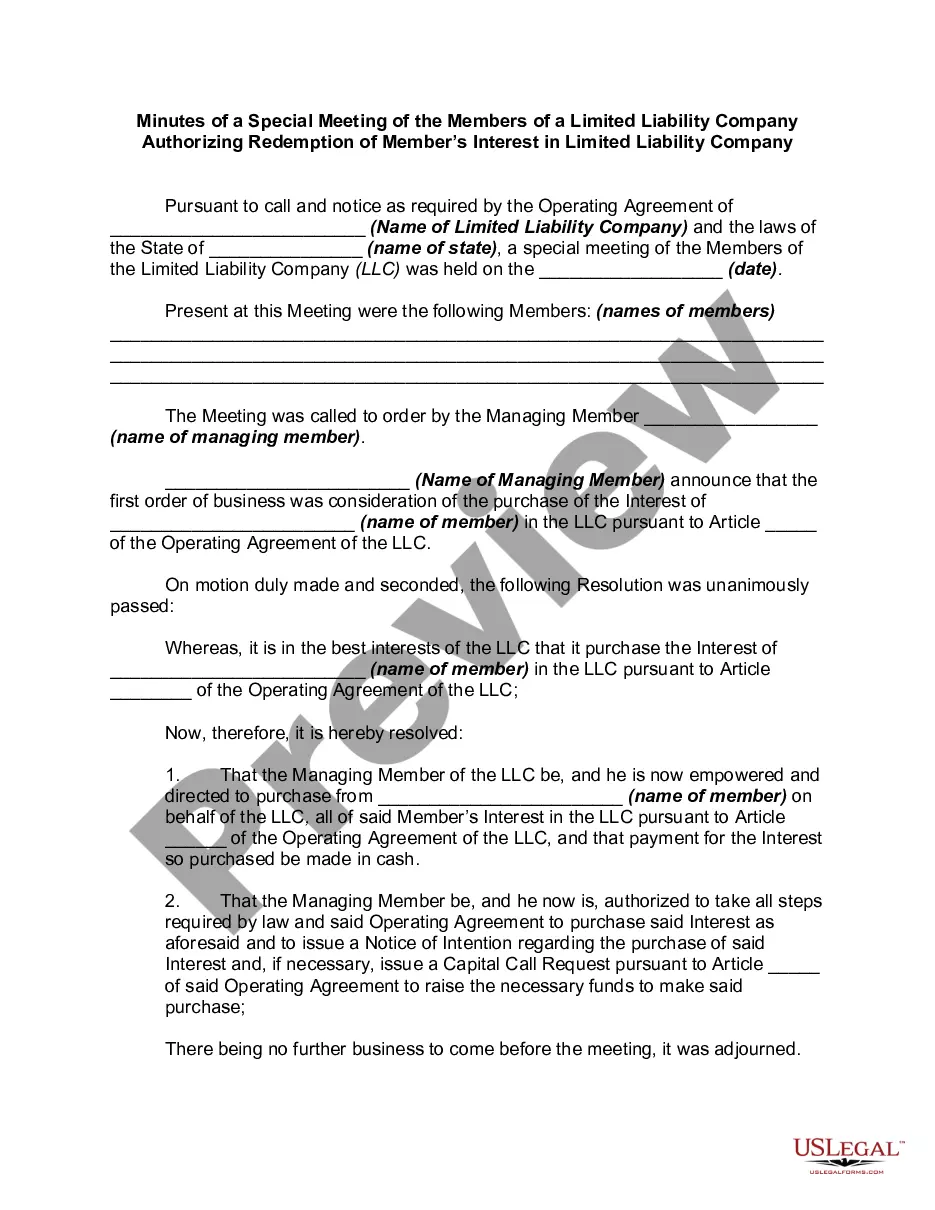

Massachusetts Minutes of a Special Meeting of the Members of a Limited Liability Company Authorizing Redemption of Member's Interest in Limited Liability

Description

How to fill out Minutes Of A Special Meeting Of The Members Of A Limited Liability Company Authorizing Redemption Of Member's Interest In Limited Liability?

Are you currently within a position the place you need to have papers for both company or person functions nearly every working day? There are plenty of lawful record themes available on the net, but locating ones you can rely on isn`t simple. US Legal Forms offers thousands of type themes, much like the Massachusetts Minutes of a Special Meeting of the Members of a Limited Liability Company Authorizing Redemption of Member's Interest in Limited Liability, that are created to satisfy federal and state needs.

Should you be presently acquainted with US Legal Forms internet site and possess an account, basically log in. Following that, you can download the Massachusetts Minutes of a Special Meeting of the Members of a Limited Liability Company Authorizing Redemption of Member's Interest in Limited Liability template.

Should you not have an profile and want to begin to use US Legal Forms, abide by these steps:

- Find the type you need and ensure it is for the correct area/county.

- Utilize the Review switch to check the shape.

- Look at the information to ensure that you have selected the appropriate type.

- If the type isn`t what you`re searching for, take advantage of the Lookup field to get the type that meets your needs and needs.

- When you discover the correct type, simply click Purchase now.

- Select the pricing plan you desire, submit the specified information and facts to make your bank account, and purchase the transaction with your PayPal or bank card.

- Decide on a hassle-free document file format and download your duplicate.

Get each of the record themes you possess purchased in the My Forms menus. You can aquire a additional duplicate of Massachusetts Minutes of a Special Meeting of the Members of a Limited Liability Company Authorizing Redemption of Member's Interest in Limited Liability whenever, if needed. Just click on the needed type to download or produce the record template.

Use US Legal Forms, probably the most extensive selection of lawful forms, in order to save some time and stay away from blunders. The support offers professionally created lawful record themes that can be used for an array of functions. Create an account on US Legal Forms and commence making your lifestyle easier.

Form popularity

FAQ

Massachusetts limited liability company owners typically only need to file a Certificate of Organization form and pay a formation fee of $500. Choose an idea for your LLC. ... Name your Massachusetts LLC. ... Create a business plan. ... Choose a resident agent in Massachusetts. ... File your Massachusetts LLC Certificate of Organization.

LLCs and LLPs are classified for Massachusetts tax purposes the same way they are for federal income tax purposes. A single-member LLC will be disregarded as an entity separate from its owner for Massachusetts income tax purposes, if it is disregarded for federal tax purposes.

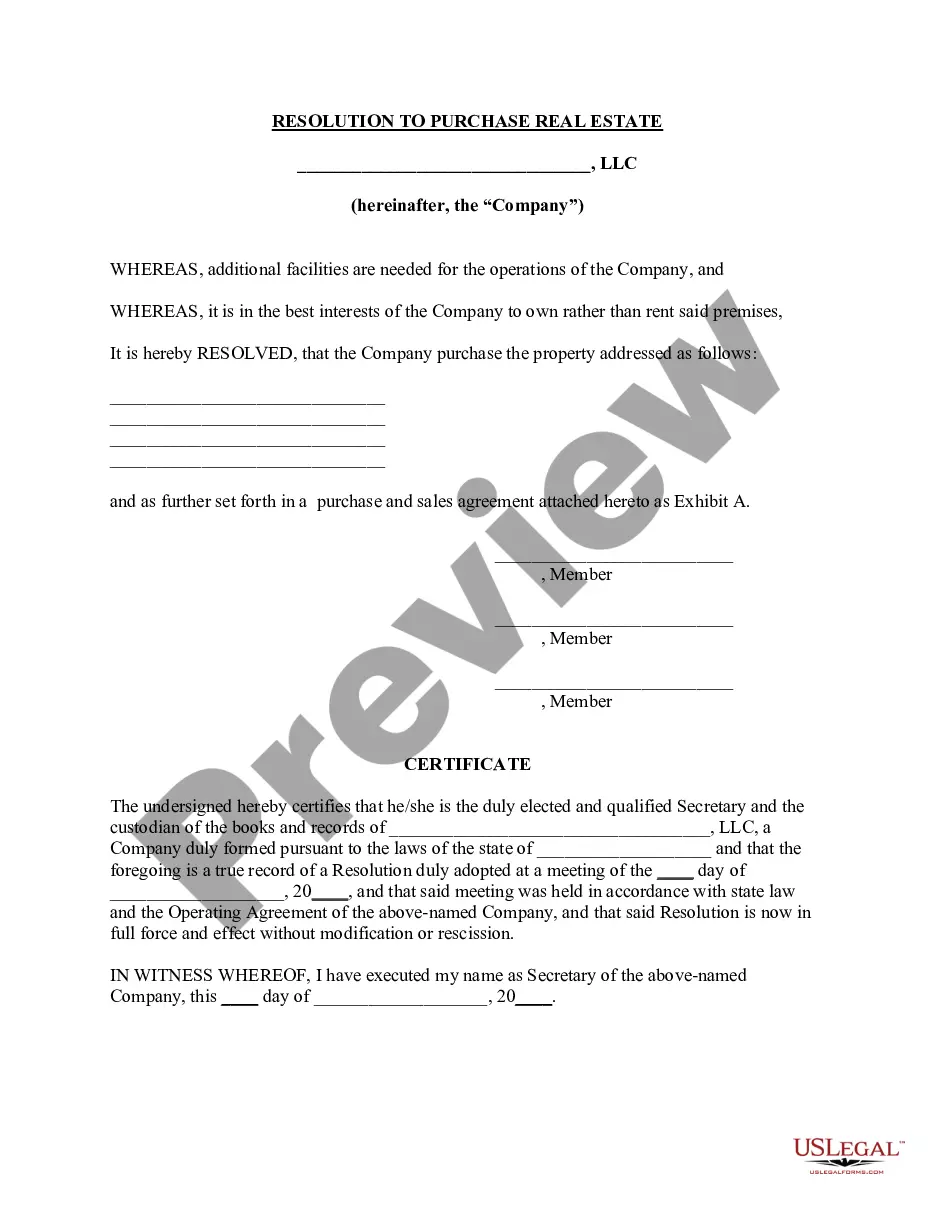

Transferring Ownership in an LLC When the ownership transfer is a sale of the LLC, a buy-sell agreement may be necessary. An operating agreement should specify the process for ownership transfer, but if it doesn't, you must follow state guidelines. Under some circumstances, the state may require you to form a new LLC.

Here are some of the key differences: a PLLC, like other LLCs, is comprised of members, but a PC, like other corporations, is comprised of shareholders. following from the previous point, PLLC ownership consists of so-called membership interests in the business, but PC ownership is based on shares of stock; and.

Advantages of a single-member LLC. There are many benefits to forming an LLC vs. operating as a sole proprietorship. A single-member LLC is generally shielded from personal liability for debts associated with the business. Note: Single-member LLCs must be careful to avoid commingling business and personal assets.

If you're a solo business owner who wants to form a limited liability company (LLC), you can start a single-member limited liability company (SMLLC) in Massachusetts. In general, the process for forming an LLC and SMLLC in Massachusetts is the same. You must follow Massachusetts's Limited Liability Company Act.

Massachusetts does not require you to submit an Operating Agreement to form your LLC. However, it is important for every LLC to have an Operating Agreement, establishing the rules and structure of the business.

In Massachusetts, LLCs are taxed as pass-through entities by default. Because of this, LLCs don't pay taxes directly. Instead, LLC profits are passed on to LLC members, who report their earnings when filing their individual income tax returns.