Massachusetts Assignment of Contract as Security for Loan

Description

How to fill out Assignment Of Contract As Security For Loan?

Are you presently in a role that requires you to obtain documents for various organizational or personal reasons almost every workday? There are numerous legal document templates available online, but locating ones you can rely on is challenging.

US Legal Forms provides thousands of form templates, such as the Massachusetts Assignment of Contract as Security for Loan, crafted to meet both state and federal requirements.

If you are already familiar with the US Legal Forms website and have your account, simply Log In. After that, you can download the Massachusetts Assignment of Contract as Security for Loan template.

Choose a convenient file format and download your copy.

Access all the document templates you have purchased in the My documents menu. You can obtain an additional copy of the Massachusetts Assignment of Contract as Security for Loan at any time, if needed. Just select the required form to download or print the document template. Utilize US Legal Forms, one of the largest collections of legal forms, to save time and prevent mistakes. The service provides professionally crafted legal document templates that can be utilized for various purposes. Create your account on US Legal Forms and start making your life a bit easier.

- If you do not possess an account and wish to start using US Legal Forms, follow these instructions.

- Find the form you need and ensure it is suitable for the correct city/state.

- Utilize the Review button to verify the form.

- Check the description to confirm you have selected the right form.

- If the form isn't what you are searching for, use the Research field to locate the form that fits your needs and requirements.

- Once you find the correct form, click Buy now.

- Select the payment plan you want, fill in the necessary details to create your account, and pay for the transaction using your PayPal or Visa or Mastercard.

Form popularity

FAQ

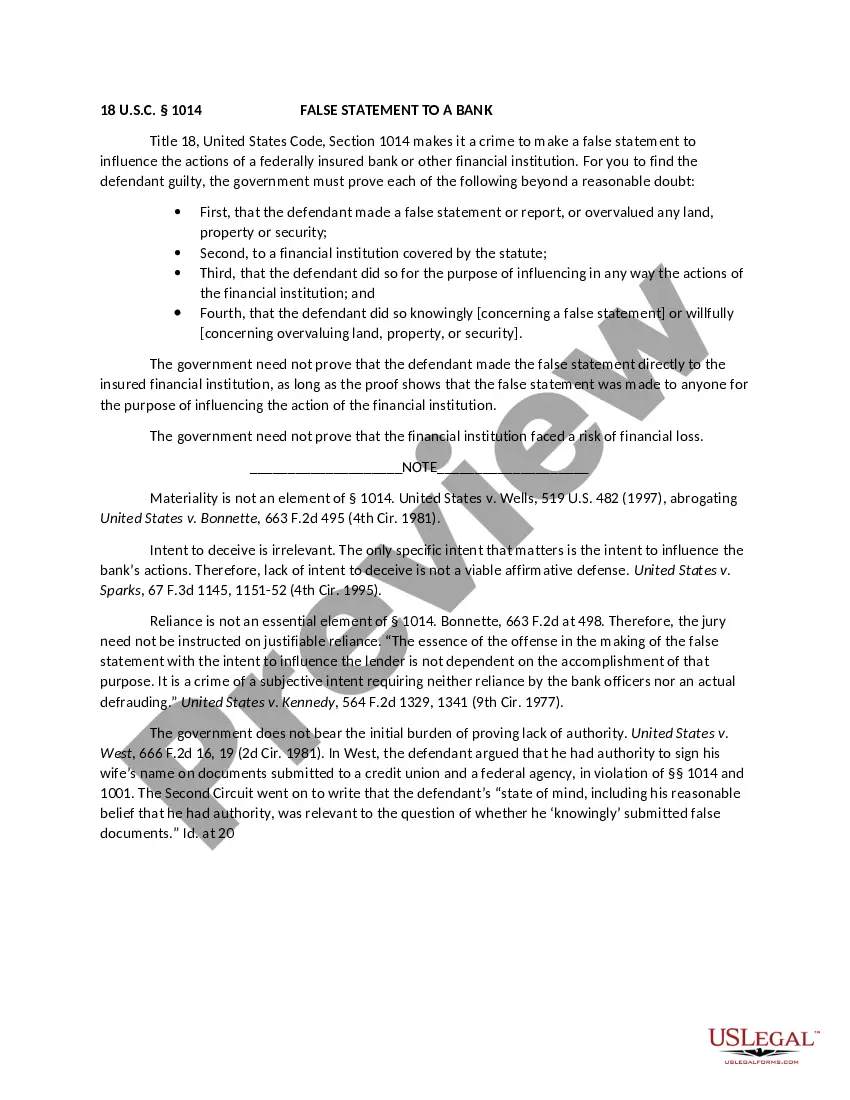

Assignment by way of security is a concept that comes up on many construction projects; typically as a condition of providing finance a funder will require an assignment by way of security of key construction documents, including building contracts and appointments, with the intention that if the borrower defaults on

For a personal loan agreement to be enforceable, it must be documented in writing and signed by both parties. You may choose to keep a copy in your county recorder's office if you wish, though it's not legally necessary. It's sufficient for both parties to store their own copy, ideally in a safe place.

A standard form deed of assignment under which a lender (the assignor) assigns its rights relating to a facility agreement (also known as a loan agreement) to a new lender (the assignee).

An assignment of contract occurs when one party to an existing contract (the "assignor") hands off the contract's obligations and benefits to another party (the "assignee"). Ideally, the assignor wants the assignee to step into his shoes and assume all of his contractual obligations and rights.

Companies that operate by contractually agreeing to provide services or products for a specific project or event can use the contract as collateral to secure necessary funding.

To draft a Loan Agreement, you should include the following:The addresses and contact information of all parties involved.The conditions of use of the loan (what the money can be used for)Any repayment options.The payment schedule.The interest rates.The length of the term.Any collateral.The cancellation policy.More items...

Collateral Assignment of Contracts means the assignment of representations, warranties, covenants, indemnities and rights to the Agent, in respect of the Loan Parties' rights under that certain Escrow Agreement executed in connection with the Riverstone Acquisition delivered on the Original Closing Date.

What is an Assignment Of Loan? Under an assignment of loan, a lender (the assignor) assigns its rights relating to a loan agreement to a new lender (the assignee). Only the assignor's rights under the loan agreement are assigned.

Collateral on a secured personal loan can include things like cash in a savings account, a car or even a home.

Collateral assignment of life insurance lets you use a life insurance policy as an asset to secure a loan. If you die while the policy is in place and still owe money on the loan, the death benefit goes to pay off the remaining debt. Any money remaining goes to your beneficiaries.