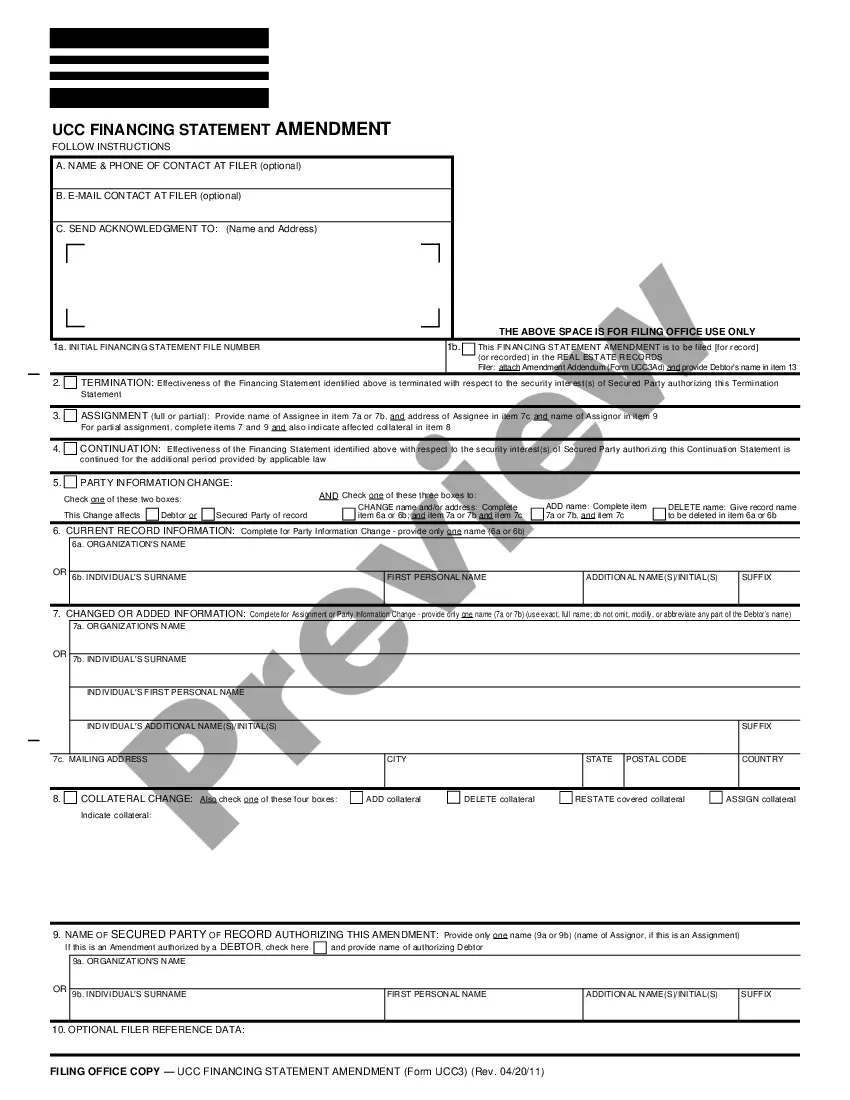

Massachusetts Suggestion for Writ of Garnishment

Description

How to fill out Suggestion For Writ Of Garnishment?

Discovering the right legal document web template can be a have a problem. Obviously, there are plenty of themes available on the net, but how will you get the legal form you require? Make use of the US Legal Forms site. The assistance offers a large number of themes, like the Massachusetts Suggestion for Writ of Garnishment, that you can use for organization and private requirements. All the kinds are inspected by pros and meet up with federal and state demands.

In case you are previously registered, log in to your bank account and click on the Down load option to get the Massachusetts Suggestion for Writ of Garnishment. Use your bank account to appear from the legal kinds you have ordered previously. Check out the My Forms tab of your own bank account and obtain another backup of your document you require.

In case you are a brand new user of US Legal Forms, listed here are basic directions that you should comply with:

- Very first, make certain you have chosen the proper form for your personal metropolis/county. You are able to look through the form using the Preview option and look at the form description to make sure this is the right one for you.

- When the form fails to meet up with your needs, utilize the Seach discipline to find the appropriate form.

- When you are sure that the form would work, select the Purchase now option to get the form.

- Choose the prices program you want and type in the required details. Build your bank account and purchase the transaction with your PayPal bank account or Visa or Mastercard.

- Select the submit formatting and acquire the legal document web template to your device.

- Total, change and produce and indicator the obtained Massachusetts Suggestion for Writ of Garnishment.

US Legal Forms is definitely the largest catalogue of legal kinds where you can see different document themes. Make use of the service to acquire skillfully-manufactured paperwork that comply with condition demands.

Form popularity

FAQ

You have up to 20 years from the date of issue to collect on your writ of execution. You may renew the writ before it expires for periods of five years at a time.

Filing your Objection You can use the Do-It-Yourself Objection to Garnishment tool if you have a reason to object to the garnishment. There is no cost to file an objection to a garnishment. You must file your objection with the court within 14 days of getting the notice of garnishment to stop the garnishment.

In a Nutshell This court order allows them to collect on the debt by seizing your real or personal property (or putting a lien on it), garnishing your wages, or levying your bank account. Personal property includes everything from household goods to vehicles. Real property includes things like your home or land.

A "wage garnishment," sometimes called a "wage attachment," is an order requiring your employer to withhold a certain amount of money from your pay and send it directly to one of your creditors. In most cases, a creditor can't garnish your wages without first getting a money judgment from a court.

Quebec. Many provinces use net pay to determine wage garnishments. Quebec however uses gross pay. Corporate creditors cannot garnish more than 30% of gross pay in the province.

If the judgment debtor isn't following the magistrate's payment order, then both parties must go to the scheduled payment hearing. If the judgment debtor doesn't appear, without further notice a magistrate may issue a civil arrest warrant (capias) for their arrest.

If a debt collector already has a judgment against you, then they might attempt to garnish your wages. This is one of the most common methods of attempting to collect judgments in Massachusetts, which is also called ?trustee process.? A wage garnishment can be stopped by the filing of a bankruptcy case.

Under Massachusetts state law, the maximum amount that might be garnished is the lesser of (1) fifteen percent (15%) of weekly gross wages or (2) fifty (50) times the state or federal minimum wage.