Massachusetts Post-Employment Information Sheet

Description

How to fill out Post-Employment Information Sheet?

You can spend hours online searching for the authentic document template that meets the state and federal requirements you need. US Legal Forms provides a wide range of valid forms that are reviewed by experts.

You can easily download or print the Massachusetts Post-Employment Information Sheet from the service.

If you have a US Legal Forms account, you can Log In and click on the Download button. After that, you can complete, edit, print, or sign the Massachusetts Post-Employment Information Sheet. Each legal document template you acquire is yours permanently.

Complete the transaction. You can use your credit card or PayPal account to pay for the legal document. Choose the format of your document and download it to your device. If necessary, make changes to your document. You can complete, edit, sign, and print the Massachusetts Post-Employment Information Sheet. Download and print numerous document templates using the US Legal Forms website, which offers the largest selection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- To obtain an additional copy of any purchased form, go to the My documents tab and click on the appropriate button.

- If you are using the US Legal Forms website for the first time, follow these simple instructions.

- First, ensure you have selected the correct document template for your particular region/city. Review the form description to confirm you have chosen the correct one.

- If available, utilize the Preview button to review the document template as well.

- To find another version of your form, use the Search field to locate the template that fits your needs.

- Once you have identified the template you want, click Get now to proceed.

- Choose the pricing plan you prefer, enter your details, and register for a US Legal Forms account.

Form popularity

FAQ

Employers must provide employees with a written work schedule, including on-call shifts, before the schedule begins (commonly around 14 days preceding the first day of the schedule).

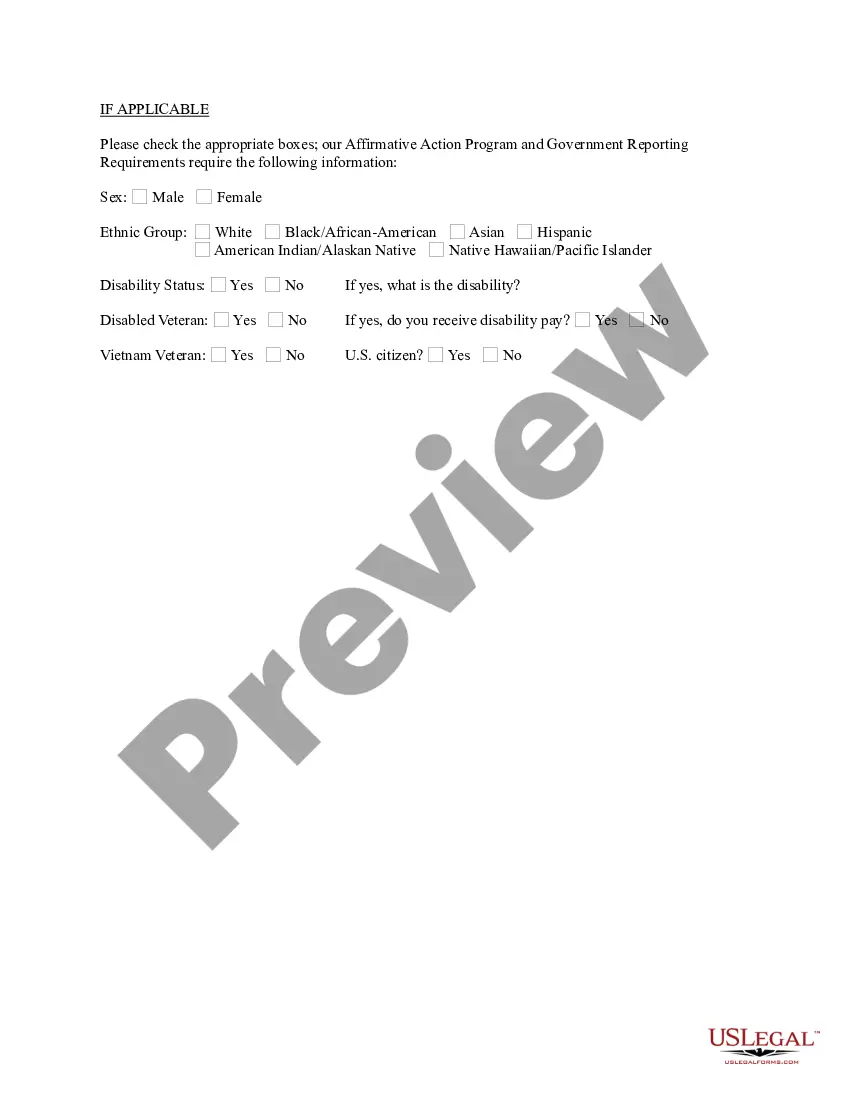

Forms and notices for newly-hired employeesForm I-9 Employment eligibility verification form, US Dept.Form M-4: Massachusetts employee's withholding exemption certificate, Mass.Form NHR: New hire and independent contractor reporting form, Mass.Form W2 Federal tax withholding, IRS.More items...?

Your employer must give you reasonable notice of any changes to your working hours, such as cancelling your shifts. They may request last minute changes, such as ringing you that morning to say that they do not require you to work. You can choose to agree to this change.

An employer should give an employee who works an irregular shift pattern reasonable notice of their hours. Normally this would be included in the contract of employment and the standard notice period is around 7 days.

(c) The employer shall post 7 days in advance of the start of each week in writing a schedule that includes the shifts of all current employees at that worksite, whether or not they are scheduled to work or be on call that week. The employer shall update that posted schedule within 24 hours of any change.

Make sure you and new hires complete employment forms required by law.W-4 form (or W-9 for contractors)I-9 Employment Eligibility Verification form.State Tax Withholding form.Direct Deposit form.E-Verify system: This is not a form, but a way to verify employee eligibility in the U.S.

How to reportOnline. If you have 25 or more employees, you must file your new hire reports online through MassTaxConnect.By mail. If you have fewer than 25 employees, you can use the New Hire Reporting Form (Form NHR) to submit your new hire reports by mail.By fax.

Before you can add a new hire to your payroll, you need to know how much money to withhold from their wages for federal and, if applicable, state income taxes. To find out, you need to collect two new hire tax forms: federal and state W-4 forms.

Employers must provide employees with prompt notice of any schedule changes. Schedule changes can occur in a smaller than 14-day window. Most scheduling laws require at least a 24-hour notice, however. Some laws require the employer to give the employee the right to accept or refuse.

Maine - E-Verify is voluntary for all employers. Maryland - E-Verify is voluntary for all employers. Massachusetts - Mandatory E-Verify for state agencies. Michigan - E-Verify is voluntary for most employers and mandatory for contractors and subcontractors of the transportation department.