Massachusetts Proof of Residency for College

Description

How to fill out Proof Of Residency For College?

You are able to spend several hours on the Internet attempting to find the legal record web template that meets the federal and state specifications you require. US Legal Forms gives 1000s of legal types which can be analyzed by professionals. You can easily down load or printing the Massachusetts Proof of Residency for College from the service.

If you already possess a US Legal Forms profile, you may log in and click on the Acquire option. Following that, you may complete, revise, printing, or indicator the Massachusetts Proof of Residency for College. Each legal record web template you acquire is your own eternally. To obtain yet another backup associated with a acquired type, check out the My Forms tab and click on the corresponding option.

If you use the US Legal Forms website the first time, follow the easy guidelines listed below:

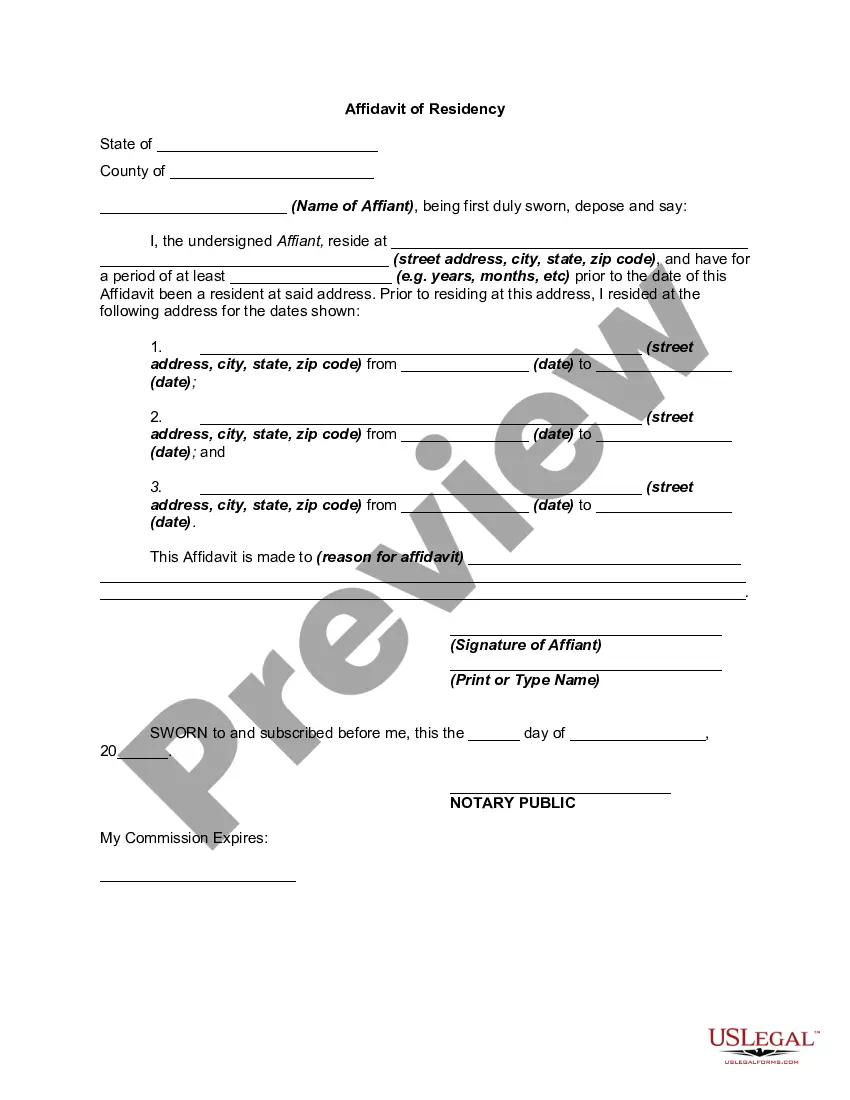

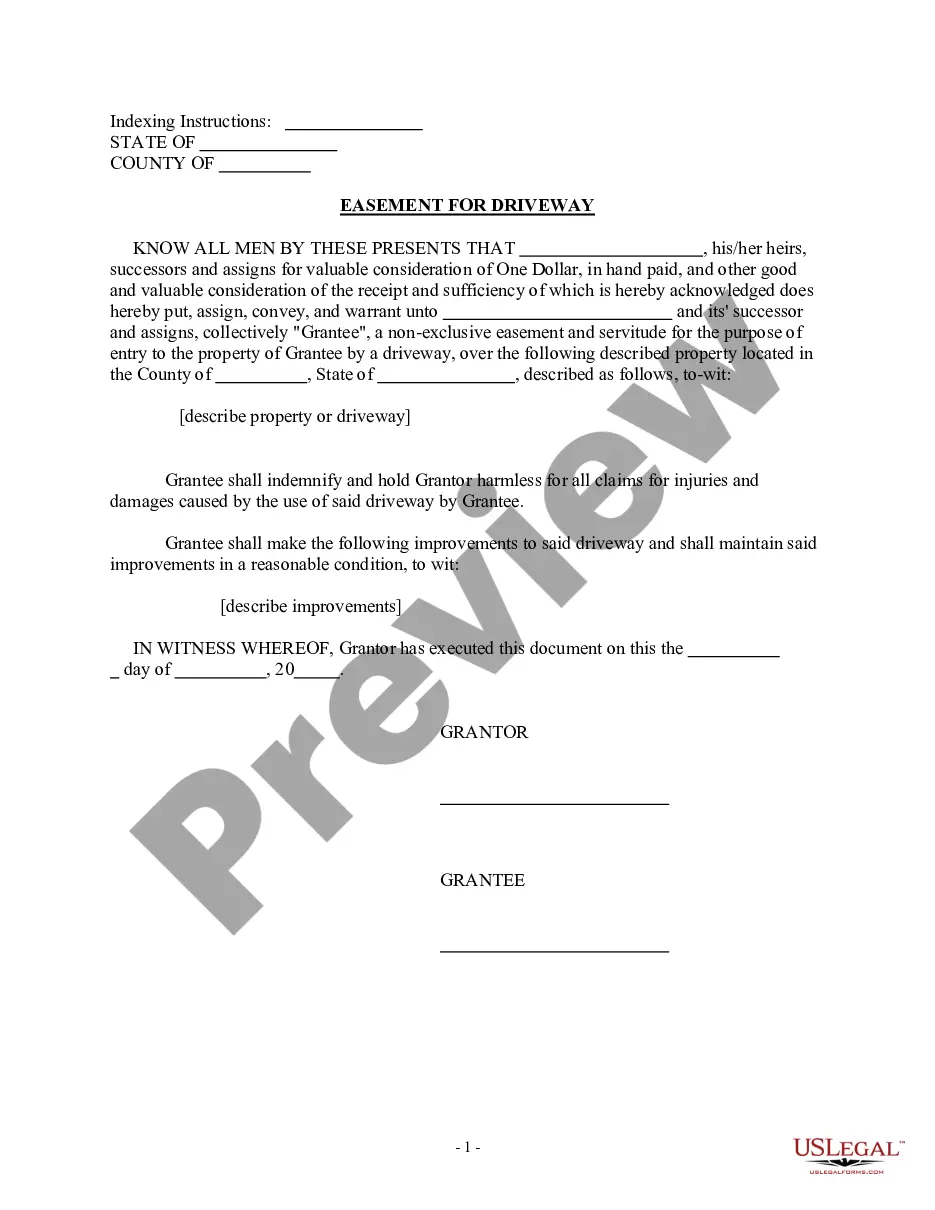

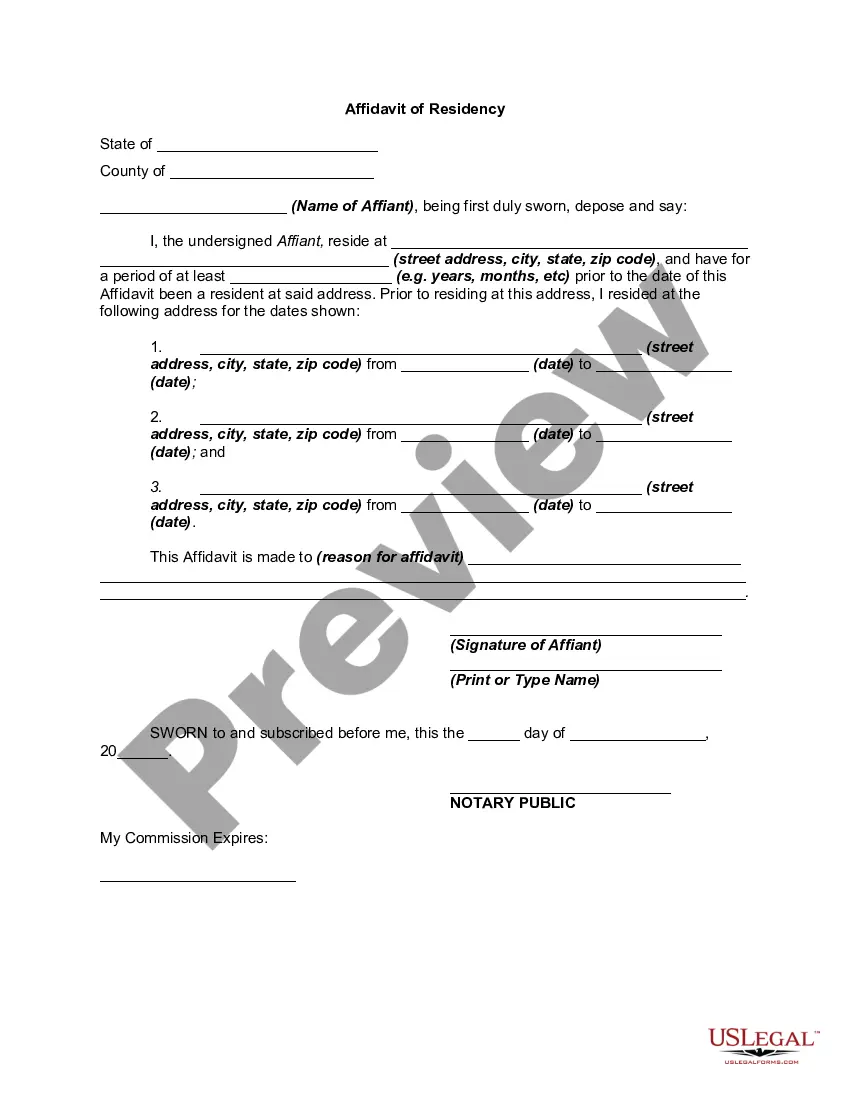

- Initial, make certain you have chosen the proper record web template for the area/city of your choosing. Browse the type explanation to ensure you have selected the correct type. If offered, utilize the Preview option to check throughout the record web template at the same time.

- If you want to locate yet another version of your type, utilize the Lookup field to get the web template that meets your needs and specifications.

- After you have found the web template you desire, just click Acquire now to continue.

- Choose the prices plan you desire, type your qualifications, and register for your account on US Legal Forms.

- Full the transaction. You should use your charge card or PayPal profile to pay for the legal type.

- Choose the format of your record and down load it in your product.

- Make changes in your record if necessary. You are able to complete, revise and indicator and printing Massachusetts Proof of Residency for College.

Acquire and printing 1000s of record web templates making use of the US Legal Forms website, that provides the most important selection of legal types. Use professional and status-particular web templates to handle your organization or individual requirements.

Form popularity

FAQ

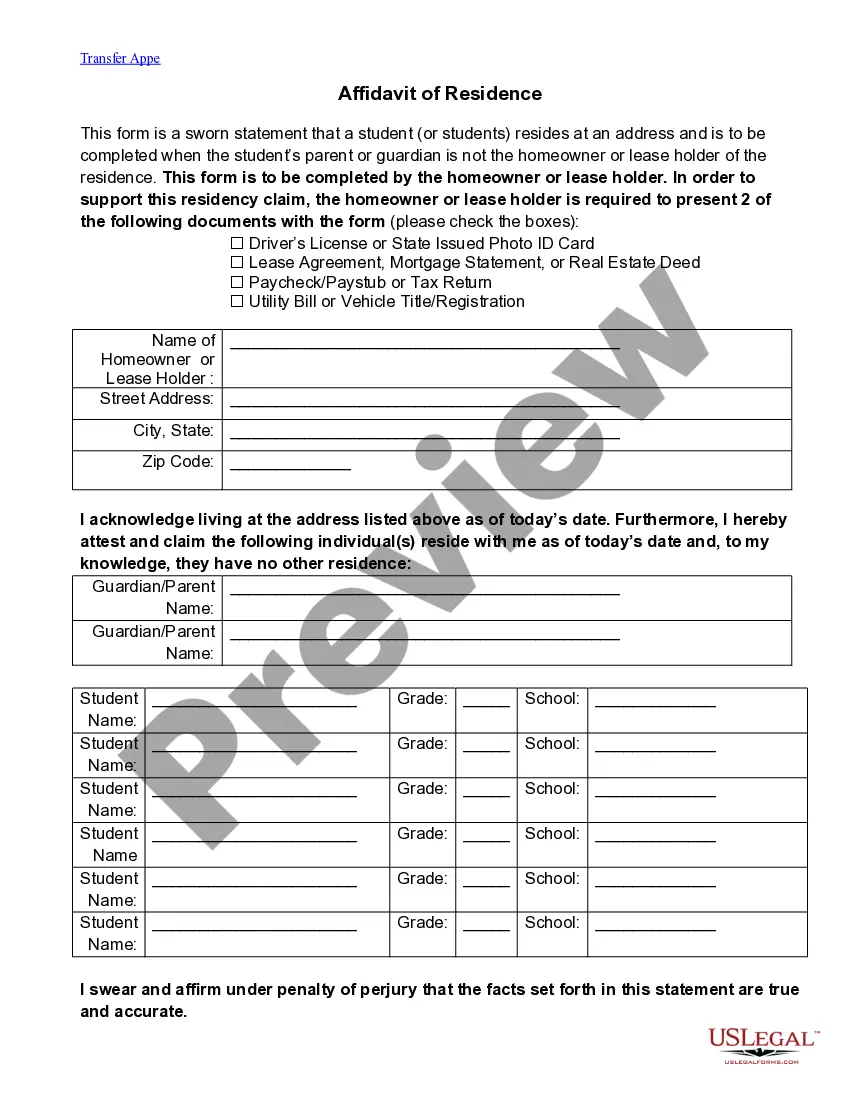

Normally tangible proof of residency is provided through: Appearance of a person's name on a city or town street list. Automobile registration. Driver's license. Rent / mortgage receipt. Utility or telephone bills. Voter registration.

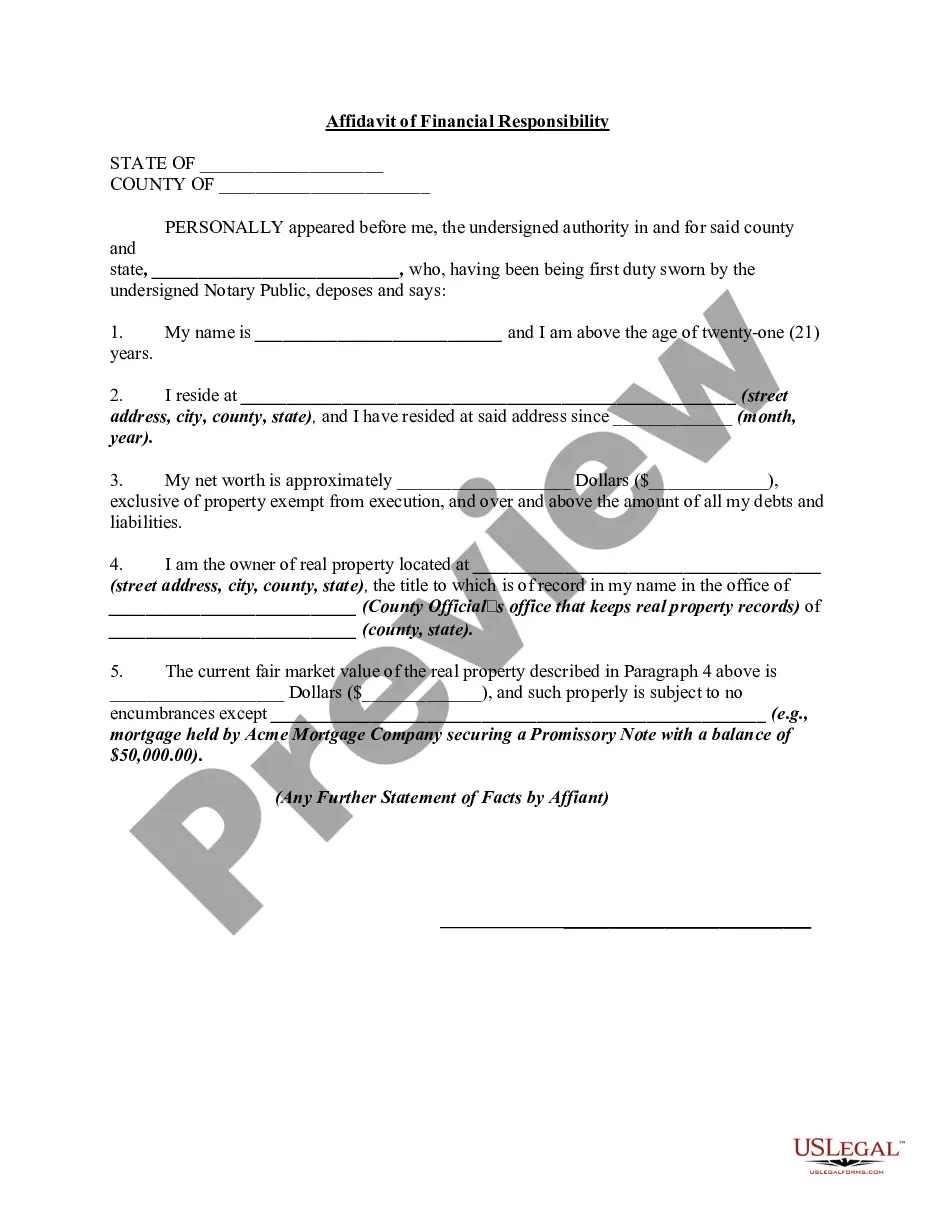

Key Takeaways. Your domicile is the state you think of as your home. You can also be considered the ?statutory resident? of another state if you spent considerable time there or derived income there. Most states will consider you a resident for tax purposes if you spend 183 days or more in that state.

You're a nonresident if you are neither a full-year nor a part-year resident. Your Massachusetts tax treatment is based on your residency status and not the type of visa you hold. Nonresidents use Form 1-NR/PY - Massachusetts Nonresident or Part-Year Resident Income Tax Return.

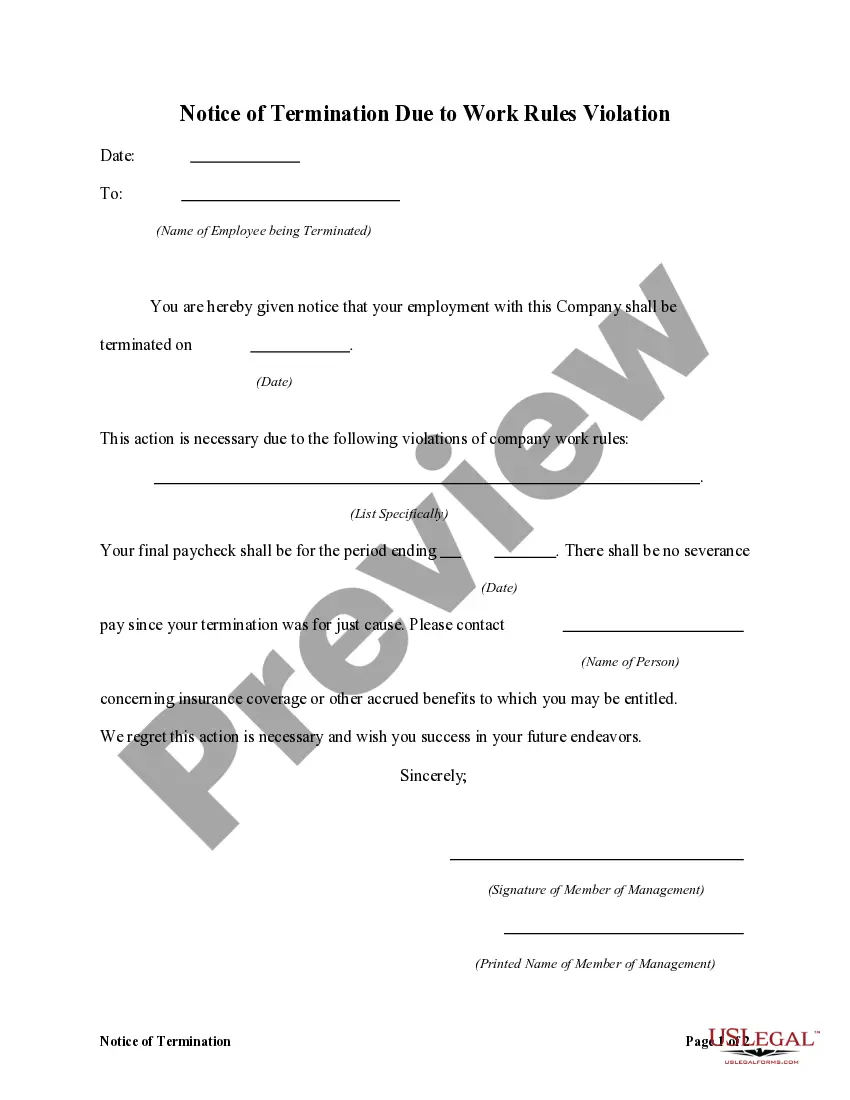

You cannot obtain in-state residency status, for tuition and fees, when you move to Massachusetts for an education. It does not matter if you live off-campus, have a job in Mass., pay Mass. taxes, have a Mass. driver's license or have your car registered in Mass.

An individual is considered to be a Massachusetts resident, for income tax purposes, if the individual: (i) is domiciled in Massachusetts; and/or (ii) maintains a permanent place of abode in Massachusetts and spends more than 183 days of the taxable year in Massachusetts.

Residency is determined by where you were living 12 months prior to starting your higher education in Massachusetts. You cannot obtain in-state residency status, for tuition and fees, when you move to Massachusetts for an education. It does not matter if you live off-campus, have a job in Mass., pay Mass.

Maintain a permanent place of abode in Massachusetts, and. Spend a total of more than 183 days of the tax year in Massachusetts, including days spent partially in Massachusetts. (Do not count days spent in Massachusetts while on active duty in the U.S. armed forces.)

Appearance of a person's name on a city or town street list. Automobile registration. Driver's license. Rent / mortgage receipt.