Louisiana Sample Proposed Amendment to Partnership Agreement to provide for issuance of preferred partnership interests

Description

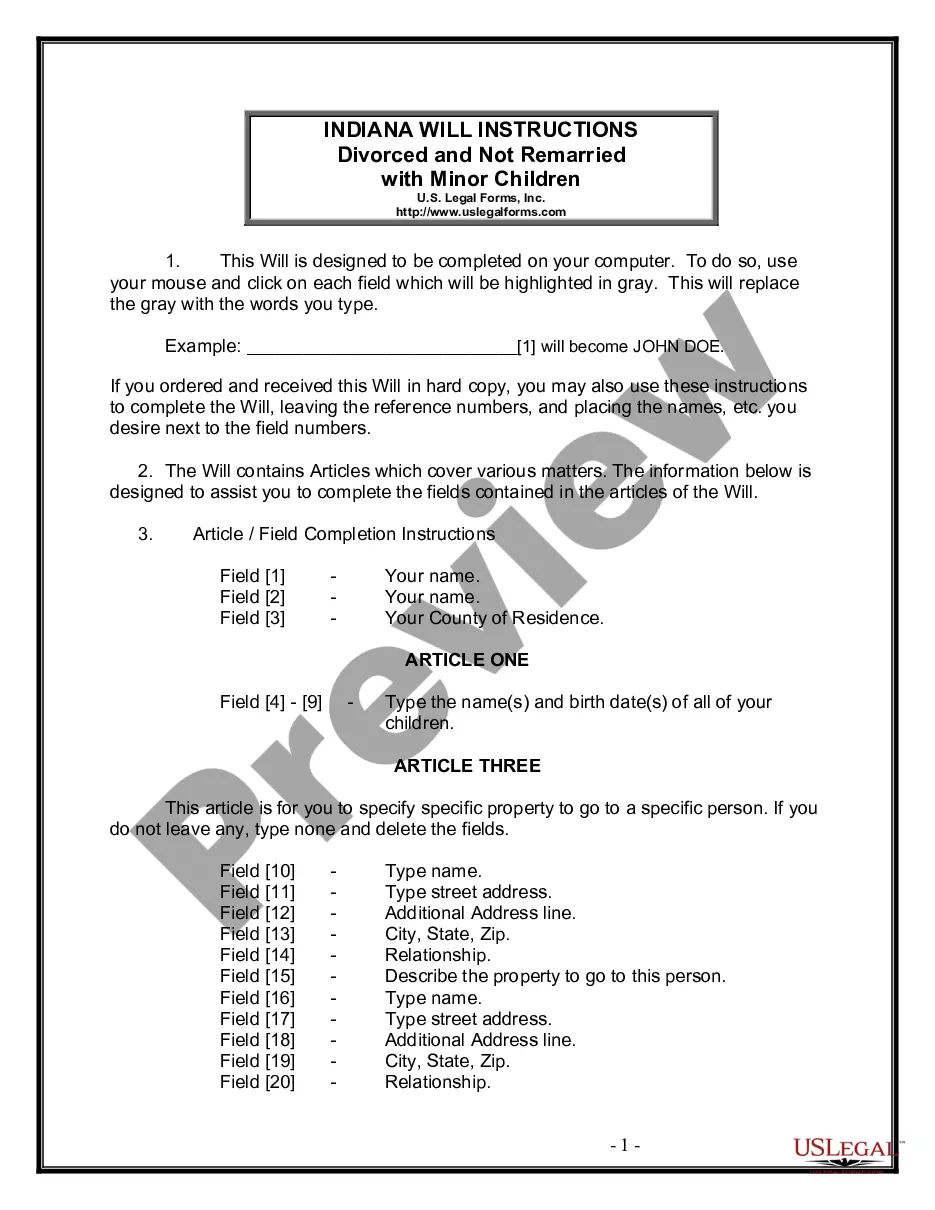

How to fill out Sample Proposed Amendment To Partnership Agreement To Provide For Issuance Of Preferred Partnership Interests?

Are you currently in a place in which you need documents for sometimes company or individual reasons almost every day time? There are tons of legitimate papers web templates available online, but getting ones you can depend on is not straightforward. US Legal Forms offers a huge number of form web templates, such as the Louisiana Sample Proposed Amendment to Partnership Agreement to provide for issuance of preferred partnership interests, that happen to be composed to meet state and federal demands.

When you are presently familiar with US Legal Forms site and also have an account, just log in. Following that, you are able to down load the Louisiana Sample Proposed Amendment to Partnership Agreement to provide for issuance of preferred partnership interests template.

Should you not come with an profile and wish to start using US Legal Forms, follow these steps:

- Discover the form you require and ensure it is for the appropriate town/region.

- Take advantage of the Preview key to examine the shape.

- See the outline to actually have selected the appropriate form.

- If the form is not what you are looking for, take advantage of the Research area to discover the form that fits your needs and demands.

- If you discover the appropriate form, simply click Get now.

- Pick the prices plan you want, complete the required info to generate your bank account, and purchase your order using your PayPal or bank card.

- Decide on a convenient document file format and down load your duplicate.

Get all the papers web templates you might have bought in the My Forms food selection. You can aquire a extra duplicate of Louisiana Sample Proposed Amendment to Partnership Agreement to provide for issuance of preferred partnership interests whenever, if necessary. Just go through the necessary form to down load or produce the papers template.

Use US Legal Forms, one of the most extensive assortment of legitimate forms, to save time and stay away from faults. The support offers appropriately produced legitimate papers web templates that you can use for a variety of reasons. Create an account on US Legal Forms and initiate creating your daily life easier.

Form popularity

FAQ

A. Amendments to this Agreement may be proposed by the General Partner or by Limited Partners holding twenty-five percent (25%) or more of the Partnership Interests. Following such proposal, the General Partner shall submit any proposed amendment to the Limited Partners.

The changes in Partnership deed are made by execution of a supplementary deed which is an addendum to the original partnership deed. Payment of appropriate stamp duty is a must for said deed. The registration of the supplementary deed would be compulsory if the firm is already registered with Registrar of Firm.

Mandated Partnerships that cannot meet the requirements of filing an electronic amended Form 1065 can request a waiver to file such amended return electronically. A subsequent return filed after the original return will be treated as an amended return, assuming the amended return box is checked.

To change information of record for your LP, fill out this form, and submit for filing along with: ? A $30 filing fee. ? A separate, non-refundable $15 service fee also must be included, if you drop off the completed form. pages if you need more space or need to include any other matters.

How to Make Change in Partnership Deed? Draft another Partnership Deed ing to the adjustments in the constitution of the Firm. Fill Form in Capital Letters in Form No. Pay the Challan Fees with the particular Bank and Submit the application with the concerned Registrar of Firms of the State.

A Partnership Amendment is used whenever there is a change to the original Partnership Agreement or new provisions must be added to the original Agreement. Often, this is used when: A partner leaves the partnership. A new partner is added to the partnership.

A Partnership Amendment, also called a Partnership Addendum, is used to modify, add, or remove terms in a Partnership Agreement. A Partnership Amendment is usually attached to an existing Partnership Agreement to reflect any changes.