Massachusetts Installment Sale and Security Agreement Regarding Sale of Automobile from One Individual to Another

Description

How to fill out Installment Sale And Security Agreement Regarding Sale Of Automobile From One Individual To Another?

Are you currently in a situation where you require documents for both business or personal purposes almost every time.

There are numerous legal document templates accessible online, but locating reliable forms can be challenging.

US Legal Forms offers thousands of form templates, including the Massachusetts Installment Sale and Security Agreement Regarding Sale of Automobile from One Individual to Another, designed to comply with state and federal requirements.

Use US Legal Forms, the most comprehensive assortment of legal forms, to save effort and prevent errors.

The service provides appropriately crafted legal document templates that you can utilize for various purposes. Create an account on US Legal Forms and start making your life a little easier.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- Afterward, you may download the Massachusetts Installment Sale and Security Agreement Regarding Sale of Automobile from One Individual to Another template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and confirm it is for the correct city/state.

- Utilize the Review button to examine the form.

- Check the details to ensure that you have selected the suitable form.

- If the form is not what you're looking for, use the Search field to find the form that fulfills your needs and requirements.

- If you locate the right form, click Get now.

- Choose the pricing plan you want, provide the necessary information to create your account, and pay for the order using your PayPal or Visa or Mastercard.

- Select a convenient document format and download your copy.

- Find all the document templates you may have purchased in the My documents menu. You can obtain another copy of the Massachusetts Installment Sale and Security Agreement Regarding Sale of Automobile from One Individual to Another at any time, if needed. Just select the necessary form to download or print the document template.

Form popularity

FAQ

An installment sale involving related individuals requires careful tax treatment. Under the Massachusetts Installment Sale and Security Agreement Regarding Sale of Automobile from One Individual to Another, gains from the sale may be recognized over time. However, related parties may face special rules regarding the interest charged on installment payments. It is advisable to work with a tax advisor to ensure appropriate reporting and compliance.

Indeed, an installment sale can occur between related parties. The Massachusetts Installment Sale and Security Agreement Regarding Sale of Automobile from One Individual to Another facilitates such transactions. However, it is critical to establish the sale at fair market value to comply with tax regulations. Proper documentation and adherence to IRS rules are necessary to avoid any potential issues.

Certain transactions do not qualify for installment sale treatment, including sales of inventory and sales of property that generate ordinary income. The Massachusetts Installment Sale and Security Agreement Regarding Sale of Automobile from One Individual to Another does not apply if the sale occurs in a manner that does not meet these criteria. Additionally, if the buyer's debt for the vehicle is canceled or forgiven, it may not qualify. Understanding these conditions can help prevent tax complications.

Yes, you can conduct an installment sale with a related party under the Massachusetts Installment Sale and Security Agreement Regarding Sale of Automobile from One Individual to Another. However, specific tax regulations apply. It is vital to adhere to IRS guidelines, as transactions between related parties are scrutinized. Consulting a tax professional can help ensure compliance.

The IRS code that governs installment sales is found under Section 453. This section outlines the tax treatment of these sales, including how gains are reported and how interest is handled. Familiarizing yourself with the provisions of the IRS code can be beneficial when drafting a Massachusetts Installment Sale and Security Agreement Regarding Sale of Automobile from One Individual to Another.

Certain factors, such as the sale of property held primarily for resale, can disqualify an installment sale. Additionally, if there is a significant change in ownership structure or if the buyer fails to make timely payments, this can void the installment agreement. Understanding these potential pitfalls in your Massachusetts Installment Sale and Security Agreement Regarding Sale of Automobile from One Individual to Another can help you avoid complications.

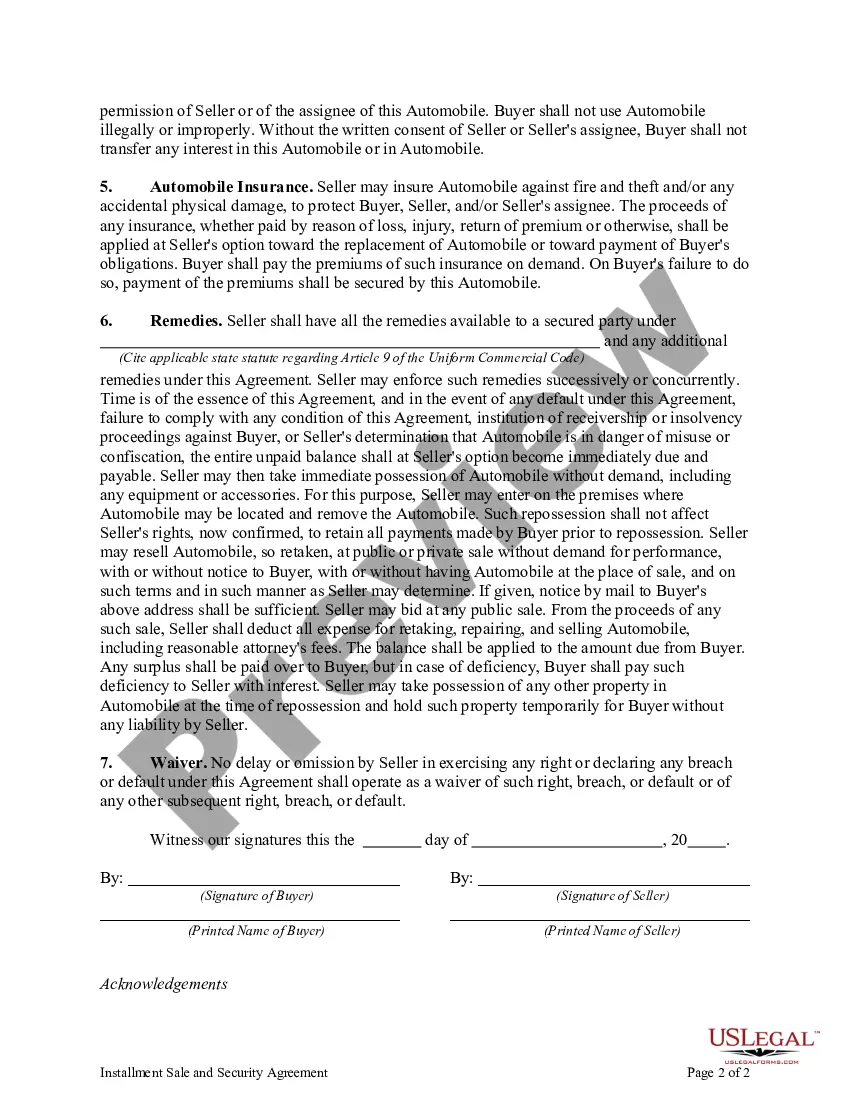

The standard for installment sales generally involves a contract that specifies payment terms, interest rates, and other relevant conditions. In the context of a Massachusetts Installment Sale and Security Agreement Regarding Sale of Automobile from One Individual to Another, the seller typically maintains a security interest in the vehicle until all payments are made. This protects both parties and establishes clear expectations for the transaction.

The primary rules governing installment sales include defining the sale terms, determining the payment schedule, and understanding the interest charged. Additionally, the IRS has specific guidelines related to the reporting of profits from these sales. Utilizing a Massachusetts Installment Sale and Security Agreement Regarding Sale of Automobile from One Individual to Another ensures that you adhere to these important requirements.

To report an installment sale, you will need to use Form 6252 when filing your tax return. This form provides details about the sale, including payments received and any profit made. It's crucial to accurately report the transaction to comply with tax regulations surrounding the Massachusetts Installment Sale and Security Agreement Regarding Sale of Automobile from One Individual to Another.

Yes, long-term capital gains are considered part of your income when you file your taxes. These gains can affect your overall tax liabilities in Massachusetts. If you engage in a Massachusetts Installment Sale and Security Agreement Regarding Sale of Automobile from One Individual to Another, tracking these gains is vital for accurate reporting. Consulting a tax expert can provide clarity on how this affects your financial situation.