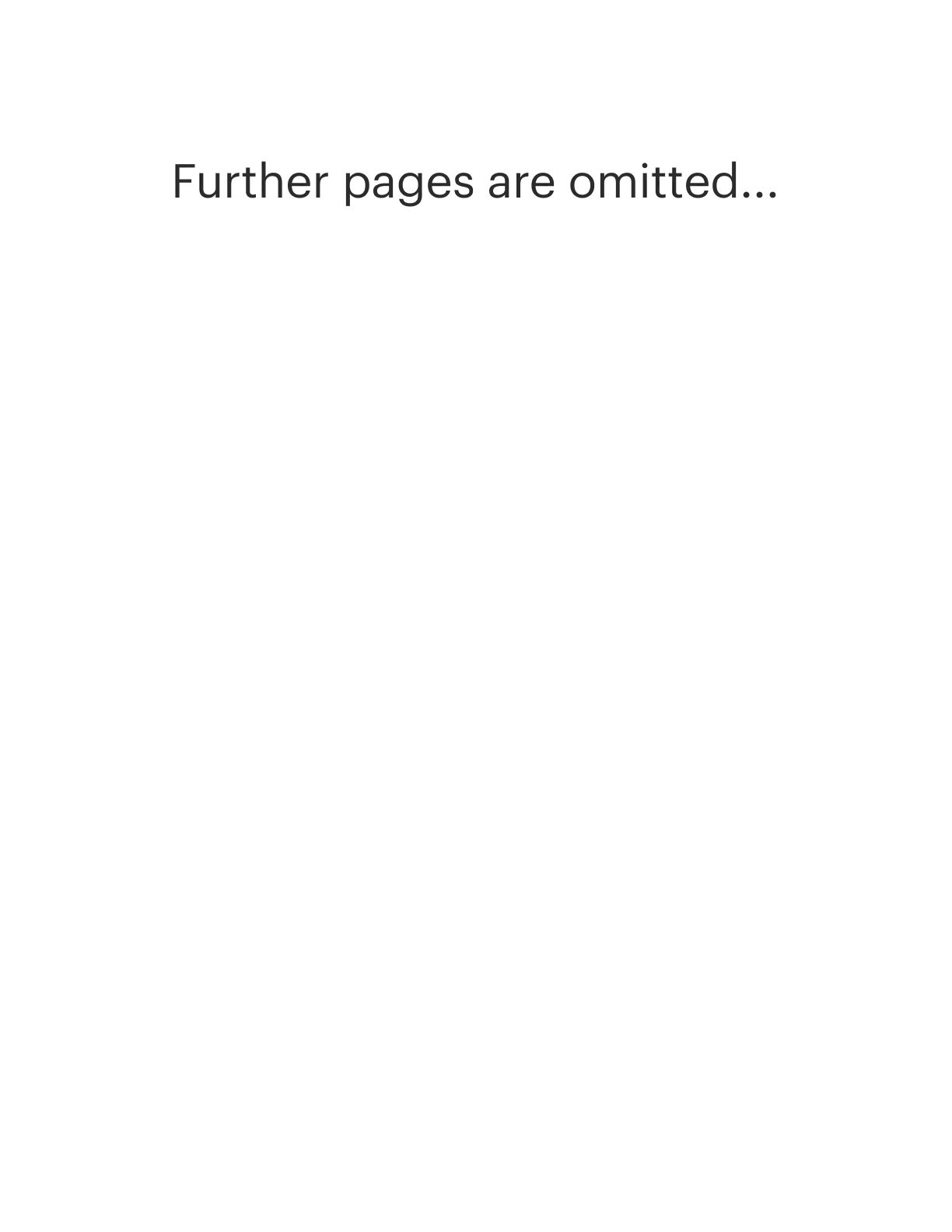

Ohio Stock Option and Long Term Incentive Plan of Golf Technology Holding, Inc.

Description

How to fill out Stock Option And Long Term Incentive Plan Of Golf Technology Holding, Inc.?

It is possible to spend hrs online searching for the authorized document web template that fits the federal and state requirements you require. US Legal Forms provides a huge number of authorized varieties that are evaluated by pros. You can easily down load or printing the Ohio Stock Option and Long Term Incentive Plan of Golf Technology Holding, Inc. from the assistance.

If you already have a US Legal Forms bank account, you can log in and click on the Download option. Afterward, you can comprehensive, revise, printing, or signal the Ohio Stock Option and Long Term Incentive Plan of Golf Technology Holding, Inc.. Every single authorized document web template you acquire is your own permanently. To get another duplicate of any purchased type, check out the My Forms tab and click on the related option.

If you work with the US Legal Forms web site the first time, adhere to the easy recommendations under:

- Initially, make sure that you have selected the best document web template to the region/city of your choice. Read the type description to ensure you have picked the correct type. If offered, take advantage of the Preview option to look from the document web template too.

- In order to discover another variation of the type, take advantage of the Look for area to get the web template that suits you and requirements.

- When you have discovered the web template you would like, click on Purchase now to move forward.

- Choose the costs plan you would like, key in your credentials, and register for an account on US Legal Forms.

- Full the financial transaction. You should use your charge card or PayPal bank account to pay for the authorized type.

- Choose the structure of the document and down load it for your system.

- Make changes for your document if required. It is possible to comprehensive, revise and signal and printing Ohio Stock Option and Long Term Incentive Plan of Golf Technology Holding, Inc..

Download and printing a huge number of document templates while using US Legal Forms site, that provides the most important assortment of authorized varieties. Use skilled and express-specific templates to tackle your small business or specific requirements.

Form popularity

FAQ

A company can choose to grant equity based on a predefined value on the grant date or predefined number of shares (the former is more popular). Unlike an appreciation-based award, a restricted stock will still have value upon vesting even if the per-stock value decreases.

Stock options are another type of LTIP. After a set length of employment, workers may be able to purchase company stock at a discount while the employer pays the balance. The worker's seniority in the organization increases with the percentage of shares owned.

Long-term incentives are earned based on the achievement of goals over a longer period of time. The goals may be based on stock price or business performance. It's important to take a holistic approach to compensation ? if it's short- or long-term, cash vs.

Through LTIPs, a new long-term incentive can be granted to an employee every year, rather than a one-time incentive, similar to a holiday bonus.

An incentive stock option (ISO) is a corporate benefit that gives an employee the right to buy shares of company stock at a discounted price with the added benefit of possible tax breaks on the profit.

LTI are typically granted with what is known as a vesting period. What this means is that grantees are conditionally granted equity, but they do not actually own it until the vesting period expires.