Louisiana Ratification of Pooled Unit Designation by Overriding Royalty Or Royalty Interest Owner

Description

How to fill out Ratification Of Pooled Unit Designation By Overriding Royalty Or Royalty Interest Owner?

If you need to total, acquire, or produce lawful papers themes, use US Legal Forms, the biggest variety of lawful varieties, which can be found on the Internet. Use the site`s simple and hassle-free research to get the files you require. Various themes for organization and personal purposes are categorized by classes and states, or key phrases. Use US Legal Forms to get the Louisiana Ratification of Pooled Unit Designation by Overriding Royalty Or Royalty Interest Owner in a few clicks.

If you are already a US Legal Forms client, log in to the profile and click on the Down load switch to have the Louisiana Ratification of Pooled Unit Designation by Overriding Royalty Or Royalty Interest Owner. You can also gain access to varieties you previously saved within the My Forms tab of your profile.

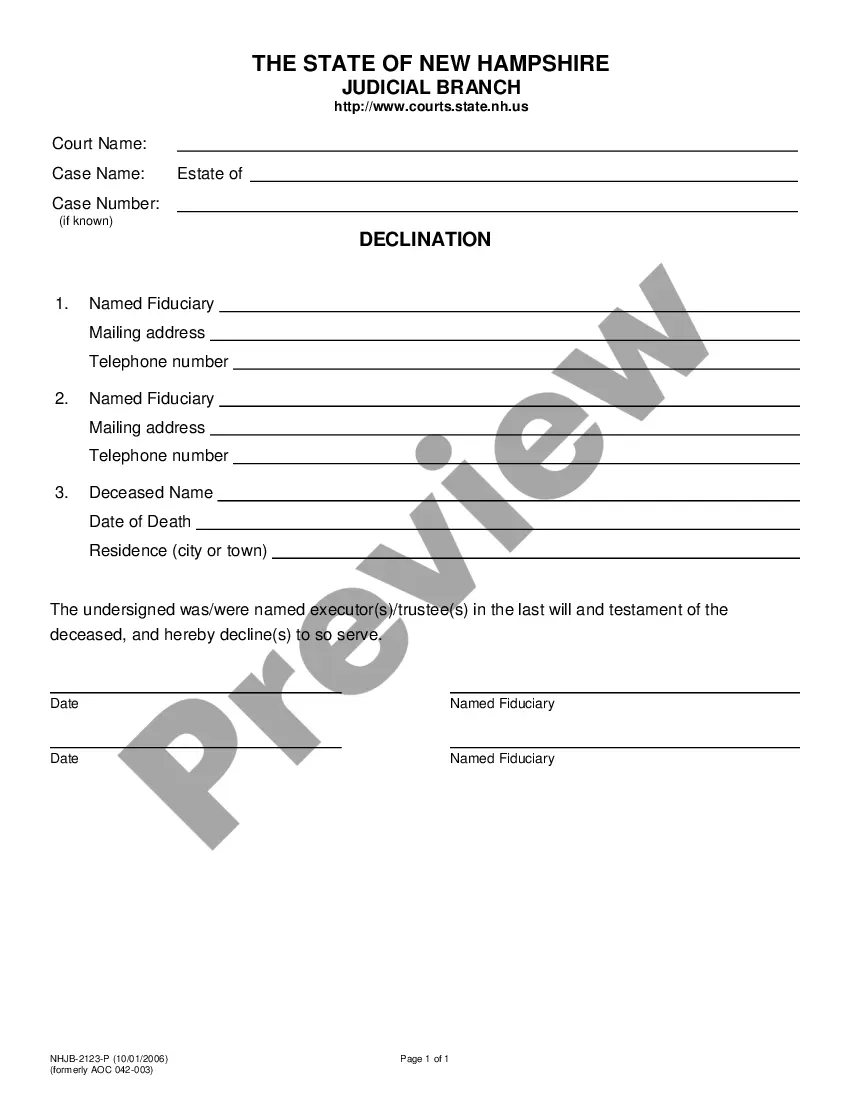

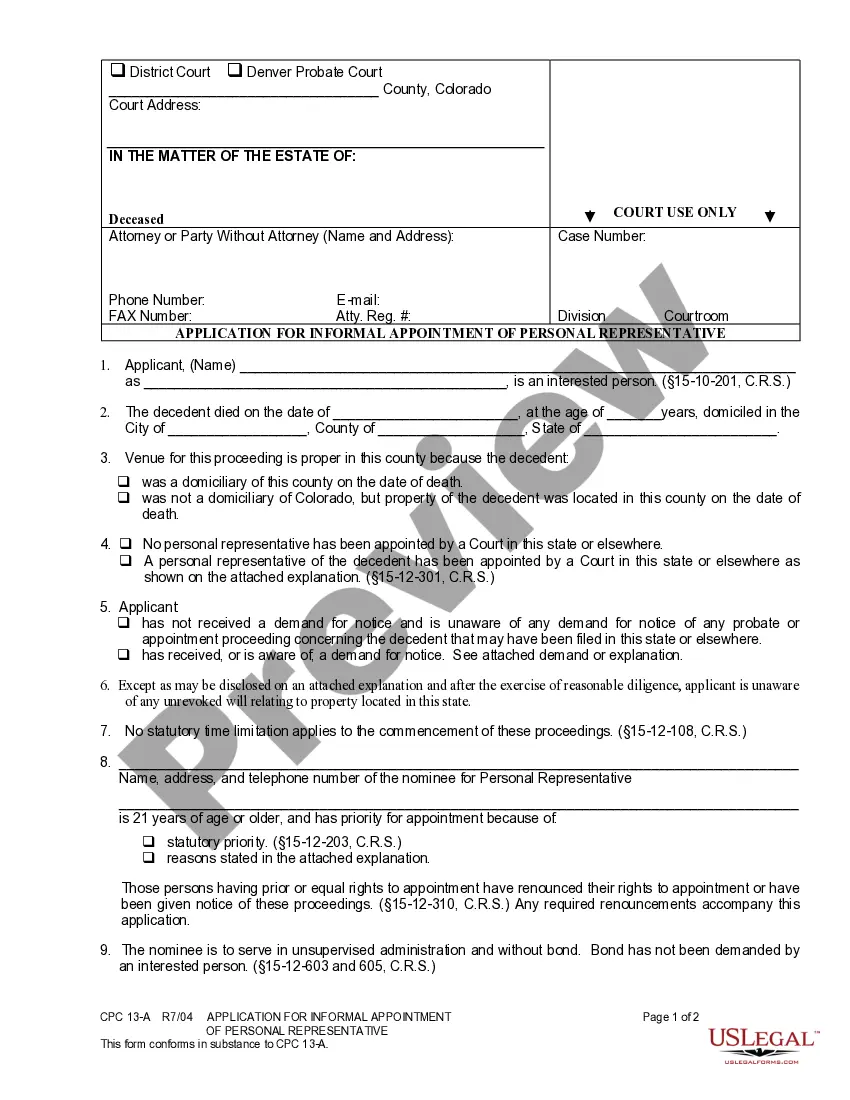

If you use US Legal Forms the very first time, refer to the instructions below:

- Step 1. Be sure you have selected the shape for that right metropolis/nation.

- Step 2. Make use of the Preview solution to examine the form`s content. Never neglect to see the information.

- Step 3. If you are not happy with the kind, make use of the Lookup area near the top of the display screen to find other variations in the lawful kind template.

- Step 4. When you have discovered the shape you require, go through the Get now switch. Pick the pricing program you choose and include your qualifications to sign up for an profile.

- Step 5. Procedure the financial transaction. You can utilize your charge card or PayPal profile to perform the financial transaction.

- Step 6. Pick the structure in the lawful kind and acquire it on your own system.

- Step 7. Complete, modify and produce or sign the Louisiana Ratification of Pooled Unit Designation by Overriding Royalty Or Royalty Interest Owner.

Each and every lawful papers template you purchase is yours permanently. You may have acces to each and every kind you saved within your acccount. Click on the My Forms portion and choose a kind to produce or acquire yet again.

Contend and acquire, and produce the Louisiana Ratification of Pooled Unit Designation by Overriding Royalty Or Royalty Interest Owner with US Legal Forms. There are many expert and state-certain varieties you can use for your organization or personal requirements.

Form popularity

FAQ

An override provision allows for ongoing royalty payment on future albums, sometimes including those not produced by the original producer.

An overriding royalty interest (ORRI) is an interest carved out of a working interest. It is: A percentage of gross production that is not charged with any expenses of exploring, developing, producing, and operating a well.

Overriding royalty interest: Unlike mineral and royalty interests, an overriding royalty interest runs with a lease and not with the land. Therefore, they only remain in effect for as long as a lease is in effect and they expire when a lease expires.

Under Louisiana's forced pooling statutes, the Commissioner may form drilling units and appoint an operator to drill and operate wells for all owners in the unit.

You may convey overriding royalty interest on either an Assignment of Record Title Interest (Form 3000-3), a Transfer of Operating Rights (Form 3000-3a), or on a private assignment. We only require filing of one signed copy per assignment plus a nonrefundable filing fee found at 43 CFR 3000.12.

An overriding royalty interest (ORRI) is an undivided interest in a mineral lease giving the holder the right to a proportional share (receive revenue) of the sale of oil and gas produced. The ORRI is carved out of the working interest or lease.

Like Royalty Interest (RI), an ORRI ends when the oil and gas lease ends. ORRI and MI/RI (mineral/royalty) interests in the same tract of land may be valued differently. Unlike the mineral interest, which lasts in perpetuity, overriding royalties expire with the lease.

To calculate the number of net royalty acres I'm selling, I use this formula: [acres in tract] X [% of minerals owned] X 8 X [royalty interest reserved in lease] X [fraction of royalty interest being sold]. 640 acres X 25% X 8 X 1/4 X 1/2 = 160 net royalty acres.