Louisiana Certificate of Incorporation for a Franchise Advertising Cooperative

Description

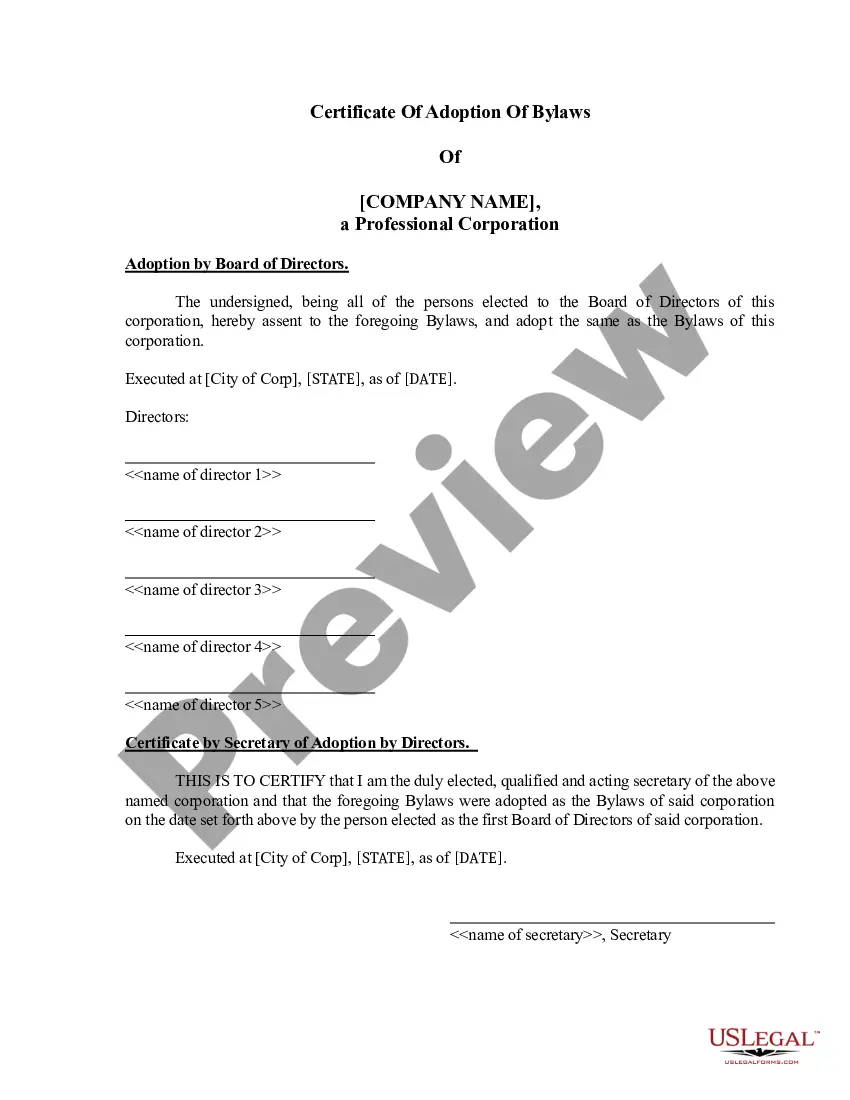

How to fill out Certificate Of Incorporation For A Franchise Advertising Cooperative?

It is possible to invest several hours on the web looking for the legal papers template that suits the state and federal needs you require. US Legal Forms offers a huge number of legal kinds which are evaluated by specialists. You can actually acquire or print the Louisiana Certificate of Incorporation for a Franchise Advertising Cooperative from my support.

If you currently have a US Legal Forms profile, you are able to log in and click the Down load button. Following that, you are able to complete, revise, print, or indication the Louisiana Certificate of Incorporation for a Franchise Advertising Cooperative. Every legal papers template you buy is yours forever. To have one more backup associated with a bought form, check out the My Forms tab and click the corresponding button.

If you are using the US Legal Forms site initially, adhere to the straightforward recommendations under:

- Initial, make certain you have chosen the proper papers template for that area/area of your choice. Read the form outline to make sure you have picked the right form. If accessible, take advantage of the Review button to search throughout the papers template also.

- In order to locate one more edition of the form, take advantage of the Research industry to discover the template that suits you and needs.

- After you have found the template you want, click on Buy now to move forward.

- Choose the rates plan you want, key in your references, and sign up for a free account on US Legal Forms.

- Comprehensive the transaction. You can utilize your charge card or PayPal profile to cover the legal form.

- Choose the format of the papers and acquire it in your gadget.

- Make alterations in your papers if necessary. It is possible to complete, revise and indication and print Louisiana Certificate of Incorporation for a Franchise Advertising Cooperative.

Down load and print a huge number of papers web templates utilizing the US Legal Forms website, that offers the most important selection of legal kinds. Use specialist and state-certain web templates to deal with your organization or specific requires.

Form popularity

FAQ

Articles of Incorporation refers to the highest governing document in a corporation. It is also known known as the corporate charter. The Articles of Incorporation generally include the purpose of the corporation, the type and number of shares, and the process of electing a board of directors.

DOMESTIC CORPORATIONS ? Corporations organized under the laws of Louisiana must file Form CIFT-620, Louisiana Income Tax and Louisiana Corporation Franchise Tax return each year unless exempt from both taxes.

PART 2: CREDIT FOR CERTAIN DISABILITIES ? A credit of $100 against the tax is permitted for the taxpayer, spouse, or dependent who is blind, deaf, mentally incapacitated, or has lost the use of a limb. Only one credit is allowed per person.

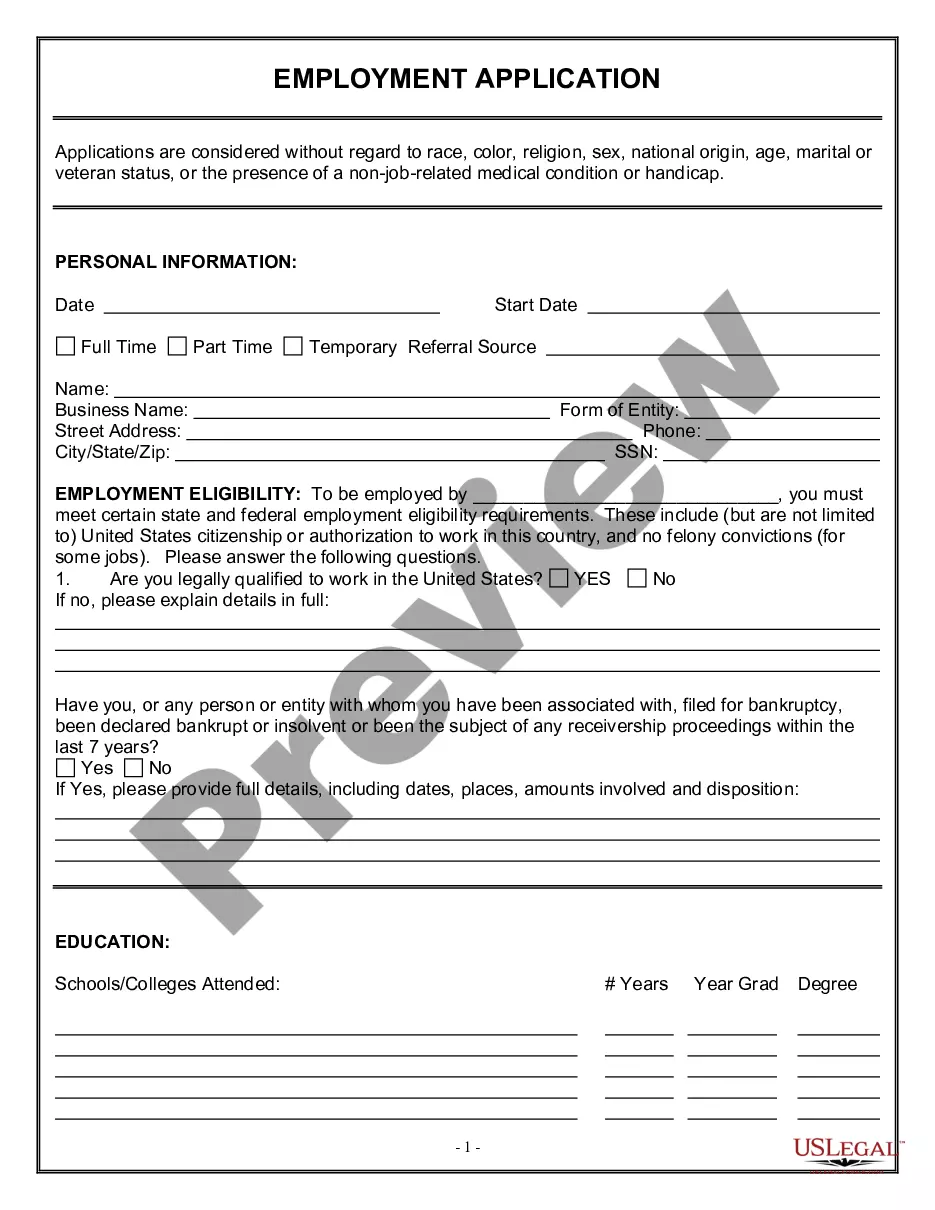

Form a Louisiana Corporation: Name Your Corporation. Designate a Registered Agent. Submit Articles of Incorporation. Get an EIN. Write Corporate Bylaws. Hold an Organizational Meeting. Open a Corporate Bank Account. File State Reports & Taxes.

Individuals who are domiciled, reside, or have a permanent residence in Louisiana are required to file a Louisiana individual income tax return and report all of their income and pay Louisiana income tax on that income, if applicable.

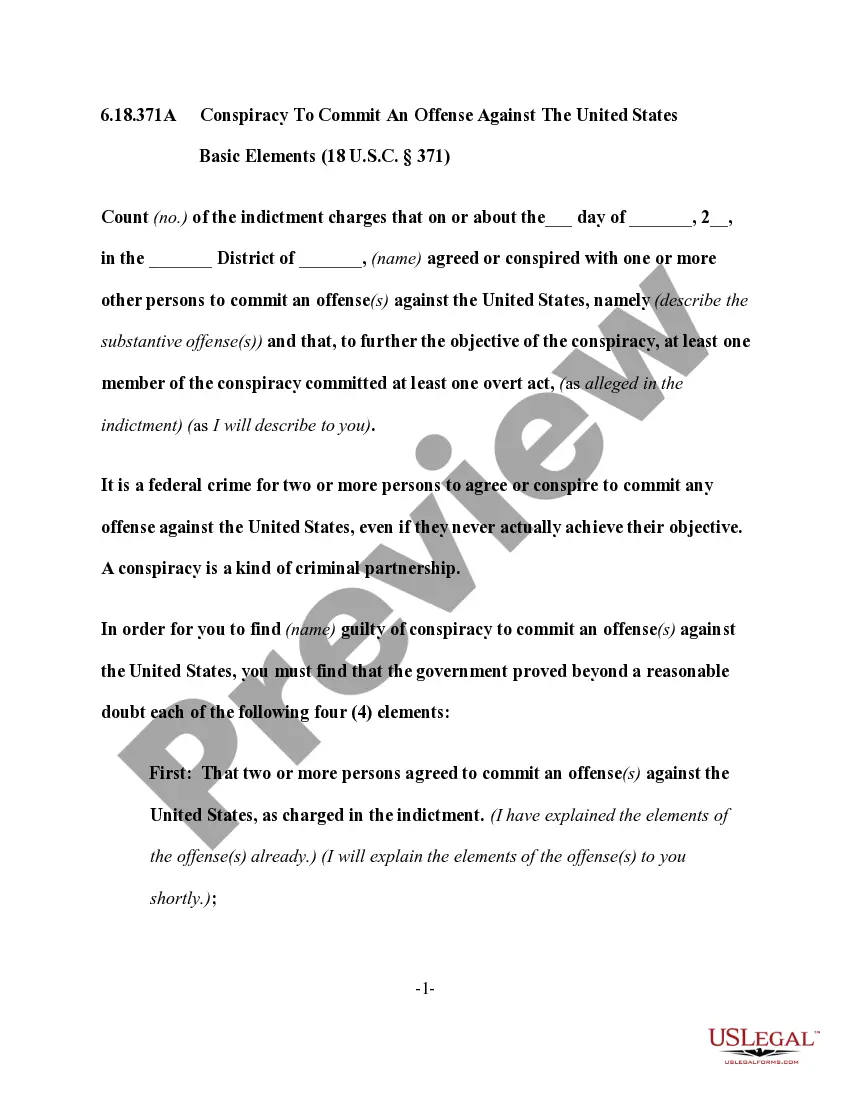

Any corporation or entity taxed as a corporation for federal income tax purposes meeting any of the following provisions, unless specifically exempted under the provisions of R.S. 8, must file a Louisiana corporation franchise tax return: Organized under the laws of Louisiana.

Louisiana State General Business Corporation tax extension Form CIFT-620EXT is due within 4 months and 15 days following the end of the corporation reporting period. Form CIFT-620EXT grants an automatic 7-month extension of time to file Form CIFT-620.

Any corporation or entity taxed as a corporation for federal income tax purposes meeting any of the following provisions, unless specifically exempted under the provisions of R.S. 8, must file a Louisiana corporation franchise tax return: Organized under the laws of Louisiana.