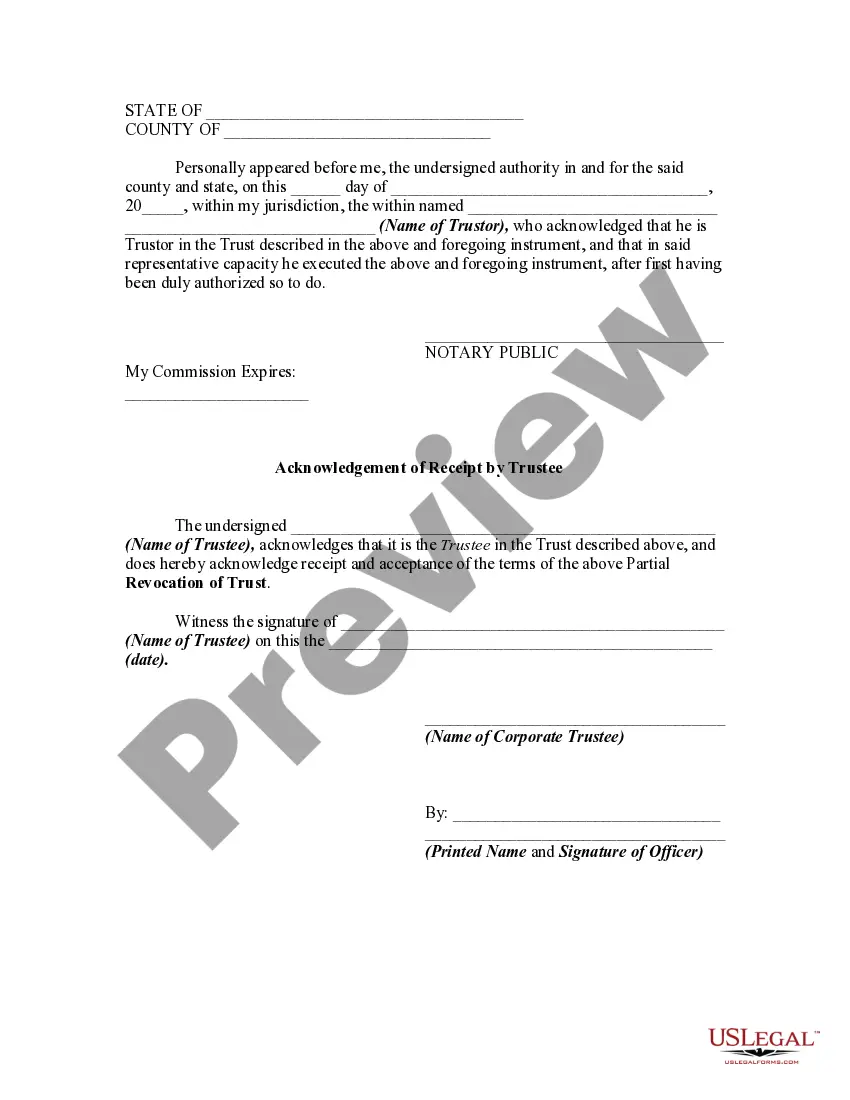

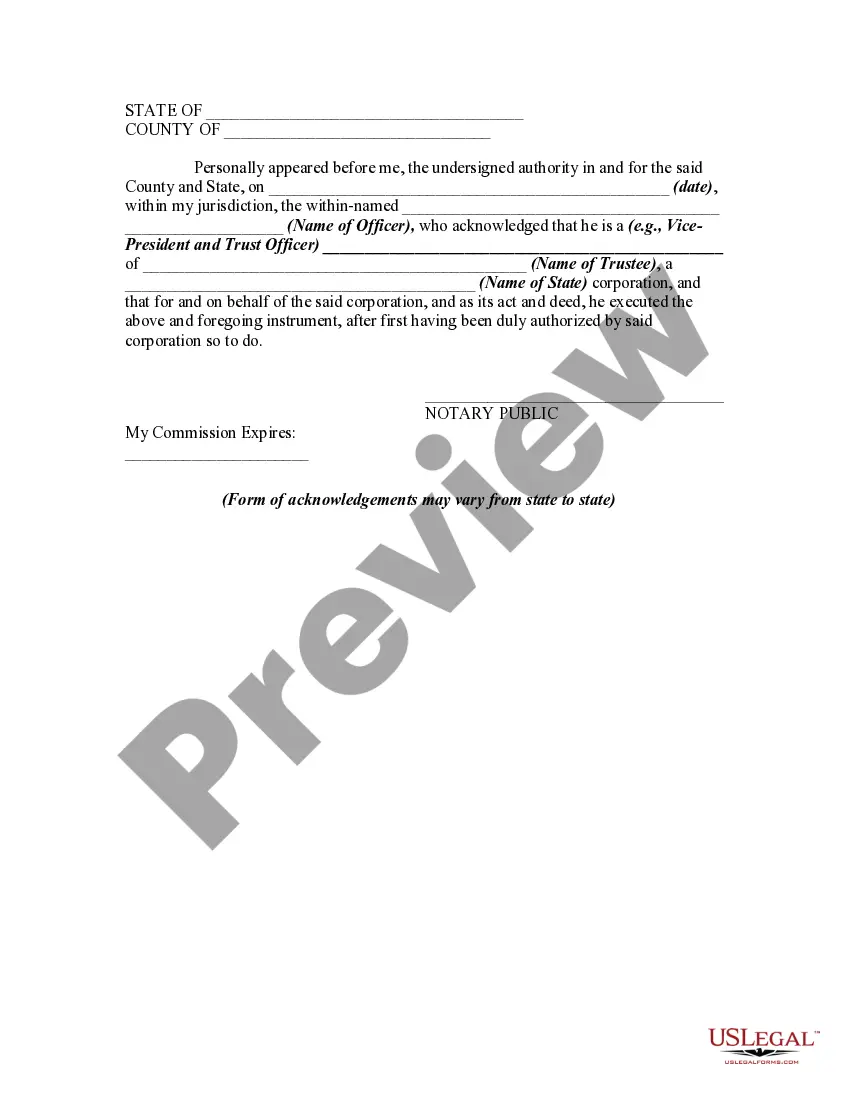

Whether a trust is to be revocable or irrevocable is very important, and the trust instrument should so specify in plain and clear terms. This form is a partial revocation of a trust (as to specific property) by the trustor pursuant to authority given to him/her in the trust instrument. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Iowa Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee

Description

How to fill out Partial Revocation Of Trust And Acknowledgment Of Receipt Of Notice Of Partial Revocation By Trustee?

US Legal Forms - among the largest collections of approved documents in the USA - provides a range of legal form templates that you can download or print.

By utilizing the website, you can access thousands of forms for business and personal use, organized by categories, states, or keywords.

You can obtain the latest versions of forms such as the Iowa Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee within minutes.

If the form does not meet your needs, utilize the Search field at the top of the page to find one that does.

Once you are satisfied with the form, confirm your choice by clicking on the Get now button. Then, select the payment plan you prefer and provide your details to create an account.

- If you already have a subscription, Log In and download Iowa Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee from the US Legal Forms library.

- The Download option will appear on every form you view.

- You have access to all previously saved forms from the My documents section of your account.

- If you are using US Legal Forms for the first time, here are some basic instructions to get started.

- Ensure you have selected the correct form for your personal area/region.

- Click the Preview option to review the form's content.

Form popularity

FAQ

An estate in Iowa can remain open indefinitely, although it is encouraged to close it within a reasonable timeframe, typically within two years. Delays may occur due to disputes, missing heirs, or the need for additional documentation. If there has been a partial revocation of a trust, this may further complicate the timeline. Utilizing resources from uslegalforms can streamline the process and ensure compliance with state laws.

In Iowa, an executor typically has a reasonable amount of time to settle an estate, often within 12 to 18 months. However, this timeline may be extended based on the estate’s complexity and any disputes that may arise. Executors should also be aware of any partial revocations of trusts and their implications on the settlement process. For best practices, consider resources from uslegalforms.

Revoking a revocable trust in Iowa involves executing a formal document that states your intent to revoke. It's essential to follow the exact procedures outlined in the trust agreement to ensure validity. If the trust has undergone partial revocation, ensure that any associated notices, like the Acknowledgment of Receipt of Notice of Partial Revocation by Trustee, are properly managed. Legal platforms like uslegalforms can assist in this process.

The 3-year rule in Iowa refers to the time frame when creditors can file claims against a deceased person's estate. After a decedent's death, creditors have three years to present their claims, ensuring they receive their due. Understanding this rule is important, especially if there has been a partial revocation of a trust, as it may affect outstanding debts. You can navigate these requirements with guidance from uslegalforms.

Yes, in Iowa, executors have a duty to provide an accounting to beneficiaries. This means they must document all income and expenses related to the estate. Additionally, if there is a partial revocation of a trust, beneficiaries should receive details regarding significant changes. The Acknowledgment of Receipt of Notice of Partial Revocation by Trustee ensures transparency in these matters.

In Iowa, once probate is granted, the timeline for fund release can vary. Generally, assets should be distributed within a few months, but it may take longer depending on the complexity of the estate. If partial revocation of a trust is involved, it’s crucial to understand the Acknowledgment of Receipt of Notice of Partial Revocation by Trustee, as it impacts distribution. For clarity, consult legal resources like uslegalforms.

Shutting down a trust involves officially terminating it based on the terms outlined in the trust document. This can be achieved through distribution of assets and completion of all trustee responsibilities. For thoroughness, consider using a Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee to ensure all legal aspects are properly settled.

To close a trust in Iowa, you typically need to fulfill all terms of the trust agreement and distribute the remaining assets to the designated beneficiaries. After this is accomplished, it's vital to document the closure formally. Utilizing a Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee can help finalize the process professionally.

Deactivating a trust generally involves following the procedures outlined in the trust document and Wisconsin state law. You may need to redistribute the trust's assets and formally record the deactivation, often using appropriate forms. If you require assistance creating the documentation, consider utilizing a service specializing in Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee.

Revocation of trust refers to the legal process of terminating a trust agreement, thus ending its obligations and distributing its assets. This can occur fully or partially, depending on the trust provisions. The Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee serve as essential tools for communicating these changes and satisfying legal obligations in Iowa.