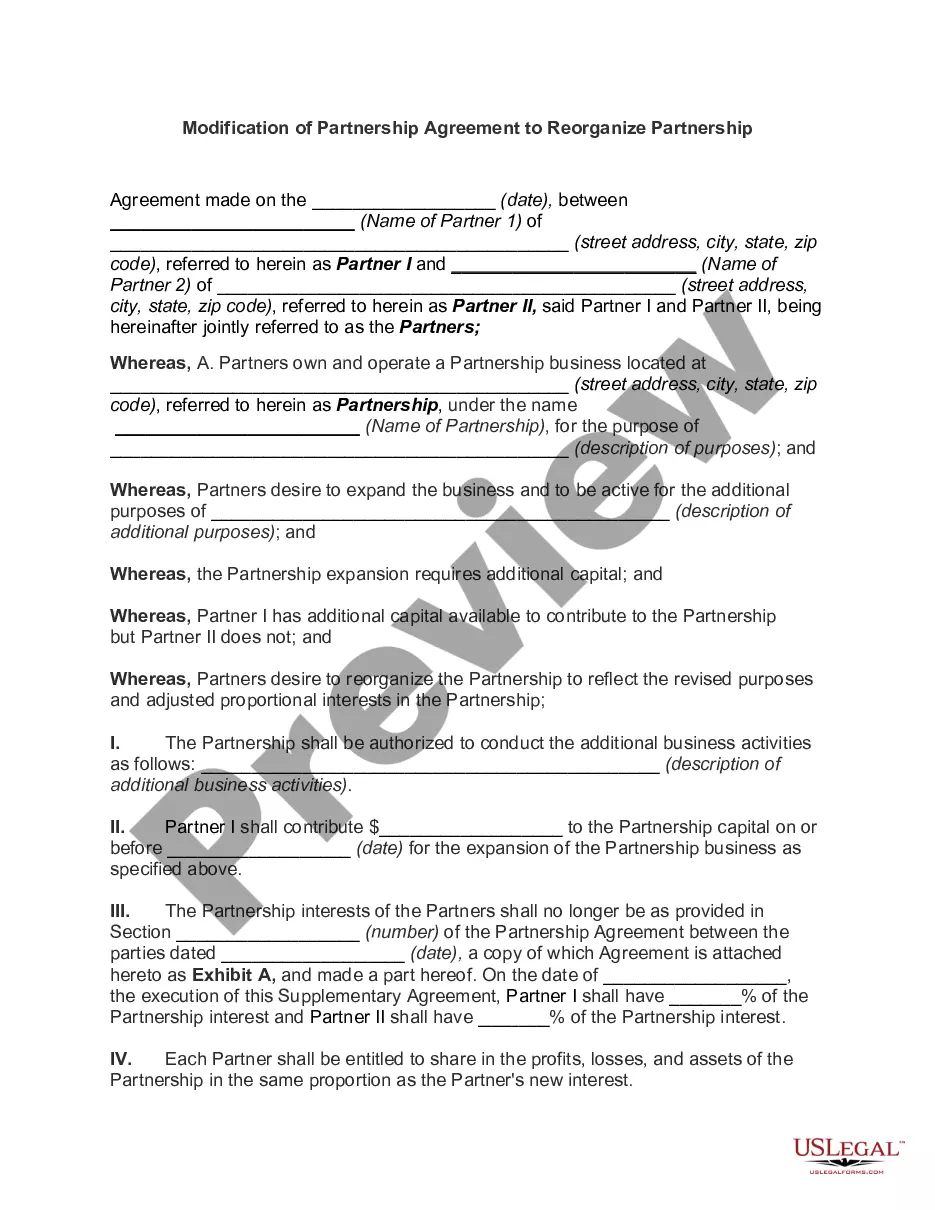

This form is an amendment or modification to a partnership agreement

Massachusetts Amendment or Modification to Partnership Agreement

Description

How to fill out Amendment Or Modification To Partnership Agreement?

If you require to fulfill, acquire, or produce authentic document templates, utilize US Legal Forms, the most extensive compilation of legal forms available online.

Take advantage of the site’s user-friendly and efficient search to find the documents you need.

Various templates for business and personal applications are organized by categories and states, or by keywords.

Step 4. Once you have located the form you need, select the Get now option. Choose the payment plan you prefer and provide your credentials to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Utilize US Legal Forms to obtain the Massachusetts Amendment or Modification to Partnership Agreement with just a few clicks.

- If you are already a US Legal Forms member, sign in to your account and select the Download option to acquire the Massachusetts Amendment or Modification to Partnership Agreement.

- You can also retrieve forms you previously saved within the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure that you have chosen the form for your appropriate city/region.

- Step 2. Use the Review option to inspect the form’s details. Make sure to read the summary.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

A partnership can remove a partner, provided it aligns with the terms outlined in the partnership agreement. This action often involves a Massachusetts Amendment or Modification to Partnership Agreement to document the change and protect the interests of the remaining partners. Clear communication and proper legal processes are crucial in this situation. If you're unsure about the best course of action, consider using the US Legal Forms platform for guidance.

Yes, changing partners in a partnership firm is definitely possible. You can outline the process for adding or removing partners in your Massachusetts Amendment or Modification to Partnership Agreement. This ensures that all parties are aware of the changes and helps maintain the partnership's integrity. Keep in mind that proper documentation is essential.

Yes, you can amend your partnership agreement to elect out of the partnership audit regime. This will require a Massachusetts Amendment or Modification to Partnership Agreement. By doing so, you may simplify the tax process for your partnership and reduce potential audits. It's always wise to consult legal guidance when making such changes.

Mail MA Form 2G to the address specified in the official instructions for the form. It is essential for businesses, especially those undergoing a Massachusetts Amendment or Modification to Partnership Agreement, to follow these instructions closely. Submitting your form to the correct location ensures timely processing and compliance with state tax laws.

Mail your tax return forms to the address indicated on the form itself, which varies depending on your location and the type of form you are submitting. For individuals or partnerships making a Massachusetts Amendment or Modification to Partnership Agreement, accuracy in addressing your return can prevent processing delays. Always verify the latest postal information on official state resources.

You should mail your MA tax form to the address specified for your particular form in the instructions provided by the Massachusetts Department of Revenue. Generally, tax documents associated with Massachusetts Amendment or Modification to Partnership Agreements require careful attention to mailing details. Ensure you check the latest mailing addresses to avoid delays in your submission.

To remove a partner from a partnership agreement, you typically need to follow steps outlined in your partnership agreement. This might require a Massachusetts Amendment or Modification to Partnership Agreement to formally outline the departure terms. It’s crucial to ensure compliance with any legal requirements to prevent disputes. Tools like US Legal Forms can guide you in drafting the necessary modifications accurately.

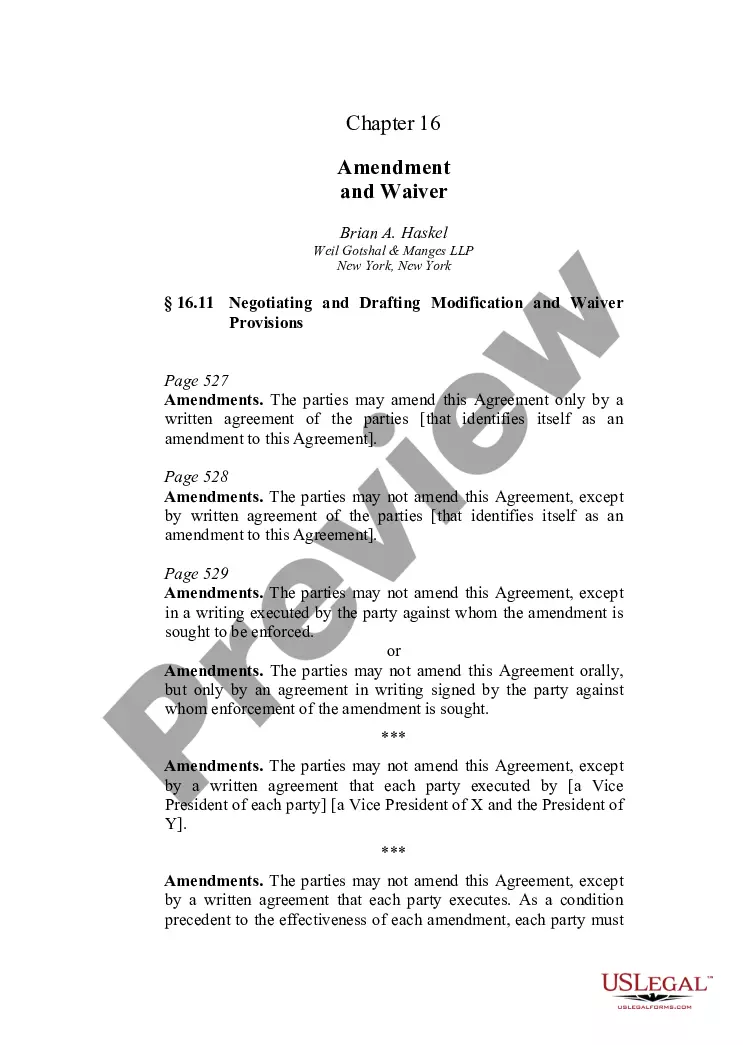

You can indeed amend a partnership. This often involves updating the terms of the partnership agreement to reflect new agreements or conditions. Implementing a Massachusetts Amendment or Modification to Partnership Agreement can help clarify responsibilities and rights among partners. Explore US Legal Forms for user-friendly templates that facilitate this process.

Yes, a partnership agreement can certainly be amended. This process is essential for addressing changes in business circumstances or partner roles. In Massachusetts, you may need the consent of all partners to initiate a Massachusetts Amendment or Modification to Partnership Agreement. Consider using resources like US Legal Forms to simplify this process.

Filing a Massachusetts amended return involves completing the appropriate forms to reflect changes in your financial details. You need to refer to the Massachusetts Department of Revenue guidelines and submit your amended return along with any necessary documentation. Ensure that all modifications to the partnership are summarized in your Massachusetts Amendment or Modification to Partnership Agreement for clarity.