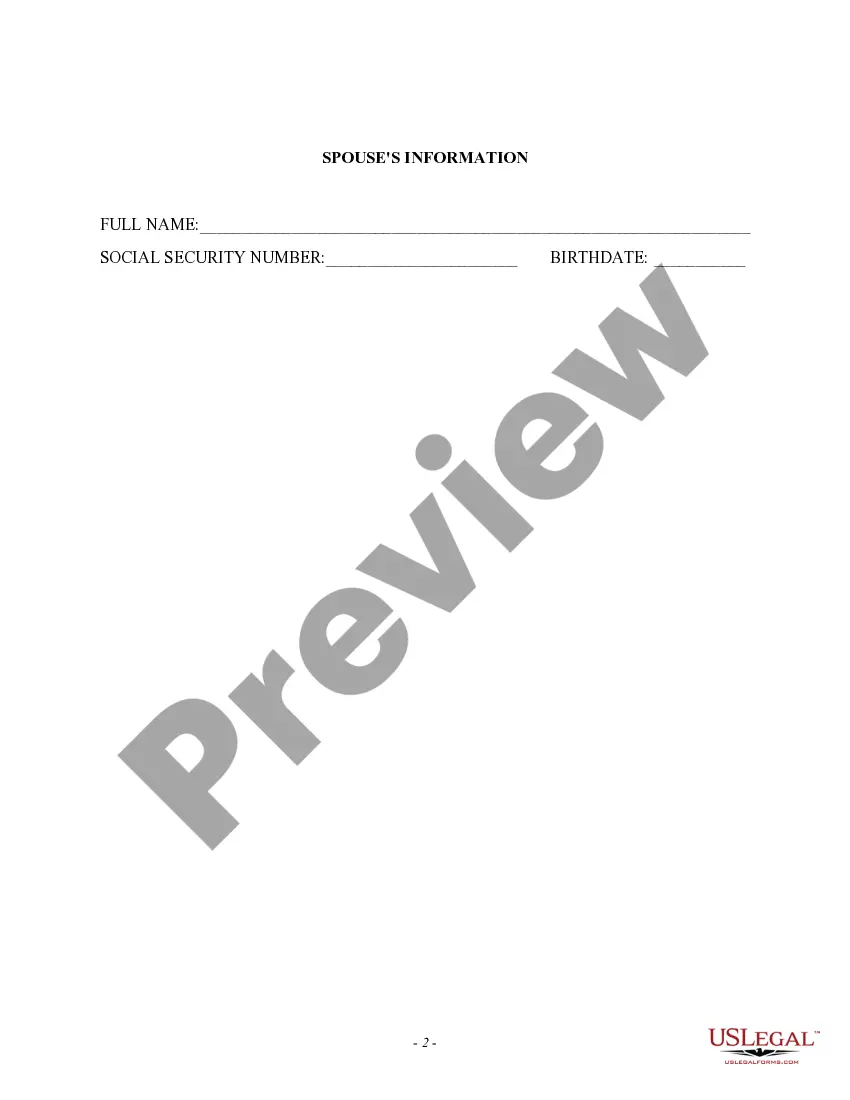

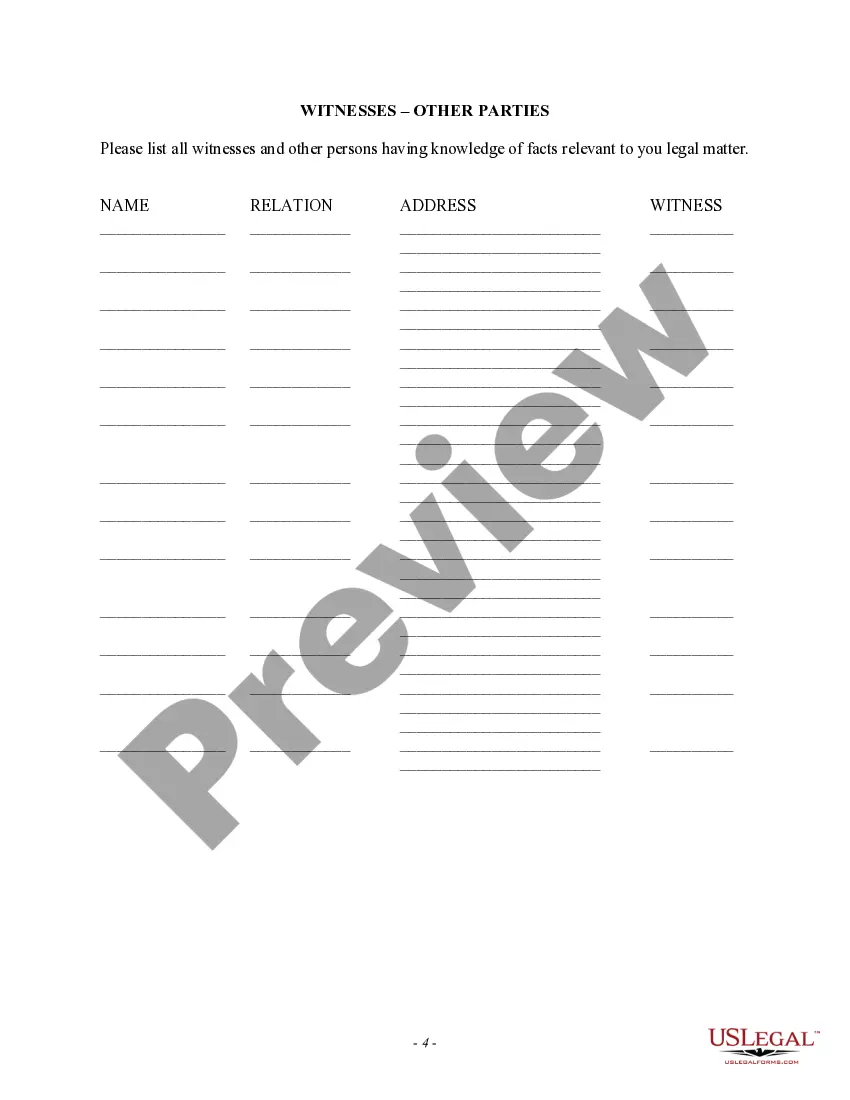

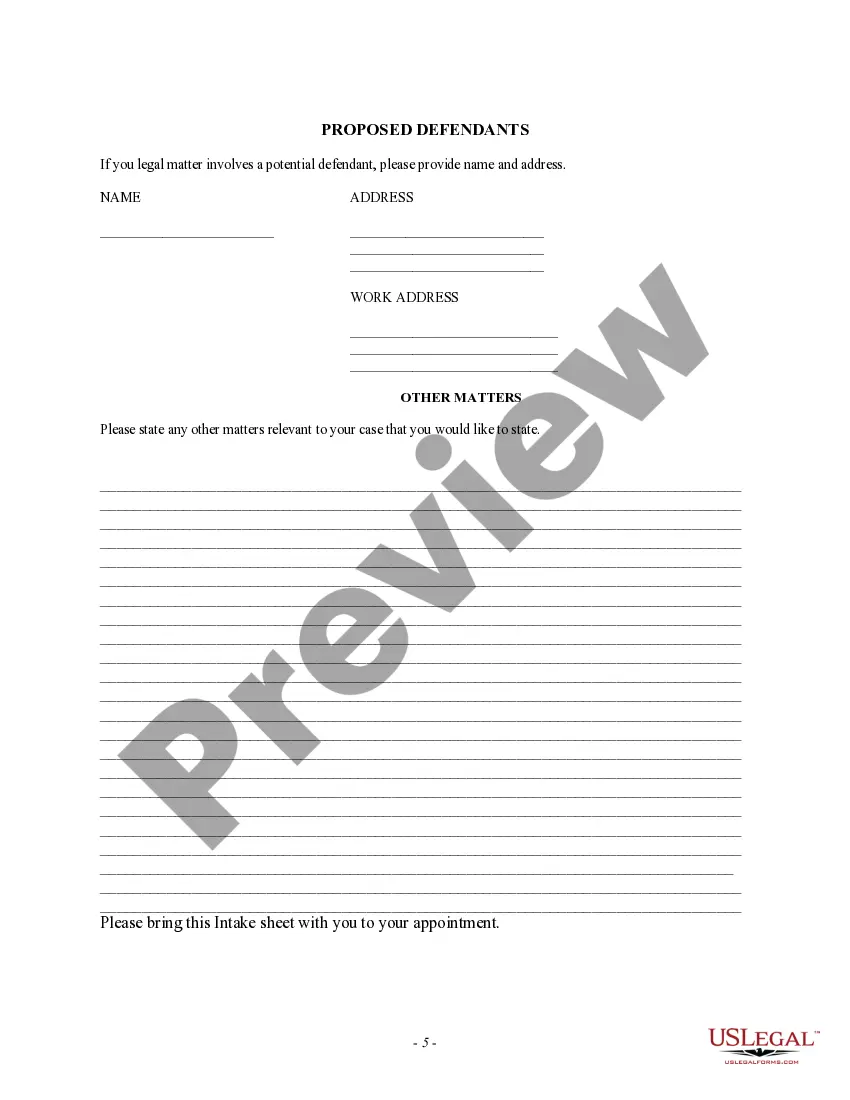

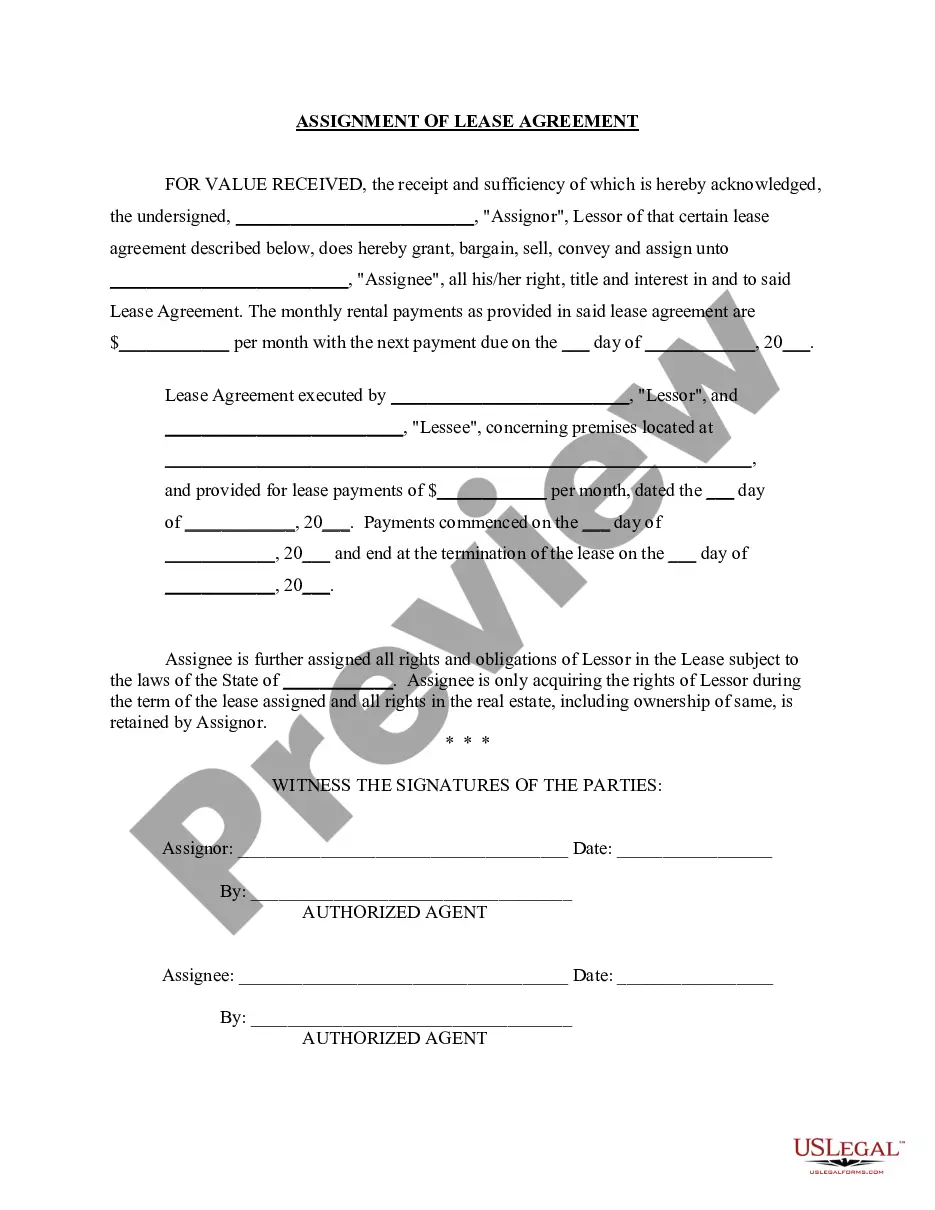

Louisiana Proposed Client Intake Sheet - General

Description

How to fill out Proposed Client Intake Sheet - General?

US Legal Forms - one of several biggest libraries of lawful varieties in the States - gives a wide range of lawful document web templates you are able to acquire or print. Utilizing the web site, you may get a large number of varieties for organization and individual reasons, sorted by groups, states, or key phrases.You can get the most recent models of varieties such as the Louisiana Proposed Client Intake Sheet - General in seconds.

If you have a registration, log in and acquire Louisiana Proposed Client Intake Sheet - General from the US Legal Forms library. The Obtain option will appear on each kind you view. You get access to all earlier delivered electronically varieties inside the My Forms tab of your own accounts.

If you want to use US Legal Forms initially, listed below are basic instructions to help you get started:

- Make sure you have chosen the correct kind to your town/county. Go through the Review option to check the form`s information. Look at the kind description to ensure that you have selected the correct kind.

- In the event the kind does not satisfy your specifications, use the Search area at the top of the monitor to discover the one who does.

- If you are pleased with the form, verify your decision by clicking on the Buy now option. Then, pick the prices prepare you want and provide your accreditations to sign up on an accounts.

- Procedure the financial transaction. Make use of credit card or PayPal accounts to complete the financial transaction.

- Pick the file format and acquire the form on your own product.

- Make alterations. Complete, modify and print and signal the delivered electronically Louisiana Proposed Client Intake Sheet - General.

Each format you added to your account lacks an expiration time and is the one you have eternally. So, if you wish to acquire or print another version, just proceed to the My Forms area and click about the kind you need.

Get access to the Louisiana Proposed Client Intake Sheet - General with US Legal Forms, probably the most comprehensive library of lawful document web templates. Use a large number of expert and express-certain web templates that fulfill your organization or individual needs and specifications.

Form popularity

FAQ

Hear this out loud PauseThe standard rate from Louisiana state taxes will vary between 2% and 6%, depending on how much earnings you have. You can also apply regular allowances and deductions.

Hear this out loud PauseWho Must File? All corporations and entities taxed as corporations for federal income tax purposes deriving income from Louisiana sources, whether or not they have any net income, must file an income tax return.

Yes. The reporting of payments on Form 1099-MISC and 1099-NEC can be submitted to the Louisiana Department of Revenue through the IRS's Combined Federal/State Filing (CF/SF) Program.

Hear this out loud PauseLLC taxes and fees The following are taxation requirements and ongoing fees for Louisiana LLCs: Annual report. Louisiana requires LLCs to file an Annual Tax Statement, which is due on or before June 1.

How do I file a return in LaTAP? Once logged in to LaTAP, select the tax-specific account at the bottom middle of the LaTAP home page. From the account screen, click on the ?File Now? link from the ?Period List? for the tax period which the return is being filed.

Hear this out loud PauseWho must file. Louisiana residents, part-year residents of Louisiana, and nonresidents with income from Louisiana sources who are required to file a federal income tax return must file a Louisiana Individual Income Tax Return.

Generally, your federal tax return should not be included with your Louisiana State Tax Return.

If you are single, you should file Form IT-540, Louisiana Resident Individual Income Tax Return, reporting all of your income to Louisiana. If you are married and both you and your spouse are residents of Louisiana, you should file Form IT-540 reporting all of your income to Louisiana.