A check disbursements journal is a book used to record all payments made in cash such as for accounts payable, merchandise purchases, and operating expenses.

Massachusetts Check Disbursements Journal

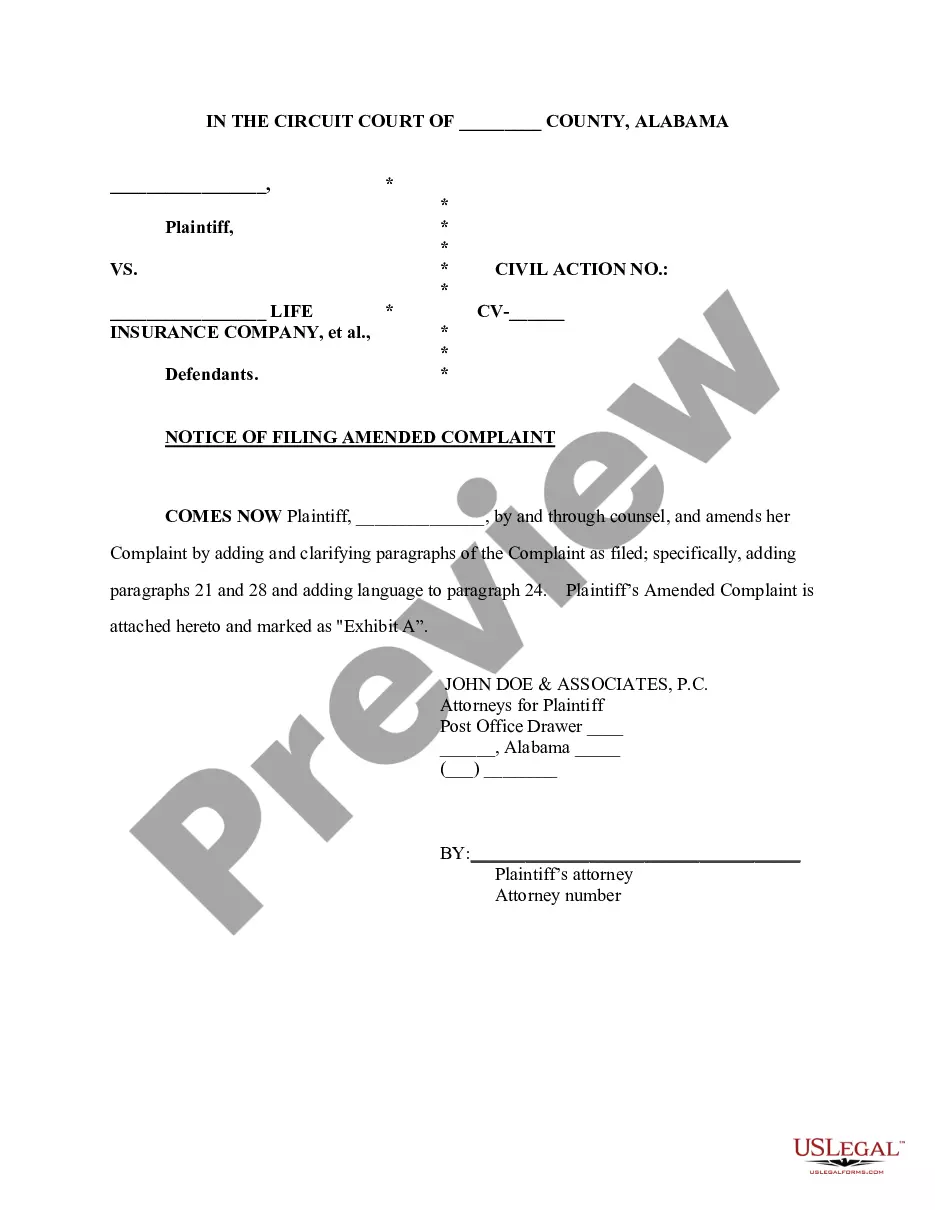

Description

How to fill out Check Disbursements Journal?

If you want to finalize, retrieve, or print valid document templates, utilize US Legal Forms, the most extensive selection of legal forms available online.

Employ the site's straightforward and convenient search feature to obtain the documents you require.

Various templates for business and personal purposes are categorized by type and state, or by keywords.

Every legal document template you acquire is yours indefinitely. You can access every form you downloaded from your account.

Visit the My documents section and select a form to print or download again. Finalize and download, and print the Massachusetts Check Disbursements Journal with US Legal Forms. There are countless professional and state-specific templates available for your business or personal needs.

- Use US Legal Forms to access the Massachusetts Check Disbursements Journal with just a few clicks.

- If you are currently a US Legal Forms subscriber, sign in to your account and click the Download button to locate the Massachusetts Check Disbursements Journal.

- You can also retrieve forms you have previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, consult the instructions provided below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Preview option to review the content of the form. Don't forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search bar at the top of the screen to find other variations in the legal form format.

- Step 4. Once you have found the form you need, click the Purchase now button. Choose your preferred pricing plan and enter your details to register for an account.

- Step 5. Complete the transaction. You can utilize your Visa or MasterCard or PayPal account to finalize the purchase.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Fill out, modify, and print or sign the Massachusetts Check Disbursements Journal.

Form popularity

FAQ

The appropriate journal to record disbursements by check is the Massachusetts Check Disbursements Journal. This specialized journal captures all relevant details about each disbursement, thus providing a complete financial picture. By using this journal, businesses enhance their ability to monitor expenditures. Moreover, it lays the groundwork for efficient financial reviews and summaries.

A record of disbursement payments is documented within the Massachusetts Check Disbursements Journal. This record includes details of all payments made by check, ensuring transparency and accuracy in financial reporting. Keeping track of these transactions allows you to maintain clarity in your finances. Furthermore, it aids in identifying any discrepancies and supports effective budget management.

The Massachusetts Check Disbursements Journal is specifically designed to record disbursements made by check. This journal tracks all outgoing payments, providing a clear overview of financial transactions. By maintaining accurate records, businesses can ensure better financial management and accountability. Using this journal can also simplify tax reporting and audit processes.

The journal used to record disbursements made by check is often referred to as a disbursement journal. This specialized ledger captures all details related to each check transaction, ensuring transparency and ease of tracking. For your convenience, the Massachusetts Check Disbursements Journal is designed to simplify this process, making it easier for you to stay organized.

An example of a disbursement includes payments for services received, such as paying a contractor for home repairs or reimbursing an employee for travel expenses. Each of these transactions would be recorded in a disbursement journal for accurate financial tracking. The Massachusetts Check Disbursements Journal can help you log such payments systematically.

Filling out a disbursement journal involves documenting each payment entry with specific details. Start by noting the date, check number, payee, and amount. Then, include a brief description of the purpose of the transaction. Adopting the Massachusetts Check Disbursements Journal can make entries easier and more consistent, enhancing your financial tracking.

A disbursement journal is a financial record that tracks all payments made by an organization, specifically those made by check. This journal provides an organized way to log each transaction, allowing for accurate financial reporting and accountability. Utilizing the Massachusetts Check Disbursements Journal helps streamline this process while ensuring all records are maintained correctly.

To fill out a disbursement authorization form, start by gathering all necessary information such as the payee's details, the amount to be disbursed, and the purpose of the payment. Next, clearly indicate the date and any required authorization signatures. If you need a reliable template, consider using the Massachusetts Check Disbursements Journal available on our platform for efficiency.