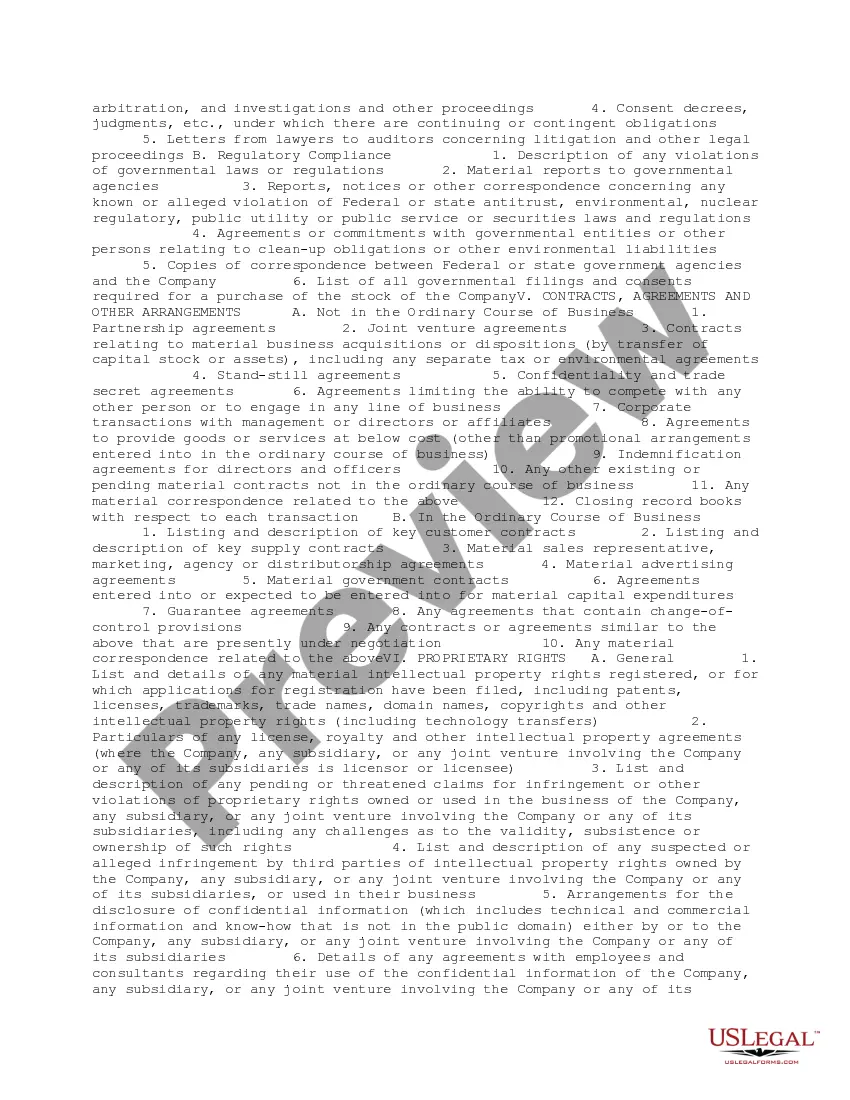

This form is a list of requested due diligence documents from a technology company for the purchase of shares of stock. The list consists of documents and information to be submitted to the due diligence team.

Louisiana Request for Due Diligence Documents from a Technology Company

Description

How to fill out Request For Due Diligence Documents From A Technology Company?

If you wish to completely obtain, download, or print legitimate document templates, utilize US Legal Forms, the premier assortment of legal forms that are available online.

Employ the website's straightforward and convenient search function to locate the documents you require.

Various templates for commercial and personal uses are categorized by types and states, or keywords.

Step 4. After you have located the form you need, select the Buy now button. Choose the pricing plan you prefer and provide your credentials to register for an account.

Step 5. Complete the transaction. You may use your credit card or PayPal account to finalize the purchase.

- Utilize US Legal Forms to find the Louisiana Request for Due Diligence Documents from a Technology Company with just a few clicks.

- If you are already a US Legal Forms customer, sign in to your account and click the Download button to obtain the Louisiana Request for Due Diligence Documents from a Technology Company.

- You may also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions outlined below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Utilize the Preview option to review the content of the form. Remember to read the information carefully.

- Step 3. If you are dissatisfied with the form, use the Search box at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

Examples of due diligence include reviewing business plans, contracts, and compliance documents. If you submit a Louisiana Request for Due Diligence Documents from a Technology Company, you can expect examples like risk management plans, intellectual property assets, and market analyses. These documents facilitate a comprehensive understanding of what is at stake. By analyzing this data closely, you can gauge the company's strengths and weaknesses effectively.

When preparing for due diligence, you typically need access to financial records, legal documents, and operational policies. A Louisiana Request for Due Diligence Documents from a Technology Company will often require items like balance sheets, profit-loss statements, and corporate bylaws. Gathering this information allows you to evaluate the company's performance and uncover any potential liabilities. Such thorough assessments ultimately aid in making sound business decisions.

Due diligence documents encompass a range of materials that reveal the inner workings of a business. When you engage in a Louisiana Request for Due Diligence Documents from a Technology Company, you can obtain crucial information such as tax returns, employment agreements, and operational procedures. These documents are important tools for investors and partners to understand the viability of a company. Having access to these records fosters transparency and trust in business dealings.

Due diligence documents are essential records that provide a comprehensive overview of a company's operations, financials, and legal status. When you make a Louisiana Request for Due Diligence Documents from a Technology Company, you can expect to receive vital information such as financial statements, contracts, and service agreements. These documents help stakeholders assess risks and opportunities effectively. Using these insights, you can make informed decisions.

Due diligence in technology involves a comprehensive evaluation of a technology company's systems, processes, and technical capabilities. This includes the analysis of software development practices, technology infrastructure, and data security measures. Conducting this thorough examination ensures you understand the company's technological position. It's a necessary step for those who are initiating a Louisiana Request for Due Diligence Documents from a Technology Company.

When proving due diligence, it is crucial to consider risk assessment, compliance with laws, and procedural documentation. First, assess any potential risks associated with the company’s operations and assets. Second, ensure that all practices meet relevant legal requirements. Lastly, maintain clear records of processes and findings to substantiate your diligence efforts, particularly when making a Louisiana Request for Due Diligence Documents from a Technology Company.

Due diligence refers to the thorough investigation and evaluation of a company or its assets before a business transaction. It helps in identifying potential issues and understanding the value and risk involved. This process is essential for making informed decisions in any business deal, including those requiring a Louisiana Request for Due Diligence Documents from a Technology Company.

Technology due diligence is the process of investigating and analyzing a technology company's assets, operations, and potential liabilities. This evaluation includes examining software, systems, and any proprietary technologies involved. It provides insight into the company's technological capabilities and risks. This information is vital for anyone filing a Louisiana Request for Due Diligence Documents from a Technology Company.

To conduct tech due diligence effectively, you should start by assessing the technology assets of the company. Evaluate the software, hardware, and intellectual property, ensuring that they align with business goals. You can also review the technology's scalability and security features. This process is especially relevant when preparing a Louisiana Request for Due Diligence Documents from a Technology Company, as it ensures all critical aspects are covered for informed decisions.

In Louisiana, attorneys are required to retain client files for a minimum of five years after the conclusion of a case. This retention period ensures that clients can revisit vital documentation related to their legal matters. When addressing the Louisiana Request for Due Diligence Documents from a Technology Company, it is important to ensure that relevant documents are accessible and organized. This timeframe helps maintain the integrity of legal practice and provides clients confidence in their attorney's commitment to preserving important information.