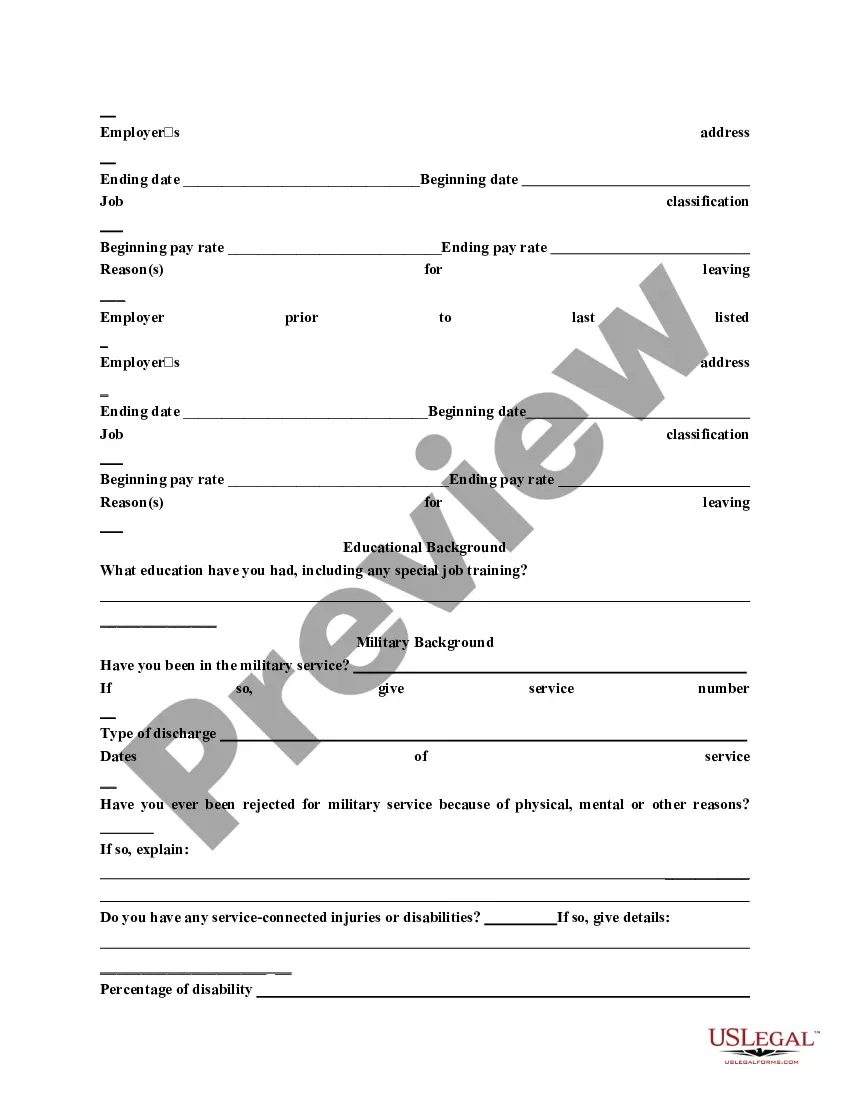

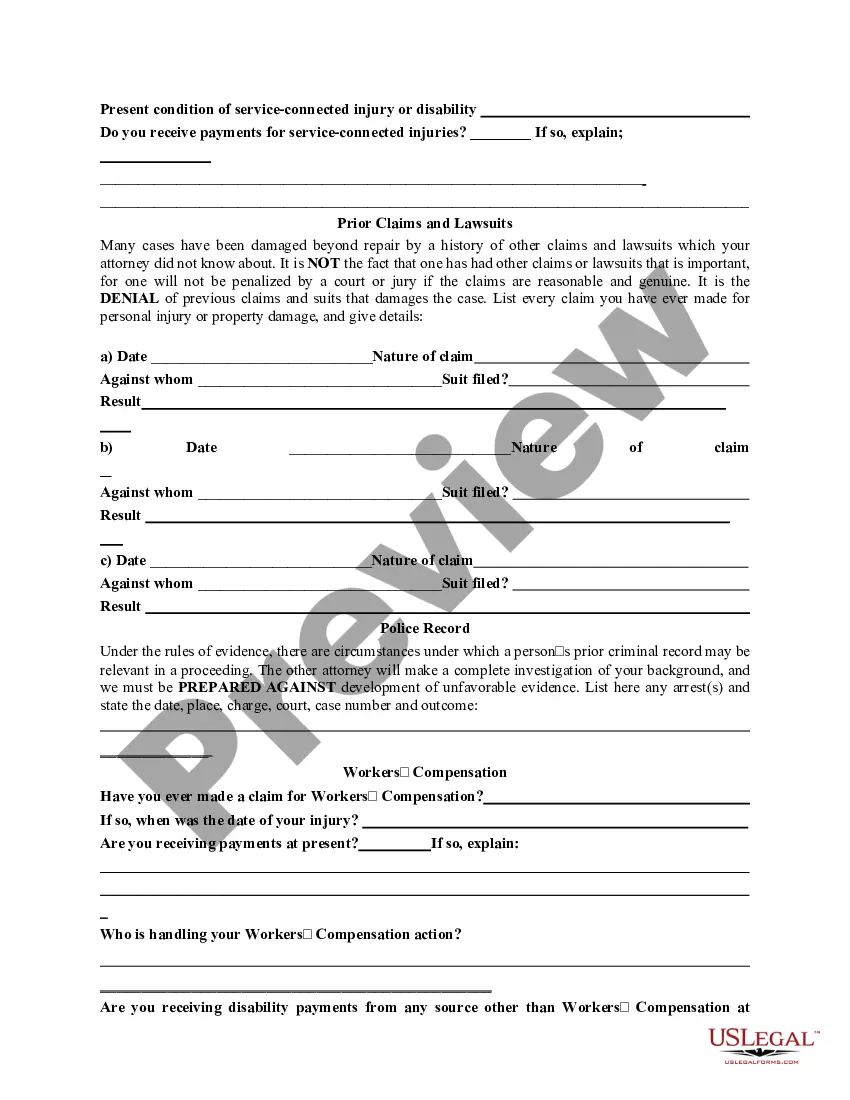

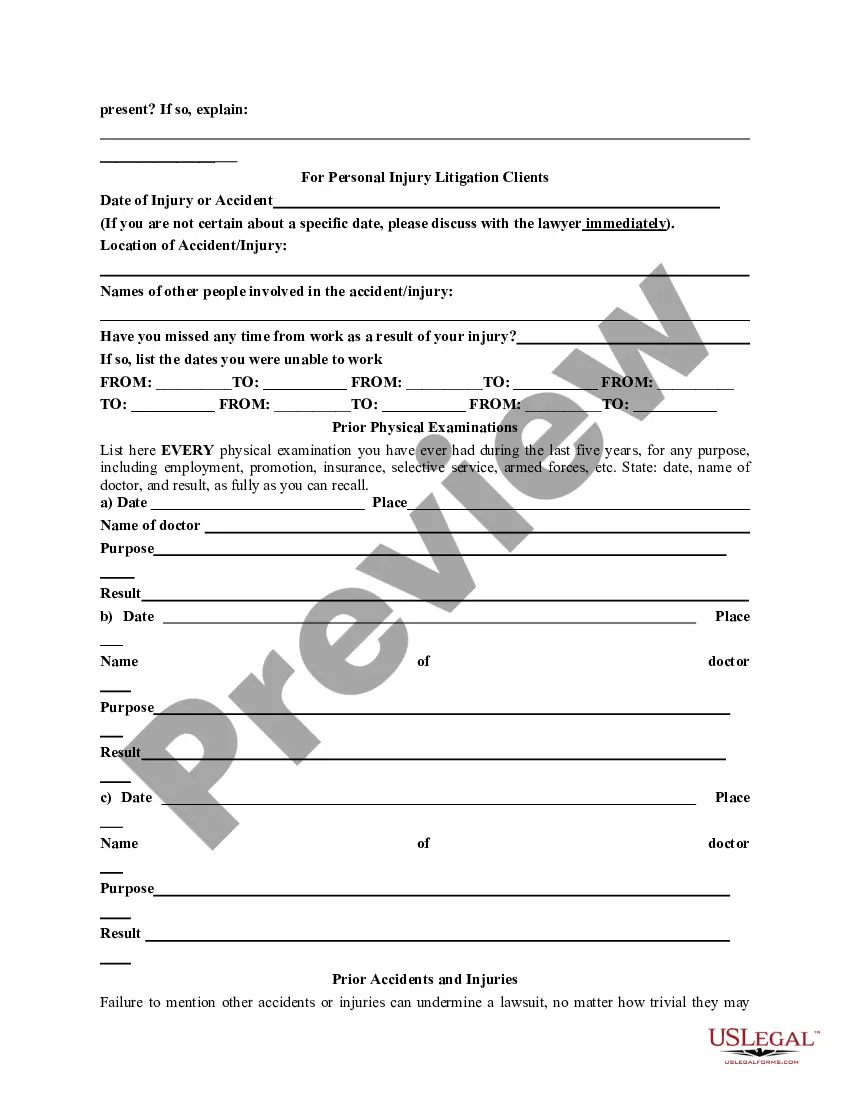

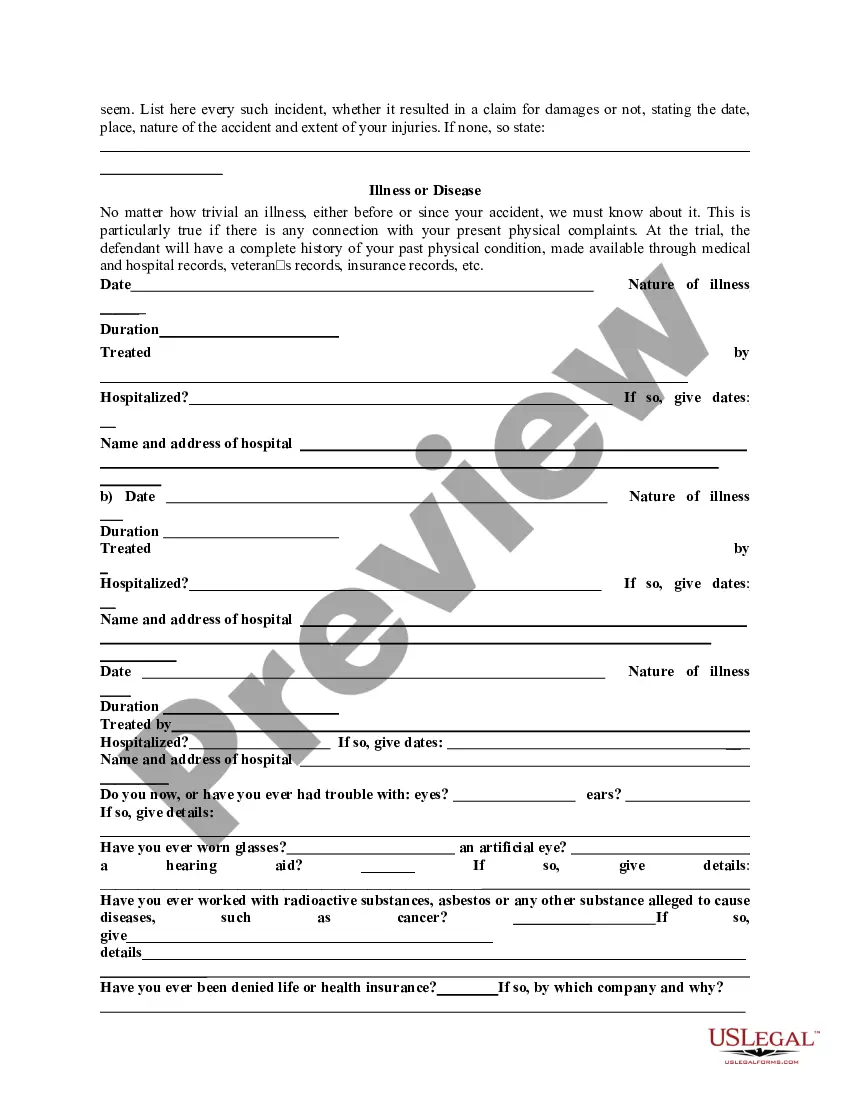

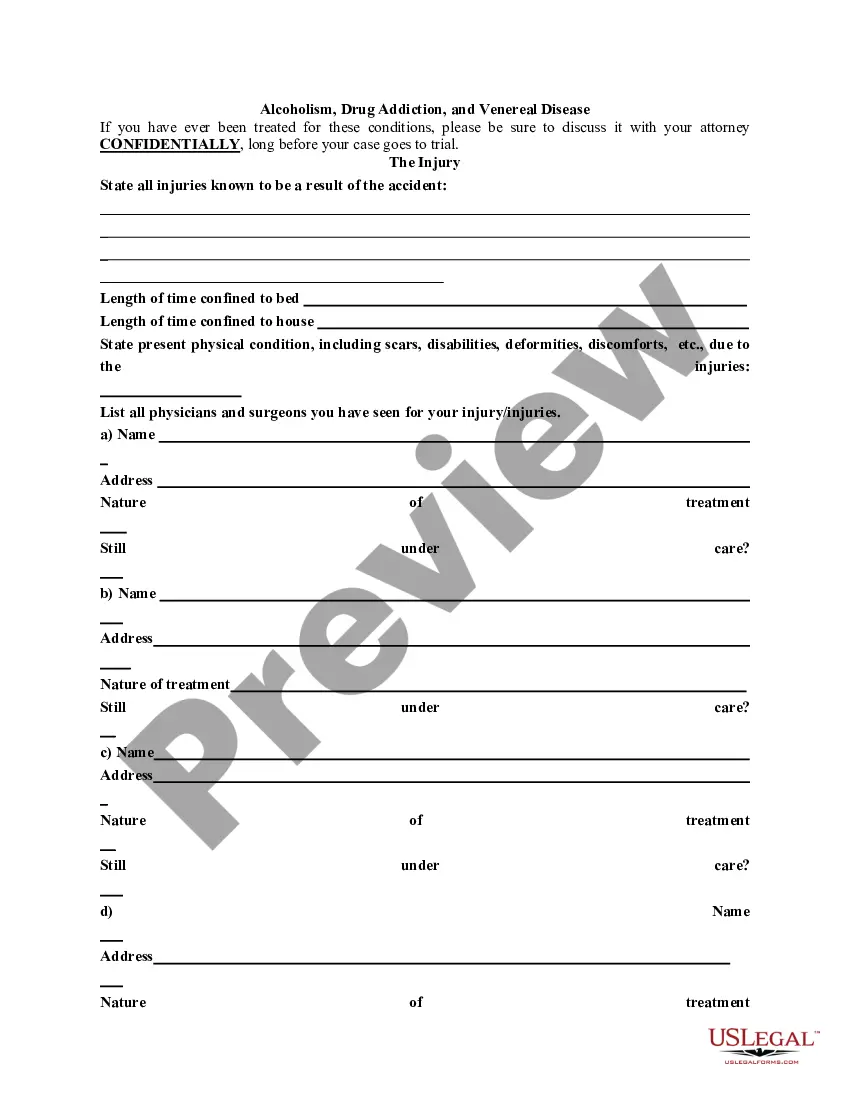

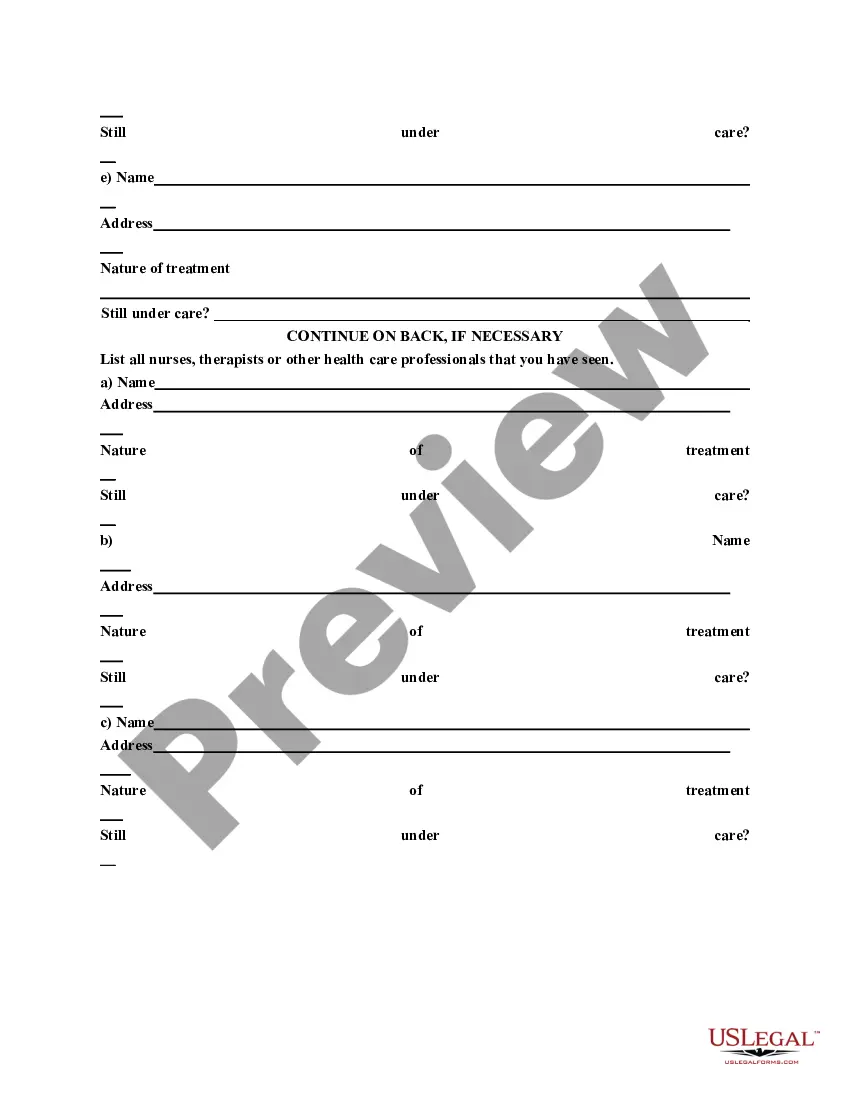

The first part of this questionnaire is designed to be useful in most civil and criminal representations. The last part can be used when screening prospective personal injury litigation clients. The questionnaire can be completed by the attorney during a first meeting with prospective clients or mailed to the client in advance and reviewed at a first meeting.

Louisiana General Information Questionnaire

Description

How to fill out General Information Questionnaire?

You can dedicate hours online searching for the legal document template that meets the federal and state requirements you need.

US Legal Forms offers a vast array of legal forms that have been reviewed by experts.

You can download or print the Louisiana General Information Questionnaire from the service.

If you wish to find another version of the form, utilize the Search field to locate the template that suits your needs and requirements. Once you have found the template you want, click Buy now to proceed. Select the pricing plan you want, enter your details, and register for your account on US Legal Forms. Complete the transaction. You can use your credit card or PayPal account to pay for the legal document. Choose the format of the document and download it to your device. Make modifications to the document if necessary. You can fill out, edit, sign, and print the Louisiana General Information Questionnaire. Download and print a multitude of document templates using the US Legal Forms site, which provides the largest selection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you already possess a US Legal Forms account, you can Log In and then click the Acquire button.

- Subsequently, you can fill out, modify, print, or sign the Louisiana General Information Questionnaire.

- Each legal document template you purchase is yours permanently.

- To obtain another copy of the purchased form, visit the My documents section and click the relevant button.

- If this is your first time using the US Legal Forms website, follow the simple instructions below.

- First, ensure that you have selected the correct document template for your state/city of choice.

- Review the form description to confirm you have chosen the correct form.

- If available, use the Review button to examine the document template as well.

Form popularity

FAQ

You are single and your total income is less than or equal to $17,252. You are married/RDP filing jointly or a qualifying surviving spouse/RDP and your total income is less than or equal to $34,554. You are head of household and your total income is less than or equal to $24,454.

To verify your tax liability for individual income tax, call LDR at (225) 219-0102. To verify your tax liability for business taxes, you can review your liabilities online using the Louisiana Taxpayer Access Point (LaTAP) system.

The most common California income tax form is the CA 540. This form is used by California residents who file an individual income tax return. This form should be completed after filing your federal taxes, using Form 1040.

Yes. The reporting of payments on Form 1099-MISC and 1099-NEC can be submitted to the Louisiana Department of Revenue through the IRS's Combined Federal/State Filing (CF/SF) Program. The CF/SF Program was established to simplify information returns filing for payers.

Need to change or amend an accepted California State Income Tax Return for the current or previous Tax Year? Simply complete Form 540 (if you're a resident) or Form 540NR and Schedule X (explanation of your amended return changes).

Form 540 is used by California residents to file their state income tax every April. This form should be completed after filing your federal taxes, such as Form 1040, Form 1040A, or Form 1040EZ, because information from your federal taxes will be used to help fill out Form 540.

Use Form 540-ES, Estimated Tax for Individuals, and the 2023 California Estimated Tax Worksheet, to determine if you owe estimated tax for 2023 and to figure the required amounts. Estimated tax is the tax you expect to owe in 2023 after subtracting the credits you plan to take and tax you expect to have withheld.

How do I file a return in LaTAP? Once logged in to LaTAP, select the tax-specific account at the bottom middle of the LaTAP home page. From the account screen, click on the ?File Now? link from the ?Period List? for the tax period which the return is being filed.