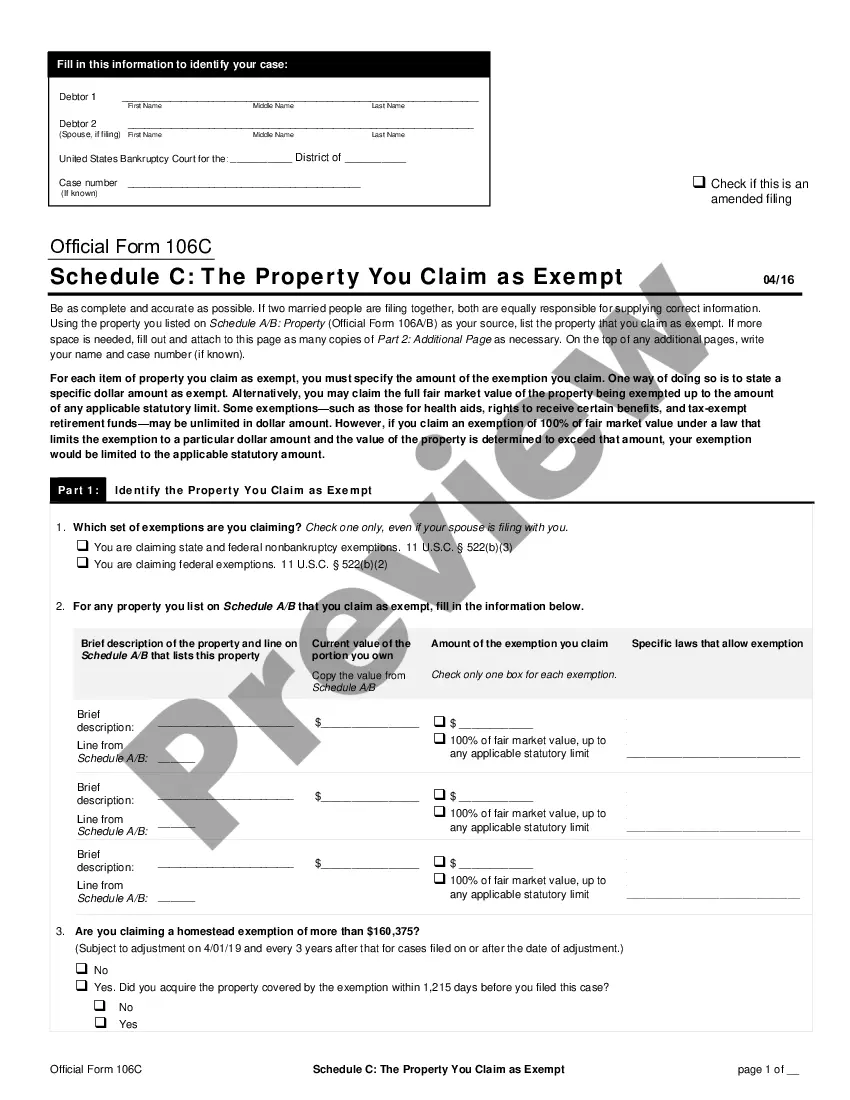

Louisiana Property Claimed as Exempt - Schedule C - Form 6C - Post 2005

Description

How to fill out Property Claimed As Exempt - Schedule C - Form 6C - Post 2005?

If you want to comprehensive, acquire, or print lawful record layouts, use US Legal Forms, the greatest variety of lawful forms, which can be found on-line. Use the site`s simple and easy handy lookup to find the documents you want. A variety of layouts for enterprise and specific uses are categorized by types and suggests, or keywords. Use US Legal Forms to find the Louisiana Property Claimed as Exempt - Schedule C - Form 6C - Post 2005 in a couple of mouse clicks.

In case you are presently a US Legal Forms consumer, log in in your accounts and click on the Download key to find the Louisiana Property Claimed as Exempt - Schedule C - Form 6C - Post 2005. You can also accessibility forms you in the past saved in the My Forms tab of your respective accounts.

If you are using US Legal Forms for the first time, refer to the instructions below:

- Step 1. Be sure you have selected the form for that right town/land.

- Step 2. Make use of the Review solution to look over the form`s content material. Never neglect to see the information.

- Step 3. In case you are not happy with all the form, utilize the Search field at the top of the screen to find other models of your lawful form format.

- Step 4. Once you have discovered the form you want, go through the Acquire now key. Choose the costs plan you like and add your accreditations to sign up for the accounts.

- Step 5. Process the deal. You may use your bank card or PayPal accounts to perform the deal.

- Step 6. Pick the format of your lawful form and acquire it in your product.

- Step 7. Complete, modify and print or indicator the Louisiana Property Claimed as Exempt - Schedule C - Form 6C - Post 2005.

Every single lawful record format you get is the one you have for a long time. You have acces to every form you saved within your acccount. Click on the My Forms segment and pick a form to print or acquire once again.

Compete and acquire, and print the Louisiana Property Claimed as Exempt - Schedule C - Form 6C - Post 2005 with US Legal Forms. There are many skilled and condition-distinct forms you can utilize for your enterprise or specific requires.

Form popularity

FAQ

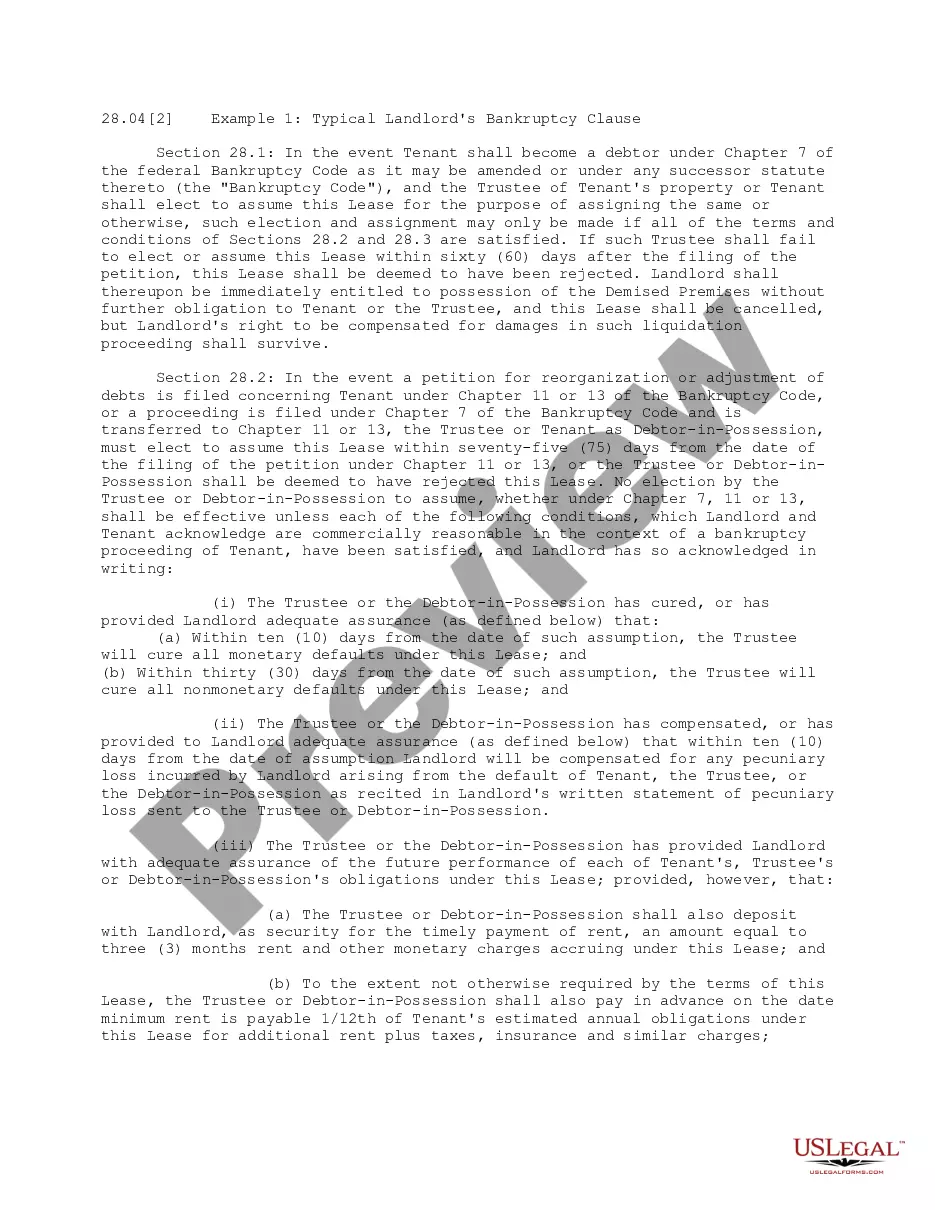

Schedule D: Secured Debts Official Form 106D, called Schedule D: Creditors Who Hold Claims Secured By Property (individuals), is for secured debts. It lists debt secured by an interest in either real property (like a house) or personal property. The most common types of secured debts are car loans and home mortgages.

The ?Claim Disallowance? IRS Letter 105C or Letter 106C is your legal notice that the IRS is not allowing the credit or refund you claimed. This notice or letter may include additional topics that have not yet been covered here. Please check back frequently for updates.

The IRS sent Letter 106C to notify you that they are only partially allowing the credit, deduction or other claim you requested. If you filed an amended tax return, the IRS sends this letter to let you know they will not accept all the adjustments on the amended return.

The ?Claim Disallowance? IRS Letter 105C or Letter 106C is your legal notice that the IRS is not allowing the credit or refund you claimed. This notice or letter may include additional topics that have not yet been covered here. Please check back frequently for updates.

Here's the information you'll need to provide: Exemption system you're using. ... Description of property. ... Schedule A/B line number. ... Current value of the portion you own. ... Amount of exemption you claim. ... Specific laws that allow the exemption. ... Claiming a homestead exemption more than $189,050.

Disallowance means a denial. Some common uses of the term ?disallowance? in a legal sense include: In the context of taxes, disallowance is a finding by the IRS after an audit that a business or individual taxpayer was not entitled to a deduction or other tax benefit claimed on a tax return.

Motor Vehicle Exemption In general, Louisiana residents are able to exempt up to $7,500 of the value of one vehicle. You are additionally allowed to exempt up to another $7,500 if you have another vehicle outfitted to assist someone who has a disability.