Massachusetts Assignment of LLC Company Interest to Living Trust

Description

How to fill out Assignment Of LLC Company Interest To Living Trust?

Locating the appropriate legal document template can be a challenge.

Clearly, there are numerous formats accessible online, but how can you acquire the legal form you need? Use the US Legal Forms website.

The service offers thousands of templates, such as the Massachusetts Assignment of LLC Company Interest to Living Trust, which you can utilize for both business and personal purposes.

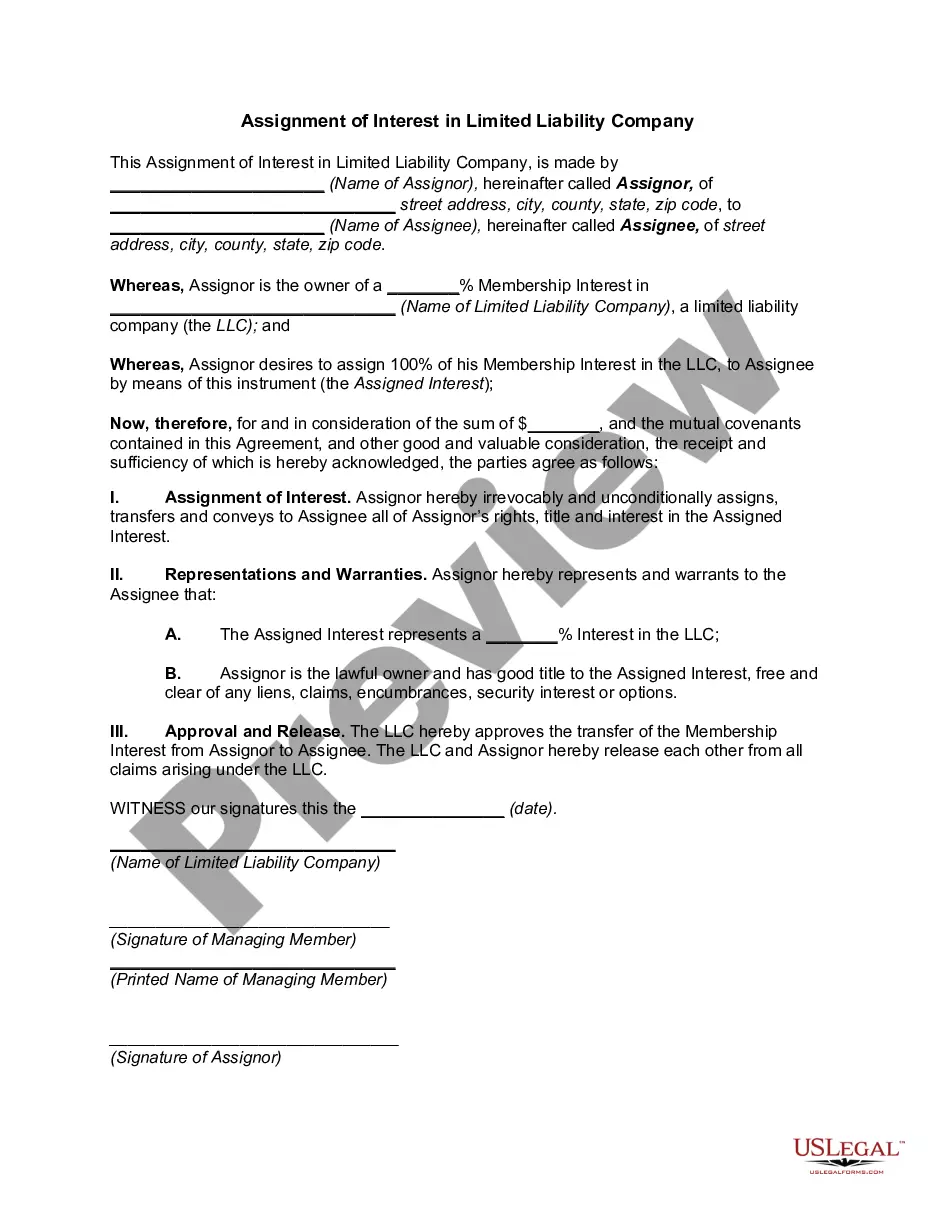

You can preview the form using the Preview button and read the form description to confirm it is suitable for you.

- All the forms are reviewed by experts and comply with federal and state requirements.

- If you are already registered, Log In to your account and click the Acquire button to obtain the Massachusetts Assignment of LLC Company Interest to Living Trust.

- Use your account to browse the legal forms you have previously purchased.

- Proceed to the My documents tab of your account and obtain another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions for you to follow.

- First, ensure that you have chosen the correct type for your region.

Form popularity

FAQ

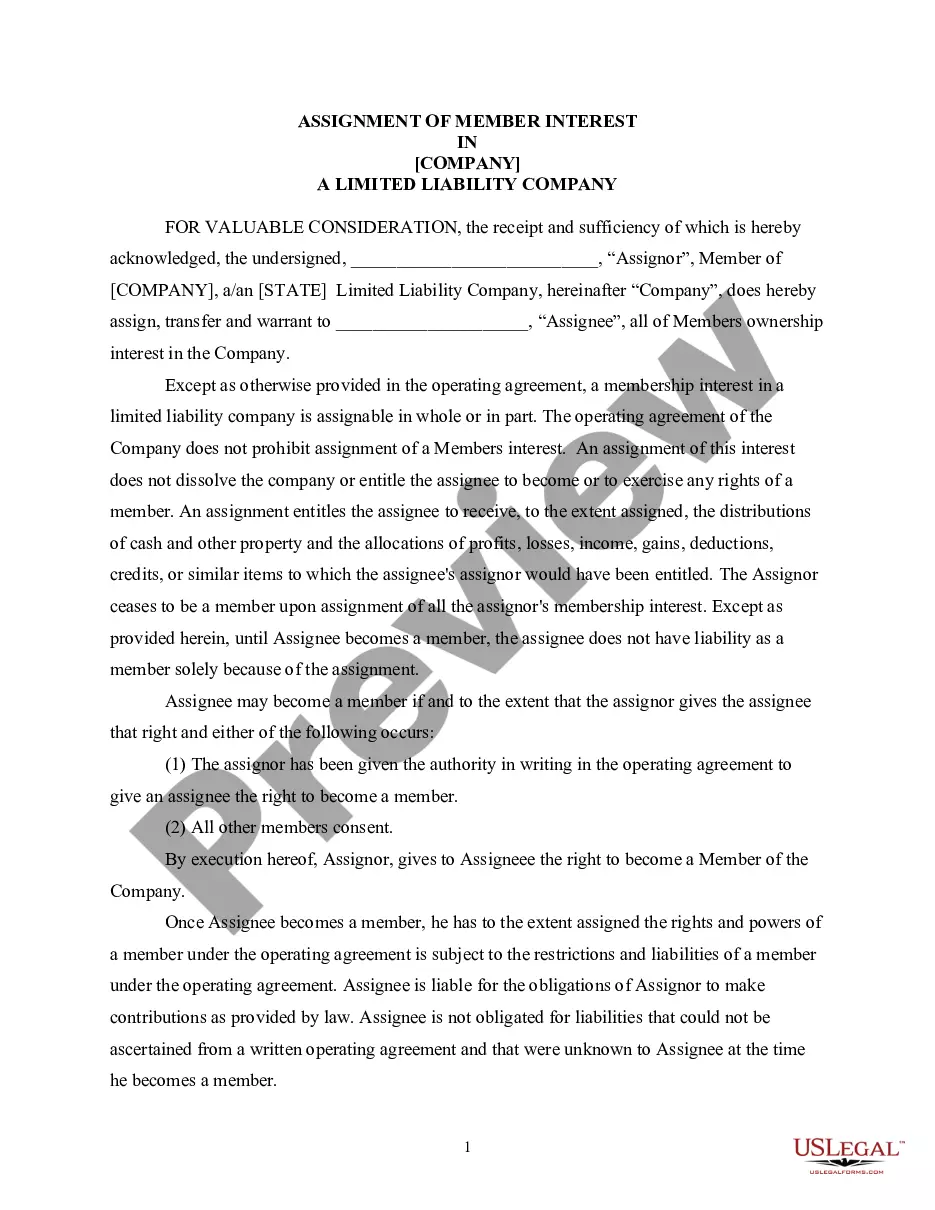

The assignment of interest is typically different from selling the ownership stake. Selling a member's ownership stake in the LLC requires unanimous approval by the other members. A departing member may also assign his membership to another member.

A membership interest represents an investor's (called a "member") ownership stake in an LLC. A person who holds a membership interest has a profit and voting interest in the LLC (although these may be amended by contract). Ownership in an LLC can be expressed by percentage ownership interest or membership units.

The answer is yes, a trust can own an LLC, either as the sole owner or as one of many owners.

By placing a business into a living trust -- a trust that is created for you and your family's benefit while you are alive -- you transfer legal ownership of your business to the trustee, which is usually a third party but can also be the business owner.

While membership interests are freely transferable in the sense that any member generally can transfer his or her economic rights in the LLC (subject to the operating agreement, a stand-alone buy-sell agreement, and state law), the management or voting rights in the LLC are usually what are restrictedotherwise, other

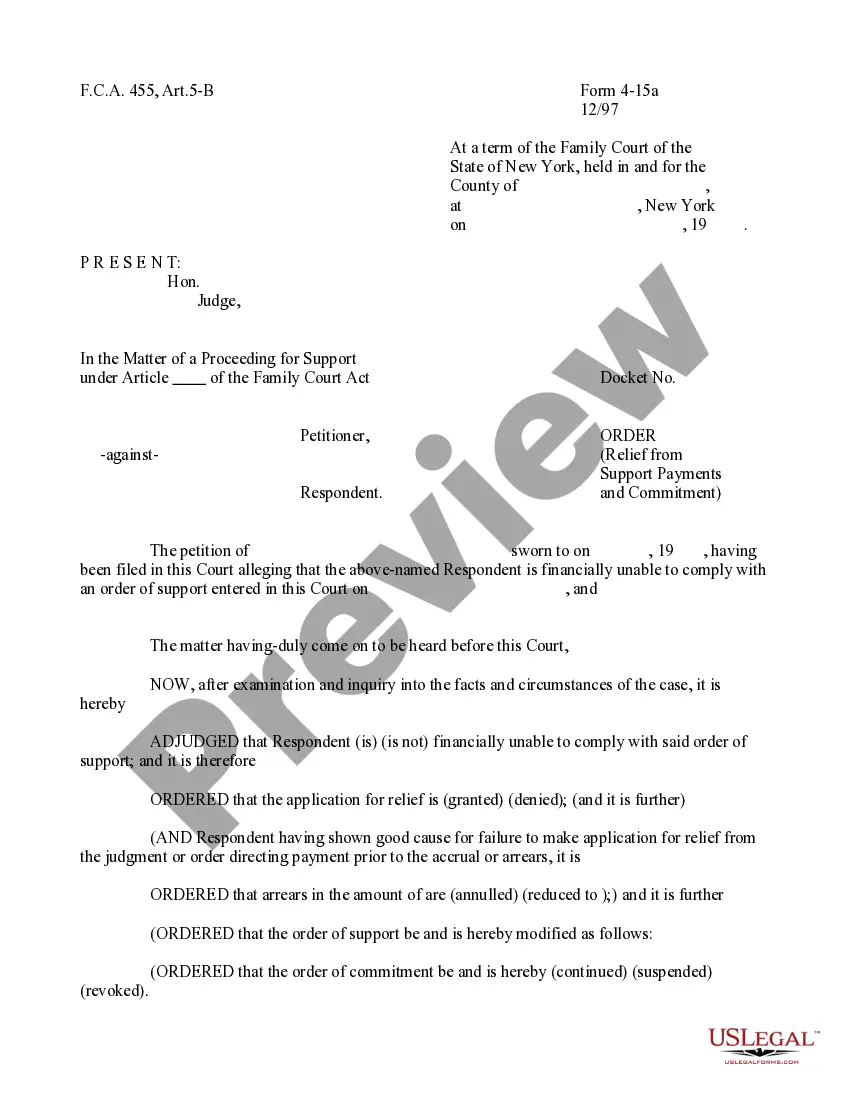

Here is how you can transfer your LLC to your Trust:Draft and Execute the Transfer Document.Draft and File an Amendment to your Articles of Organization with the Arizona Corporation Commission.Amend the Operating Agreement.Have LLC Members Sign a Resolution Accepting Transfer.

If an LLC member's interest is held in a trust, then the administrator, sometimes called a "trustee," will vote and otherwise exercise the duties and rights of the LLC member. Transferring the membership interest to the trust could require an official transfer document, which is similar to a bill of sale.

The answer is yes. First, trust law permits trusteeswho are acting on behalf of trusts, including revocable truststo own any asset, or almost any asset, that an individual can own, and this includes an interest in an LLC, which qualifies as an asset.