Massachusetts Subordination Agreement Subordinating Existing Mortgage to New Mortgage

Description

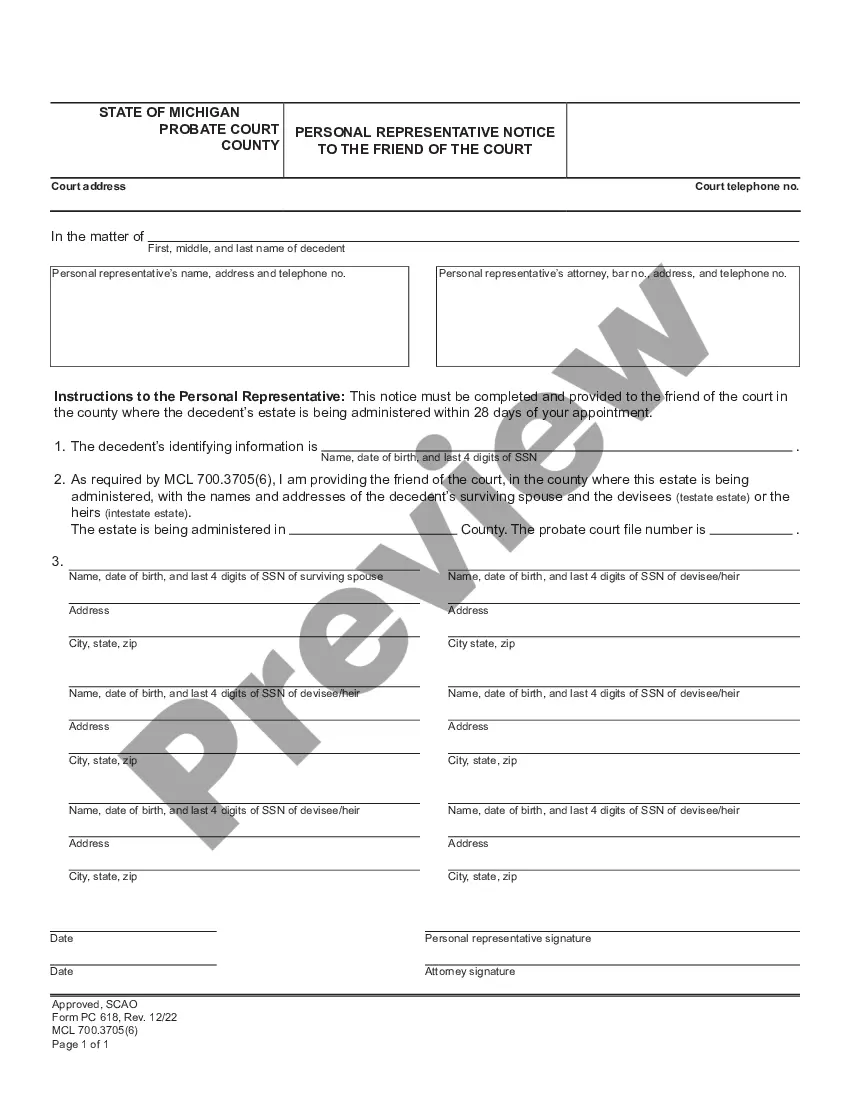

How to fill out Subordination Agreement Subordinating Existing Mortgage To New Mortgage?

Have you been within a situation in which you need to have files for either organization or specific reasons nearly every working day? There are plenty of legitimate document themes available online, but locating types you can rely isn`t effortless. US Legal Forms offers a large number of type themes, like the Massachusetts Subordination Agreement Subordinating Existing Mortgage to New Mortgage, which are composed in order to meet federal and state needs.

Should you be previously informed about US Legal Forms internet site and have a merchant account, just log in. Following that, you can download the Massachusetts Subordination Agreement Subordinating Existing Mortgage to New Mortgage web template.

If you do not come with an account and would like to start using US Legal Forms, adopt these measures:

- Get the type you will need and make sure it is for your appropriate metropolis/county.

- Take advantage of the Preview key to analyze the shape.

- Browse the explanation to actually have chosen the proper type.

- When the type isn`t what you`re looking for, utilize the Search area to obtain the type that suits you and needs.

- Whenever you obtain the appropriate type, click Get now.

- Opt for the pricing plan you would like, submit the desired info to produce your money, and pay for the transaction making use of your PayPal or Visa or Mastercard.

- Select a practical file format and download your copy.

Discover all of the document themes you have bought in the My Forms food list. You may get a additional copy of Massachusetts Subordination Agreement Subordinating Existing Mortgage to New Mortgage at any time, if needed. Just select the needed type to download or printing the document web template.

Use US Legal Forms, the most substantial variety of legitimate types, to save lots of efforts and stay away from blunders. The assistance offers appropriately manufactured legitimate document themes which you can use for an array of reasons. Produce a merchant account on US Legal Forms and begin producing your way of life a little easier.

Form popularity

FAQ

Many people have a subordinate mortgage in the form of a home equity line of credit or home equity loan. A subordinate mortgage is secured by your property but sits in second position, if you have a primary mortgage, for getting paid in the event you default.

For example, if a lender loans money to a parent company, that lender is structurally subordinated to a lender who loaned money to a subsidiary operating company which is lower down in the company organizational structure.

Example of a Subordination Agreement A standard subordination agreement covers property owners that take a second mortgage against a property. One loan becomes the subordinated debt, and the other becomes (or remains) the senior debt. Senior debt has higher claim priority than junior debt.

When you get a mortgage loan, the lender will likely include a subordination clause essentially stating that their lien will take precedence over any other liens placed on the house. A subordination clause serves to protect the lender if a homeowner defaults.

There are also situations where your first purchase loan can become subordinate by law or regulation, without your lender's agreement. Here are two examples: If you have a Federal tax lien for unpaid income taxes, this debt automatically becomes a primary lien ahead of your first mortgage.

A first mortgage is a primary lien on a property. 1 As the primary loan that pays for a property, it has priority over all other liens or claims on a property in the event of default. A first mortgage is not the mortgage on a borrower's first home; it is the original mortgage taken on any one property.

Primary tabs. Subordination is the act or process by which one person or creditor's rights or claims are ranked below those of others, dealing with the distribution priority of debts between creditors.

A subordinate mortgage loan is any loan not in the first lien position. The subordination order goes by the order the loans were recorded. For example, your first mortgage (the mortgage used to buy the house) is recorded first because it's the first loan you borrow.

Broadly, there are two types of subordination: structural (common in the UK and mainland Europe) and contractual (common in the US). On a contractual subordination, loans are made to the same company but the senior creditor and junior creditor agree priority of payment by contract.

A mortgage subordination refers to the order the outstanding liens on your property get repaid if you stop making your mortgage payments. For example, your first home loan (primary mortgage) is repaid first, with any remaining funds paying off additional liens, including second mortgages, HELOCs and home equity loans.