Are you inside a position the place you need to have papers for sometimes organization or personal purposes virtually every day? There are tons of authorized record web templates accessible on the Internet, but discovering kinds you can trust isn`t effortless. US Legal Forms gives a huge number of develop web templates, much like the Louisiana Letter Informing Debt Collector of False or Misleading Misrepresentations in Collection Activities - Using False Representation or Deceptive Means to Collect a Debt - Asserting that the Debt Collector Cannot Accept Partial Payments When They Can, which can be created to fulfill federal and state specifications.

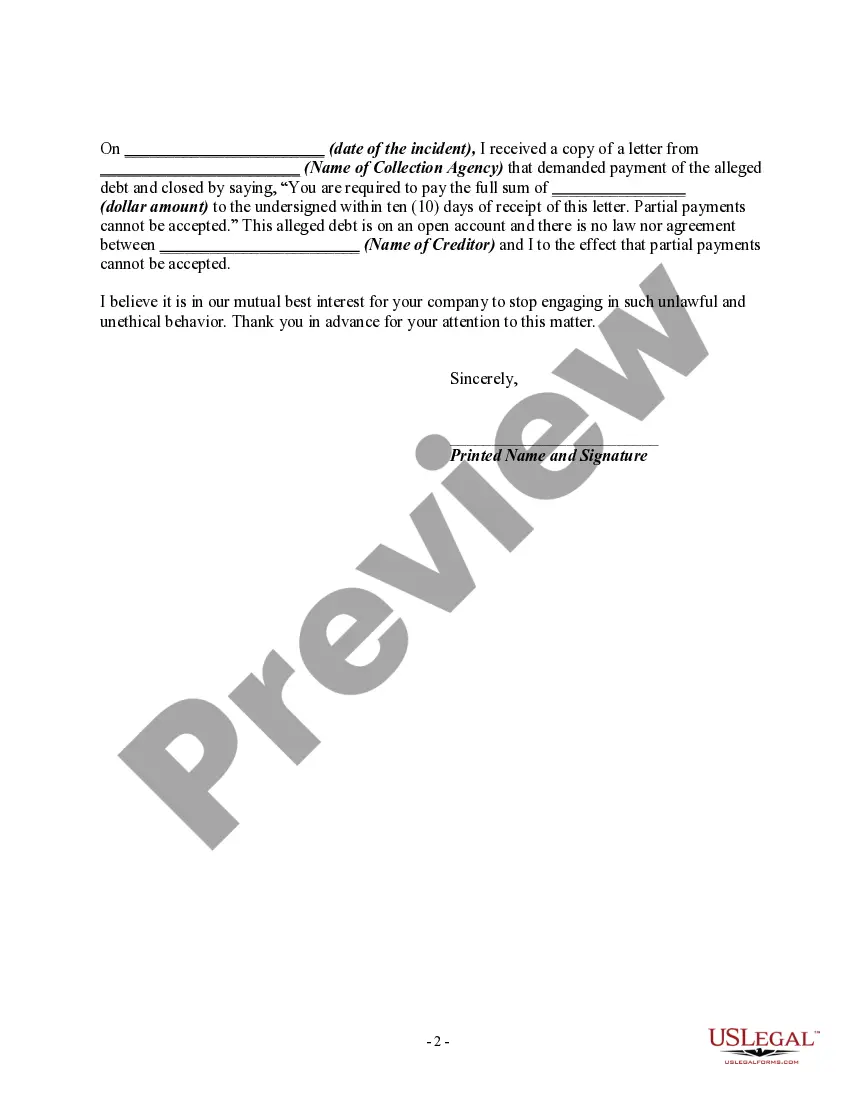

When you are previously knowledgeable about US Legal Forms web site and have an account, just log in. Following that, you are able to obtain the Louisiana Letter Informing Debt Collector of False or Misleading Misrepresentations in Collection Activities - Using False Representation or Deceptive Means to Collect a Debt - Asserting that the Debt Collector Cannot Accept Partial Payments When They Can template.

Should you not come with an account and wish to begin to use US Legal Forms, follow these steps:

- Obtain the develop you need and ensure it is for your correct area/county.

- Utilize the Review button to examine the shape.

- Look at the explanation to ensure that you have selected the appropriate develop.

- When the develop isn`t what you are trying to find, make use of the Look for field to discover the develop that meets your needs and specifications.

- Whenever you get the correct develop, click on Purchase now.

- Select the rates prepare you need, submit the specified information to make your account, and buy your order making use of your PayPal or bank card.

- Pick a hassle-free paper format and obtain your backup.

Find each of the record web templates you have bought in the My Forms menus. You can obtain a extra backup of Louisiana Letter Informing Debt Collector of False or Misleading Misrepresentations in Collection Activities - Using False Representation or Deceptive Means to Collect a Debt - Asserting that the Debt Collector Cannot Accept Partial Payments When They Can at any time, if possible. Just click on the necessary develop to obtain or printing the record template.

Use US Legal Forms, by far the most extensive assortment of authorized forms, to save some time and prevent faults. The services gives skillfully made authorized record web templates that can be used for an array of purposes. Produce an account on US Legal Forms and begin making your life easier.