Louisiana Sale of stock

Description

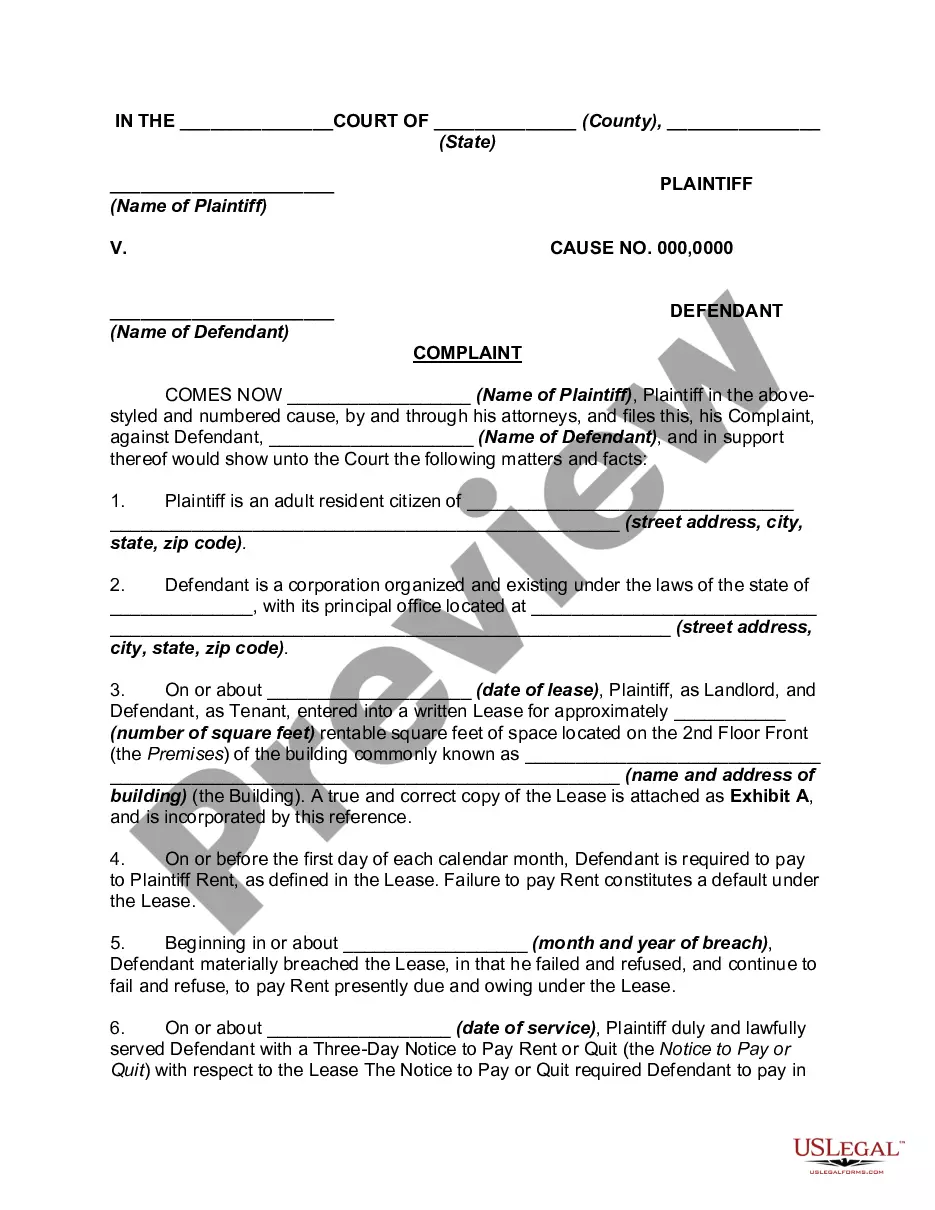

How to fill out Sale Of Stock?

You are able to commit hours on the web trying to find the lawful papers template that meets the state and federal demands you need. US Legal Forms supplies a huge number of lawful forms that are evaluated by specialists. It is possible to obtain or print the Louisiana Sale of stock from the assistance.

If you already have a US Legal Forms accounts, you can log in and then click the Obtain switch. Following that, you can total, change, print, or signal the Louisiana Sale of stock. Every lawful papers template you acquire is yours forever. To get yet another version for any obtained form, check out the My Forms tab and then click the corresponding switch.

If you use the US Legal Forms web site initially, follow the straightforward directions listed below:

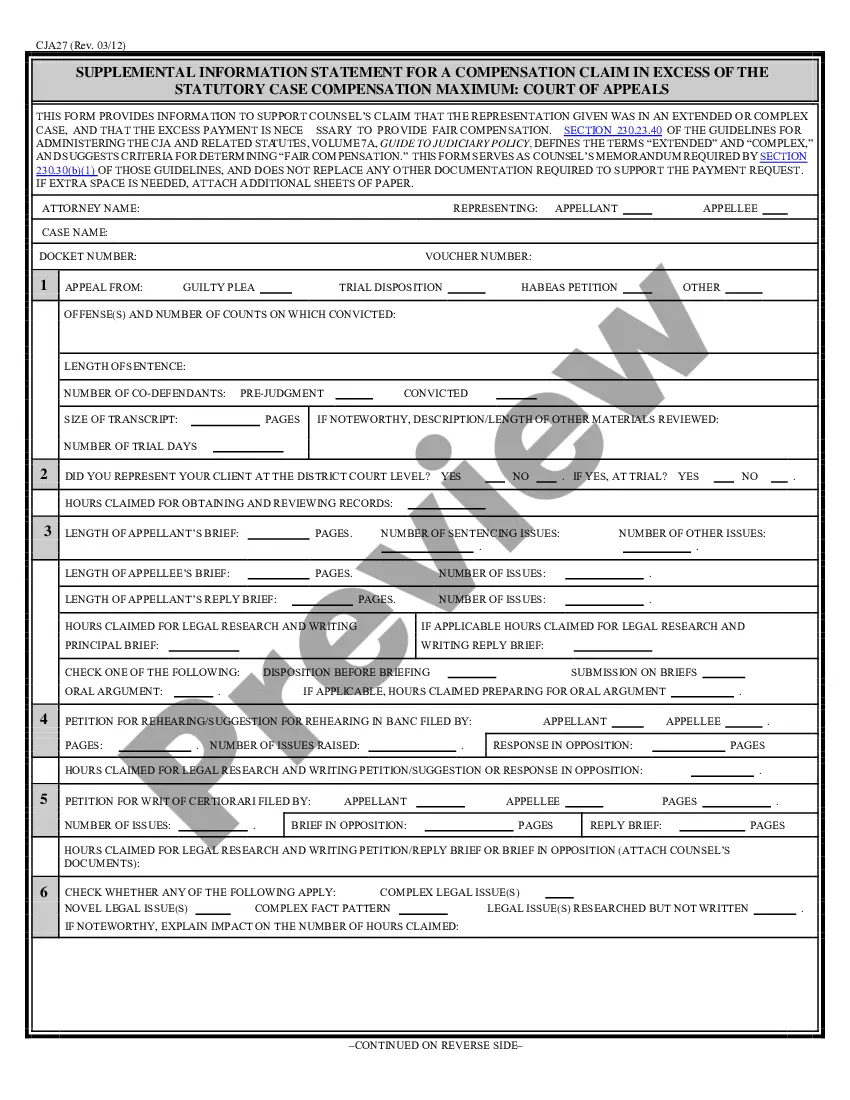

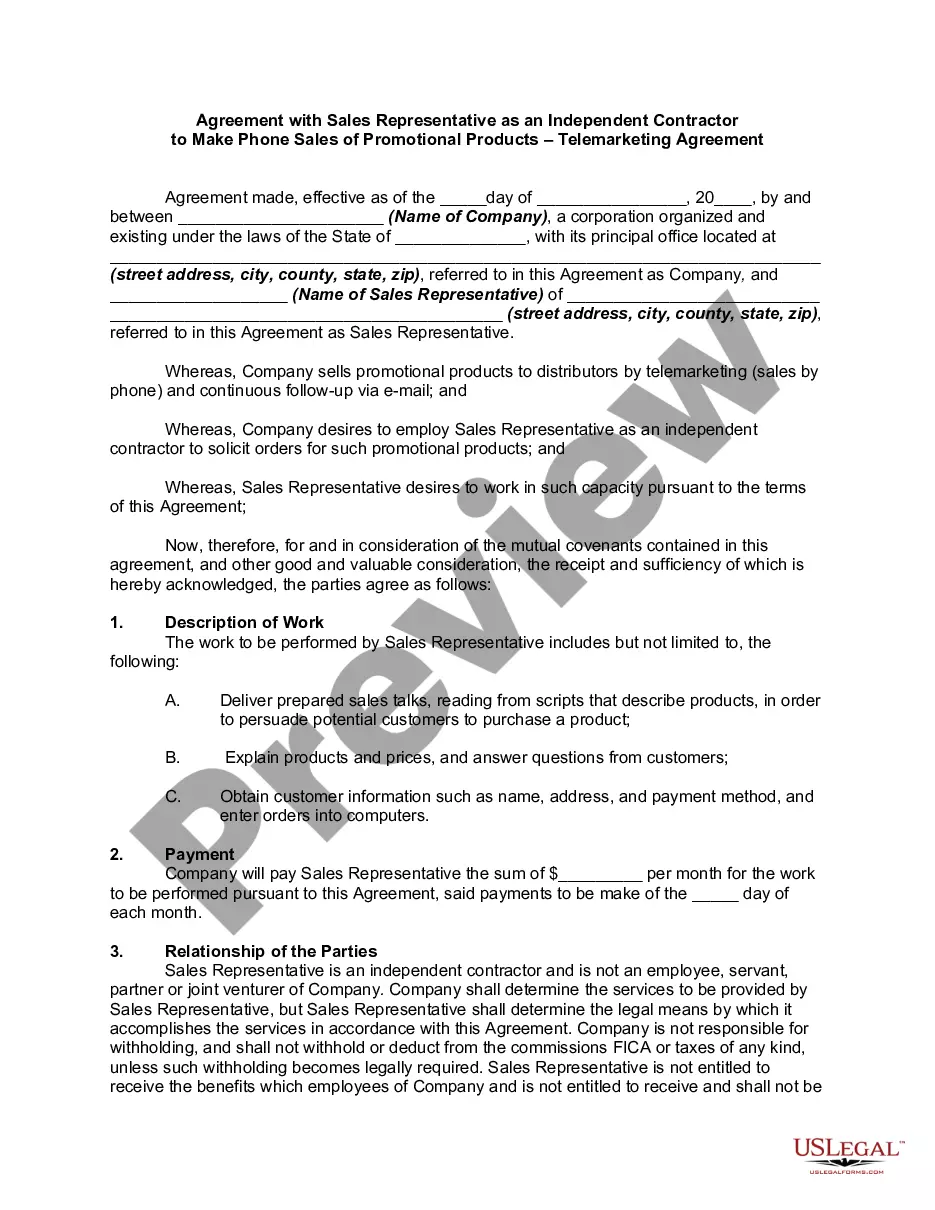

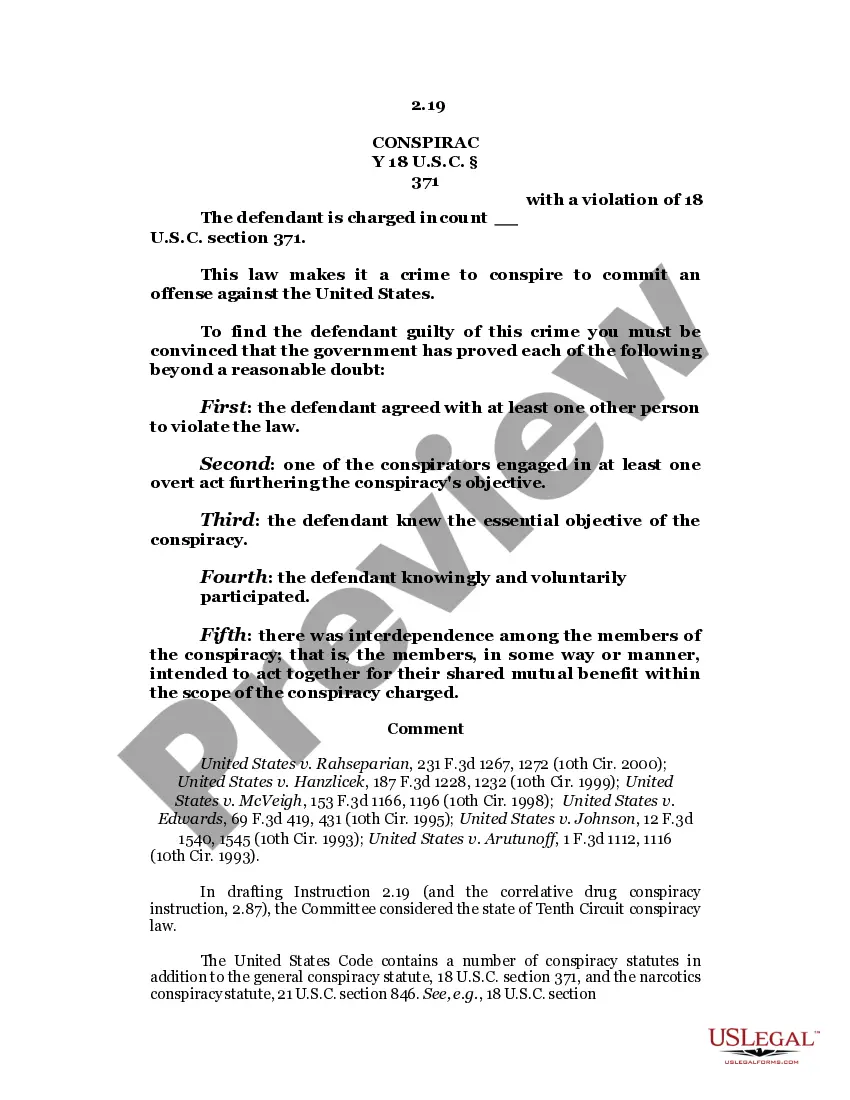

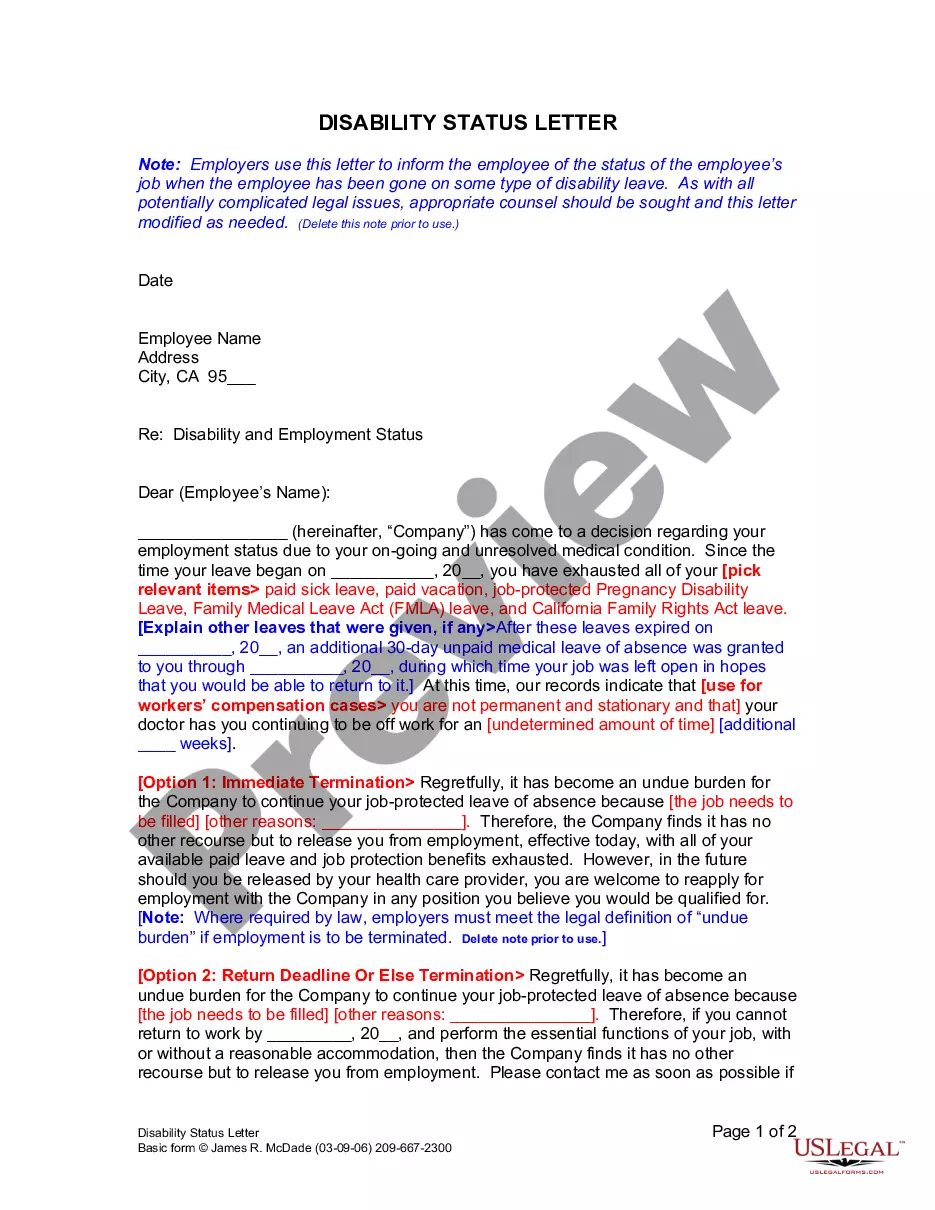

- First, be sure that you have chosen the right papers template to the state/area of your choice. Look at the form outline to ensure you have picked out the right form. If readily available, use the Preview switch to check through the papers template at the same time.

- If you would like get yet another version of the form, use the Look for field to find the template that meets your needs and demands.

- Once you have discovered the template you need, simply click Purchase now to proceed.

- Pick the prices program you need, enter your accreditations, and register for a merchant account on US Legal Forms.

- Full the transaction. You should use your Visa or Mastercard or PayPal accounts to pay for the lawful form.

- Pick the formatting of the papers and obtain it to your device.

- Make alterations to your papers if required. You are able to total, change and signal and print Louisiana Sale of stock.

Obtain and print a huge number of papers themes while using US Legal Forms website, that offers the largest collection of lawful forms. Use skilled and status-certain themes to take on your company or person requirements.

Form popularity

FAQ

To file and pay your Louisiana sales tax you have some options: File online at the Louisiana Taxpayer Access Point: You can remit your payment through their online system. Pay by credit card. AutoFile ? Let TaxJar file your sales tax for you. We take care of the payments, too.

Calculating the sales tax applied to a purchase is a matter of simply multiplying the tax rate by the purchase price using the equation sales tax = purchase price x sales tax rate. Adding the sales tax to the original purchase price gives the total price paid with tax.

Louisiana has a 4.45 percent state sales tax rate, a max local sales tax rate of 7.00 percent, and an average combined state and local sales tax rate of 9.55 percent. Louisiana's tax system ranks 39th overall on our 2023 State Business Tax Climate Index.

How Income Taxes Are Calculated First, we calculate your adjusted gross income (AGI) by taking your total household income and reducing it by certain items such as contributions to your 401(k). Next, from AGI we subtract exemptions and deductions (either itemized or standard) to get your taxable income.

Know the retail price and the sales tax percentage. Divide the sales tax percentage by 100 to get a decimal. Multiply the retail price by the decimal to calculate the sales tax amount.

The gain on the sale of a personal item is taxable. You must report the transaction (gain on sale) on Form 8949, Sales and Other Dispositions of Capital AssetsPDF, and Form 1040, U.S. Individual Income Tax Return, Schedule D, Capital Gains and LossesPDF.

Line 10 ? To compute vendor's compensation, multiply the amount shown on Line 9 by 0.944%. Beginning August 1, 2020, Act 27 of the 2020 First Extraordinary Session of the Louisiana Legislature provides the State of Louisiana vendor's compensation rate is 1.05% of the tax amount due.

How much is sales tax in Louisiana? The base state sales tax rate in Louisiana is 4.45%. Local tax rates in Louisiana range from 0% to 7%, making the sales tax range in Louisiana 4.45% to 11.45%.