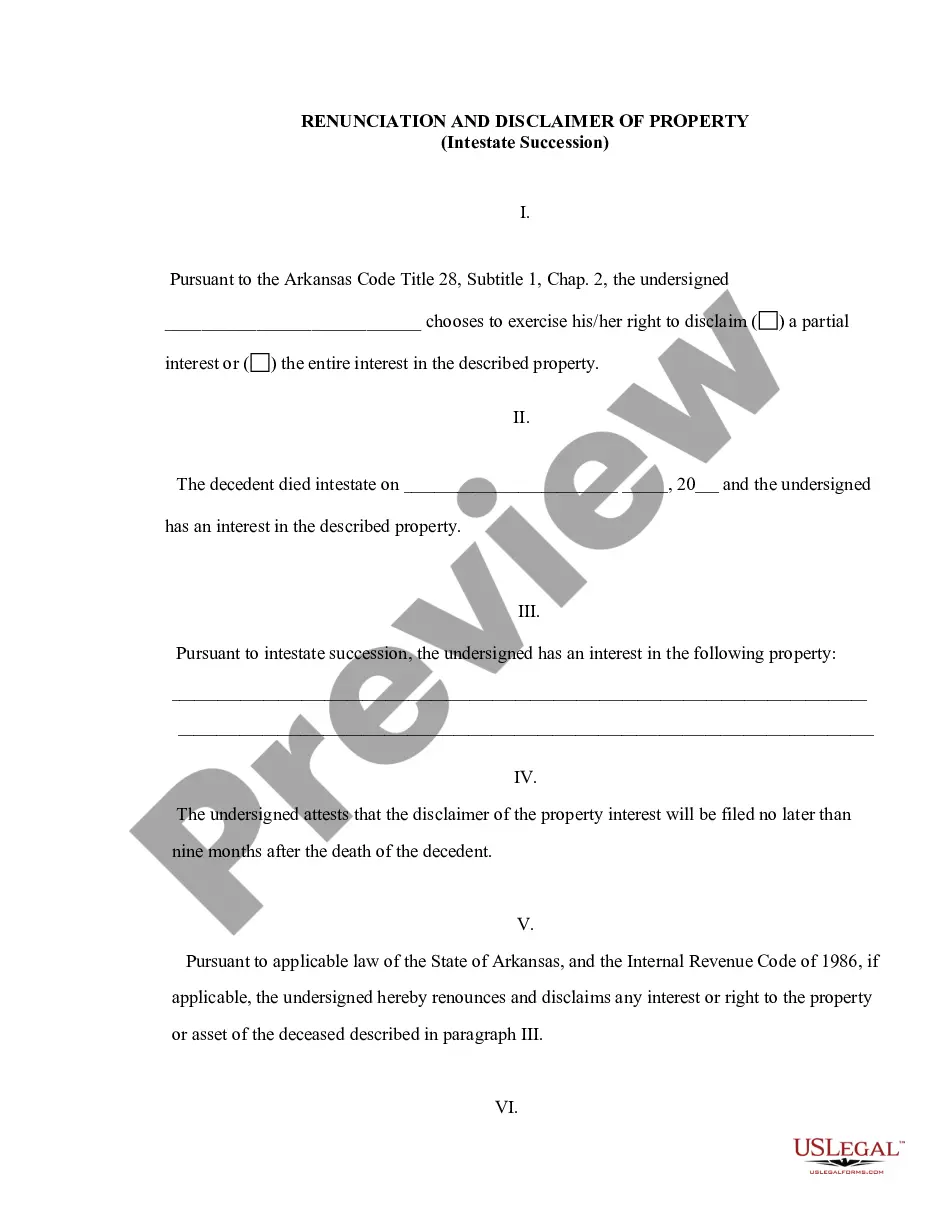

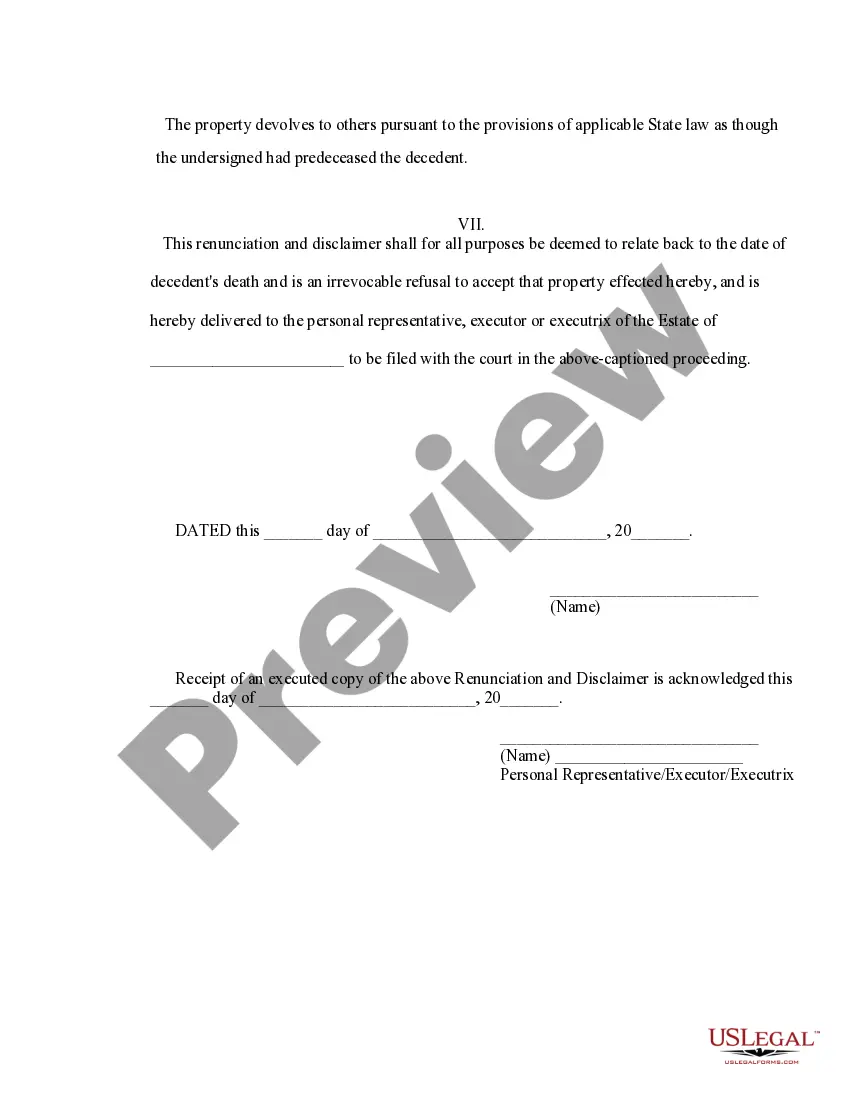

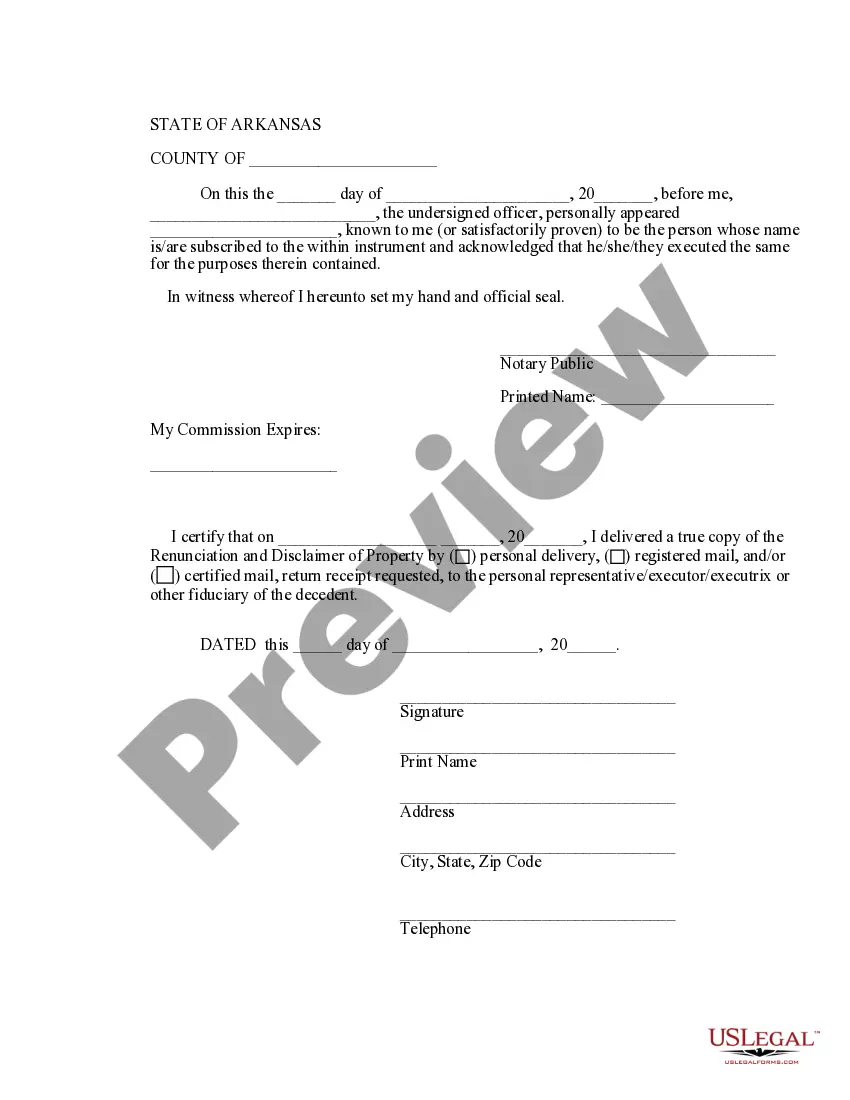

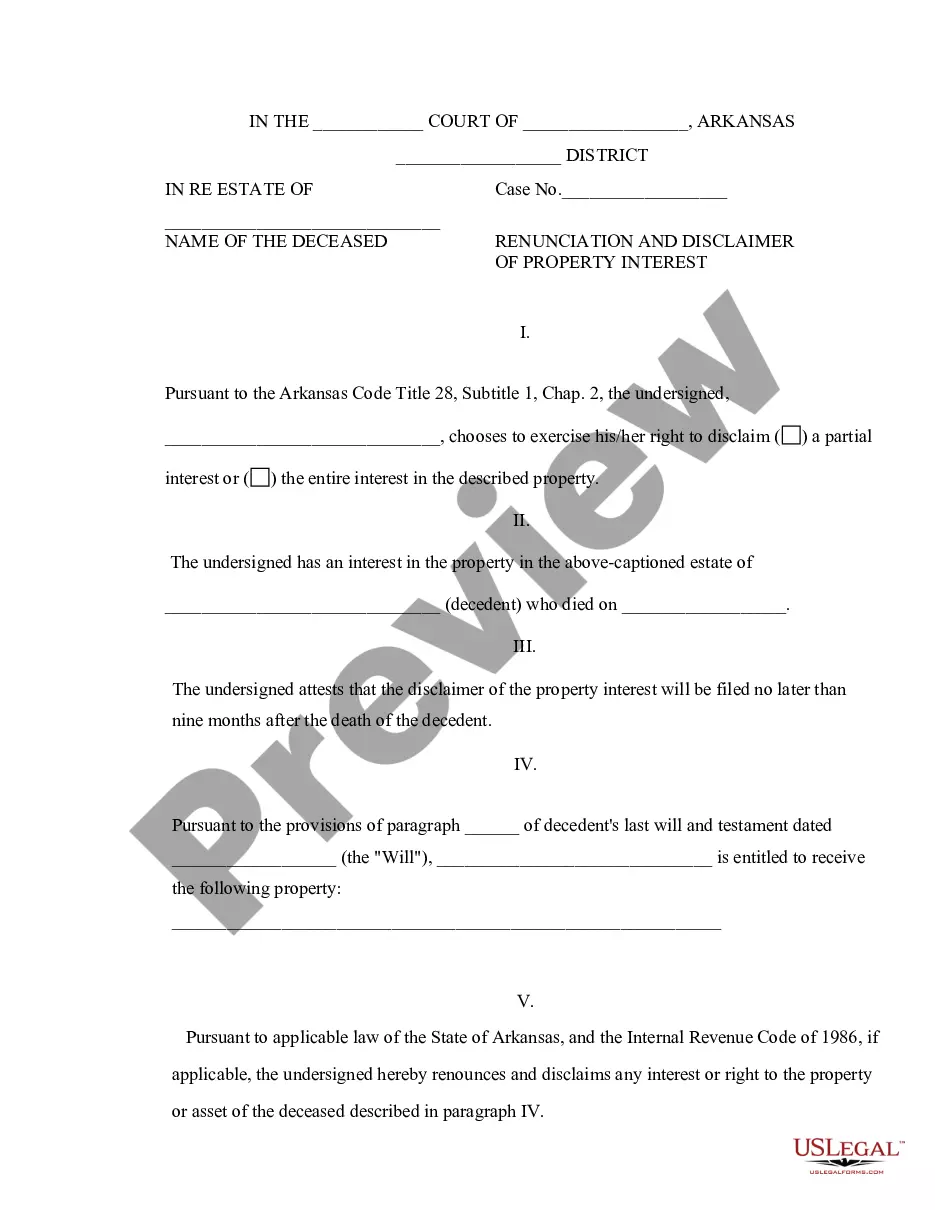

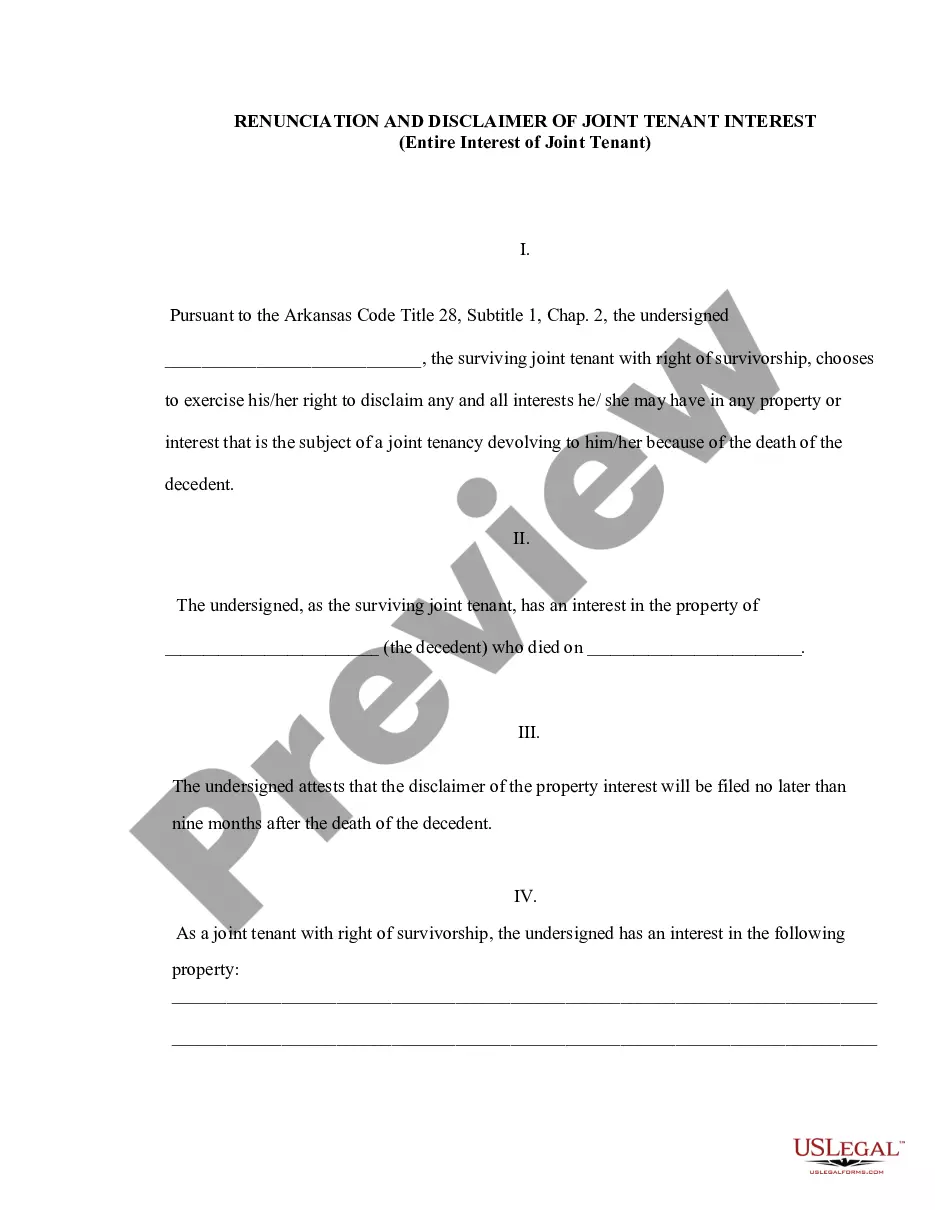

This form is a Renunciation and Disclaimer of Property granted to the beneficiary through intestate succession. The decedent died intestate and the beneficiary gained an interest in the described property. The beneficiary has chosen to disclaim a portion of or the entire interest he/she has in the property. Based upon the Arkansas Code Title 28, Subtitle 1, Chap. 2 the beneficiary is entitled to disclaim the property and submit a copy of the disclaimer to the decedent's personal representative. The form also contains a state specific acknowledgment and a certificate to verify delivery.

Arkansas Renunciation and Disclaimer of Property received by Intestate Succession

Description

How to fill out Arkansas Renunciation And Disclaimer Of Property Received By Intestate Succession?

Utilizing Arkansas Renunciation and Disclaimer of Property acquired through Intestate Succession illustrations crafted by expert attorneys allows you to avert complications when completing paperwork.

Simply download the example from our site, complete it, and request legal advice to verify it.

This can assist you in conserving considerably more time and expenses than searching for a legal expert to create a document from scratch that meets your requirements would.

Utilize the Preview feature and peruse the description (if applicable) to determine if you need this exact template and if so, just click Buy Now. Find an alternative document using the Search bar if required. Select a subscription that suits your preferences. Begin with your credit card or PayPal. Choose a file format and download your document. Once you have completed all of the above steps, you will be able to fill out, print, and sign the Arkansas Renunciation and Disclaimer of Property received by Intestate Succession sample. Remember to carefully verify all entered information for accuracy before submitting it or sending it out. Reduce the time you spend on filling documents with US Legal Forms!

- If you possess a US Legal Forms membership, merely Log In to your profile and navigate back to the form page.

- Locate the Download button close to the templates you are reviewing.

- Following the download of a template, you can find all your saved examples in the My documents section.

- If you don't have a subscription, that's perfectly fine.

- Just adhere to the step-by-step instructions below to register for an online account, obtain, and complete your Arkansas Renunciation and Disclaimer of Property received through Intestate Succession template.

- Ensure to verify that you are downloading the correct state-specific form.

Form popularity

FAQ

The Arkansas intestacy law outlines how property is distributed when someone passes away without a will. Under these laws, the estate goes to the deceased's closest relatives, which may include children, parents, or siblings. Understanding this law helps you navigate the Arkansas Renunciation and Disclaimer of Property received by Intestate Succession, guiding the rightful heirs in claiming their inheritance.

An inheritance disclaimer example might include a formal letter stating that you do not wish to accept a specific asset, like a piece of real estate. This document should clearly list the property details and affirm that you are rejecting the inheritance under the guidelines of the Arkansas Renunciation and Disclaimer of Property received by Intestate Succession. Such disclaimers help redirect inheritance smoothly to intended beneficiaries.

A beneficiary disclaimer letter should begin with your full name and address, followed by a statement indicating your desire to disclaim your rights to the inheritance. Describe the property or assets you wish to disclaim and include the date. Remember to refer to the Arkansas Renunciation and Disclaimer of Property received by Intestate Succession for legal requirements to ensure the letter is properly executed.

To write an inheritance disclaimer letter, start by clearly stating your intention to disclaim the inheritance. Include your name, the deceased's name, a description of the property you are disclaiming, and the date of the letter. Make sure to follow the protocols outlined in the Arkansas Renunciation and Disclaimer of Property received by Intestate Succession for it to be valid.

Disclaiming inherited property means that you give up your right to accept an inheritance. By doing this, you refuse to take ownership of the assets, which can have tax benefits or allow the property to pass on to another beneficiary. The process follows the Arkansas Renunciation and Disclaimer of Property received by Intestate Succession guidelines, protecting your personal interests.

An inheritance letter is a document that outlines the details of the inheritance you have received, including any assets and their values. For example, if you inherit a house and some stocks, your letter should specify these items and their estimated worth. This document helps clarify what you are entitled to under the Arkansas Renunciation and Disclaimer of Property received by Intestate Succession.

In Arkansas, a disclaimer of inheritance does not necessarily need to be notarized; however, doing so can provide additional legal protection. It is always a good idea to consult legal guidance or utilize services like USLegalForms to ensure all documentation meets state requirements regarding Arkansas Renunciation and Disclaimer of Property received by Intestate Succession. Notarization can enhance the document’s credibility.

The right of the state to take property in such cases is called escheat. If an individual dies intestate without any legal heirs, their property may revert to the state. This scenario emphasizes the importance of understanding Arkansas Renunciation and Disclaimer of Property received by Intestate Succession to ensure that your intentions are clearly stated.

In Arkansas, you typically have nine months from the date of death to file a disclaimer of inheritance. This timeframe is important to consider when deciding whether to renounce your rights to the property. It is advisable to act promptly and consult legal resources like USLegalForms for specific guidance related to the Arkansas Renunciation and Disclaimer of Property received by Intestate Succession.

In Arkansas, intestate succession laws dictate how property is distributed when someone dies without a will. Generally, the surviving spouse and children have the first claim to the deceased's estate, while other relatives may inherit if no immediate family is present. Understanding these laws is crucial for individuals considering the Arkansas Renunciation and Disclaimer of Property received by Intestate Succession.