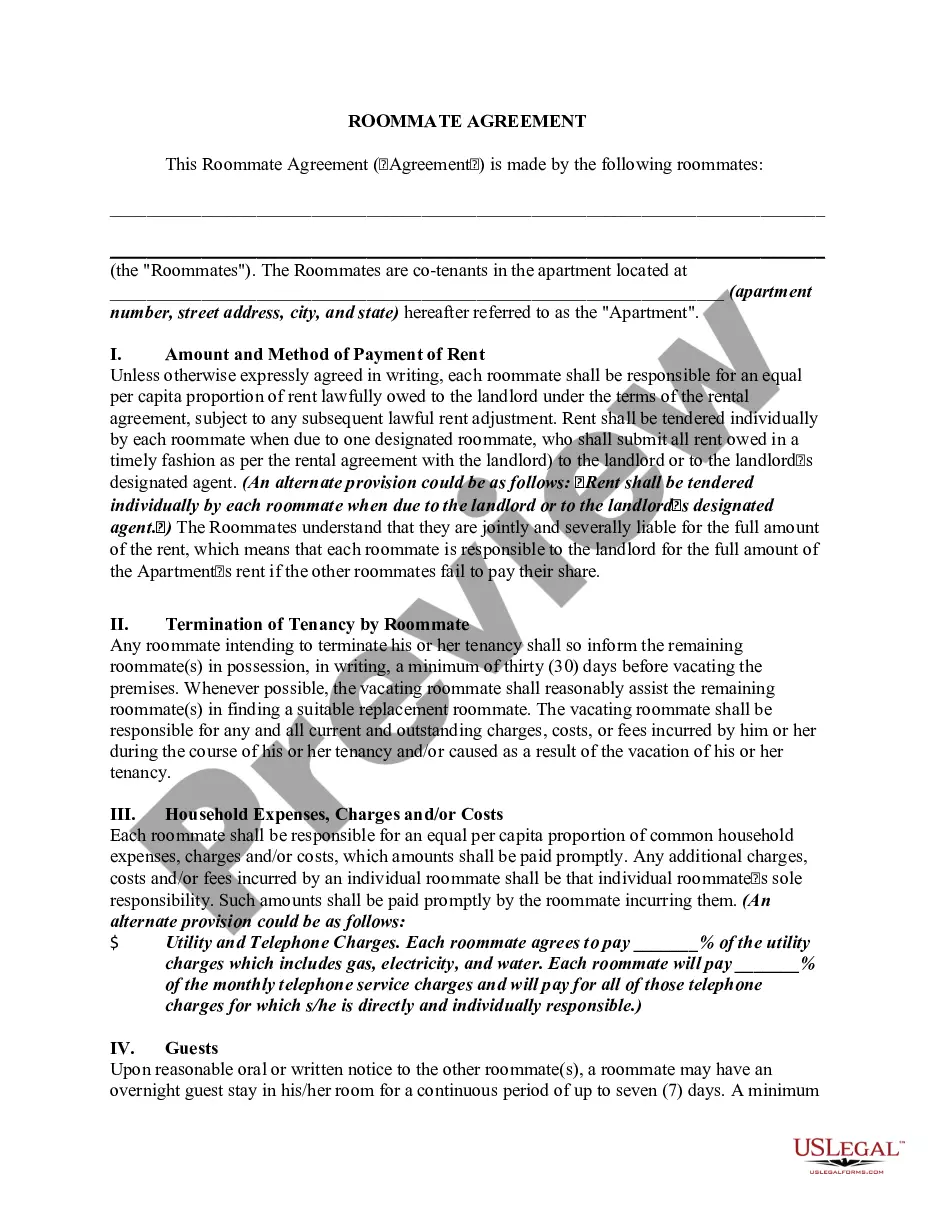

If there is a conspiracy between the employer and employee not to report, that penalty may not exceed $500 per newly hired employee. States may also impose non-monetary civil penalties under state law for noncompliance.

New Hires means a new employee who, as an inducement essential to the individual's entering into an employment relationship with the Company, is to receive Options.

Federal law requires employers to report basic information on new and rehired employees within 20 days of hire to the state where the new employees work. Some states require it sooner.

Make sure you and new hires complete employment forms required by law.W-4 form (or W-9 for contractors)I-9 Employment Eligibility Verification form.State Tax Withholding form.Direct Deposit form.E-Verify system: This is not a form, but a way to verify employee eligibility in the U.S.