Massachusetts Sworn Statement of Identity Theft

Description

1. Obtains, records, or accesses identifying information that would assist in accessing financial resources, obtaining identification documents, or obtaining benefits of the victim.

2. Obtains goods or services through the use of identifying information of the victim.

3. Obtains identification documents in the victim's name.

Identity theft statutes vary by state and usually do not include use of false identification by a minor to obtain liquor, tobacco, or entrance to adult business establishments. The types of information protected from misuse by identity theft statutes includes, among others:

-Name

-Date of birth

-Social Security number

-Driver's license number

-Financial services account numbers, including checking and savings accounts

-Credit or debit card numbers

-Personal identification numbers (PIN)

-Electronic identification codes

-Automated or electronic signatures

-Biometric data

-Fingerprints

-Passwords

-Parent's legal surname prior to marriage

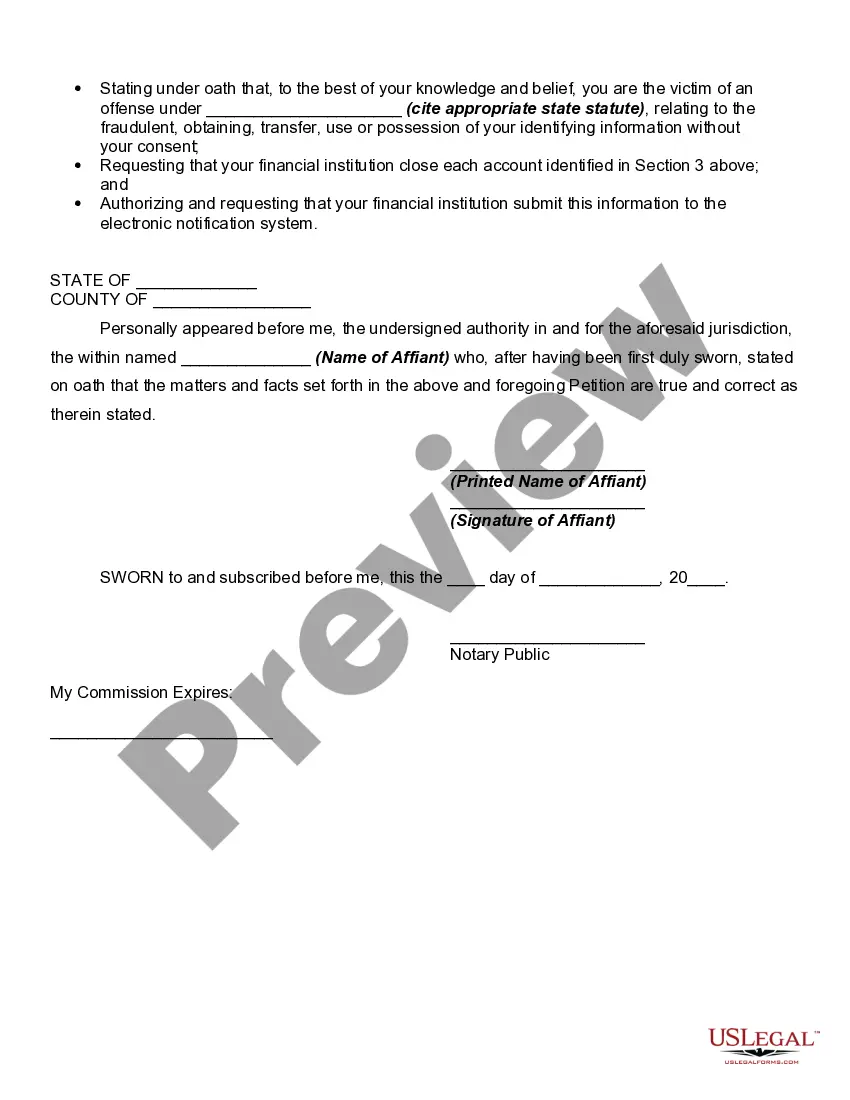

How to fill out Sworn Statement Of Identity Theft?

If you wish to total, obtain, or printing legitimate record themes, use US Legal Forms, the biggest collection of legitimate varieties, which can be found on-line. Use the site`s basic and practical research to get the papers you require. A variety of themes for company and personal reasons are sorted by types and claims, or keywords and phrases. Use US Legal Forms to get the Massachusetts Sworn Statement of Identity Theft in a couple of click throughs.

Should you be currently a US Legal Forms customer, log in to your profile and click on the Obtain button to obtain the Massachusetts Sworn Statement of Identity Theft. Also you can gain access to varieties you in the past delivered electronically inside the My Forms tab of the profile.

Should you use US Legal Forms the first time, refer to the instructions below:

- Step 1. Be sure you have chosen the form to the appropriate area/region.

- Step 2. Make use of the Review choice to check out the form`s articles. Don`t forget about to see the outline.

- Step 3. Should you be not happy with all the type, take advantage of the Search industry on top of the display to find other versions of your legitimate type web template.

- Step 4. After you have located the form you require, select the Get now button. Pick the pricing plan you like and add your accreditations to sign up for an profile.

- Step 5. Procedure the transaction. You should use your charge card or PayPal profile to complete the transaction.

- Step 6. Select the file format of your legitimate type and obtain it on your product.

- Step 7. Complete, edit and printing or indication the Massachusetts Sworn Statement of Identity Theft.

Each legitimate record web template you acquire is the one you have for a long time. You possess acces to each and every type you delivered electronically in your acccount. Click the My Forms portion and select a type to printing or obtain once again.

Be competitive and obtain, and printing the Massachusetts Sworn Statement of Identity Theft with US Legal Forms. There are thousands of specialist and express-specific varieties you can utilize for the company or personal requirements.

Form popularity

FAQ

In most cases, taxpayers do not need to complete this form. Only victims of tax-related identity theft should submit the Form 14039, and only if they haven't received certain letters from the IRS.

I am a victim of identity theft, and I did not make [this/these] charge(s). I request that you remove the fraudulent charge(s) and any related finance charge and other charges from my account, send me an updated and accurate statement, and close the account (if applicable).

The criminal offense of identity fraud is governed by Massachusetts General Laws chapter 266 section 37E and makes it a crime to either pose as another or obtain the personal identifying information of another without that persons express authorization in order to obtain money, goods, services or anything of value or ...

I am a victim of identity theft. I recently learned that my personal information was used to open an account at your company. I did not open or authorize this account, and I therefore request that it be closed immediately.

You can file IRS Form 14039, Identity Theft Affidavit when someone else uses your Social Security Number (SSN) to file a tax return. To alert the IRS that your identity has been stolen, you file this form. The IRS will refer your account to an identity theft specialist for evaluation.

Identity theft happens when someone takes your name and personal information (like your social security number) and uses it without your permission to do things like open new accounts, use your existing accounts, or obtain medical services.