Compiled financial statements represent the most basic level of service that certified public accountants provide with respect to financial statements. In a compilation, the CPA must comply with certain basic requirements of professional standards, such as having a knowledge of the client's industry and applicable accounting principles, having a clear understanding with the client as to the services to be provided, and reading the financial statements to determine whether there are any obvious departures from generally accepted accounting principles (or, in some cases, another comprehensive basis of accounting used by the entity). It may be necessary for the CPA to perform "other accounting services" (such as creating a general ledger for the client, or assisting the client with adjusting entries for the books of the client (before the financial statements can be prepared). Upon completion, a report on the financial statements is issued that states a compilation was performed in accordance with AICPA professional standards, but no assurance is expressed that the statements are in conformity with generally accepted accounting principles. This is known as the expression of "no assurance." Compiled financial statements are often prepared for privately-held entities that do not need a higher level of assurance expressed by the CPA.

Massachusetts Engagement Letter for Review of Financial Statements and Compilation by Accounting Firm

Description

How to fill out Engagement Letter For Review Of Financial Statements And Compilation By Accounting Firm?

If you want to finalize, download, or print sanctioned documentation formats, utilize US Legal Forms, the largest collection of legal templates accessible online.

Make use of the site’s straightforward and user-friendly search to locate the documents you require.

A range of templates for business and personal purposes are categorized by groups and jurisdictions, or keywords.

Step 3. If you are dissatisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal document template.

Step 4. Once you have found the form you need, click the Get now button. Select the pricing plan you prefer and provide your information to register for the account.

- Utilize US Legal Forms to locate the Massachusetts Engagement Letter for Review of Financial Statements and Compilation by Accounting Firm with a few clicks.

- If you are already a US Legal Forms member, Log In to your account and click the Obtain button to locate the Massachusetts Engagement Letter for Review of Financial Statements and Compilation by Accounting Firm.

- You can also access documents you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Make sure you have selected the form for the correct city/state.

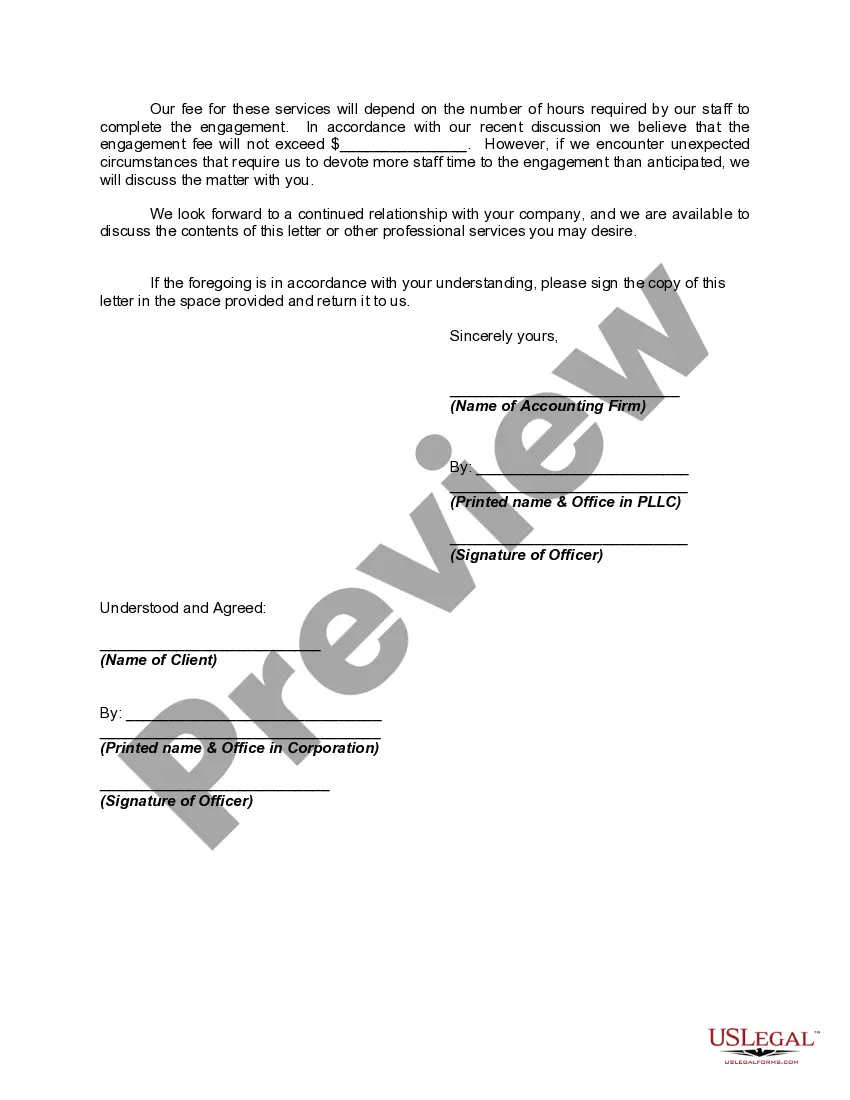

- Step 2. Use the Preview option to review the form's contents. Be sure to check the details.

Form popularity

FAQ

The letter of engagement is a formal agreement between an accounting firm and a client, detailing the scope of work, responsibilities, and expectations. This document is crucial as it protects both parties and clarifies the terms of the engagement. In the context of a Massachusetts Engagement Letter for Review of Financial Statements and Compilation by Accounting Firm, this letter serves to outline the specific services to be provided and the commitments involved.

Reviewed financial statements can only be prepared by qualified accounting professionals like CPAs who have completed the necessary training. These accountants analyze the financial data and provide commentary on the statements. To streamline this process, it is helpful to utilize a Massachusetts Engagement Letter for Review of Financial Statements and Compilation by Accounting Firm for clarity on the terms of service.

Review engagement financial statements can be prepared by licensed CPAs who have the necessary expertise and knowledge of accounting standards. These professionals ensure that the financial statements are accurate and comply with relevant laws. It is essential to use a Massachusetts Engagement Letter for Review of Financial Statements and Compilation by Accounting Firm to outline the specifics of the engagement and ensure a smooth process.

The responsibility for reviewing financial statements lies primarily with the CPA conducting the review. However, the management of the company also plays a critical role in providing accurate records and disclosures. To formalize the responsibilities, a Massachusetts Engagement Letter for Review of Financial Statements and Compilation by Accounting Firm should be created, detailing the expectations of both parties.

Only qualified CPAs or accounting firms can perform a review of financial statements. These professionals must meet specific licensure requirements in Massachusetts to ensure compliance. When engaging with such firms, it's advisable to establish a clear agreement using a Massachusetts Engagement Letter for Review of Financial Statements and Compilation by Accounting Firm.

Yes, a financial statement review is considered an attest engagement. The CPA gathers sufficient evidence to provide limited assurance that there are no material misstatements in the financial statements. This process often involves the use of a Massachusetts Engagement Letter for Review of Financial Statements and Compilation by Accounting Firm to clarify the scope and responsibilities of the engagement.

A licensed CPA, or Certified Public Accountant, is typically the professional who performs a review engagement. In Massachusetts, firms involved in the review of financial statements must comply with relevant regulations. Utilizing a Massachusetts Engagement Letter for Review of Financial Statements and Compilation by Accounting Firm ensures that the engagement is formalized and protects both the client and the accountant.

Only qualified CPAs or licensed accounting firms can prepare a compilation engagement. These professionals have the knowledge and experience necessary to compile financial data accurately. This process can be initiated through a Massachusetts Engagement Letter for Review of Financial Statements and Compilation, ensuring all parties are aligned and informed.

To write a good engagement letter, aim for clarity and conciseness. Outline the services, fees, expected outcomes, and responsibilities effectively. Referencing a Massachusetts Engagement Letter for Review of Financial Statements and Compilation by Accounting Firm can provide a strong framework to create a comprehensive document.

Yes, engagement letters are necessary for accounting and review services as they establish clear expectations between the accountant and the client. They protect both parties by outlining the agreed-upon services and responsibilities. A Massachusetts Engagement Letter for Review of Financial Statements and Compilation provides a solid foundation for this working relationship.