Massachusetts Electrical Contract for Contractor

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Massachusetts Electrical Contract For Contractor?

You are invited to the largest repository of legal documents, US Legal Forms.

Here, you can locate any template, including the Massachusetts Electrical Contract for Contractor forms, and download as many as you desire.

Create official documents within hours instead of days or weeks, without having to pay a fortune to a lawyer.

Once you’ve completed the Massachusetts Electrical Contract for Contractor, present it to your lawyer for verification. Though this is an additional step, it is crucial to ensure that you are fully protected. Enroll in US Legal Forms today and gain access to a vast collection of reusable templates.

- Obtain the state-specific form with just a few clicks.

- Feel assured knowing it was prepared by our licensed attorneys.

- If you are already a registered user, simply Log In to your account and select Download for the Massachusetts Electrical Contract for Contractor you prefer.

- Because US Legal Forms is online-based, you’ll typically have access to your downloaded documents, regardless of the device you are using.

- You can find them under the My documents section.

- If you haven’t created an account yet, why wait.

- Follow our guidelines below to begin.

- If this document is state-specific, verify its validity within your jurisdiction.

Form popularity

FAQ

For most types of projects you hire an independent contractor (IC) to do, the law does not require you to put anything in writing. You can meet with the IC, agree on the terms of your arrangement, and have an oral contract or agreement that is legally binding. Just because you can doesn't mean you should, however.

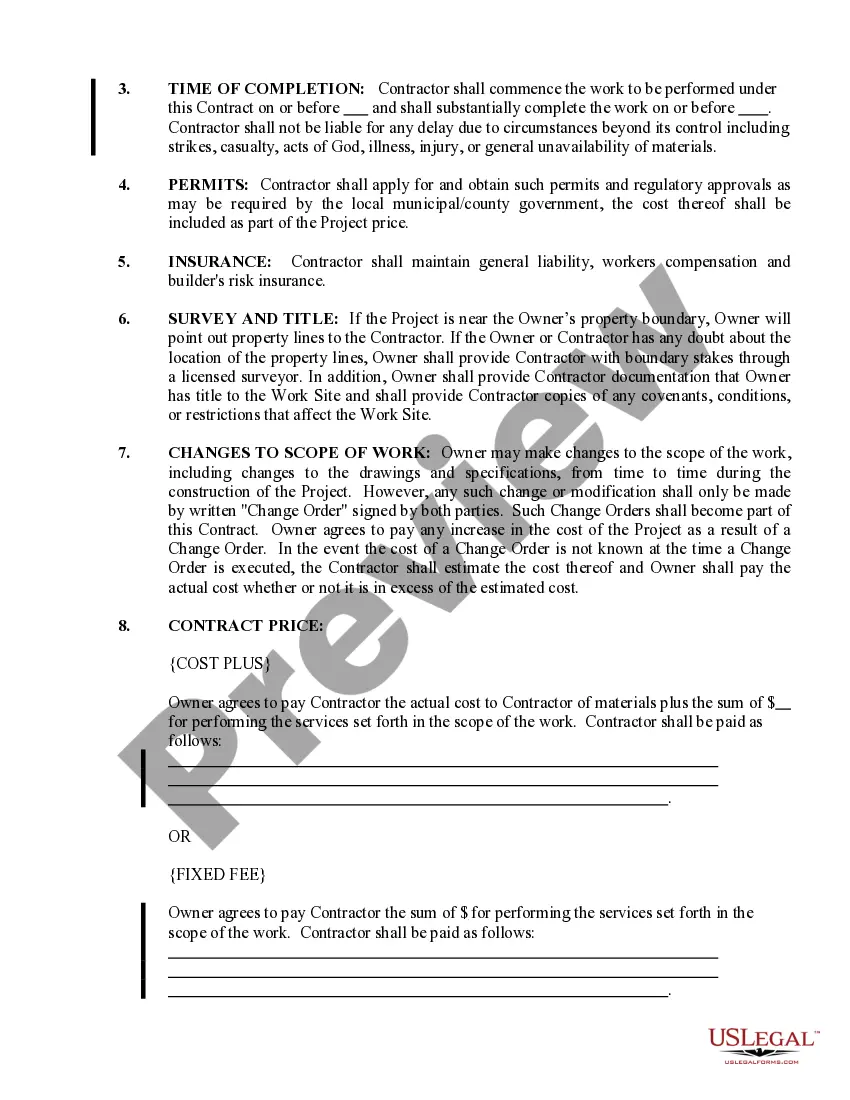

Massachusetts law prohibits a contractor requiring an initial deposit of over 33% of the total contract price unless special materials are ordered. Any contractor demanding over a 33% deposit should raise a huge red flag .

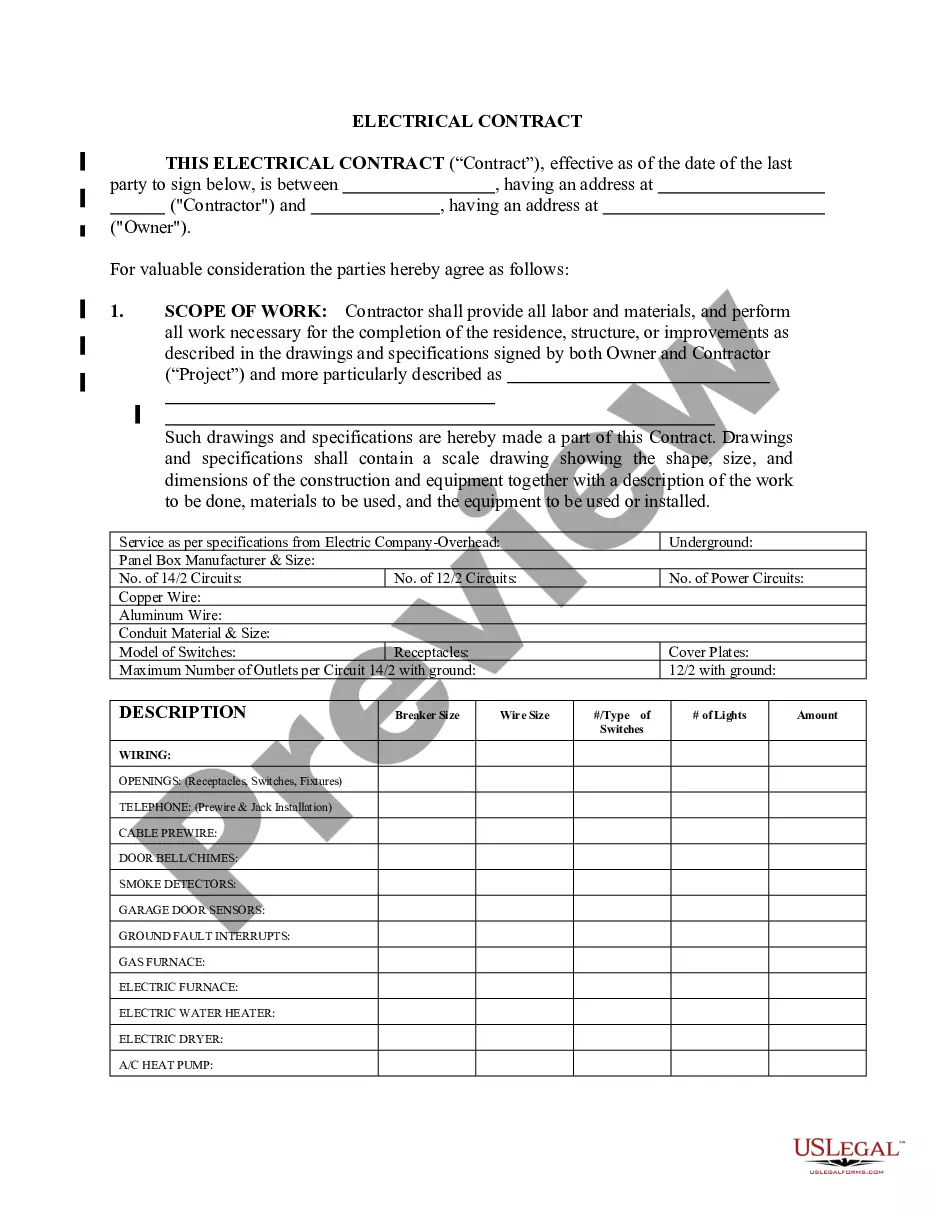

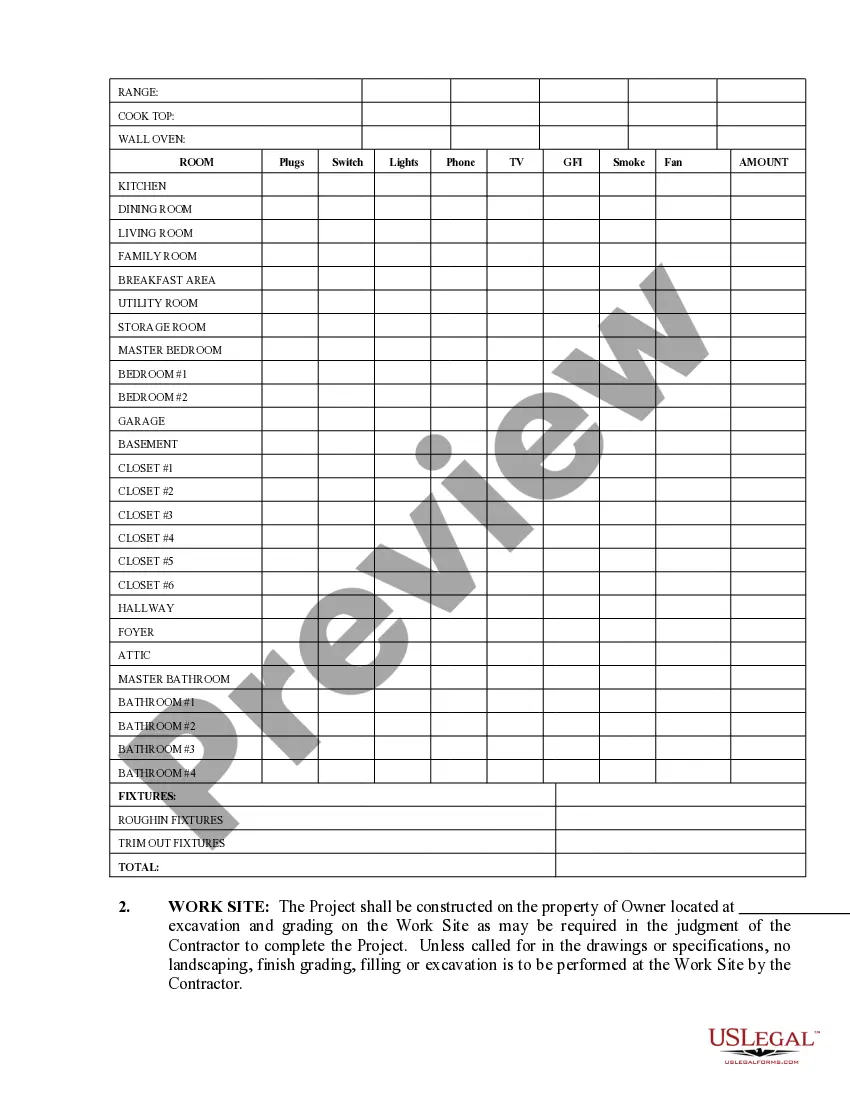

The contractor's name, address, phone, and license number (if required) an estimated start and completion date. the payment schedule for the contractor, subcontractors, and suppliers. the contractor's obligation to get all necessary permits. how change orders are handled.

You shouldn't pay more than 10 percent of the estimated contract price upfront, according to the Contractors State License Board.

If you run a small business that hires 1099 contractors, also known as independent contractors, it is vital that you have them sign an independent contractor contract. This is because there is a significant gray area between who is classified as an independent contractor and who is classified as an employee.

Name of contractor and contact information. Name of homeowner and contact information. Describe property in legal terms. List attachments to the contract. The cost. Failure of homeowner to obtain financing. Description of the work and the completion date. Right to stop the project.

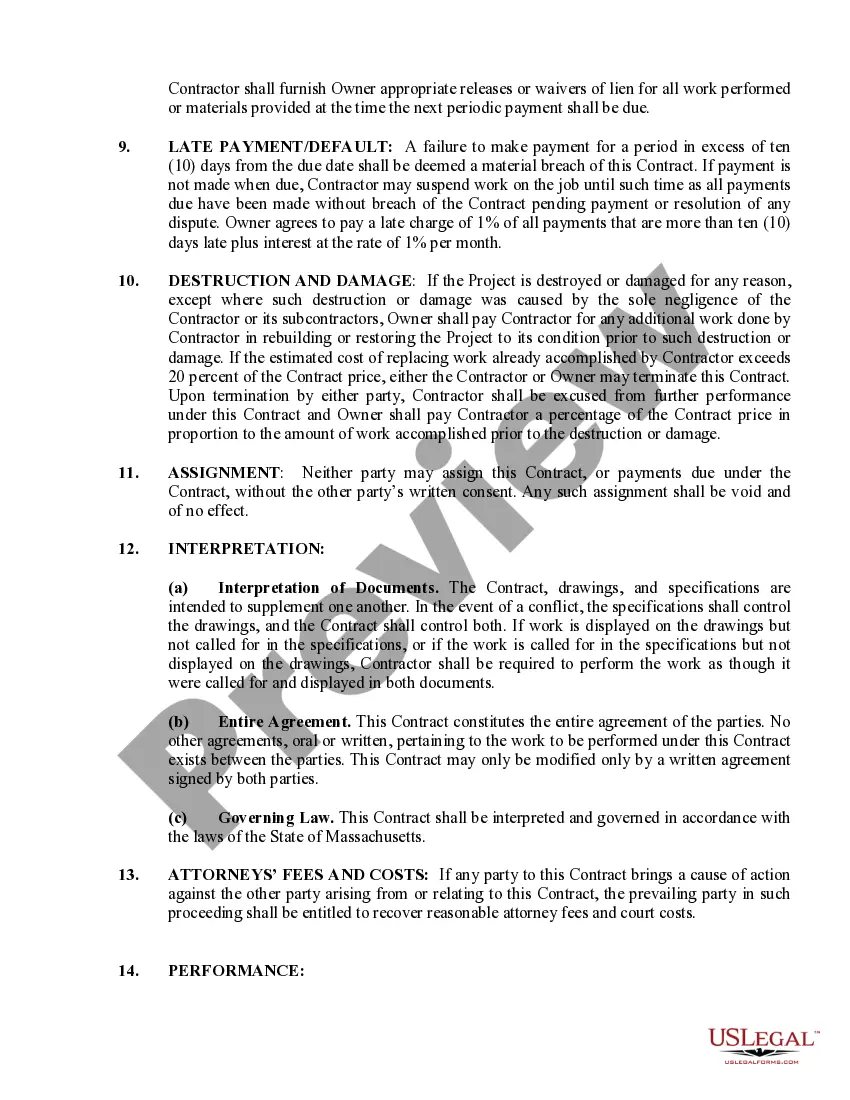

Go to Small Claims Court. Small claims court is a legal venue for homeowners who feel they are owed money back from a contractor. Hire an Attorney. File a Complaint with the State. Pursue a Bond Claim. Post Reviews.

Both parties should sign the contract, and both should be bound by the terms and conditions spelled out in the agreement. In general that means the contractor will be obliged to provide specified materials and to perform certain services for you. In turn, you will be required to pay for those goods and that labor.

Yes, absolutely. Starting work without a signed contract means that your position isn't clear, or even worse it's weak.It also means that the contract is legally enforceable and will be able to support you if you decide to take legal action.