Louisiana Agreement for Sales of Data Processing Equipment

Description

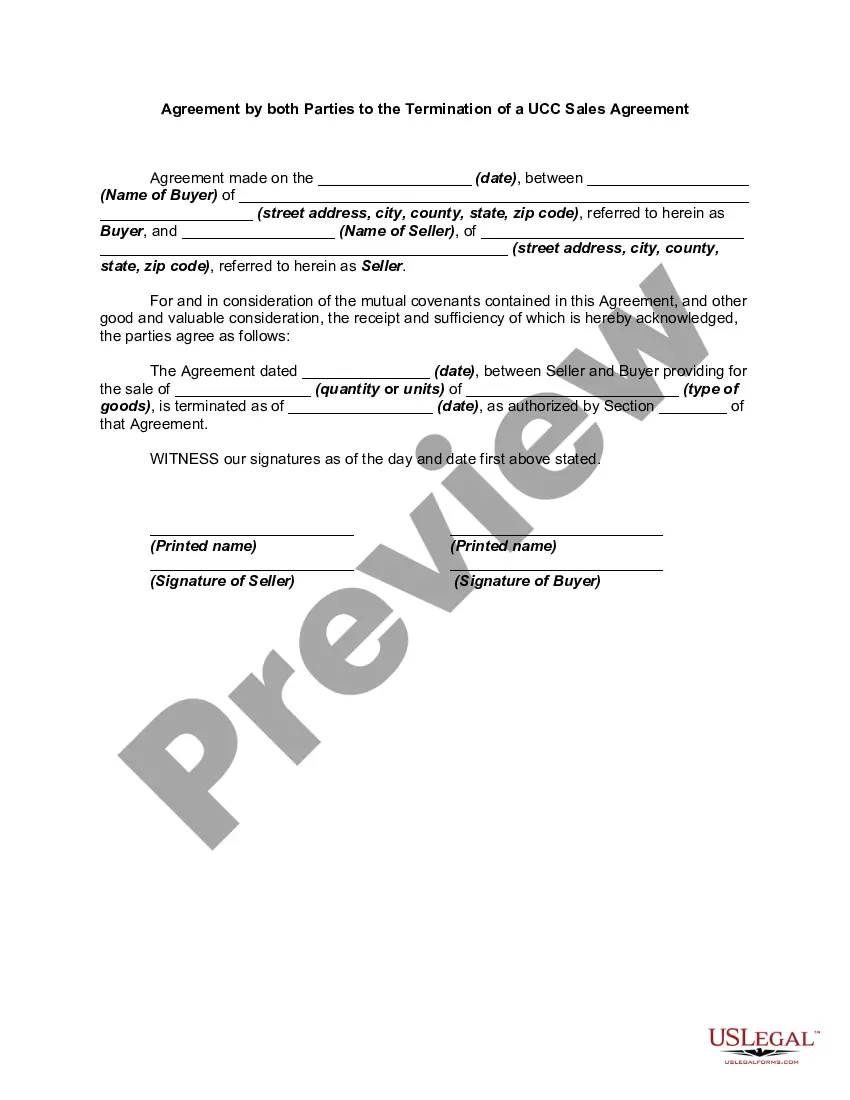

How to fill out Agreement For Sales Of Data Processing Equipment?

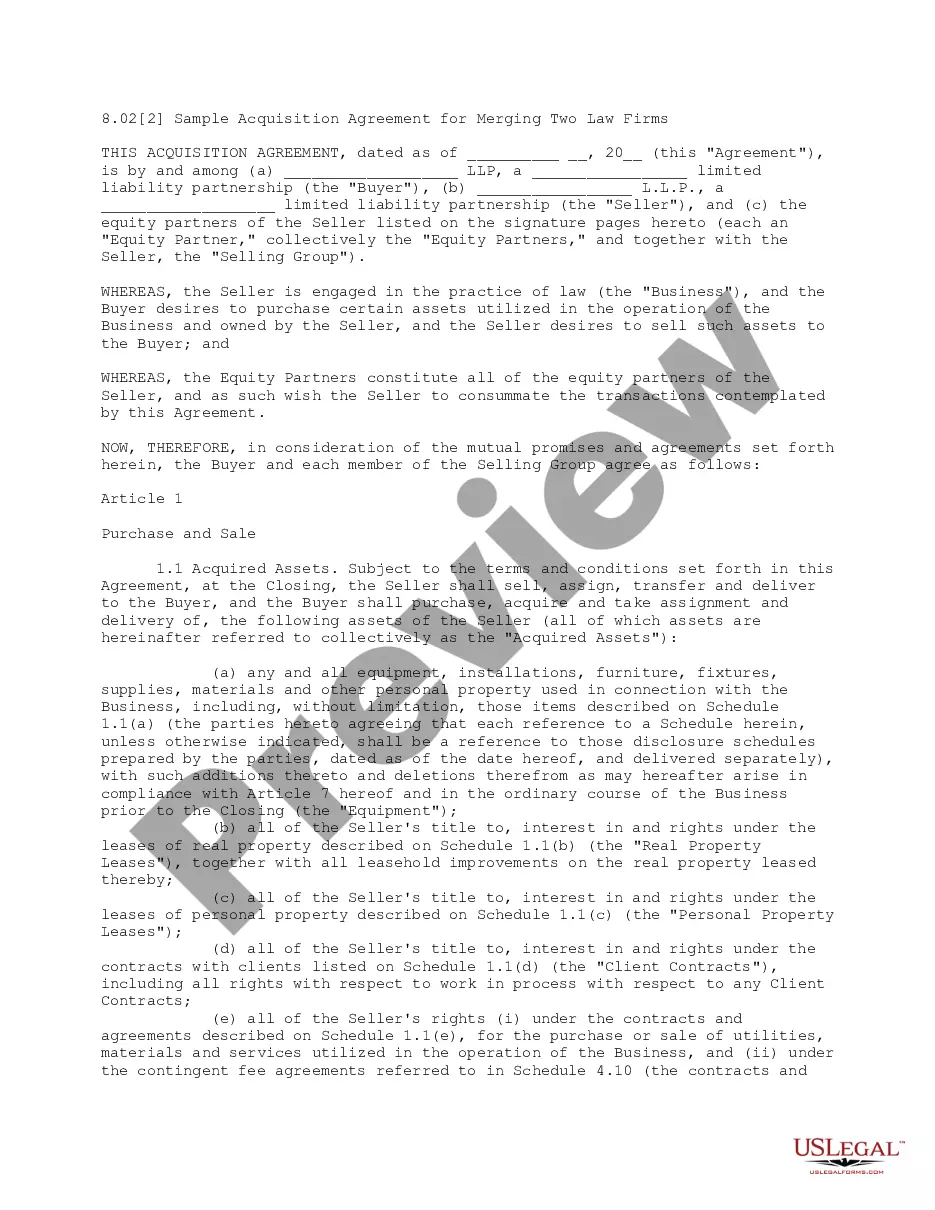

US Legal Forms - one of the largest collections of authentic documents in the USA - offers a vast selection of legal document templates you can download or print. By using the site, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can obtain the latest versions of forms like the Louisiana Agreement for Sales of Data Processing Equipment in moments.

If you already have an account, Log In and download the Louisiana Agreement for Sales of Data Processing Equipment from the US Legal Forms library. The Download button will be available on every form you view. You can access all previously saved forms in the My documents tab of your account.

If you are using US Legal Forms for the first time, here are simple steps to get you started: Make sure you have selected the correct form for your city/state. Click the Review button to examine the form’s content. Check the form details to ensure that you have chosen the right form. If the form does not meet your requirements, utilize the Search field at the top of the screen to find one that does. If you are satisfied with the form, confirm your choice by clicking the Buy now button. Then, select the payment plan you want and provide your information to create an account. Complete the transaction. Use your credit card or PayPal account to finalize the payment. Choose the format and download the form to your device. Make edits. Fill out, modify, print, and sign the saved Louisiana Agreement for Sales of Data Processing Equipment. Each template you added to your account has no expiration date and belongs to you indefinitely. So, if you wish to download or print another copy, simply navigate to the My documents section and click on the form you need.

Access the Louisiana Agreement for Sales of Data Processing Equipment with US Legal Forms, the most extensive library of legal document templates.

Utilize a multitude of professional and state-specific templates that satisfy your business or personal needs.

- Gain access to the Louisiana Agreement for Sales of Data Processing Equipment with US Legal Forms, the most extensive library of legal document templates.

- Utilize a multitude of professional and state-specific templates that satisfy your business or personal needs.

- Easily navigate through categories and states to find the right document.

- Enjoy perpetual ownership of the forms you download.

- Streamline your document management with organized access.

- Experience efficient transaction processing with various payment options.

Form popularity

FAQ

Yes, equipment rentals are subject to sales tax in Louisiana. When you engage in a Louisiana Agreement for Sales of Data Processing Equipment that involves rental, you need to account for this tax. This rule applies to various types of equipment, impacting your overall budgeting and accounting strategies. Utilizing uslegalforms can assist you in drafting agreements that clearly outline these financial obligations.

The Louisiana data center incentive is a program designed to attract data processing businesses to the state. This initiative offers significant tax breaks and financial incentives that make setting up a data processing facility more appealing. If you're considering entering this market, the Louisiana Agreement for Sales of Data Processing Equipment could be essential in establishing your operations under these benefits. For more detailed information, consider checking resources provided by uslegalforms for creating comprehensive agreements.

To make a Louisiana Agreement for Sales of Data Processing Equipment effective against third parties, you must ensure that the contract is properly recorded. This recording involves filing the agreement with the appropriate local authorities. By doing this, you increase its visibility, and thereby provide protection to your interests in case of disputes. Always consult with a legal expert to ensure you fulfill all legal requirements.

In Louisiana, taxpayers can qualify for school expense deductions for tuition, fees, and other educational costs for their dependent children. Eligible expenses may include supplies, books, and technology purchases. When finalizing a Louisiana Agreement for Sales of Data Processing Equipment, understanding these deductions can help you plan for related educational costs and incentives.

The 540 form in Louisiana is specifically designed for state income tax reporting for residents. It captures various income sources and applicable deductions. Careful completion of this form is important when entering agreements, such as the Louisiana Agreement for Sales of Data Processing Equipment, to ensure compliance with state regulations.

A Louisiana L4 form, also known as the Louisiana Employee's Withholding Exemption Certificate, allows employees to claim their withholding exemptions. This form is crucial for accurately determining the correct amount of state income tax to deduct. Knowledge of the L4 form can help individuals manage their finances better about a Louisiana Agreement for Sales of Data Processing Equipment.

The purpose of Form 540 is to summarize an individual's income and calculate the state tax owed to Louisiana. It plays a key role in ensuring that residents meet their tax liabilities accurately. If you're involved in a Louisiana Agreement for Sales of Data Processing Equipment, understanding Form 540 is important for tax planning and compliance.

Tax Form 504 is used in Louisiana primarily for businesses and organizations to report sales tax information. It helps ensure compliance with state tax laws. Familiarity with Form 504 is crucial if you're working on agreements like the Louisiana Agreement for Sales of Data Processing Equipment, as it informs how you manage your tax obligations.

Yes, digital products are generally taxable in Louisiana. This includes software and digital downloads, which fall under sales tax regulations. If you are involved in a Louisiana Agreement for Sales of Data Processing Equipment, being aware of how digital products are taxed can guide your sales and marketing strategies.

Form 540 in Louisiana is a tax form that allows residents to report their state income taxes. It is primarily used for individual income tax filings and can include various deductions. Knowing how to properly fill out Form 540 is essential, especially when dealing with a Louisiana Agreement for Sales of Data Processing Equipment, as it can impact your tax responsibilities.