Massachusetts Personal Guaranty - Guarantee of Lease to Corporation

Description

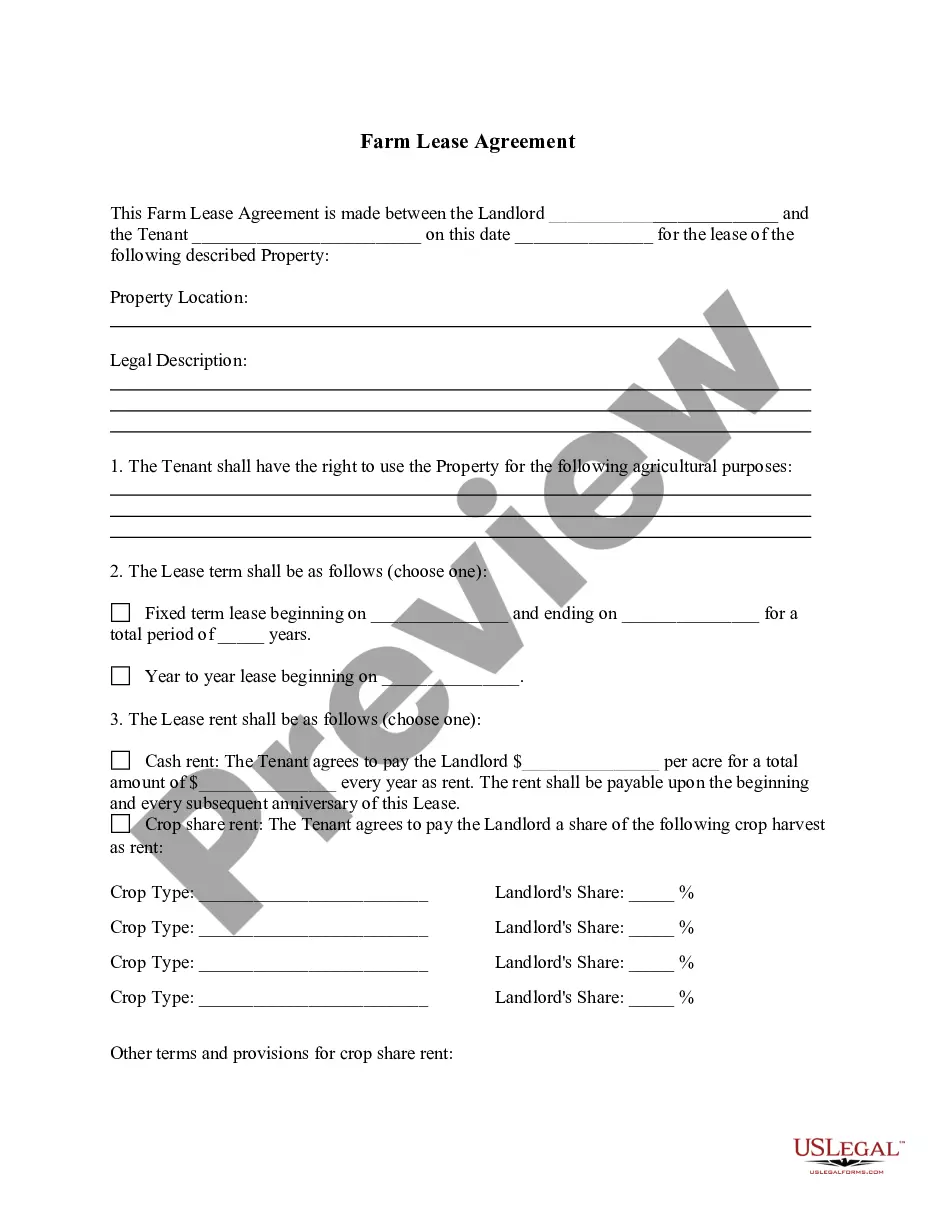

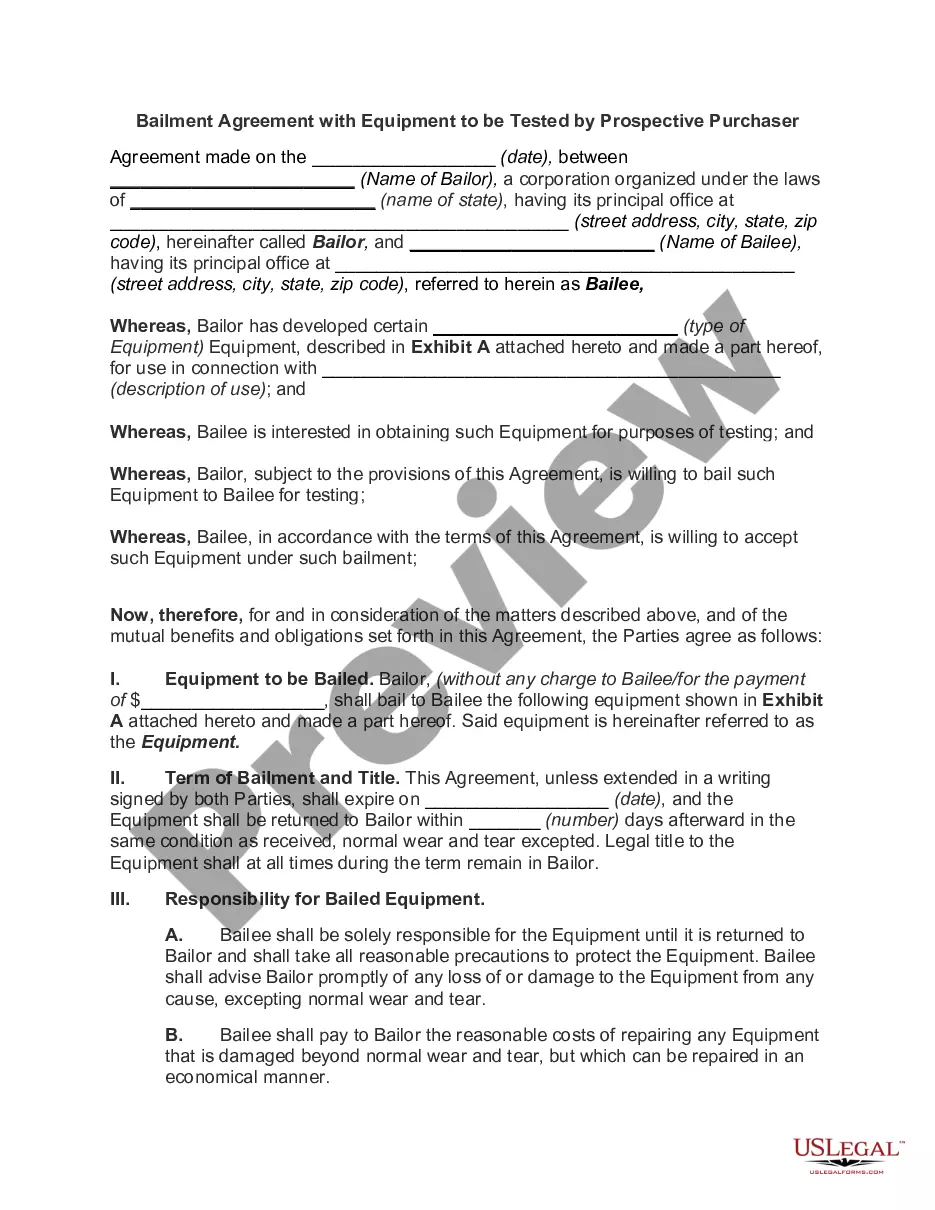

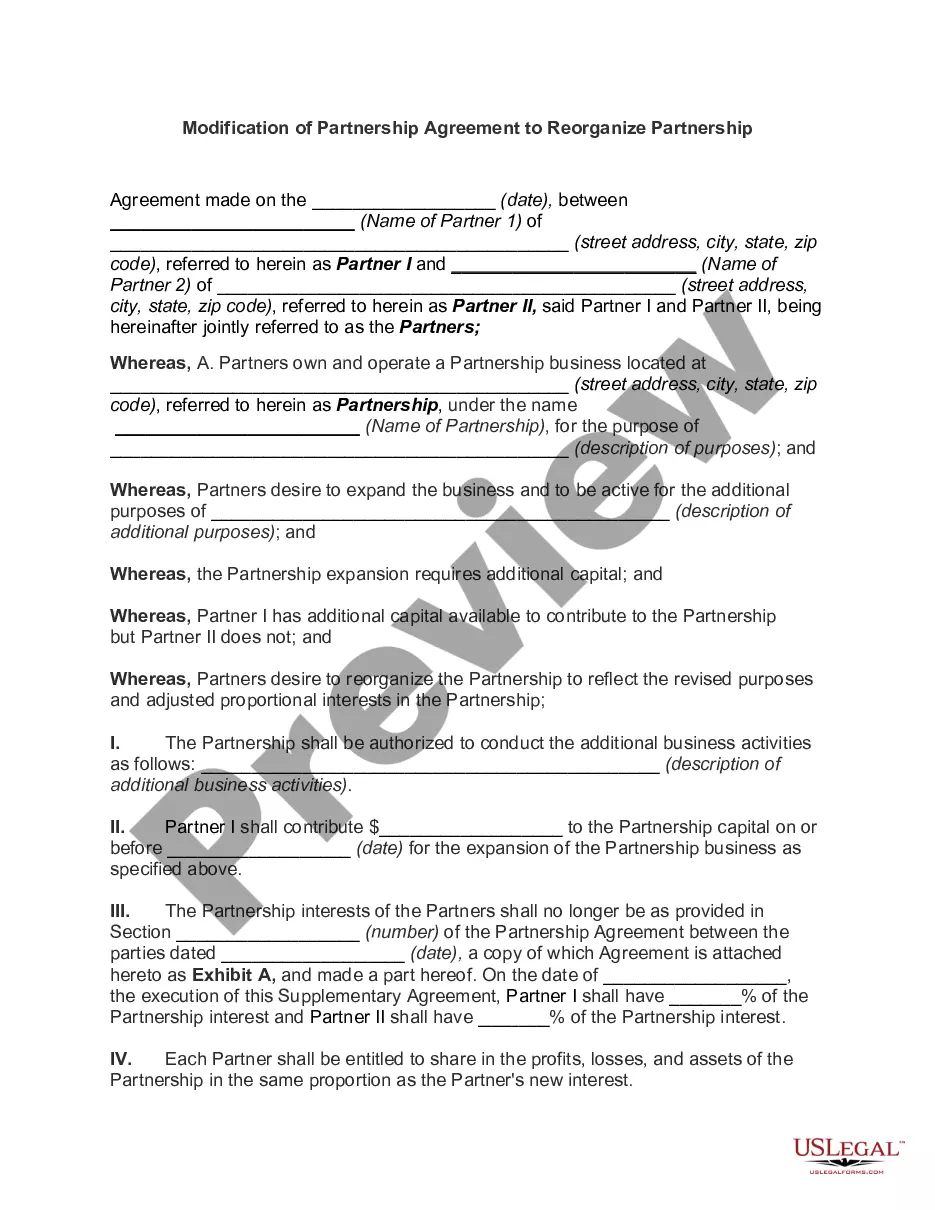

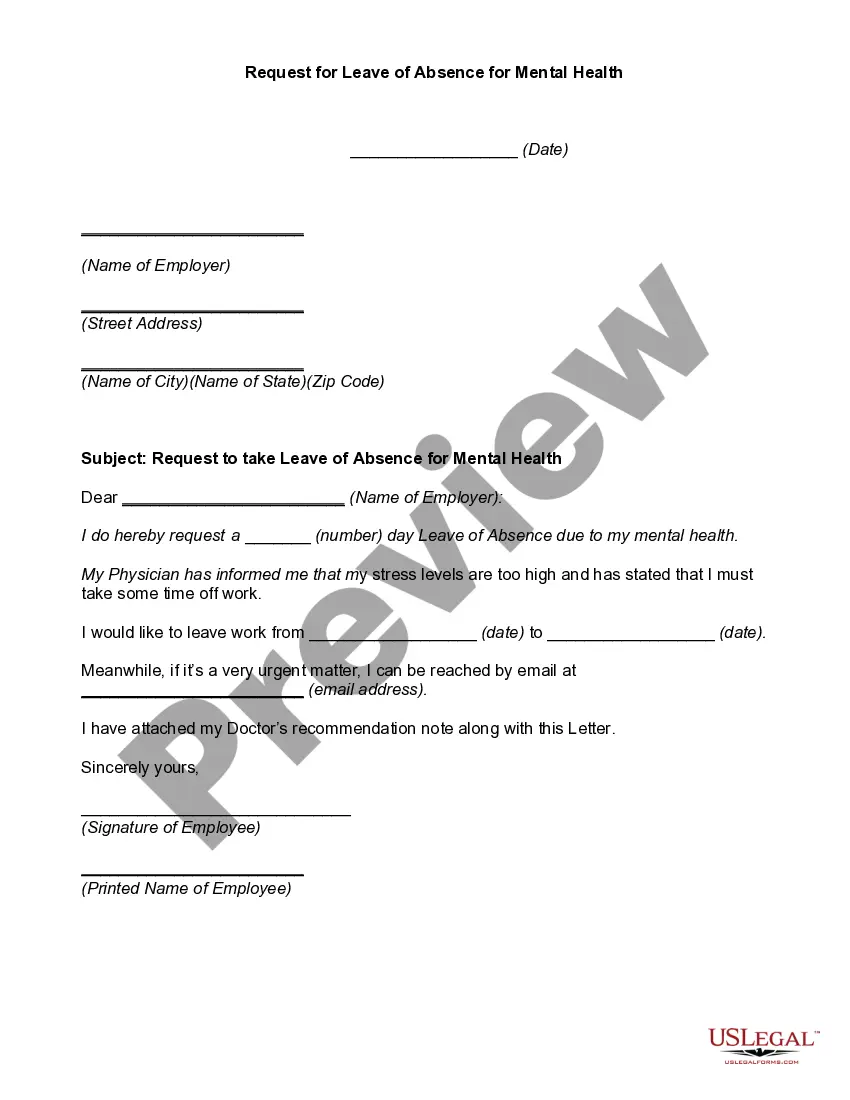

How to fill out Personal Guaranty - Guarantee Of Lease To Corporation?

US Legal Forms - one of the most prominent collections of legal documents in the United States - offers an array of legal form templates that you can purchase or print.

By utilizing the website, you can access thousands of forms for both business and personal purposes, organized by categories, states, or keywords. You can find the latest versions of forms like the Massachusetts Personal Guaranty - Assurance of Lease to Corporation in just a few moments.

If you already possess a monthly subscription, Log In and obtain the Massachusetts Personal Guaranty - Assurance of Lease to Corporation from the US Legal Forms repository. The Download button will be visible on every form you review. You can access all previously saved forms from the My documents tab in your account.

Edit. Complete, modify, print, and sign the saved Massachusetts Personal Guaranty - Assurance of Lease to Corporation.

Every template you add to your account has no expiration date and belongs to you permanently. Therefore, if you wish to purchase or print another copy, simply navigate to the My documents section and click on the document you need.

- If you wish to use US Legal Forms for the first time, here are some simple instructions to get you started.

- Ensure you have selected the appropriate form for your region/area. Click the Preview button to review the content of the form. Check the form details to confirm you have chosen the correct document.

- If the form does not meet your criteria, utilize the Search bar at the top of the screen to find one that does.

- Once satisfied with the form, validate your choice by clicking the Buy now button. Next, select your preferred payment plan and provide your information to create an account.

- Process the transaction. Use a credit card or PayPal account to complete the purchase.

- Choose the format and download the form to your device.

Form popularity

FAQ

A corporate guaranty is one usually signed by a parent or more developed affiliated company. It is a comfort to a landlord to have an extra set of assets to go after should its tenant default.

All guarantees must be in writing A guarantee has to be in writing and signed by the guarantor or some party authorised by the guarantor (Statute of Frauds 1677). It is often thought that more formality is required, but in fact the formal requirements are few.

The elements of offer, acceptance, intention to be bound by law and consideration must be satisfied. This also slightly varies depending on the form of the agreement. Personal guarantees are often written in the form of a deed because deeds do not require consideration.

If the corporate debtor refuses to pay, a personal guarantee agreement allows the bank to enforce that debt against other individuals. Often times it is the directors of the corporation that are asked to give personal guarantees, but at other times it may be an uninvolved third party, such as a spouse or a parent.

Consideration Like any contract, there must be evidence of offer, acceptance, consideration, intention and capacity for the guarantee to be enforceable.

By agreeing to a personal guarantee, the business borrower is agreeing to be 100 percent personally responsible for repayment of the entire loan amount, in addition to any collection, legal, or other costs related to the loan.

7 Ways to Avoid a Personal GuaranteeBuy insurance.Raise the interest rate.Increase Reporting.Increased the Frequency of Payments.Add a Fidelity Certificate.Limit the Guarantee Time Period.Use Other Collateral.

A corporate guarantee is an agreement in which one party, called the guarantor, takes on the payments or responsibilities of a debt if the debtor defaults on the loan.

With a personal guarantee, an individual agrees to be held contractually responsible if a borrower falls behind on repaying a loan. Similarly, a corporate guarantee represents an agreement where a corporate entity agrees to be held responsible.