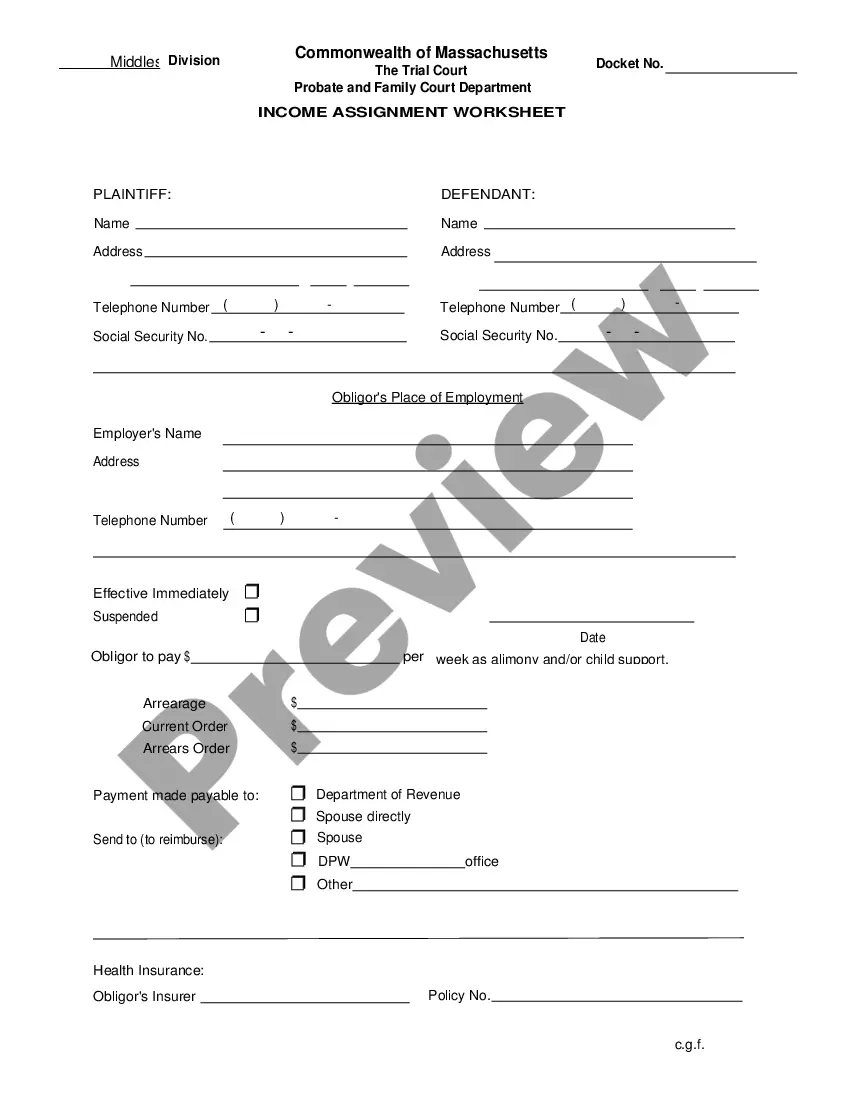

Massachusetts Income Assignment Worksheet

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

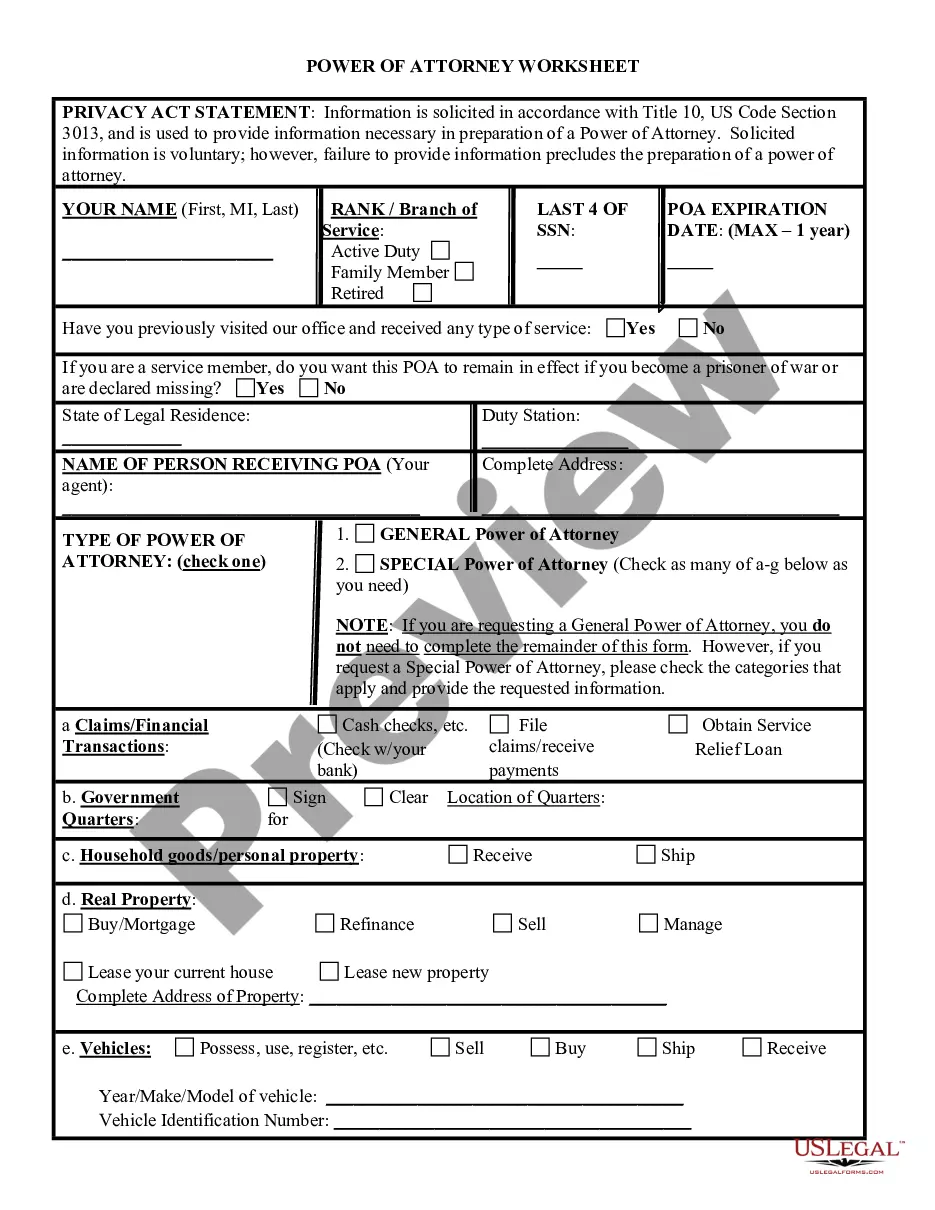

How to fill out Massachusetts Income Assignment Worksheet?

Greetings to the finest legal documents library, US Legal Forms.

Here you can locate any template such as Massachusetts Income Assignment Worksheet forms and acquire them (as many of them as you wish/require). Create official documents in a few hours, instead of days or weeks, without having to spend an arm and a leg on a lawyer.

Obtain your state-specific example in just a few clicks and be assured knowing that it was prepared by our skilled legal professionals.

To create an account, choose a pricing plan. Utilize a card or PayPal account to register. Save the template in the format you prefer (Word or PDF). Print the document and complete it with your/your business’s details. Once you’ve filled out the Massachusetts Income Assignment Worksheet, send it to your legal professional for validation. It’s an additional step but a necessary one for ensuring you’re fully protected. Join US Legal Forms today and access thousands of reusable samples.

- If you’re already a registered user, just Log In to your account and then click Download next to the Massachusetts Income Assignment Worksheet you desire.

- Since US Legal Forms is online-based, you’ll always have access to your downloaded templates, regardless of the device you’re utilizing.

- Locate them in the My documents section.

- If you don't possess an account yet, what are you delaying for.

- Review our instructions detailed below to get started.

- If this is a state-specific example, verify its applicability in your state.

- Examine the description (if available) to ascertain if it’s the correct template.

- See additional content with the Preview feature.

- If the sample fulfills all your requirements, click Buy Now.

Form popularity

FAQ

The Massachusetts non-resident income tax form is known as Form 1-NR. This form is specifically for individuals who earn income in Massachusetts but live elsewhere. Using the Massachusetts Income Assignment Worksheet in conjunction with this form can help you accurately report your income and ensure compliance with state tax regulations.

You can obtain a copy of your Massachusetts state tax return by visiting the Massachusetts Department of Revenue website. They provide an option to download copies of previously filed tax returns directly online. Alternatively, if you have used the Massachusetts Income Assignment Worksheet, you may have a copy saved for your records.

California courts can enforce a child support order by holding the delinquent parent in contempt of court. Being held in contempt means the judge believes you have willfully disobeyed a court order. Contempt can be criminal or civil.

If, under the same circumstances, the child support payment is overdue for longer than 2 years, or the amount exceeds $10,000, the violation is a criminal felony, and convicted offenders face fines and up to 2 years in prison (See 18 U.S.C.

If the delinquent parent is found guilty of contempt for failing to pay child support, the court can order that person to pay fines, perform community service, and/or serve time in jail. The party seeking enforcement in court must file a motion (a written request) for contempt.

The most common way to enforce a child support order is by filing a motion for civil contempt. Filing this motion (written request) tells the court that you have a valid child support order in place, and the noncustodial parent is behind on payments.

The most common way to enforce a child support order is by filing a motion for civil contempt. Filing this motion (written request) tells the court that you have a valid child support order in place, and the noncustodial parent is behind on payments.

If the court finds that someone has the ability to pay support but is willfully not paying it, it can find that the person ordered to pay support is in contempt of court. Being in contempt of court could mean jail time for the person who is not paying the child support.

In this situation, there is a temptation to withhold child support, but this is not allowed. Child support payments and visitation are considered by law to be separate issues.You have an obligation to financially support your children, regardless of any visitation issues.