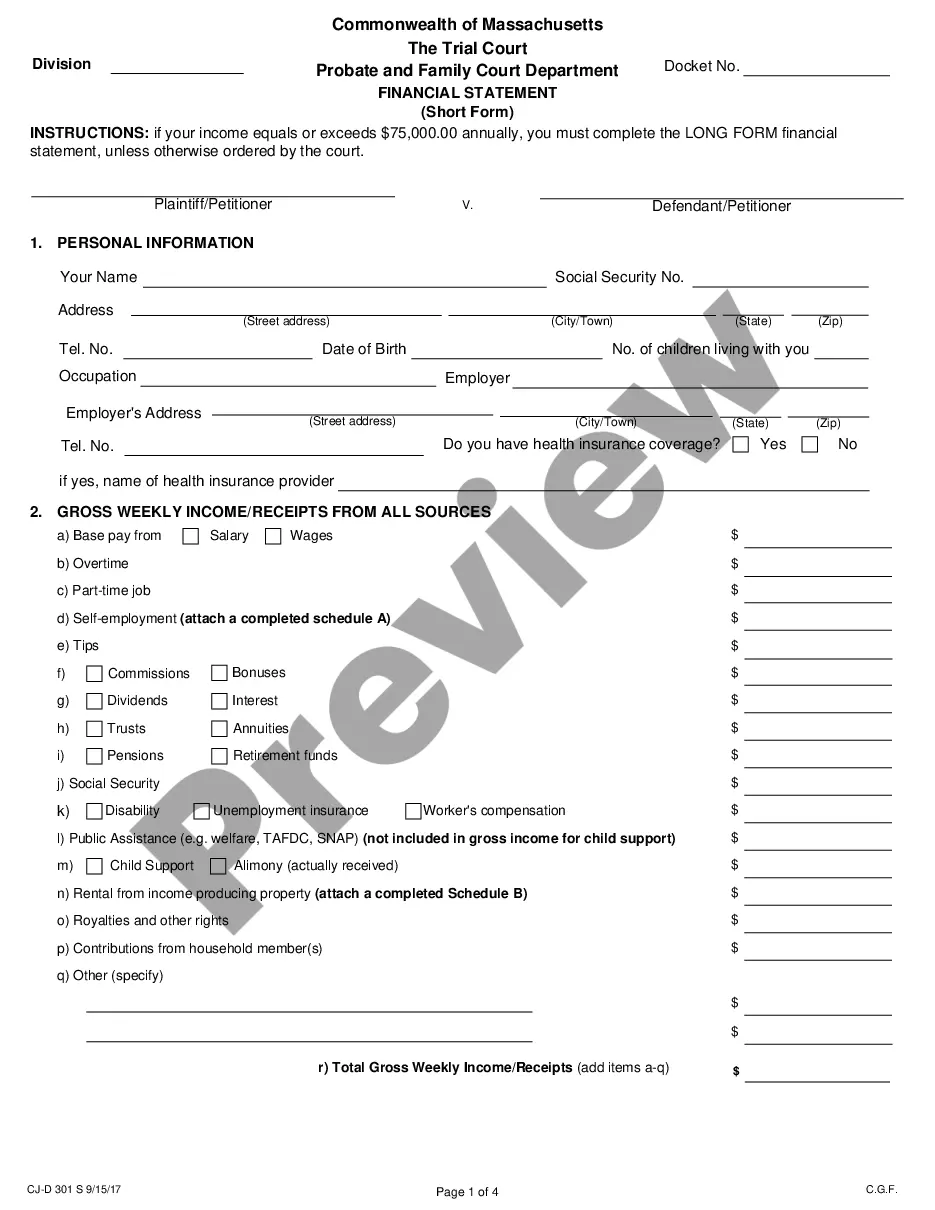

The Massachusetts Financial Statement-Short Form is a financial document used by the Massachusetts court system. It is used to determine the financial status of a party in a legal dispute. The form provides a comprehensive overview of the party's income, assets, liabilities, and other financial information. It is typically used to determine the party's ability to pay court costs, attorney's fees, and other financial obligations. The Massachusetts Financial Statement-Short Form is divided into four sections: 1) Income & Expenses; 2) Assets & Liabilities; 3) Financial Obligations; and 4) Miscellaneous. The first section of the form requires the party to list income sources, such as wages, rent, investments, and other sources. The second section requires the listing of assets and liabilities, including bank accounts, investments, real estate, and other property. The third section requires the party to list any financial obligations, such as mortgages, car loans, and credit card debt. The fourth section is for any additional information not covered in the other sections. There are three types of Massachusetts Financial Statement-Short Form: 1) Preliminary Financial Statement; 2) Final Financial Statement; and 3) Supplemental Financial Statement. The Preliminary Financial Statement is used by the court to preliminarily determine the party’s financial status. The Final Financial Statement is used by the court to finalize its determination. The Supplemental Financial Statement is used to update the court on any changes in the party’s financial status.

Massachusetts Financial Statement-Short Form

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Massachusetts Financial Statement-Short Form?

How much duration and resources do you typically invest in creating formal documents.

There’s a better alternative to obtaining such forms than employing legal experts or spending hours searching online for a suitable template. US Legal Forms is the premier online repository that provides professionally crafted and validated state-specific legal documents for any purpose, including the Massachusetts Financial Statement-Short Form.

Another benefit of our service is that you can access previously acquired documents that you securely store in your profile under the My documents tab. Retrieve them at any time and re-complete your documents as frequently as you need.

Save time and energy managing legal documents with US Legal Forms, one of the most reliable web services. Join us today!

- Review the document content to ensure it aligns with your state regulations. To do this, examine the document description or utilize the Preview option.

- If your legal template does not fulfill your specifications, seek a different one using the search field at the top of the page.

- If you already possess an account with us, Log In and obtain the Massachusetts Financial Statement-Short Form. Otherwise, continue to the subsequent steps.

- Select Buy now once you locate the appropriate template. Choose the subscription plan that best meets your needs to gain access to our library’s complete offerings.

- Register for an account and pay for your subscription. You can make a payment with your credit card or through PayPal - our service is completely secure for this.

- Download your Massachusetts Financial Statement-Short Form onto your device and fill it out on a printed hard copy or electronically.

Form popularity

FAQ

The three main types of financial statements are the balance sheet, the income statement, and the cash flow statement. These three statements together show the assets and liabilities of a business, its revenues and costs, as well as its cash flows from operating, investing, and financing activities.

What does F/S stand for? Rank Abbr.MeaningF/SFor SaleFSFor SaleF/SFull ServiceFSFinancial Services35 more rows

Massachusetts only has $41.5 billion of assets available to pay bills totaling $115.5 billion. Because Massachusetts doesn't have enough money to pay its bills, it has a $74 billion financial hole. To fill it, each Massachusetts taxpayer would have to send $28,100 to the state.

A balance sheet aims to outline a business's assets and liabilities. A financial statement has a more holistic goal of revealing the company's overall fiscal health. A balance sheet offers raw data, but the financial statement lends greater context to the data.

Audited financial statements are those that have been reviewed and verified as accurate by a Certified Public Accountant (CPA). Any company may require audited statements for internal use or to present to external stakeholders. The company prepares the financial statements and presents them to a CPA for assessment.

What are Financial Statements? Financial statements are a collection of summary-level reports about an organization's financial results, financial position, and cash flows. They include the income statement, balance sheet, and statement of cash flows.

FS stands for Financial Statement.

Tips to Help Ensure your Financial Statement is Accurate & Complete Do not estimate your monthly expenses.Make sure you account for all income.Report assets at their proper fair market value.Make sure all the assets and liabilities are accounted for.Update your financial statement.