Massachusetts Sample Letter regarding Chapter 13 Plan

Description

How to fill out Sample Letter Regarding Chapter 13 Plan?

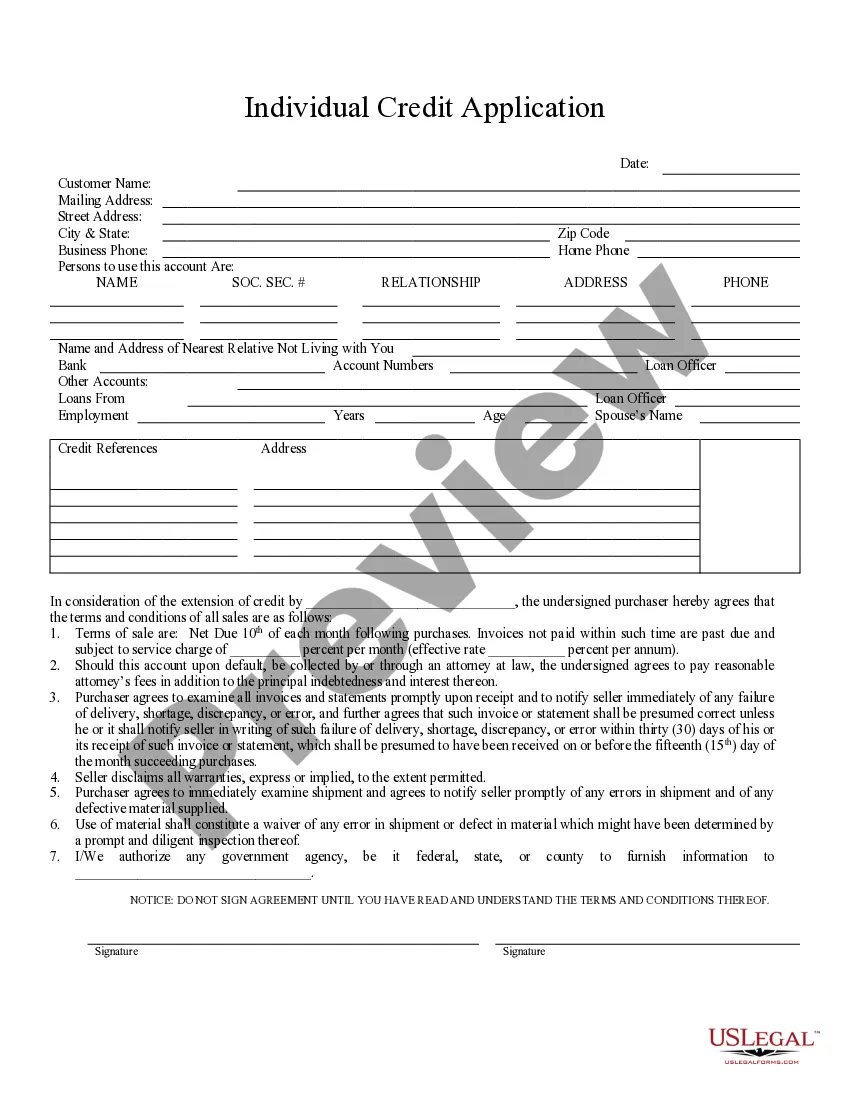

US Legal Forms - among the largest libraries of lawful types in America - gives an array of lawful papers layouts you can down load or produce. Using the site, you can find thousands of types for company and individual reasons, categorized by categories, claims, or search phrases.You can get the most recent types of types such as the Massachusetts Sample Letter regarding Chapter 13 Plan in seconds.

If you have a monthly subscription, log in and down load Massachusetts Sample Letter regarding Chapter 13 Plan from your US Legal Forms library. The Download button will appear on each and every form you look at. You have accessibility to all formerly downloaded types in the My Forms tab of the bank account.

In order to use US Legal Forms the first time, listed here are easy directions to get you started out:

- Be sure you have picked out the right form for your personal city/county. Go through the Review button to analyze the form`s content material. Browse the form description to actually have selected the right form.

- When the form doesn`t satisfy your requirements, make use of the Research field towards the top of the display to find the one which does.

- Should you be content with the form, verify your selection by simply clicking the Buy now button. Then, opt for the prices prepare you want and offer your accreditations to register for the bank account.

- Approach the transaction. Make use of bank card or PayPal bank account to accomplish the transaction.

- Find the format and down load the form on the gadget.

- Make modifications. Fill out, revise and produce and indicator the downloaded Massachusetts Sample Letter regarding Chapter 13 Plan.

Each and every format you put into your money does not have an expiration date and it is your own for a long time. So, if you would like down load or produce another backup, just visit the My Forms segment and click in the form you require.

Gain access to the Massachusetts Sample Letter regarding Chapter 13 Plan with US Legal Forms, by far the most substantial library of lawful papers layouts. Use thousands of specialist and condition-specific layouts that fulfill your small business or individual requires and requirements.

Form popularity

FAQ

Some common reasons creditors object to Chapter 13 plan confirmation include: Disagreement about the outstanding balance on the debt. Disagreement about the past-due amount. Objection to a ?cramdown? of an automobile loan.

This bankruptcy form Notice of Objecton to Proof of Claim and Notice of Hearing and Objection to Claim can be used in Chapter 13 bankruptcy by a debtor's attorney to object to the proof of claim of a creditor who has overstated the amount due.

This is where an experienced Chapter 13 bankruptcy lawyer can help. There are a number of reasons why a trustee might object to your repayment plan: Your payments exceed your income. Your plan doesn't have all of your disposable income going to unsecured creditors.

If you are considering filing for Chapter 13 bankruptcy, it is important to be aware that one or more creditors may object to your proposed repayment plan. However, if you are prepared to respond to their objections, you may be able to overcome them and continue with your bankruptcy case.

Some common reasons creditors object to Chapter 13 plan confirmation include: Disagreement about the outstanding balance on the debt. Disagreement about the past-due amount. Objection to a ?cramdown? of an automobile loan. Disagreement about the classification of the debt.

If the court declines to confirm the plan or the modified plan and instead dismisses the case, the court may authorize the trustee to keep some funds for costs, but the trustee must return all remaining funds to the debtor (other than funds already disbursed or due to creditors). 11 U.S.C. § 1326(a)(2).

The chapter 13 trustee may file an objection to the confirmation of an amended plan no later than fourteen (14) days from the date the amended plan is filed or five (5) days before the date set for the first confirmation hearing, whichever is earlier.

Once your repayment plan gets confirmed, you must continue to make timely payments to the bankruptcy trustee each month for the duration of your plan. You must also continue to make payments on debts, such as your mortgage or car payment, which you proposed to pay outside of bankruptcy.