Massachusetts Assignment of Interest in Trust

Description

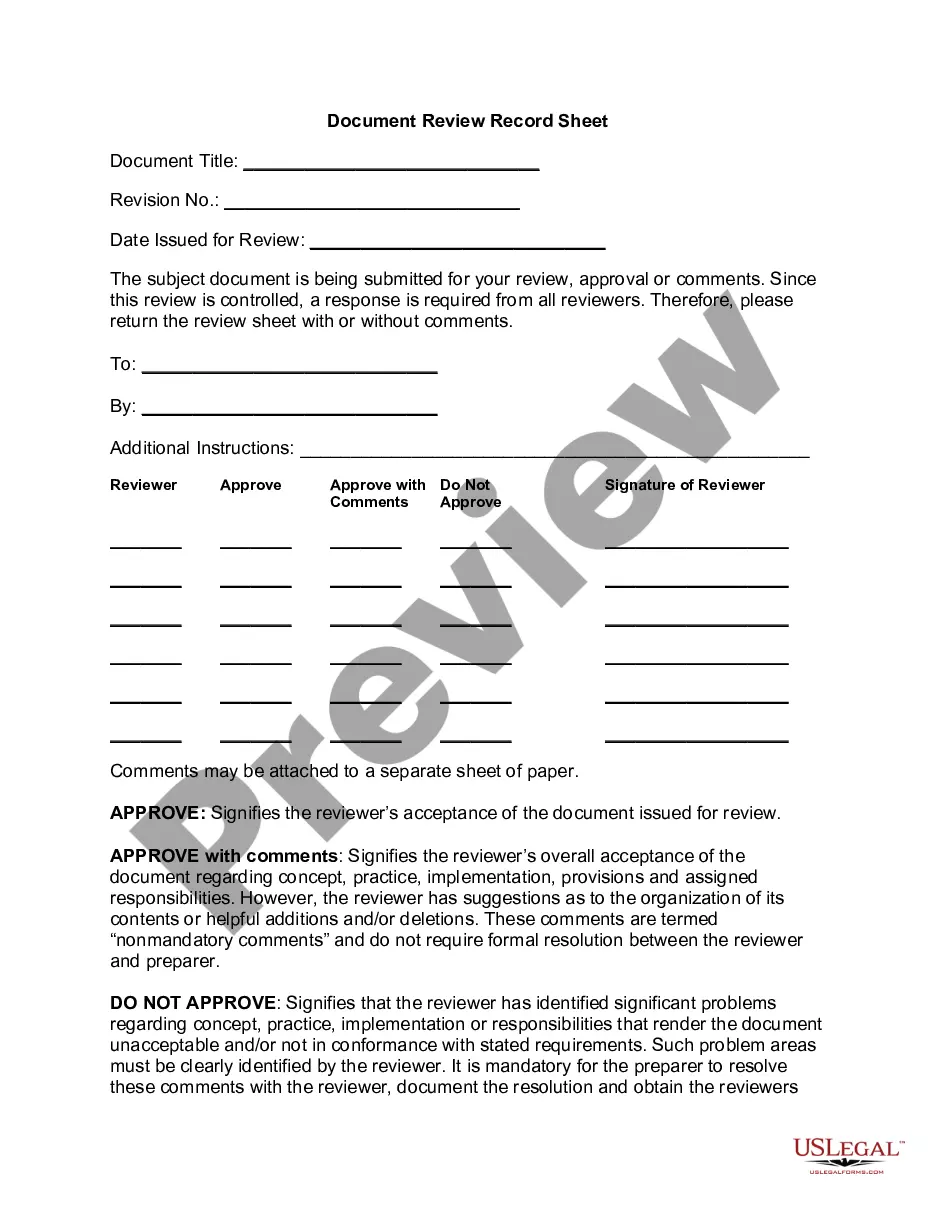

How to fill out Assignment Of Interest In Trust?

If you wish to finalize, obtain, or produce legal document templates, utilize US Legal Forms, the top selection of legal forms that are accessible online.

Employ the website's straightforward and user-friendly search feature to find the documents you require.

Various templates for business and personal purposes are categorized by types and states, or keywords.

Step 4. Once you have located the form you need, click on the Buy now button. Choose the payment plan that suits you and enter your information to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Use US Legal Forms to acquire the Massachusetts Assignment of Interest in Trust with just a few clicks.

- If you are an existing US Legal Forms client, Log In to your account and click the Acquire button to obtain the Massachusetts Assignment of Interest in Trust.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Make sure you have selected the form for the correct city/state.

- Step 2. Use the Review option to browse through the form's content. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search box at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

Assigning inheritance is the process of transferring your inheritance to someone else. For instance, if you receive an inheritance advance, you will assign a portion of your inheritance to the funding company providing the cash advance in return for immediate funds.

At this time a beneficiary has no entitlement to any fixed interest other than to demand the due administration of the estate. As such, a disclaimer made at this time will not attract Stamp Duty.

Trust Interest means an account owner's interest in the trust created by a participating trust agreement and held for the benefit of a designated beneficiary.

Usually, a trust prohibits beneficiaries from assigning their interest in the trust before distribution. The anti-assignment provision protects undistributed trust assets from claims by a beneficiary's creditors. Next, disclaimers are used when a beneficiary, or heir, refuses to accept a gift or inheritance.

A beneficiary typically has a future interest in the trust's assets meaning they might access funds at a determined time, such as when the recipient reaches a certain age.

What if the beneficiary decides to simply sell his/her interest in the trust or use that interest as collateral for a loan? Can a beneficiary do that? As a general rule, trust property cannot be sold outright by a beneficiary; the property must be first transferred to the beneficiary and placed in his name.

If you accept the inheritance and then give it to your child, it may be subject to a gift tax. However, the inheritance will be subject to the will once you refuse it. If your child isn't named on the will, you may be better off accepting the will and gifting it to them. The inheritance doesn't appeal to you.

Trustees are trusted to make decisions in the beneficiary's best interests and often have a fiduciary responsibility, meaning they act in the best interests of the trust beneficiaries to manage their assets.