Louisiana Self-Employed Mechanic Services Contract

Description

How to fill out Self-Employed Mechanic Services Contract?

US Legal Forms - one of the largest collections of legal documents in the USA - offers a vast selection of legal paperwork templates that you can download or print.

Using the site, you can access thousands of documents for both business and personal use, organized by categories, states, or keywords. You can quickly obtain the latest versions of forms such as the Louisiana Self-Employed Mechanic Services Contract.

If you have a monthly membership, Log In and download the Louisiana Self-Employed Mechanic Services Contract from the US Legal Forms repository. The Download button will be visible on every document you view. You have access to all previously saved documents within the My documents section of your account.

Process the purchase. Use your credit card or PayPal account to finalize the transaction.

Select the format and download the form onto your device. Make edits. Fill out, modify, and print and sign the saved Louisiana Self-Employed Mechanic Services Contract. Every template you added to your account has no expiration date and belongs to you permanently. So, if you want to download or print an additional copy, simply navigate to the My documents section and click on the document you need. Access the Louisiana Self-Employed Mechanic Services Contract with US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs.

- Ensure you have selected the correct document for your city/county.

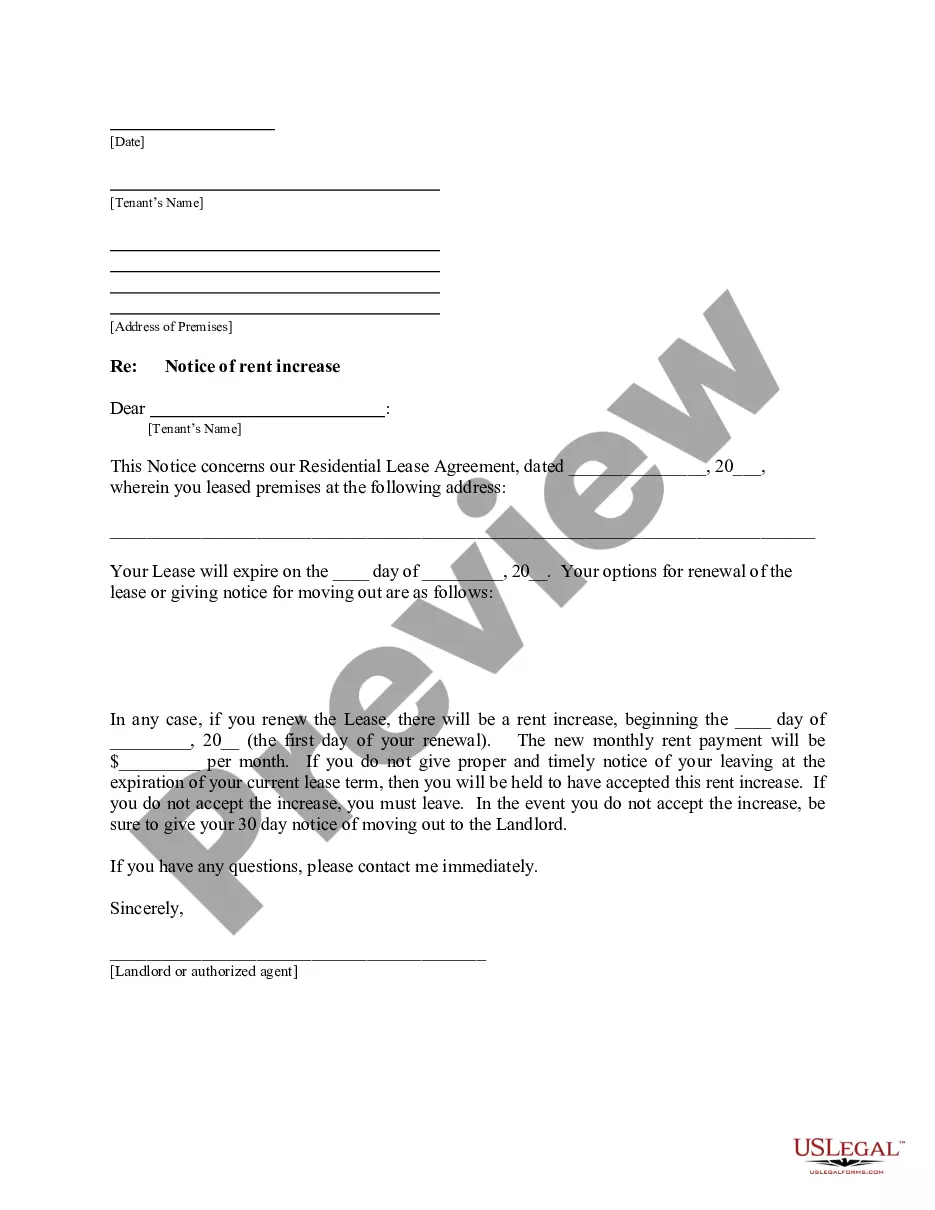

- Click on the Preview button to review the document's details.

- Check the document information to confirm that you have selected the appropriate file.

- If the document does not fulfill your needs, use the Search field at the top of the screen to locate a suitable one.

- Once you are satisfied with the document, confirm your choice by clicking on the Get now button.

- Then, select your preferred payment plan and provide your details to register for an account.

Form popularity

FAQ

There are two main accounting methods that independent contractors can choose from when filing their first tax returns as a business.Cash basis is the most simple form of tax returns.Accrual basis will count your expenses and cash when it is earned, not when the money is received.

How to Invoice as a ContractorIdentify the Document as an Invoice.Include Your Business Information.Add the Client's Contact Details.Assign a Unique Invoice Number.Add the Invoice Date.Provide Details of Your Services.Include Your Payment Terms.List the Total Amount Due.More items...

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

By definition, a contractor is an individual who works for someone else (individual or company) as a non-employee. It's also a way of being self-employed. However, while a contractor may be self-employed, a self-employed person might not be an independent contractor.

It seems obvious, but make sure that you include in the contract the contractor's name, physical address, phone number, insurance company and account and license numbers.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

What should be included in a Contractor Agreement?Statement of Relationship.Project Description.Payment and Billing Terms.Responsibilities of Each Party.Project Timeline and Deadlines.Termination Conditions.Nondisclosure Terms, and Confidentiality and Non-Compete Clauses.

How to write an employment contractTitle the employment contract.Identify the parties.List the term and conditions.Outline the job responsibilities.Include compensation details.Use specific contract terms.Consult with an employment lawyer.

Write the contract in six stepsStart with a contract template.Open with the basic information.Describe in detail what you have agreed to.Include a description of how the contract will be ended.Write into the contract which laws apply and how disputes will be resolved.Include space for signatures.

Unlike employee wages, which you'll handle through your payroll, you pay your independent contractors like you would any other kind of supplier, via your accounts payable system. Typically an independent contractor will first send you an invoice, which will specify certain payment terms.