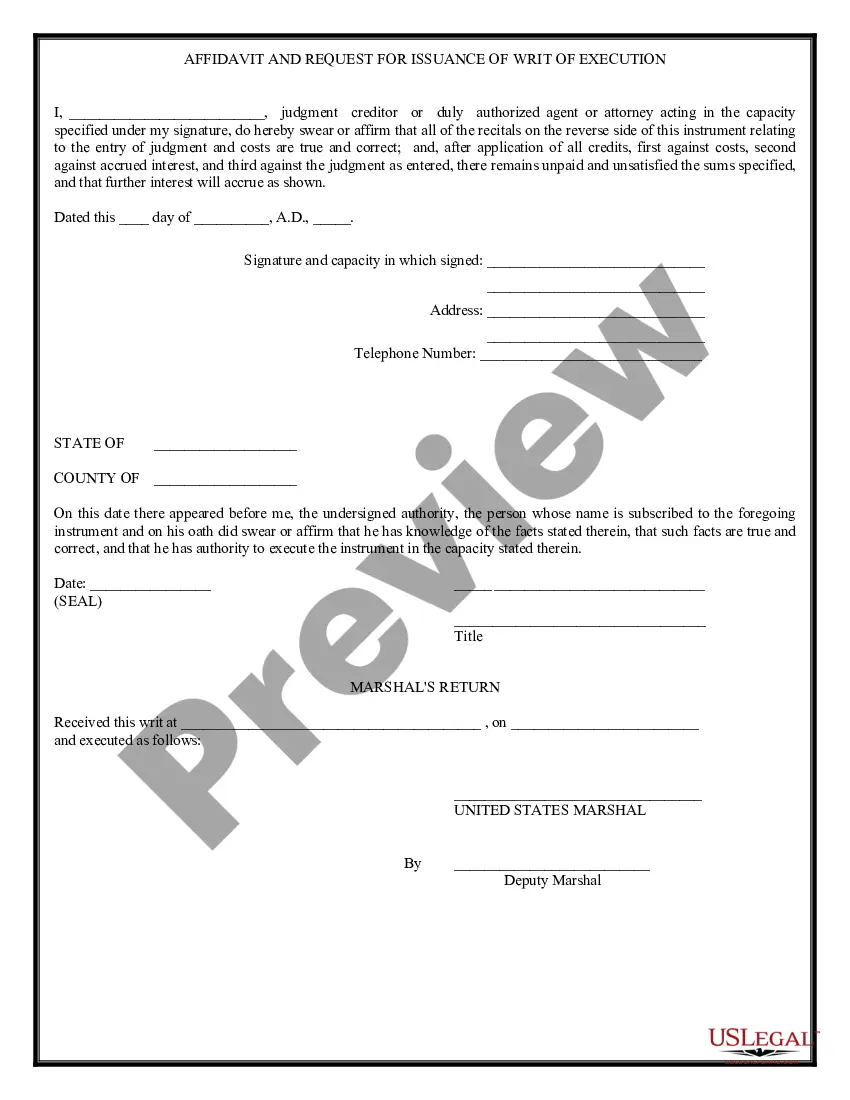

Massachusetts Writ of Execution

Description

How to fill out Writ Of Execution?

US Legal Forms - among the most significant libraries of legal varieties in the United States - offers a wide range of legal file templates it is possible to obtain or printing. Making use of the internet site, you will get a large number of varieties for organization and specific purposes, sorted by groups, claims, or keywords and phrases.You can find the most recent variations of varieties just like the Massachusetts Writ of Execution in seconds.

If you currently have a monthly subscription, log in and obtain Massachusetts Writ of Execution from the US Legal Forms catalogue. The Download key will show up on every form you perspective. You have accessibility to all formerly delivered electronically varieties inside the My Forms tab of the bank account.

If you would like use US Legal Forms the very first time, here are simple directions to obtain began:

- Be sure you have picked the best form for the city/state. Go through the Preview key to examine the form`s articles. Look at the form explanation to actually have chosen the right form.

- In case the form doesn`t match your specifications, use the Look for discipline near the top of the monitor to find the one who does.

- Should you be content with the shape, validate your selection by visiting the Purchase now key. Then, opt for the rates program you favor and supply your references to sign up for an bank account.

- Process the deal. Utilize your Visa or Mastercard or PayPal bank account to perform the deal.

- Pick the file format and obtain the shape on your own gadget.

- Make alterations. Fill up, edit and printing and indication the delivered electronically Massachusetts Writ of Execution.

Each and every format you included with your account does not have an expiration date which is your own property forever. So, in order to obtain or printing an additional copy, just proceed to the My Forms section and click on in the form you require.

Get access to the Massachusetts Writ of Execution with US Legal Forms, the most comprehensive catalogue of legal file templates. Use a large number of skilled and condition-certain templates that satisfy your organization or specific demands and specifications.

Form popularity

FAQ

How does a writ of execution work in Massachusetts? When you win your case, the court will issue you a writ of execution. Once you have that writ of execution, you can enlist the help of the sheriff to collect certain property from your debtor and sell that property at auction.

Pay the full judgment within the time ordered If you don't pay the amount required even though you're able to, you may be held in contempt of court and imprisoned or given additional costs. Pay the full amount directly to the other party (the "judgment creditor") unless the magistrate has ordered otherwise.

A Rule 69 Agreement allows the parties to settle some or all of their disputes privately, leaving only the unresolved issues to be resolved by the family law court. Common disputes settled ahead of divorce trial proceedings are visitation, parenting time, child support, and how to divide assets.

A writ of execution is a process issued by the court directing the U.S. Marshal to enforce and satisfy a judgment for payment of money. (Federal Rules of Civil Procedure 69).

How to get a Writ of Execution Fill out the court form. Writ of Execution (form EJ-130) This tells the sheriff to collect money for you. Bring to court clerk to issue and pay fee. Bring your completed Writ of Execution to the court clerk. Pay a $40 fee. This can be added to the amount you are owed.

Can the execution in a summary process case expire? Yes. The execution must be used within 3 months. The monetary part of the execution is valid for 20 years.