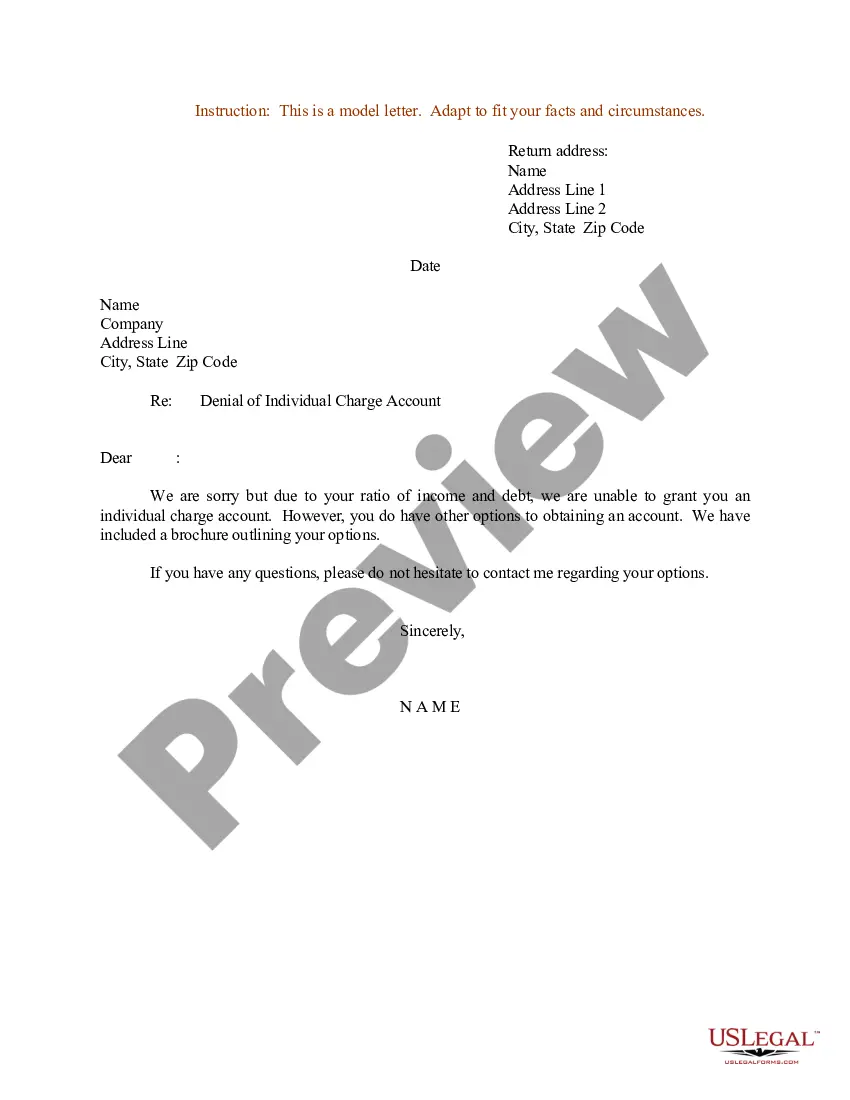

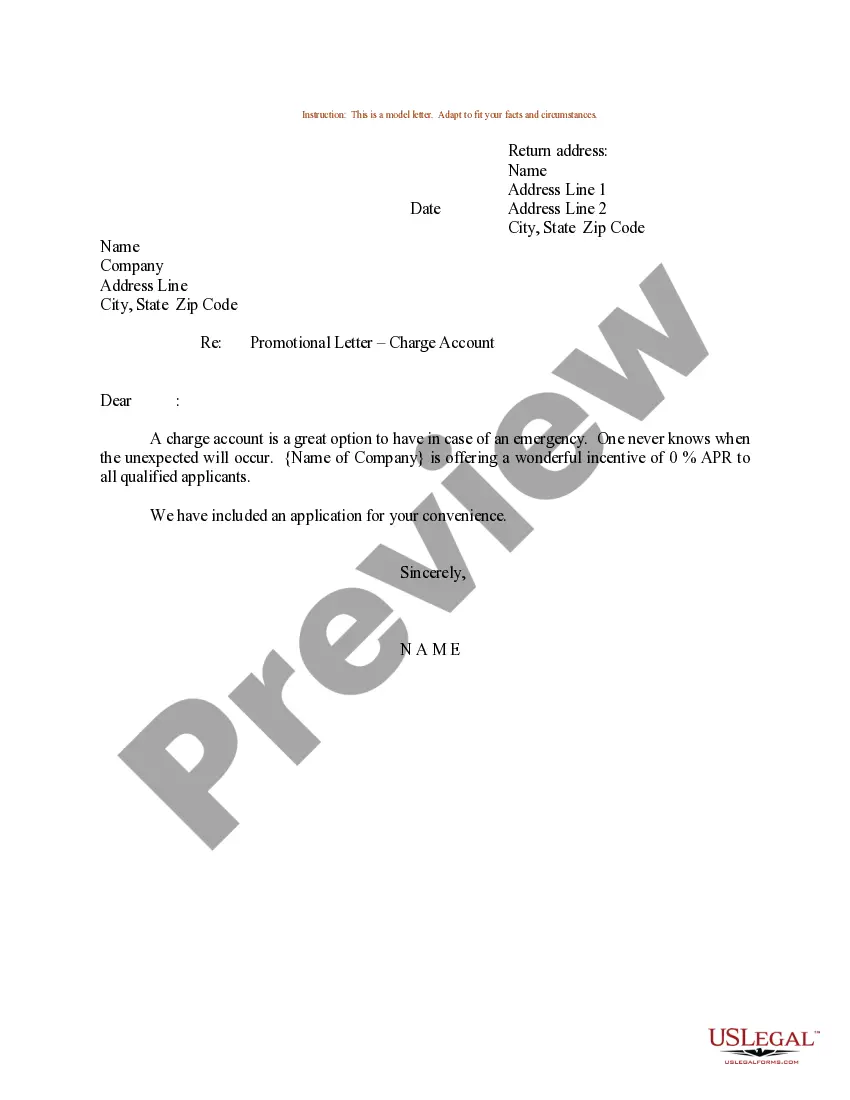

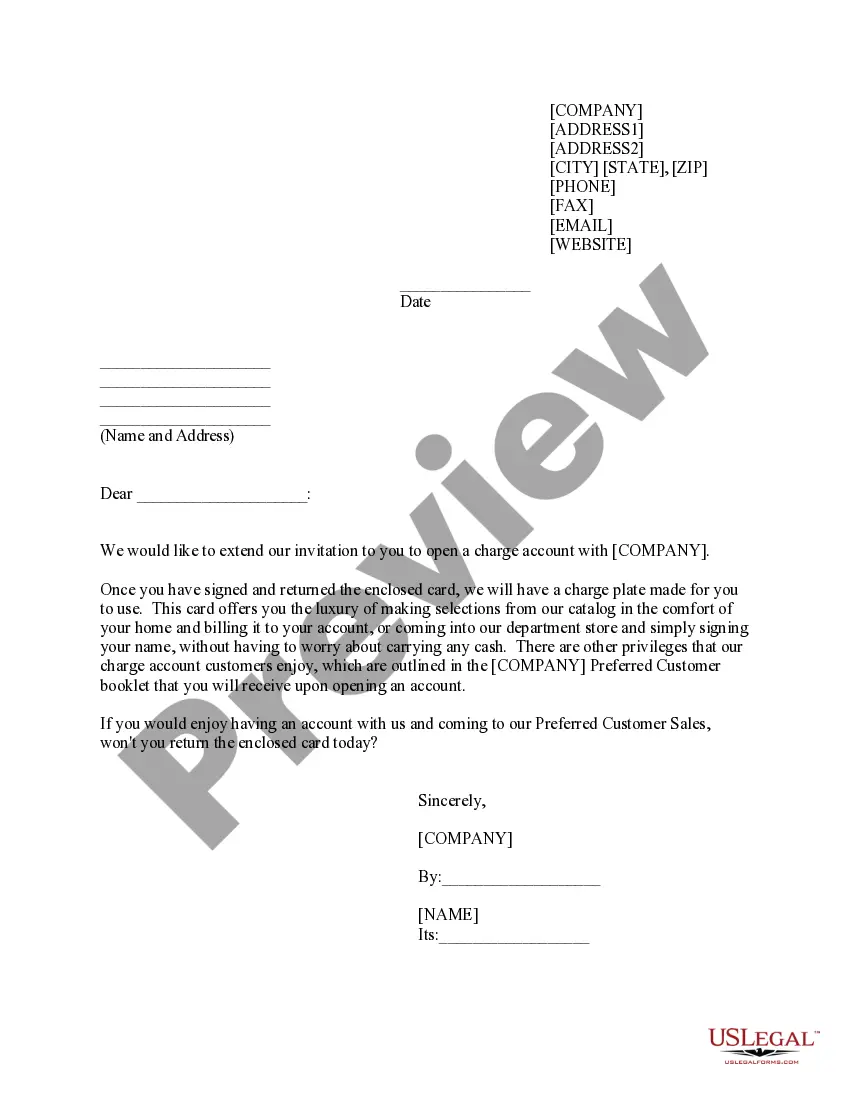

Louisiana Sample Letter for Charge Account Terms and Conditions

Description

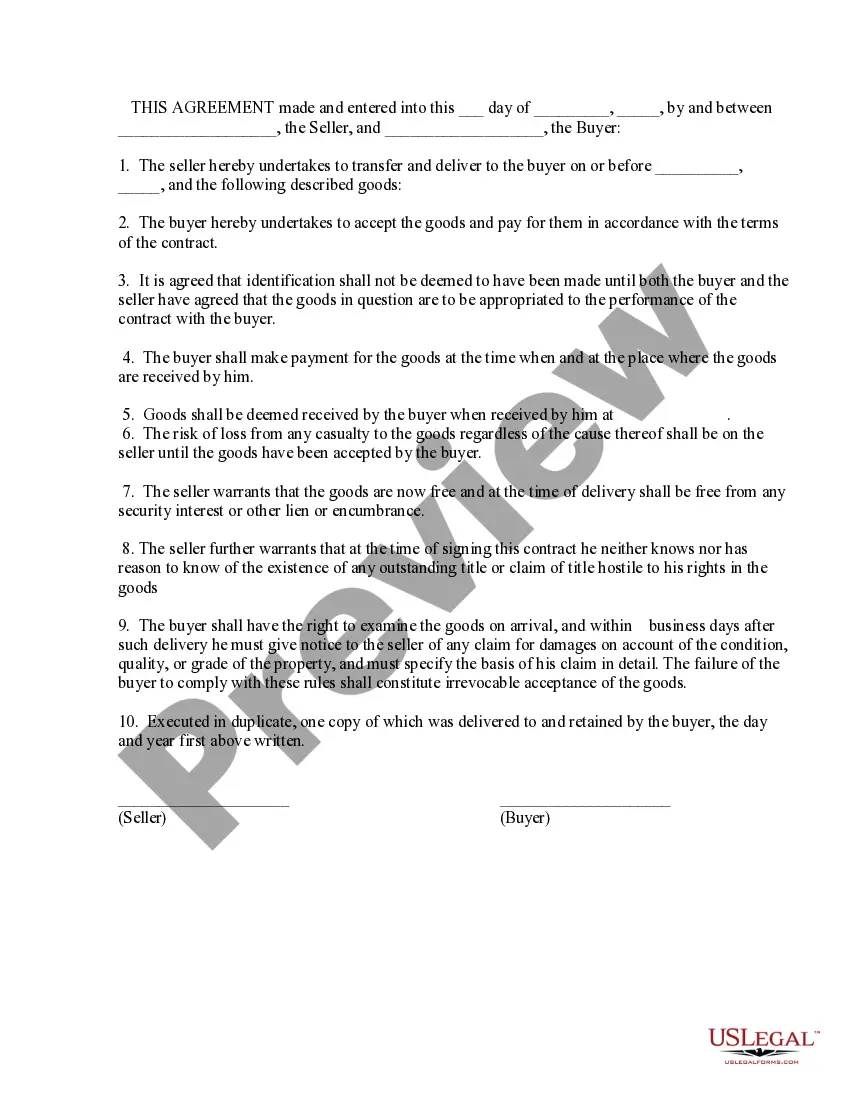

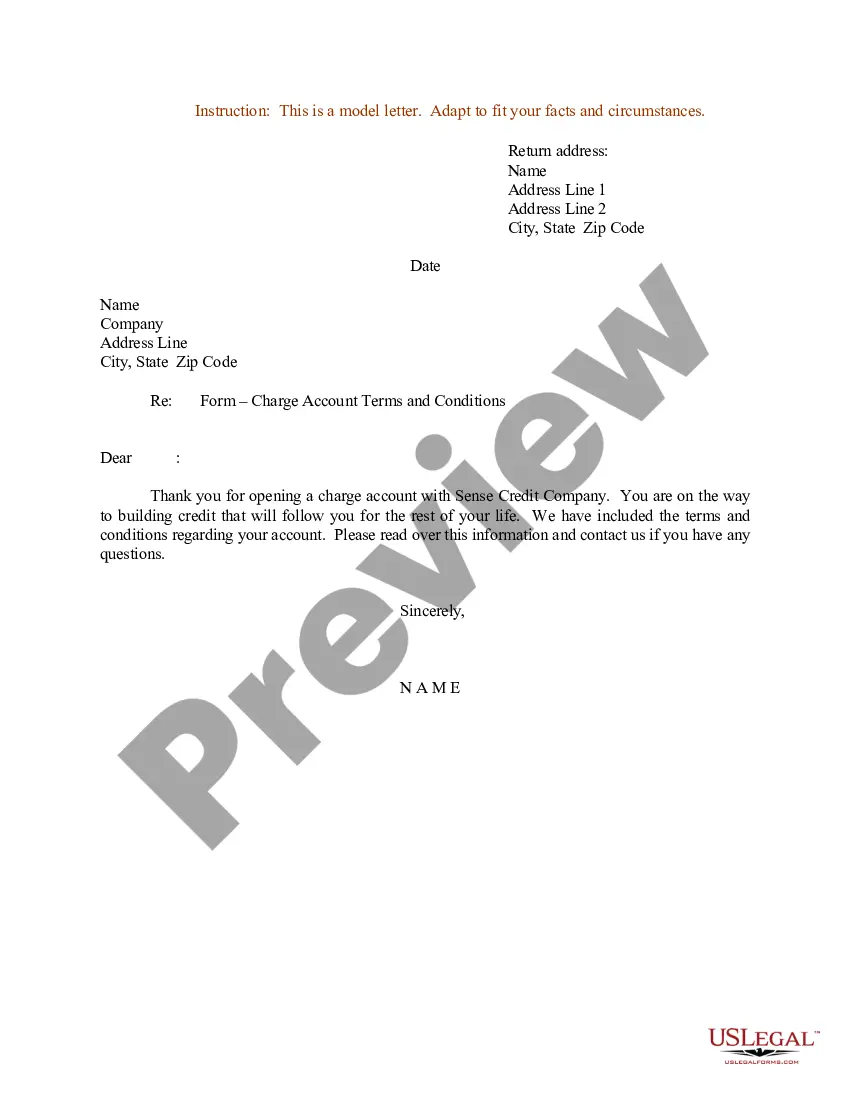

How to fill out Sample Letter For Charge Account Terms And Conditions?

Finding the appropriate legal document format can be challenging. Naturally, there are numerous templates accessible online, but how can you locate the legal form you require.

Utilize the US Legal Forms website. This platform offers thousands of templates, including the Louisiana Sample Letter for Charge Account Terms and Conditions, which you can use for both business and personal purposes.

All forms are reviewed by professionals and comply with state and federal regulations.

If the form does not meet your requirements, use the Search field to find the appropriate form. Once you confirm that the form is appropriate, click the Acquire now button to download the form. Choose the pricing plan you prefer and enter the required information. Create your account and pay for your order using your PayPal account or credit card. Select the file format and download the legal document format to your device. Complete, edit, print, and sign the received Louisiana Sample Letter for Charge Account Terms and Conditions. US Legal Forms is the largest repository of legal forms where you can find various document templates. Utilize the service to acquire professionally crafted documents that meet state requirements.

- If you are already a member, Log In to your account and click the Download button to obtain the Louisiana Sample Letter for Charge Account Terms and Conditions.

- Use your account to browse the legal forms you have previously purchased.

- Go to the My documents tab of your account to get an additional copy of the documents you need.

- If you are a new user of US Legal Forms, here are simple instructions for you to follow.

- First, ensure you have selected the correct form for your city/state.

- You can preview the form using the Review button and read the form description to ensure it is suitable for you.

Form popularity

FAQ

How to Ask for Payment ProfessionallyCheck the Client Received the Invoice.Send a Brief Email Requesting Payment.Speak to the Client By Phone.Consider Cutting off Future Work.Research Collection Agencies.Review Your Legal Options.

5 elements of an effective dispute letterThe basics. First, make sure you've got the basics: name, account number, address and which charge you're disputing.The reason the charge is erroneous. It helps to supply the reason you believe the charge is not valid, says Milz.Documentation.The correct address.The time frame.

I am writing to dispute a charge of $ to my credit or debit card account on date of the charge. The charge is in error because explain the problem briefly. For example, the items weren't delivered, I was overcharged, I returned the items, I did not buy the items, etc..

I request that you accept a monthly payment of $ instead of the regular payment of $ that I have been making every month. I will begin making regular monthly payments as soon as I recover from this financial crisis. I hope you will understand my situation and consider my request.

How to Dispute a Transaction: Step By StepStep 1: Contact the Seller.Step 2: Collect Any Documents or Evidence You Have Related to the Dispute.Step 3: Contact the Credit Issuer.Step 4: Wait While the Credit Issuer Investigates Your Claim.Step 5: Receive a Refund Back to Your Account.

Letter of Charge means notification by the International Ethics Committee to a Member Charged that probable cause has been found so as to merit the impaneling of a hearing committee to formally inquire into the allegation(s) raised against such member.

A demand letter is a document that you give to the person that you think owes you money. Within the letter, you set out why you are entitled to the payment and demand it. You'd be surprised how often a simple demand letter can work without you having to go to court.

Valid Reasons to Dispute a Credit Card ChargeCharges with wrong date or dollar amount.Math errors (such as an incorrect total after adding a tip)Failure to post payments or credits.Failure to deliver the bill to your current address (assuming you provided it 20 days before the billing cycle closing date)More items...?

I am requesting that you accept payments of $paid on the. I assure you that I will add no further debt until my financial situation improves. I will begin making normal payments again as soon as possible. I regret that I have to ask for this consideration and hope that you will understand.

How to Write a Simple Payment Contract LetterThe date that the agreement was signed and thus going into effect.The date of the first payment.The date when each payment after will be made.A grace period, if any.When a payment is considered late.