The Massachusetts Department of Revenue provides directions on how to fill out Form 110- Chinese for residents in the state. Form 110-Chinese is a form used by Massachusetts residents to report their income and pay taxes on it. The form is divided into five parts labeled A through E. Part A: This section requires the taxpayer to enter their personal information, such as name, address, Social Security Number, and filing status. Part B: This section requires the taxpayer to enter their income from wages, salaries, tips, or other compensation. Part C: This section requires the taxpayer to enter their income from business profits, investments, or other sources. Part D: This section requires the taxpayer to enter any deductions or credits they are eligible for. Part E: This section requires the taxpayer to enter any tax payments they have already made. Once the taxpayer has completed the form, they must sign and date it before submitting it to the Department of Revenue. There are two types of Massachusetts Directions on how to fill out the Form 110-Chinese: one for individuals and one for businesses. The instructions for individuals are the same as those outlined above, but the instructions for businesses are slightly different. Businesses will need to provide additional information in Part C, such as the business name, address, type of business, and total gross income from the business. They may also be required to provide additional information in Part E, such as any estimated tax payments made, if applicable.

Massachusetts Directions on how to fill out the Form 110- Chinese

Description

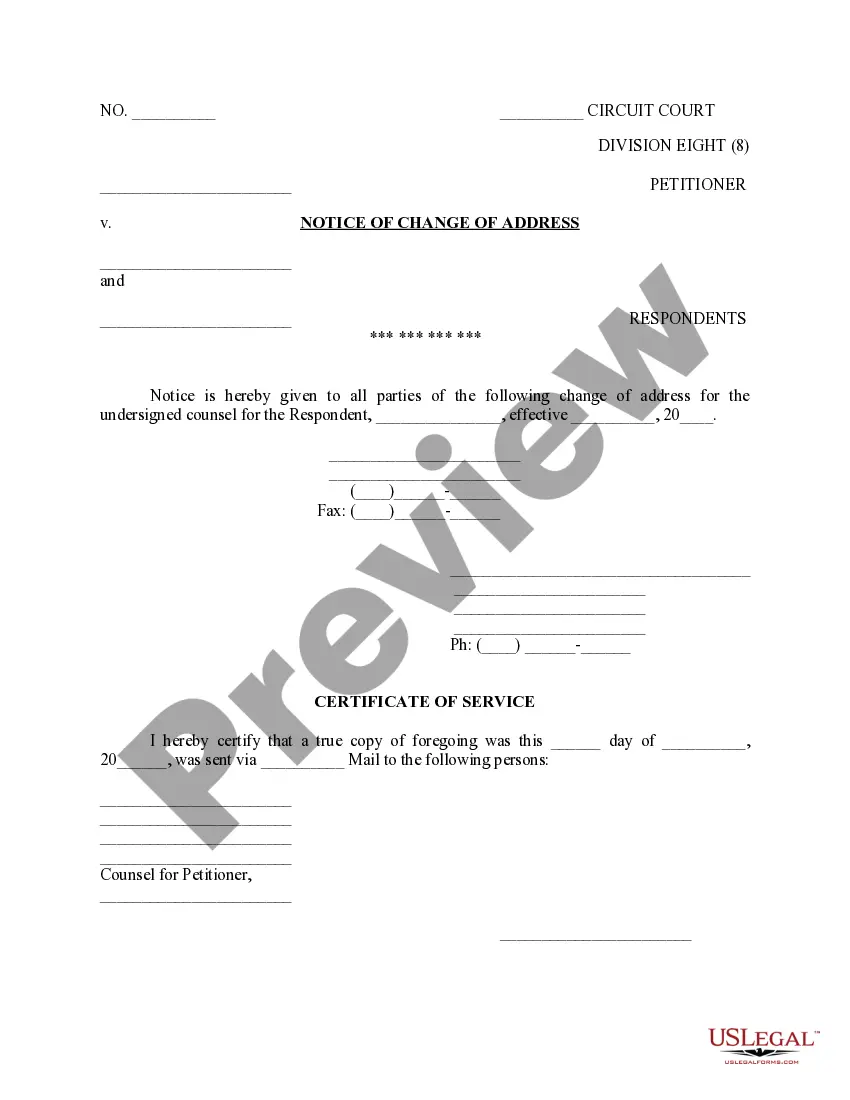

How to fill out Massachusetts Directions On How To Fill Out The Form 110- Chinese?

US Legal Forms is the simplest and most cost-effective method to locate appropriate official templates.

It boasts the largest online repository of business and personal legal documents created and verified by attorneys.

Here, you can access printable and fillable templates that adhere to federal and local regulations - just as you would find with your Massachusetts Directions on how to fill out the Form 110- Chinese.

Review the form details or preview the document to ensure you’ve identified one that fulfills your needs, or search for another using the search bar above.

Click Buy now when you’re confident about its suitability with all the requirements, and choose the subscription package you favor most.

- Acquiring your template requires just a few straightforward steps.

- Individuals who already possess an account with an active subscription simply need to Log In to the platform and download the form onto their device.

- Later, they can locate it in their profile under the My documents section.

- And here’s how you can obtain a professionally prepared Massachusetts Directions on how to fill out the Form 110- Chinese if you are using US Legal Forms for the first time.

Form popularity

FAQ

If you were injured at work, you may be eligible for workers' compensation benefits. If you qualify, you can receive payments to partially replace your paycheck and for medical care related to your injury. You may also be eligible for vocational rehabilitation if you need help getting back to work.

If you were injured at work, you may be eligible for workers' compensation benefits. If you qualify, you can receive payments to partially replace your paycheck and for medical care related to your injury. You may also be eligible for vocational rehabilitation if you need help getting back to work.

You can also call our Office of Insurance for assistance at (617) 626-5480 or (617) 626-5481, or look up your employer's insurer online. If your employer doesn't have workers' compensation insurance, you will need to file a claim against the Workers' Compensation Trust Fund, which is part of the DIA.

What is the statute of limitations? Under the workers compensation law, (MGL c. 152, § 41) for injuries on or after January 1, 1986, a claim must be filed with the insurer within 4 years of the date you become aware of a connection between your injury/illness and your employment.

Members of a LLC, partners of a LLP, or sole proprietors are exempt from workers' compensation insurance. Corporate officers who own at least 25% interest in the corporation can also file for an exemption.

You have 7 calendar days (except for Sundays and legal holidays) after the injured worker's 5th day of full or partial disability to report the injury to the DIA. You need to file the Form 101 - Employer's First Report of Injury/Fatality via a DIA online account.

What is the statute of limitations? Under the workers compensation law, (MGL c. 152, § 41) for injuries on or after January 1, 1986, a claim must be filed with the insurer within 4 years of the date you become aware of a connection between your injury/illness and your employment.

You can also call our Office of Insurance for assistance at (617) 626-5480 or (617) 626-5481, or look up your employer's insurer online. If your employer doesn't have workers' compensation insurance, you will need to file a claim against the Workers' Compensation Trust Fund, which is part of the DIA.