Massachusetts Software Support Agreement

Description

Software is often divided into two categories: Systems Software includes the operating system and all the utilities that enable the computer to function; and Applications Software includes programs that do real work for users (e.g., word processors, spreadsheets, and database management systems).

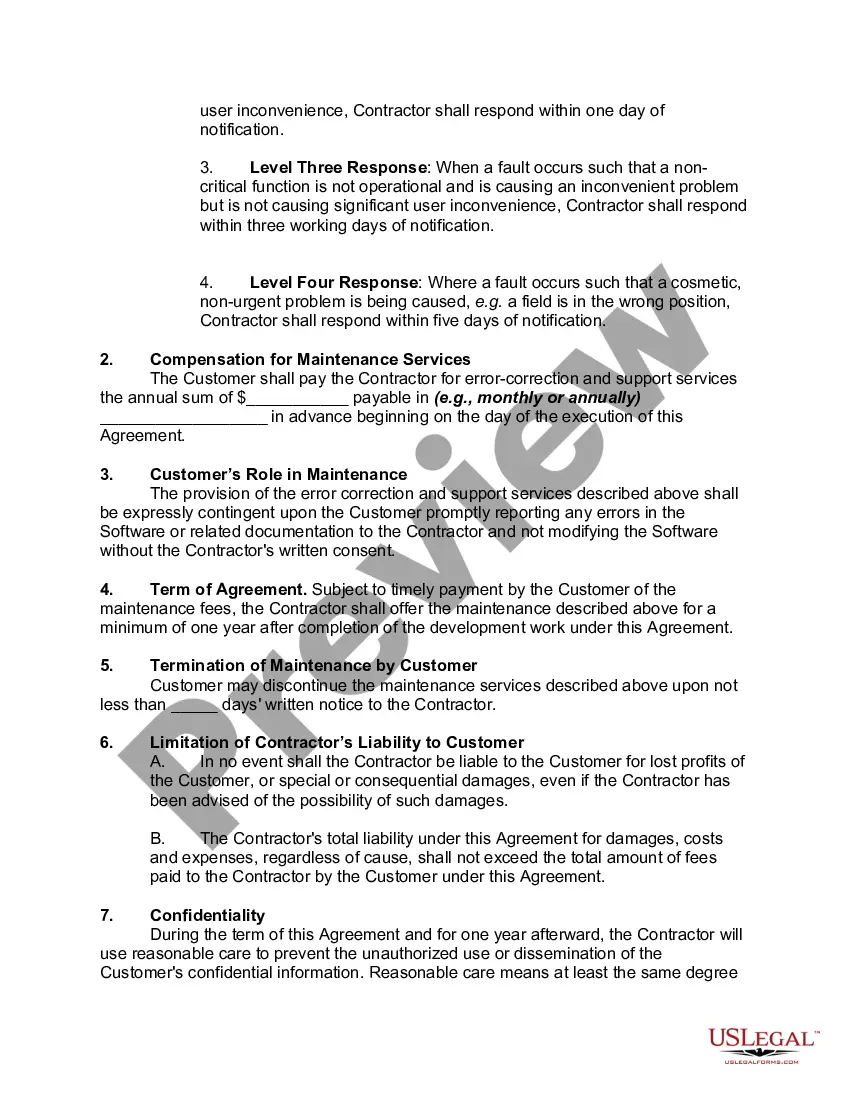

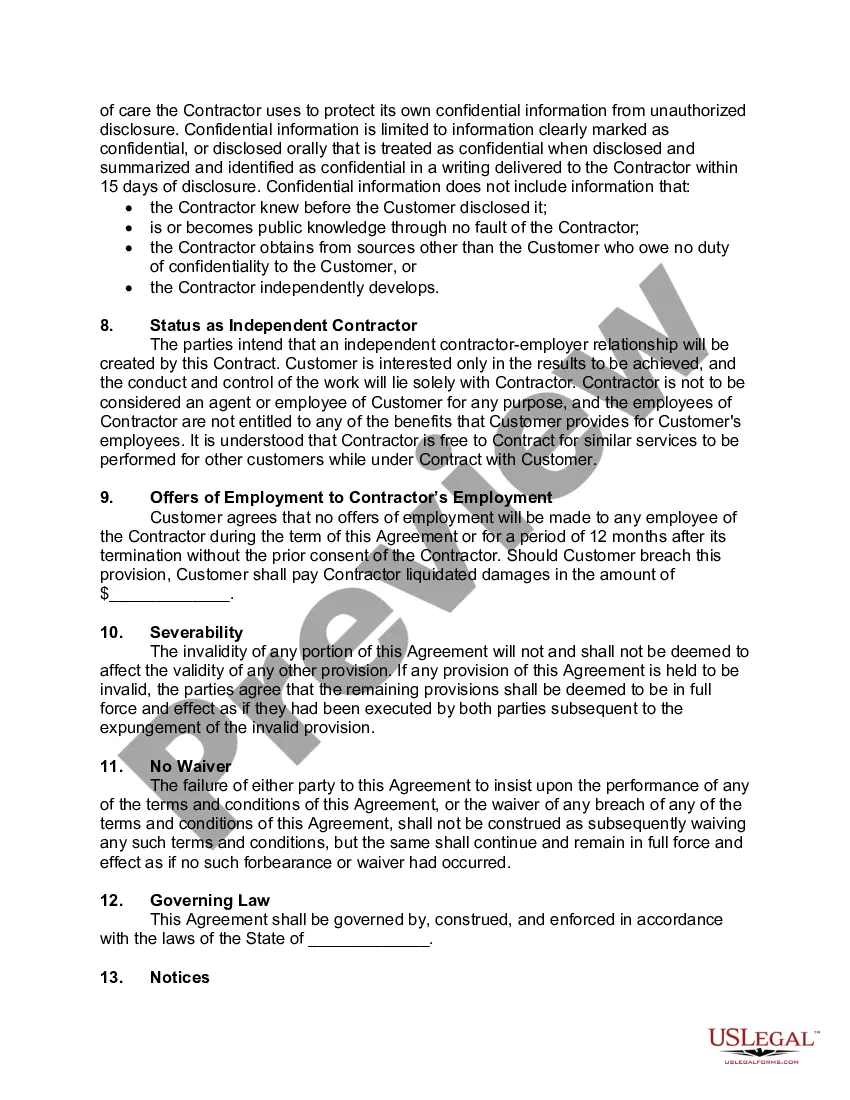

How to fill out Software Support Agreement?

Have you ever found yourself in a scenario where you need documents for various organizational or personal reasons almost every day? There are numerous legal document templates available online, but locating trustworthy versions can be challenging. US Legal Forms offers a wide array of form templates, such as the Massachusetts Software Support Agreement, designed to comply with federal and state regulations.

If you are already familiar with the US Legal Forms site and have an account, simply Log In. Then, you can download the Massachusetts Software Support Agreement template.

If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct state/region.

- Use the Preview button to review the form.

- Verify the information to ensure you have selected the right form.

- If the form isn’t what you're looking for, use the Search field to find the form that meets your needs and specifications.

- Once you find the correct form, click Purchase now.

- Select the pricing plan you prefer, fill in the necessary information to create your account, and pay for the transaction using PayPal or a credit card.

- Choose a convenient file format and download your copy.

Form popularity

FAQ

An operating agreement is not mandated by Massachusetts law for LLCs but is highly advisable. Such an agreement serves as a crucial document that details the structure and procedures of your organization. If you are entering into a Massachusetts Software Support Agreement, having an operating agreement can help establish clear terms and expectations for software services, fostering a smoother business relationship.

While Massachusetts does not legally require an operating agreement for LLCs, having one is strongly recommended. This agreement outlines the roles and responsibilities of members, helping avoid conflicts. For businesses engaging in a Massachusetts Software Support Agreement, an operating agreement can clarify the obligations and services provided, ensuring all parties are aligned on expectations.

Not necessarily. In Massachusetts, while it is common for corporations to have an operating agreement, it is not legally required. This agreement outlines the management structure and operational guidelines of your corporation. However, if you plan to establish a strong operational foundation, linking it with your Massachusetts Software Support Agreement can provide clarity and support.

Yes, an LLC in Massachusetts must file an annual report with the Secretary of the Commonwealth. This report helps maintain your LLC's good standing and provides updated information about your business. Failing to file this report may result in penalties or administrative dissolution. If you have questions about aligning your annual reports with your Massachusetts Software Support Agreement, consulting legal resources can be beneficial.

If an operating agreement is not signed, members may face ambiguity regarding management and operational processes. This often leads to disputes, as there is no agreed-upon framework guiding business decisions. In the context of your Massachusetts Software Support Agreement, having a clear operating agreement is vital. Consider using uslegalforms to draft and sign an operating agreement to prevent misunderstandings.

A contract in Massachusetts, often referred to as a legally binding agreement, outlines the rights and responsibilities of the parties involved. It should detail crucial terms to ensure clarity in any business transaction, particularly within a Massachusetts Software Support Agreement. Understanding the elements that make a contract valid is essential for compliance and protection of all parties. Therefore, consult legal resources to frame a solid contract.

You can certainly write your own operating agreement, but it requires careful consideration and knowledge of legal terminology. Many businesses benefit from professional assistance to ensure compliance with state laws and best practices. Utilizing platforms like uslegalforms can help guide you in creating a solid operating agreement tailored to your Massachusetts Software Support Agreement. This ensures that all critical aspects of your business are covered thoroughly.

While Massachusetts does not mandate LLCs to have an operating agreement, it is strongly advisable. This document outlines the business operations and protects the members’ interests, particularly in matters defined within your Massachusetts Software Support Agreement. Having an operating agreement can be crucial during disputes or when seeking loans. It provides a clear foundation for your LLC's governance.

Banks often require an operating agreement to verify the authority and identity of the LLC's members. It serves as proof of the business's legitimacy and provides insight into how decisions are made within the company. When you apply for a business account, presenting your operating agreement ensures your Massachusetts Software Support Agreement aligns with banking requirements. This documentation builds trust with financial institutions.

An operating agreement is not a legal requirement in every state, but it is highly recommended. For businesses operating under a Massachusetts Software Support Agreement, having an operating agreement clarifies roles, responsibilities, and the management structure. Without it, disputes could arise, affecting the LLC's operations and credibility. To ensure smooth business functioning, consider drafting an operating agreement.