This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Massachusetts Mortgage Securing Guaranty of Performance of Lease

Description

How to fill out Mortgage Securing Guaranty Of Performance Of Lease?

Choosing the best authorized papers design can be a struggle. Obviously, there are a variety of themes available online, but how can you obtain the authorized type you require? Take advantage of the US Legal Forms web site. The services provides 1000s of themes, like the Massachusetts Mortgage Securing Guaranty of Performance of Lease, that can be used for business and personal needs. All the forms are checked out by professionals and fulfill federal and state demands.

Should you be previously authorized, log in to the bank account and then click the Obtain key to find the Massachusetts Mortgage Securing Guaranty of Performance of Lease. Make use of your bank account to search through the authorized forms you have purchased earlier. Check out the My Forms tab of your respective bank account and acquire another backup from the papers you require.

Should you be a new end user of US Legal Forms, listed here are easy directions that you can stick to:

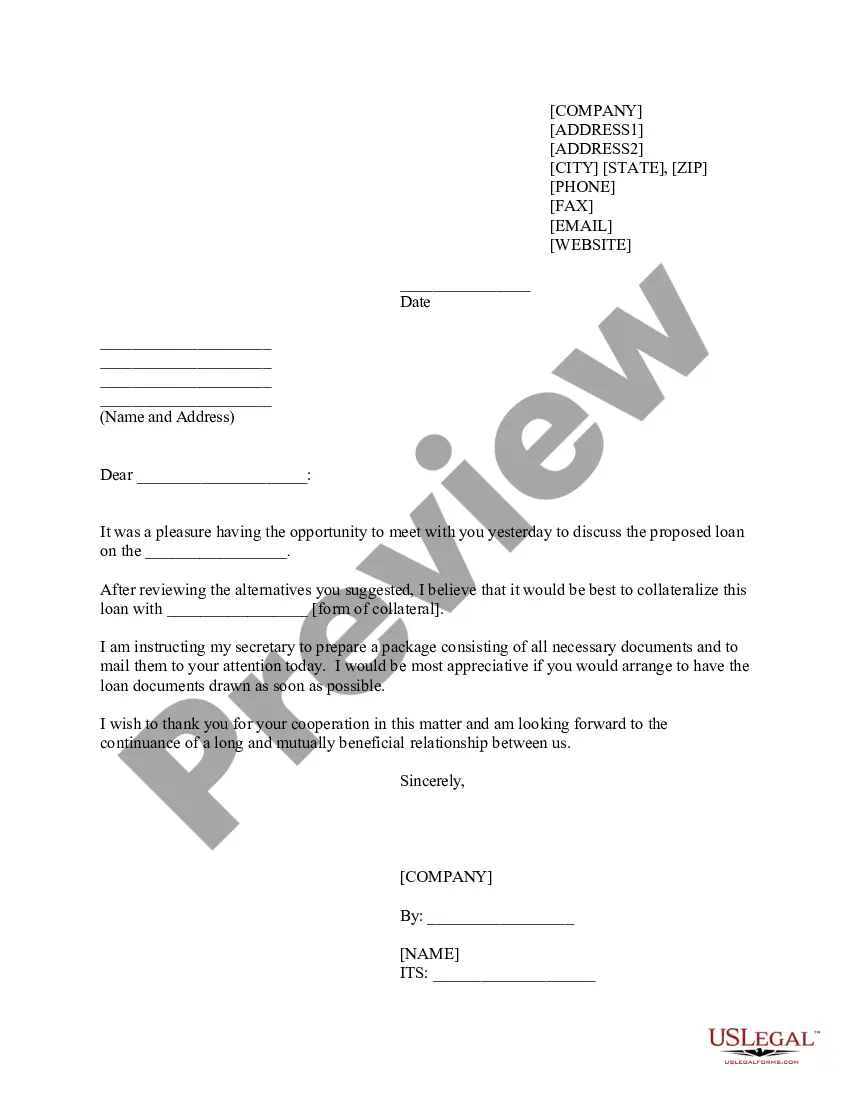

- First, be sure you have selected the proper type to your metropolis/region. You may look through the form making use of the Preview key and read the form information to make certain it will be the best for you.

- If the type does not fulfill your needs, utilize the Seach discipline to get the right type.

- When you are certain the form is acceptable, click the Purchase now key to find the type.

- Choose the costs plan you would like and enter in the needed info. Design your bank account and buy an order utilizing your PayPal bank account or bank card.

- Choose the file format and acquire the authorized papers design to the device.

- Full, edit and printing and indication the obtained Massachusetts Mortgage Securing Guaranty of Performance of Lease.

US Legal Forms may be the most significant catalogue of authorized forms for which you can discover various papers themes. Take advantage of the company to acquire skillfully-created paperwork that stick to state demands.

Form popularity

FAQ

This Guarantee is supplemental to the Mortgage and incorporates the Mortgage Conditions. The Guarantor acknowledges receipt of the mortgage deed, the mortgage conditions, and the offer (as defined in the mortgage conditions) and confirms that he or she has read and understands them.

It is a legally binding personal promise to step into the shoes of the original party to the contract. For example, an individual may personally agree to pay off the debts of a company they are acquiring as part of the acquisition.

In order for a guaranty agreement to be enforceable, it has to be in writing, the writing has to be signed by the guarantor, and the writing has to contain each of the following essential elements: 1. the identity of the lender; 2. the identity of the primary obligor; 3.

The Bottom Line A guarantor is an individual that agrees to pay a borrower's debt if the borrower defaults on their obligation. A guarantor is not a primary party to the agreement but is considered to be an additional comfort for a lender.

A guarantor home loan works as a way to get into the market sooner. You may only need a small deposit. In some cases, you may not need a deposit at all. That's because a guarantor ? usually a family member, offers equity in their own home as additional security for your loan.

In such circumstances, they are a contractual arrangement where one party agrees to answer for the liability of another party to another party. Guarantees do not create rights over property. In this context, guarantees are characterised as quasi-security.

With a guarantor mortgage, you may be able to get a mortgage even if you have no deposit or a bad credit score. A mortgage guarantor is someone ? usually a parent, a relative or even a close friend ? who will cover your mortgage repayments if you can't pay them for any reason.

If this happens and additional funds are advanced or re-advanced, the guarantee secures the additional funds up to the fixed amount. When a mortgage secures a guarantee, it secures the guarantor's obligation to repay the funds advanced related to the other party's debt, up to the guarantee amount.