Massachusetts Request for Debtor to File Federal Tax Information with the Court is a form used by the courts in Massachusetts to request that debtors provide information about their federal tax filing history. This form is used to verify the information provided by the debtor when filing for bankruptcy relief. The court will use the information to determine the debtor’s ability to pay creditors in the bankruptcy process. There are two types of Massachusetts Request for Debtor to File Federal Tax Information with the Court: Form B-1 and Form B-2. Form B-1 requires the debtor to provide the court with copies of their federal income tax returns from the previous two years. Form B-2 requires the debtor to provide the court with copies of their federal income tax returns from the previous four years. Both forms require the debtor to provide additional documents, such as W-2s, 1099s, and other relevant documents.

Massachusetts Request For Debtor To File Federal Tax Information With The Court

Description

How to fill out Massachusetts Request For Debtor To File Federal Tax Information With The Court?

Drafting legal documents can be a significant source of anxiety if you don’t have readily available fillable templates. With the US Legal Forms online database of official documentation, you can trust the blanks you encounter, as they all adhere to federal and state regulations and are verified by our specialists.

Acquiring your Massachusetts Request For Debtor To File Federal Tax Information With The Court from our collection is as straightforward as A-B-C. Previously approved users with an active subscription simply need to sign in and click the Download button after they find the correct template. Subsequently, if necessary, users can retrieve the same blank from the My documents tab in their profile. However, even if you are unfamiliar with our service, registering with a valid subscription will only take a few moments. Here’s a brief guideline for you.

Haven’t you tried US Legal Forms yet? Register for our service today to obtain any official document promptly and effortlessly whenever you need to, and maintain your paperwork in order!

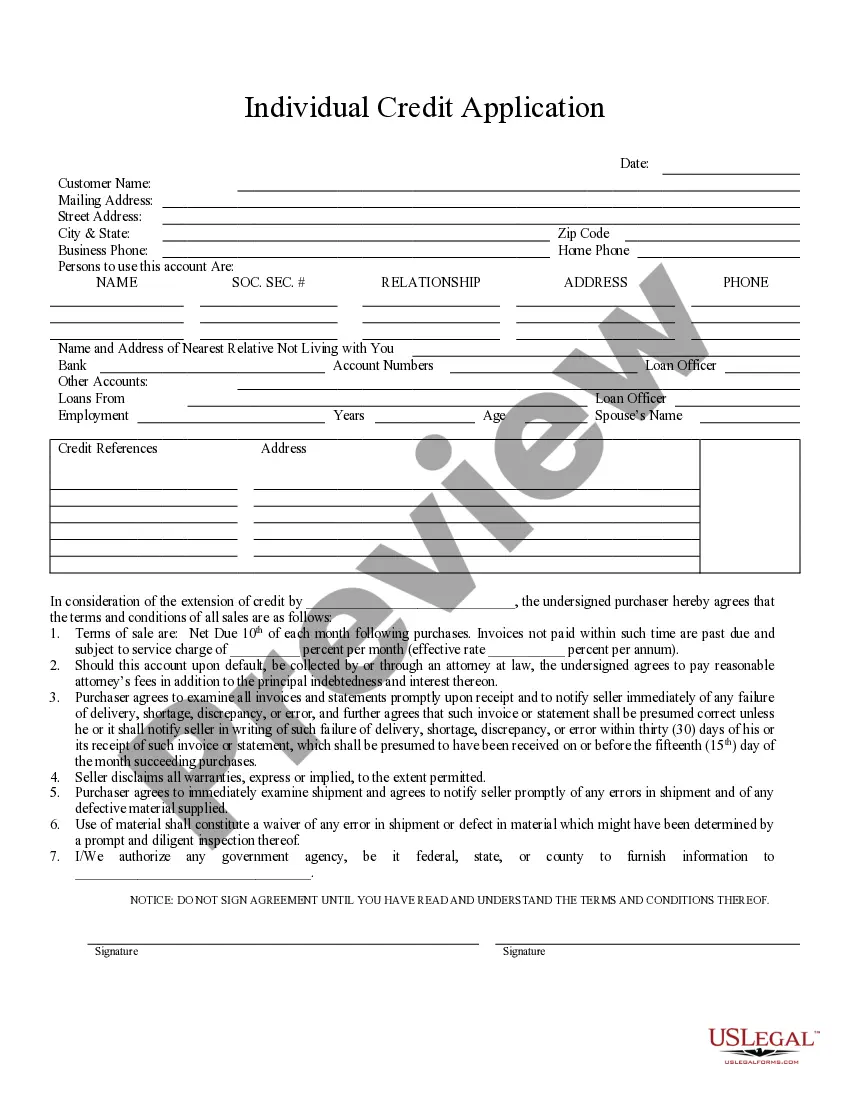

- Document compliance assessment. You should thoroughly review the content of the form you require and verify whether it meets your needs and aligns with your state law requirements. Previewing your document and examining its general description will assist you in doing just that.

- Alternative search (optional). In the event of any discrepancies, navigate the library using the Search tab at the top of the page until you discover a suitable blank, and click Buy Now once you identify the one you require.

- Account creation and form acquisition. Create an account with US Legal Forms. After account validation, Log In and choose your most appropriate subscription plan. Make a payment to continue (options include PayPal and credit card).

- Template retrieval and subsequent use. Choose the file format for your Massachusetts Request For Debtor To File Federal Tax Information With The Court and click Download to save it to your device. Print it to fill out your documents manually, or utilize a multi-featured online editor to prepare an electronic version more quickly and efficiently.