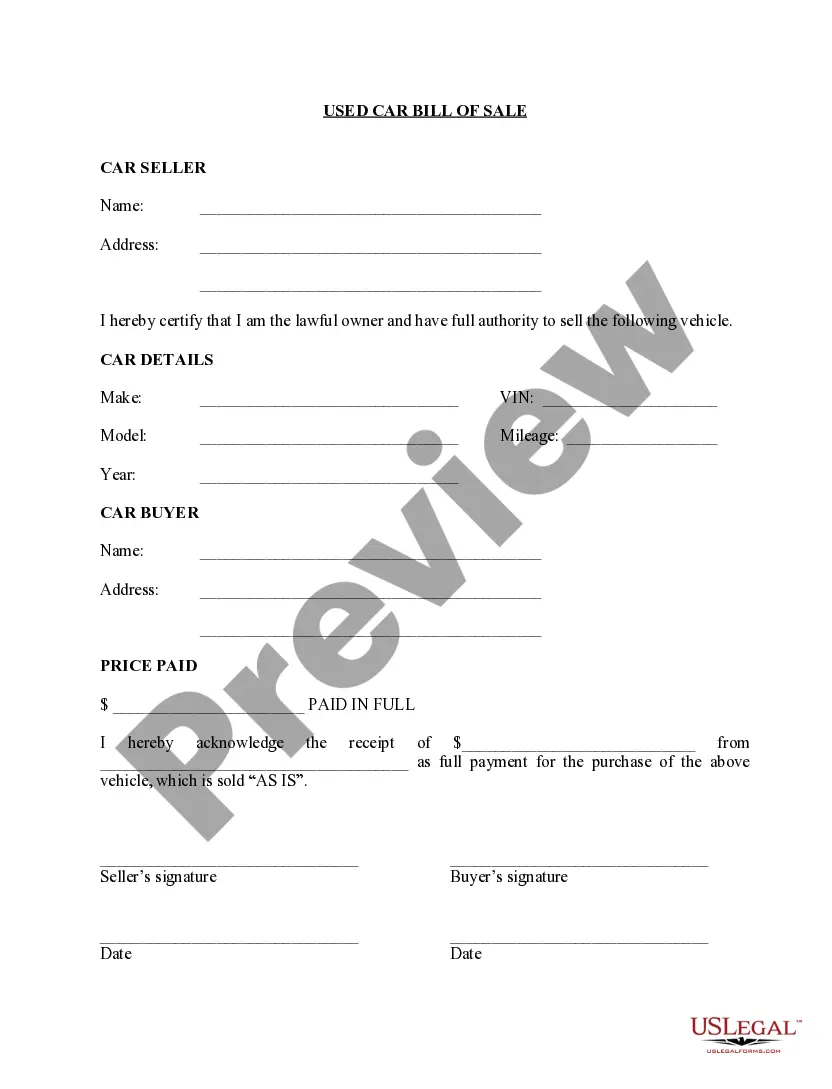

This form is a bill of sale of an automobile which shows proof of purchase.

Louisiana Proof of Purchase - Personal Automobile - Bill of Sale

Description

How to fill out Proof Of Purchase - Personal Automobile - Bill Of Sale?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a broad assortment of legal form templates you can download or print. By utilizing the website, you will obtain thousands of forms for business and personal use, organized by categories, states, or keywords. You can find the latest versions of forms such as the Louisiana Proof of Purchase - Personal Vehicle - Bill of Sale within minutes.

If you already possess a subscription, Log In and download Louisiana Proof of Purchase - Personal Vehicle - Bill of Sale from the US Legal Forms collection. The Download button will appear on every form you view. You have access to all previously saved forms in the My documents section of your account.

If you wish to use US Legal Forms for the first time, here are simple instructions to assist you in getting started: Make sure you have selected the correct form for your city/area. Click the Review button to examine the form's details. Check the form summary to ensure you have chosen the right form. If the form does not meet your requirements, use the Search field at the top of the screen to find one that does. Once you are satisfied with the form, confirm your selection by clicking the Buy now button. Then, choose your preferred payment plan and provide your information to register for the account. Process the transaction. Use your Visa or Mastercard or PayPal account to complete the transaction. Select the format and download the form to your device. Make modifications. Complete, edit, print, and sign the saved Louisiana Proof of Purchase - Personal Vehicle - Bill of Sale. Each template you add to your account does not have an expiration date and is yours forever. Therefore, if you want to download or print another copy, simply go to the My documents section and click on the form you desire.

- Access the Louisiana Proof of Purchase - Personal Vehicle - Bill of Sale with US Legal Forms, the most extensive collection of legal document templates.

- Utilize thousands of professional and state-specific templates that fulfill your business or personal requirements and needs.

Form popularity

FAQ

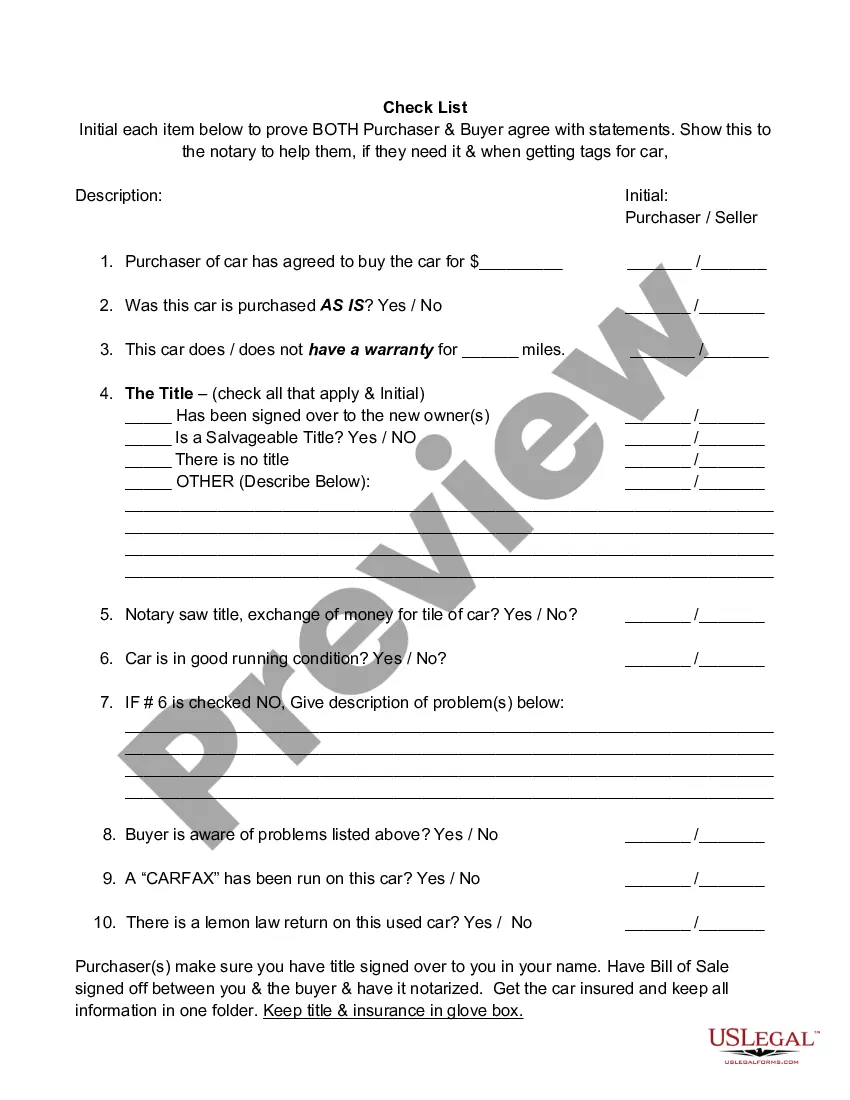

Common mistakes in bills of sale often include leaving out critical information or misrepresenting the vehicle's condition. Failing to include the full names and addresses of both parties can also lead to complications. Another frequent error is neglecting to sign the document, as this can invalidate the agreement. To avoid these pitfalls, consider using USLegalForms, which offers templates specifically designed for a Louisiana Proof of Purchase - Personal Automobile - Bill of Sale.

Yes, a bill of sale acts as proof of purchase in Louisiana. This document officially records the transaction between the buyer and seller, outlining the terms of the sale. It serves as a Louisiana Proof of Purchase - Personal Automobile - Bill of Sale, which can be essential for registration and other legal purposes related to vehicle ownership.

When buying a car from a private seller in Louisiana, you will need several key documents. Primarily, you need a signed bill of sale, which serves as your Louisiana Proof of Purchase - Personal Automobile - Bill of Sale. Additionally, you should obtain the vehicle's title and any maintenance records to ensure a smooth transaction and future ownership transfer.

Absolutely, you can write your own bill of sale in Louisiana. This option gives you control over the content and format of the document. Ensure that it captures all necessary information for it to function effectively as a Louisiana Proof of Purchase - Personal Automobile - Bill of Sale, which can be crucial for future transactions or registrations.

In Louisiana, a notarized bill of sale is not a strict requirement for all vehicle transactions. However, having a notarized bill of sale can provide added legal protection and clarity for both the buyer and seller. This document serves as a Louisiana Proof of Purchase - Personal Automobile - Bill of Sale, helping to establish ownership and the terms of the sale.

Is a bill of sale required in Louisiana? The state of Louisiana only requires a bill of sale for private vehicle sales if the car's title does not include the following information: Date of sale. Sale price.

Yes, you can still sell the vehicle in Louisiana. However, if the vehicle is going to be registered in Louisiana, you must have a notarized bill of sale as well as a properly signed title transferring ownership rights to the vehicle.

The state of Louisiana requires a notarized bill of sale for any private vehicle sale where the car's title does not include the date of sale, purchase price, or names and signatures of both the buyer and seller.

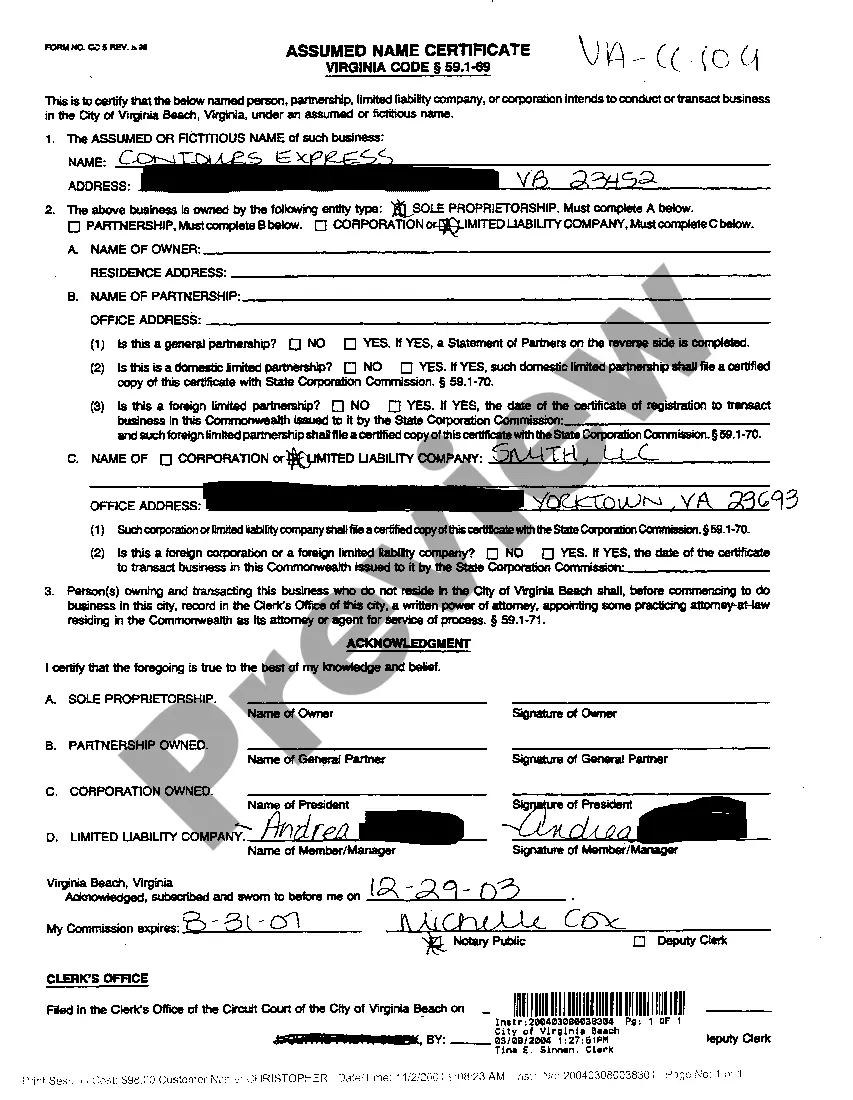

In Louisiana, you can use a template for a general bill of sale to document almost any personal property sale. The state does not provide an official general bill of sale. When you fill in a Louisiana general bill of sale, you'll need to include the buyer's and seller's contact information.

It is only necessary to notarize the bill of sale, invoice, or title. However, if a trade vehicle is listed on the bill of sale, it must be notarized. If a tax credit is shown on an invoice, the invoice must be notarized. Exception: If the state is a non-notary state, then the invoice is not required to be notarized.