This form is an Application for Release of Right to Redeem Property from IRS After Foreclosure. Check for compliance with your specific facts and circumstances.

Massachusetts Application for Release of Right to Redeem Property from IRS After Foreclosure

Description

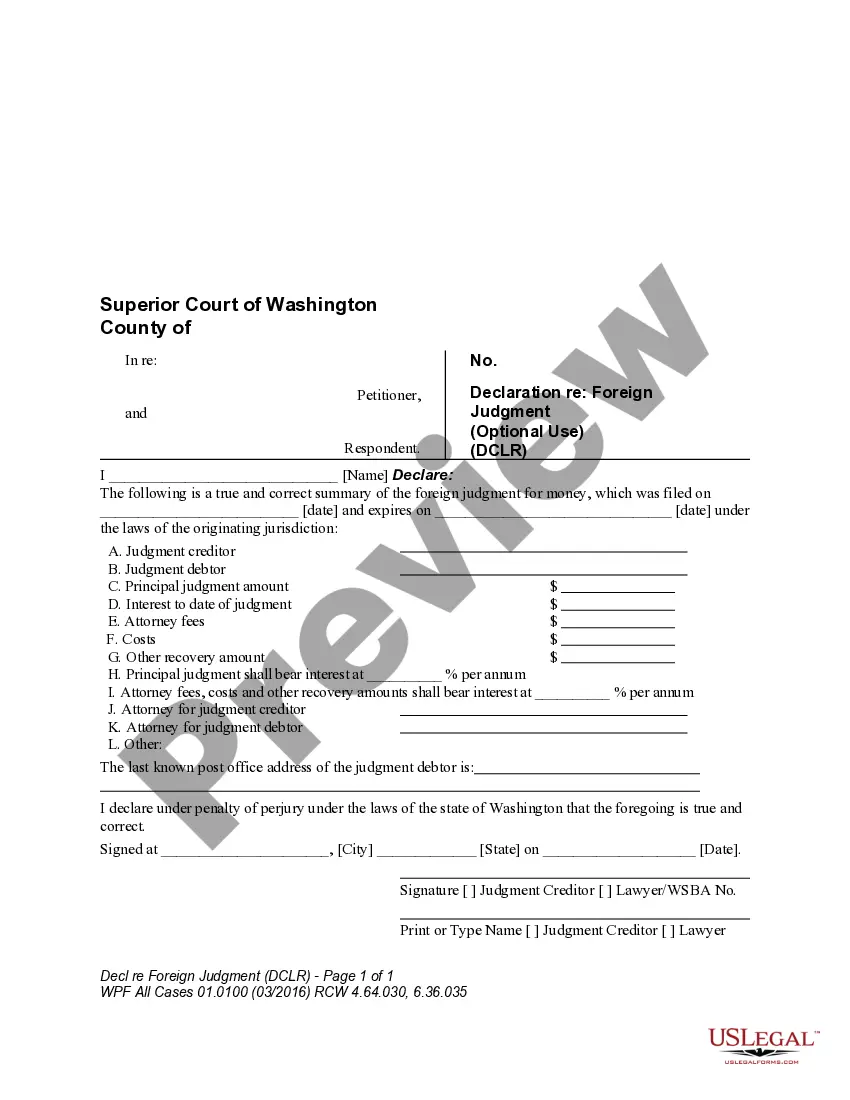

How to fill out Application For Release Of Right To Redeem Property From IRS After Foreclosure?

It is feasible to spend hours online searching for the legal document template that meets both state and federal requirements you have.

US Legal Forms offers a wide variety of legal forms that are reviewed by experts.

You can easily download or print the Massachusetts Application for Release of Right to Redeem Property from IRS After Foreclosure through the service.

If available, use the Preview button to view the document template as well. If you want to find another version of the form, use the Search field to locate the template that fits your needs and requirements. Once you have found the template you want, click Purchase now to proceed. Select the pricing plan you prefer, enter your credentials, and sign up for an account on US Legal Forms. Complete the transaction. You can utilize your credit card or PayPal account to purchase the legal form. Choose the format of the document and download it to your device. Make modifications to your document if necessary. You can fill out, revise, sign, and print the Massachusetts Application for Release of Right to Redeem Property from IRS After Foreclosure. Download and print numerous document templates using the US Legal Forms website, which offers the largest selection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you already have a US Legal Forms account, you can Log In and then click the Download button.

- After that, you can fill out, modify, print, or sign the Massachusetts Application for Release of Right to Redeem Property from IRS After Foreclosure.

- Every legal document template you receive is yours to keep forever.

- To obtain another copy of the purchased form, go to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, make sure you have chosen the correct document template for your county/city of interest.

- Check the form details to ensure you have selected the appropriate form.

Form popularity

FAQ

To obtain a lien payoff from the IRS, property owners need to contact the IRS directly and request a payoff amount for the lien. This process involves providing specific information about the property and the outstanding tax obligations. Using the Massachusetts Application for Release of Right to Redeem Property from IRS After Foreclosure can streamline the process and ensure all necessary information is collected.

The rule of redemption allows property owners to reclaim their foreclosed property by paying off the total debt owed. This rule varies by state, but in Massachusetts, it is an important legal right. For individuals navigating this complex process, the Massachusetts Application for Release of Right to Redeem Property from IRS After Foreclosure can offer valuable assistance.

The right of redemption in Massachusetts allows homeowners to recover their property after foreclosure by paying the full debt owed. This right is typically available until the property is sold at auction. To make this process more manageable, using the Massachusetts Application for Release of Right to Redeem Property from IRS After Foreclosure can provide essential insights and support.

The IRS right of redemption refers to the IRS's ability to reclaim property within 120 days after a foreclosure sale if taxes are owed. This right ensures that the IRS can recover unpaid taxes before the property is fully transferred to the new owner. To navigate this process, consider using the Massachusetts Application for Release of Right to Redeem Property from IRS After Foreclosure, as it provides guidance in dealing with IRS liens.

A certificate releasing a Massachusetts estate lien is a document that clears any liens associated with a property, typically allowing for a smoother sale or transfer. This certificate is essential when dealing with foreclosure and redemption. By using the Massachusetts Application for Release of Right to Redeem Property from IRS After Foreclosure, individuals can ensure that all necessary paperwork is correctly handled.

In Massachusetts, the right of redemption allows homeowners the opportunity to reclaim their property after a foreclosure by paying off the mortgage debt. This right can exist until the property is sold at auction. Understanding this right is crucial; thus, filing the Massachusetts Application for Release of Right to Redeem Property from IRS After Foreclosure can assist in navigating this situation effectively.

In some Massachusetts foreclosure cases, the homeowner gets the right to redeem the home after the foreclosure sale. But if your foreclosure is like most in Massachusetts, you won't be able to get the home back afterward.

If you do not pay it within 14 days of receiving that demand letter, the city or town may conduct a ?tax taking? of your property, or it may conduct a tax sale of your property. The city or town also may assign (give/sell) the right to enforce the lien (the ?tax receivable?) to a third party.

Tax Lien Certificates and Tax Deeds in Massachusetts MA. By law Massachusetts can have tax lien sales, but most municipalities conduct tax deed sales instead. 16%, but municipalities do not conduct tax lien sales. Following a tax deed sale there is no right of redemption.

Once paid in full the Treasurer can issue and file (with the registry of deeds for a fee) an official acknowledgement called ?certificate of redemption?, showing that the account has been paid in full, including all delinquent property taxes, penalties, fees and interest owed on the property.