Louisiana Stone Contractor Agreement - Self-Employed

Description

How to fill out Stone Contractor Agreement - Self-Employed?

US Legal Forms - one of the most prominent collections of legal documents in the USA - provides a variety of legal document templates that you can download or print.

By utilizing the website, you can find thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can access the most recent forms like the Louisiana Stone Contractor Agreement - Self-Employed in just moments.

If you already have an account, Log In and download the Louisiana Stone Contractor Agreement - Self-Employed from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously downloaded forms in the My documents section of your account.

Process the payment. Use your credit card or PayPal account to finalize the transaction.

Choose the format and download the form onto your device. Make edits. Complete, modify, print, and sign the downloaded Louisiana Stone Contractor Agreement - Self-Employed. Every template you add to your account has no expiration date and belongs to you forever. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the form you need. Access the Louisiana Stone Contractor Agreement - Self-Employed with US Legal Forms, the most comprehensive collection of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal requirements and specifications.

- If you are using US Legal Forms for the first time, here are simple steps to get started.

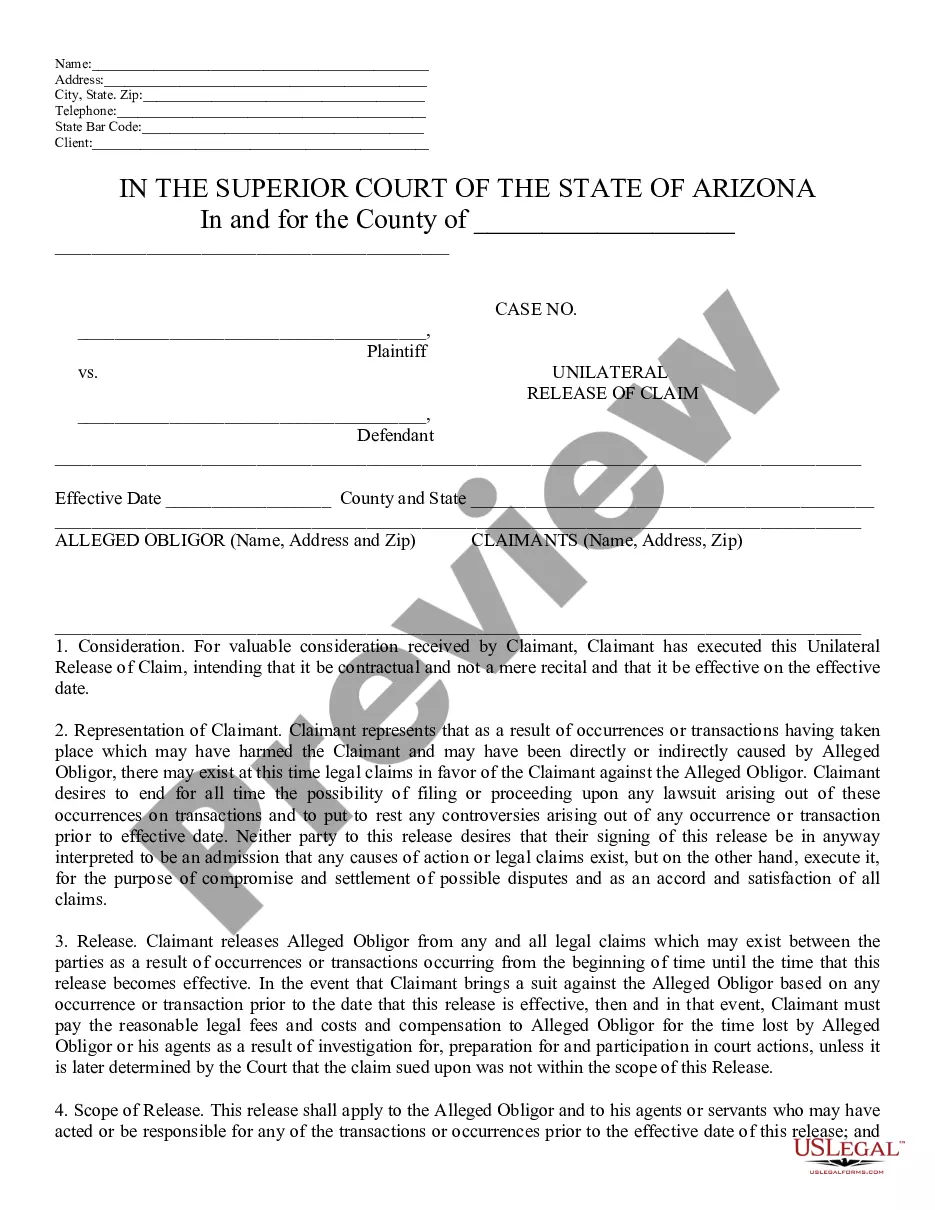

- Ensure you have selected the correct form for your region/area. Select the Review option to check the form's content.

- Read the form description to confirm you have chosen the right form.

- If the form does not meet your needs, use the Search field at the top of the screen to find one that does.

- Once you are satisfied with the form, confirm your choice by clicking the Purchase now button.

- Then, select the payment plan you prefer and provide your details to register for the account.

Form popularity

FAQ

Creating an independent contractor agreement begins with defining the scope of work and deliverables clearly. Include essential details like payment terms, deadlines, and confidentiality clauses if necessary. You can find templates online, but a tailored Louisiana Stone Contractor Agreement - Self-Employed can safeguard both parties. Utilizing platforms like US Legal Forms can simplify this process, providing you with legally sound documentation.

To set up as a self-employed contractor, you must first choose a business name and register it if necessary. Next, obtain the required licenses and permits for your industry and location. It is also crucial to set up a separate bank account for your business finances to keep your personal and professional expenses distinct. Finally, consider using a Louisiana Stone Contractor Agreement - Self-Employed to outline your terms with clients and protect your interests.

To write a self-employed contract, establish a clear framework including contact information, project details, and payment terms. Clearly define the rights and responsibilities of each party to ensure clarity and transparency. Resources like the Louisiana Stone Contractor Agreement - Self-Employed on US Legal Forms can provide a reliable basis for your contract drafting.

Writing an independent contractor agreement starts by stating the mutual intent to form a contractor relationship. Include specific details such as job responsibilities, payment structure, and termination clauses. For a streamlined approach, consider using the Louisiana Stone Contractor Agreement - Self-Employed available on US Legal Forms, which provides a comprehensive template tailored for your needs.

To fill out an independent contractor form, begin by gathering necessary information about the contractor, such as their contact details and tax identification number. Clearly outline the scope of work and payment arrangements, ensuring all involved parties have a common understanding. Utilizing a structured platform like US Legal Forms can simplify this process with easy-to-follow templates that include the Louisiana Stone Contractor Agreement - Self-Employed.

Filling out an independent contractor agreement, like the Louisiana Stone Contractor Agreement - Self-Employed, requires clear identification of the parties involved and the services to be performed. Start by entering personal details such as names and addresses. Next, specify the payment terms and the timeline for the project, ensuring that all conditions are mutually understood to avoid future disputes.

Both terms, self-employed and independent contractor, convey the same idea but may be used in different contexts. 'Self-employed' highlights your overall status as a business owner, while 'independent contractor' specifies your role in providing services. Using a Louisiana Stone Contractor Agreement - Self-Employed can make it easier for you to position yourself effectively in the marketplace, regardless of the term you prefer.

Yes, a contractor would generally be considered self-employed, especially if they have the autonomy to make decisions about their work. Being self-employed means you manage your business and handle aspects like contracts and finances. A Louisiana Stone Contractor Agreement - Self-Employed can help clarify your self-employed status and outline the expectations and responsibilities in a professional manner.

Receiving a 1099 form typically indicates that you are self-employed, as it is issued to freelancers and independent contractors. If you work under a Louisiana Stone Contractor Agreement - Self-Employed and earn income reported on a 1099, you are indeed classified as self-employed. This means you will also be responsible for handling your own taxes, including self-employment tax.

Yes, a contractor is often considered self-employed, especially when they operate independently and are responsible for their own taxes. This status allows contractors to have flexibility in choosing projects, clients, and their working hours. A well-drafted Louisiana Stone Contractor Agreement - Self-Employed solidifies this self-employed classification, protecting both parties involved.