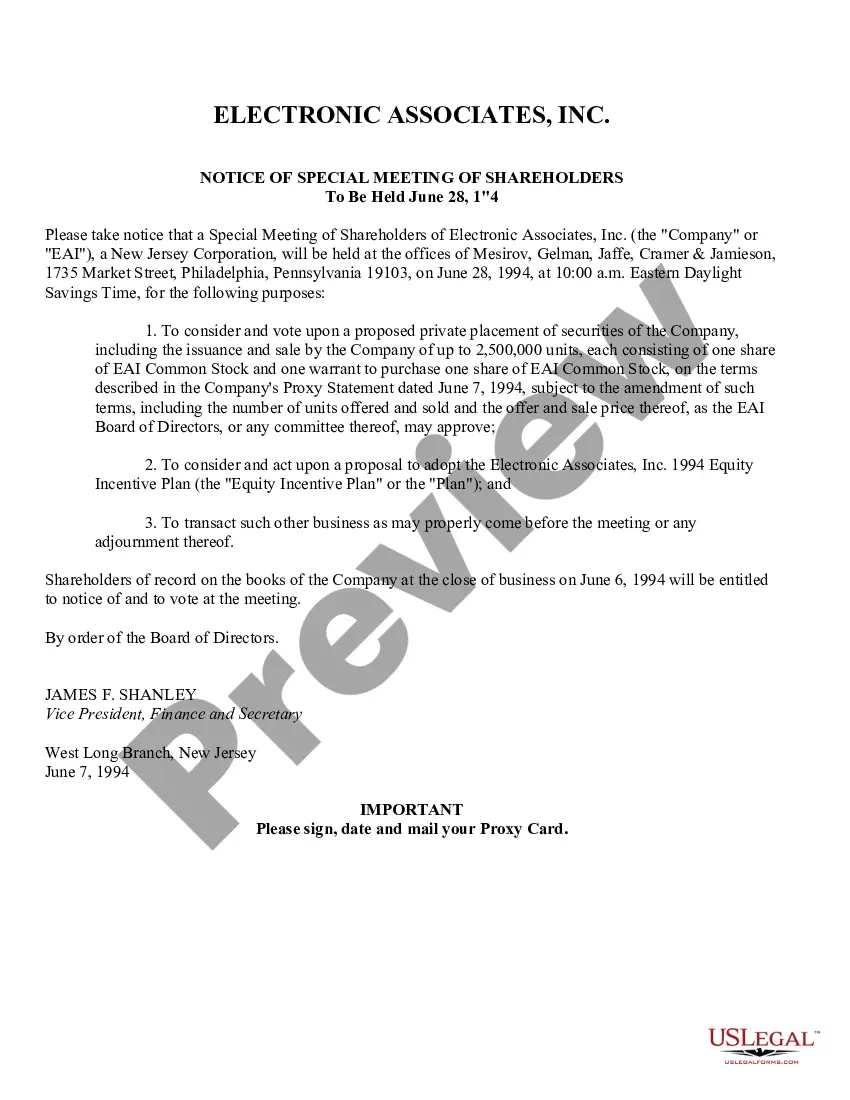

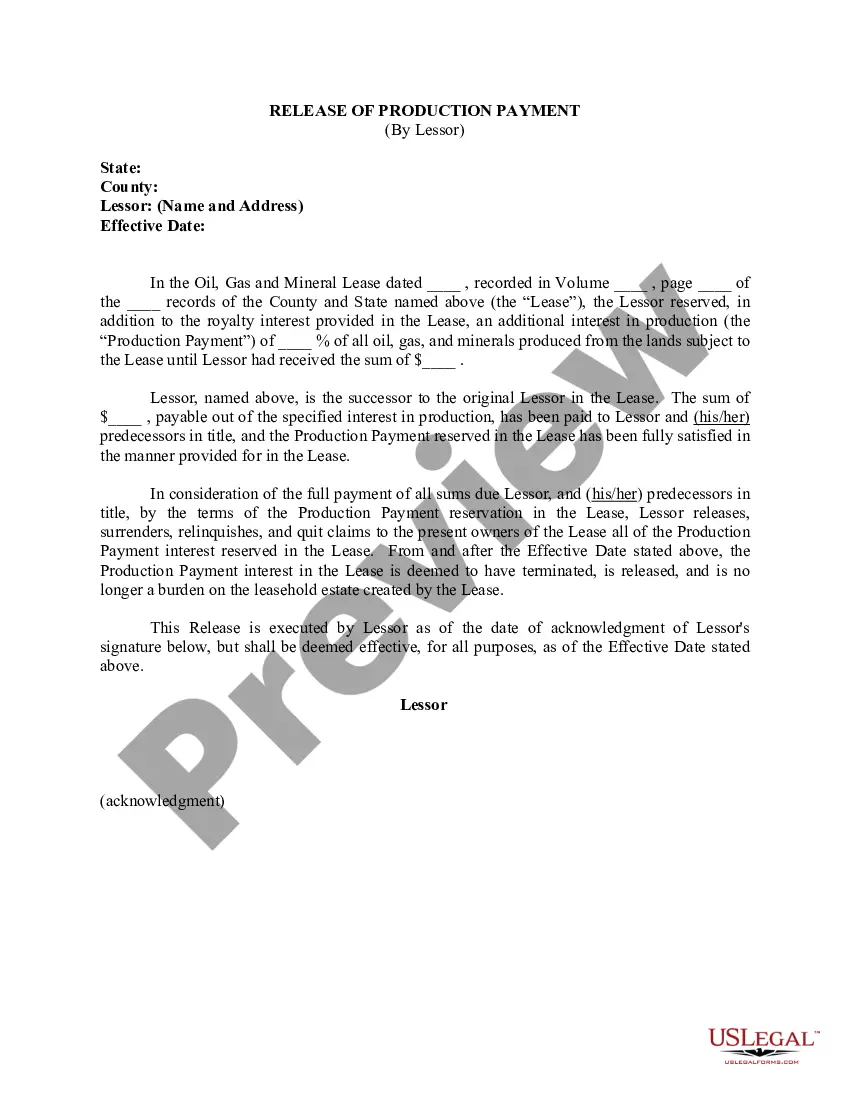

This form of release is used when Lessor releases, relinquishes, and quit claims to the present owners of the Lease all of a Production Payment interest. From and after the Effective Date, the Production Payment interest in the Lease is deemed to have terminated and is no longer a burden on the leasehold estate created by the Lease.

Georgia Release of Production Payment by Lessor

Description

How to fill out Release Of Production Payment By Lessor?

You may invest several hours on the web searching for the legitimate record design that meets the federal and state requirements you need. US Legal Forms gives a huge number of legitimate types which are reviewed by specialists. You can easily download or print the Georgia Release of Production Payment by Lessor from our services.

If you have a US Legal Forms accounts, you may log in and click the Obtain button. Afterward, you may complete, change, print, or indicator the Georgia Release of Production Payment by Lessor. Each and every legitimate record design you purchase is your own eternally. To acquire another duplicate of any obtained kind, check out the My Forms tab and click the corresponding button.

If you work with the US Legal Forms site the first time, stick to the simple guidelines beneath:

- Very first, make certain you have chosen the best record design to the region/town of your choosing. Look at the kind information to ensure you have selected the proper kind. If readily available, take advantage of the Preview button to look with the record design as well.

- If you wish to discover another edition of your kind, take advantage of the Look for discipline to get the design that fits your needs and requirements.

- Once you have discovered the design you would like, just click Purchase now to move forward.

- Select the costs plan you would like, key in your credentials, and sign up for your account on US Legal Forms.

- Complete the deal. You can utilize your bank card or PayPal accounts to cover the legitimate kind.

- Select the file format of your record and download it to your product.

- Make alterations to your record if possible. You may complete, change and indicator and print Georgia Release of Production Payment by Lessor.

Obtain and print a huge number of record themes while using US Legal Forms website, which provides the greatest variety of legitimate types. Use skilled and condition-distinct themes to deal with your small business or person requires.

Form popularity

FAQ

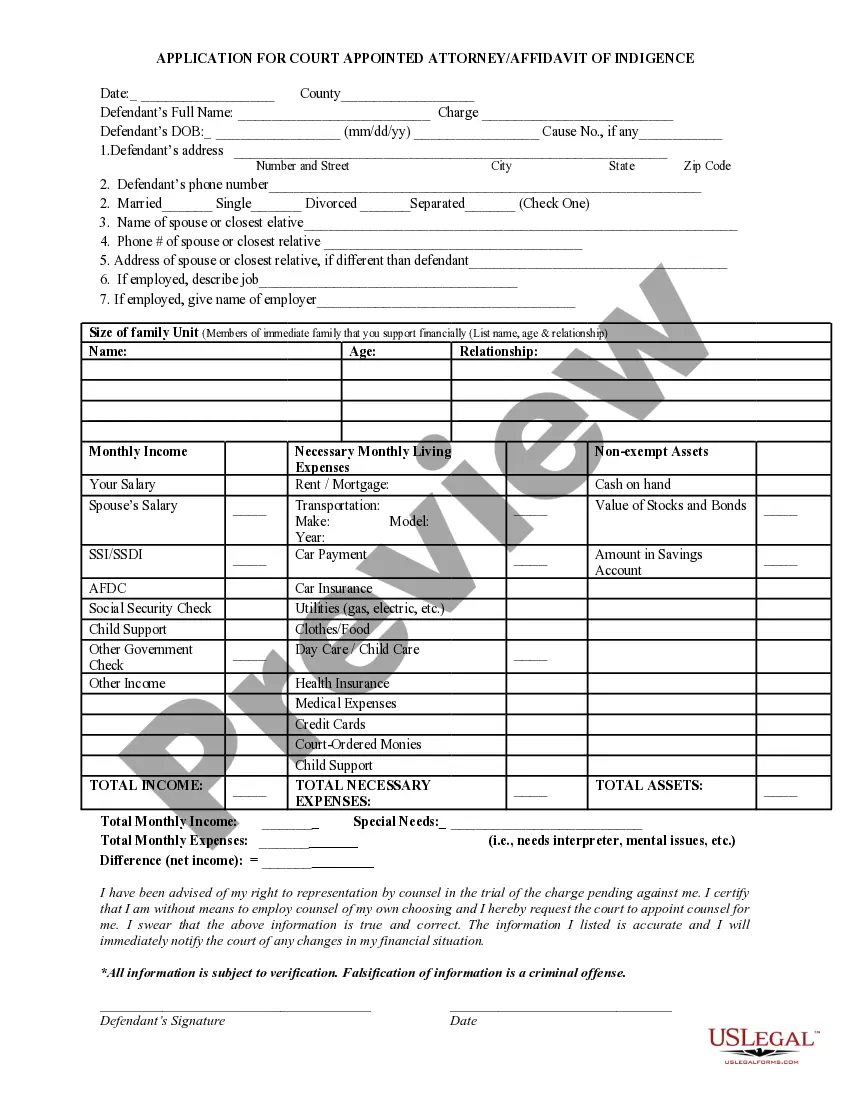

When the lease agreement is classified as a finance lease, the lessor will calculate the net investment in the lease using the present value of future expected lease receipts and record this amount as a receivable. Lessors are also required to derecognize the carrying value of the underlying asset.

For operating leases, the lease payments should be recognised as an expense in the income statement over the lease term on a straight-line basis, unless another systematic basis is more representative of the time pattern of the user's benefit [IAS 17.33]

Under ASC 842, a lessor excludes from the consideration in the contract, and therefore from lease payments, most variable payments related to the use of the asset (such as the volume of electricity generated by a solar farm).

How to record a finance lease and journal entries. In the first month, two entries are recorded: one to record the payment of the lease and a second to record amortization expense. The periodic cash payment is split between the following: interest expense on the finance lease liability.

The lease payments are split into interest and principal components, and are reported as cash outflows from financing activities and operating activities, respectively, on the cash flow statement.

Accounting for a Direct Financing Lease The lessor uses the interest method to recognize that amount of unearned income that produces a constant rate of return over the lease term. At least once a year, the lessor reviews the estimated residual value of the leased property.

Accounting for a finance lease has four steps: Record the present value of all lease payments as the cost of the lease. Record only the interest portion of each payment as an expense. Depreciate the recognised cost of the asset over its applicable life. Recognise the asset's disposal upon its retirement.

Accounting by lessors at commencement of the lease term, the lessor should record a finance lease in the balance sheet as a receivable, at an amount equal to the net investment in the lease [IAS 17.36]